by Calculated Risk on 5/19/2021 12:04:00 PM

Wednesday, May 19, 2021

Lawler: Early Read on Existing Home Sales in April

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.96 million in April, down 0.8% from March’s preliminary pace but up 36.4% from last April’s seasonally adjusted pace.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY decline in the inventory of existing homes for sale last month was similar to the big drop in March.

Finally, local realtor/MLS data suggest that the median existing single-family home sales price last month was up by about 18% from last April.

CR Note: The National Association of Realtors (NAR) is scheduled to release April existing home sales on Friday, May 21, 2021 at 10:00 AM ET. The consensus is for 6.09 million SAAR.

AIA: Architecture "Design activity strongly increases" in April

by Calculated Risk on 5/19/2021 10:03:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Design activity strongly increases

Continuing its meteoric rebound, the Architecture Billings Index (ABI) recorded its third consecutive month of positive billings, according to a new report today from The American Institute of Architects (AIA).

AIA’s ABI score for April rose to 57.9 compared to 55.6 in March (any score above 50 indicates an increase in billings). Neither score has been achieved since before the Great Recession. During April, new project inquiries and new design contracts reached record highs with scores of 70.8 and 61.7 respectively.

“This recent acceleration in the demand for design services demonstrates that both consumers and businesses are feeling much more confident about the economic outlook,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The pent-up demand for new and retrofitted facilities is keeping architecture firms in all regions and building sectors busy.”

...

• Regional averages: Midwest (60.6); South (58.3); Northeast (55.0); West (52.4)

• Sector index breakdown: commercial/industrial (59.1); multi-family residential (56.9); institutional (56.7); mixed practice (55.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 57.9 in April, up from 55.6 in March. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had been below 50 for eleven consecutive months, but has been solidly positive for the last three months.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 5/19/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 14, 2021.

... The Refinance Index increased 4 percent from the previous week and was 2 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 2 percent higher than the same week one year ago.

“Mortgage rates increased last week, with all loan types hitting their highest levels in two weeks. Rates were still lower than levels reported in late March and early April, providing additional opportunity for borrowers to refinance. Despite the 30-year fixed rate rising to 3.15 percent, applications for conventional and VA refinances increased. Ongoing volatility in refinance applications is likely if rates continue to oscillate around current levels,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “A decline in purchase applications was seen for both conventional and government loans. There continues to be strong demand for buying a home, but persistent supply shortages are constraining purchase activity, and building material shortages and higher costs are making it more difficult to increase supply. As a result, home prices and average purchase loan balances continue to rise, with the average purchase application reaching $411,400 – the highest since February.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.15 percent from 3.11 percent, with points increasing to 0.36 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. T

emphasis added

Click on graph for larger image.

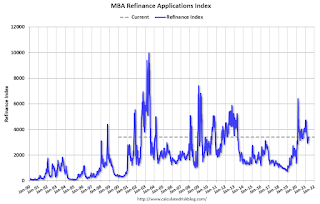

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but below recent levels since mortgage rates have moved up from the record lows.

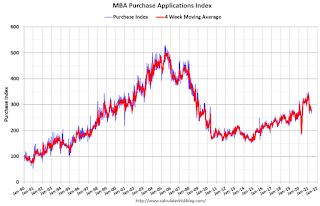

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is up 2% year-over-year unadjusted.

According to the MBA, purchase activity is up 2% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index will be more difficult going forward since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, May 18, 2021

Wednesday: FOMC Minutes

by Calculated Risk on 5/18/2021 09:11:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, the AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of April 27-28, 2021

May 18th COVID-19 New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 5/18/2021 04:10:00 PM

1) 60.0% of the population over 18 has had at least one dose (70% goal by July 4th).

2) 124.5 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all four of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000, and

4) average daily deaths under 50 (currently 558 per day).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 27,027, up from 26,726 reported yesterday, and still above the post-summer surge low of 23,000.

Alabama Real Estate in April: Sales Up 33% YoY, Inventory Down 46% YoY

by Calculated Risk on 5/18/2021 01:04:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April 2020 due to the pandemic, so the YoY sales comparison is easy.

For the entire state of Alabama:

Closed sales in April 2021 were 7,068, up 33.4% from 5,300 in April 2020.

Active Listings in April 2021 were 9,582, down 46.6% from 17,956 in April 2020.

Months of Supply was 1.4 Months in April 2021, compared to 3.4 Months in April 2020.

Inventory in April was down 1.4% from last month.

Rhode Island Real Estate in April: Sales Up 27% YoY, Inventory Down 48% YoY

by Calculated Risk on 5/18/2021 12:01:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April 2020 due to the pandemic, so the YoY sales comparison is easy.

For for the entire state Rhode Island:

Closed sales (single family and condos) in April 2021 were 1,080, up 26.6% from 853 in April 2020.

Active Listings (single family and condos) in April 2021 were 1,520, down 48.0% from 2,922 in April 2020.

Inventory in April was down 7.1% from last month.

Comments on April Housing Starts

by Calculated Risk on 5/18/2021 10:39:00 AM

Earlier: Housing Starts decreased to 1.569 Million Annual Rate in April

It is possible that supply constraints held back housing starts in April. Here is a comment from MBA SVP and Chief Economist Mike Fratantoni:

“Single-family starts in April dropped more than 13% compared to last month, but permits to build single-family homes saw a smaller decline. This is consistent with reports that builders are delaying starting new construction because of the marked increase in costs for lumber and other inputs. Moreover, builders are also reporting difficulty obtaining other inputs like appliances."

The housing starts report showed total starts were down 9.5% in April compared to March, and total starts were up 67.3% year-over-year compared to April 2020.

The first graph shows the month to month comparison for total starts between 2020 (blue) and 2021 (red).

Click on graph for larger image.

Click on graph for larger image.Starts were up 67.3% in April compared to April 2020. The year-over-year comparison will be easy again in May and June.

2020 was off to a strong start before the pandemic, and with low interest rates and little competing existing home inventory, starts finished 2020 strong. Starts have started 2021 strong (February was impacted by the harsh weather).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- then starts picked up a little again late last year, but have fallen off with the pandemic.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Single family starts are getting back to more normal levels, but I still expect some further increases in single family starts and completions on a rolling 12 month basis - especially given the low level of existing home inventory.

Housing Starts decreased to 1.569 Million Annual Rate in April

by Calculated Risk on 5/18/2021 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in April were at a seasonally adjusted annual rate of 1,569,000. This is 9.5 percent below the revised March estimate of 1,733,000, but is 67.3 percent above the April 2020 rate of 938,000. Single‐family housing starts in April were at a rate of 1,087,000; this is 13.4 percent below the revised March figure of 1,255,000. The April rate for units in buildings with five units or more was 470,000.

Building Permits:

Privately‐owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,760,000. This is 0.3 percent above the revised March rate of 1,755,000 and is 60.9 percent above the April 2020 rate of 1,094,000. Single‐family authorizations in April were at a rate of 1,149,000; this is 3.8 percent below the revised March figure of 1,194,000. Authorizations of units in buildings with five units or more were at a rate of 559,000 in April

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in April compared to March. Multi-family starts were up 91% year-over-year in April.

Single-family starts (blue) decreased in April, and were up 59% year-over-year (starts slumped at the beginning of the pandemic).

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in April were below expectations, and starts in February and March were revised down.

I'll have more later …

Monday, May 17, 2021

May 17th COVID-19 New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 5/17/2021 11:16:00 PM

1) 59.8% of the population over 18 has had at least one dose (70% goal by July 4th).

2) 123.8 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all four of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000, and

4) average daily deaths under 50 (currently 545 per day).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 26,726, down from 27,992 reported yesterday, but still above the post-summer surge low of 23,000.