by Calculated Risk on 5/27/2021 09:03:00 PM

Thursday, May 27, 2021

Friday: Personal Income & Outlays

Friday:

• At 8:30 AM ET, Personal Income and Outlays, April 2021. The consensus is for a 14.8% decrease in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.6%.

• At 9:45 AM, Chicago Purchasing Managers Index for May.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 83.0.

Las Vegas Visitor Authority for April: No Convention Attendance, Visitor Traffic Down 27% Compared to 2019

by Calculated Risk on 5/27/2021 04:58:00 PM

From the Las Vegas Visitor Authority: April 2021 Las Vegas Visitor Statistics

Visitation continued to ramp up in April as the destination welcomed more than 2.5M visitors, up more than 15% MoM and down roughly ‐27% vs. pre‐COVID levels in Apr 2019.

Hotel occupancy increased to 65.6%, up 10.1 pts MoM, with Weekend occupancy improving to 83.5%, up 5.8 pts MoM and within 13 pts of Apr 2019 levels.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 27.3% compared to the same month in 2019.

Convention traffic was non-existent again in April, and was down 100% compared to April 2019.

Note: A convention is scheduled for early June (HT MS): "Informa Markets, organizers of the World of Concrete, has received approval from the Nevada Department of Business and Industry to move forward with its 2021 in-person edition. The event is scheduled to be held June 8-10, 2021 at the Las Vegas Convention Center."

May 27th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 5/27/2021 03:38:00 PM

I'm switching to a simple table to track progress.

| COVID Metrics (7 day average Cases, Hospitalized, Deaths) | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 62.0% | 61.8% | 70.0%1,2 |

| Fully Vaccinated (millions) | 132.8 | 131.8 | 1601 |

| New Cases per Day | 21,627 | 22,139 | 5,0002 |

| Hospitalized | 22,443 | 22,810 | 3,0002 |

| Deaths per Day | 437 | 435 | 502 |

| 1 Biden Administration Goals, 2my goals | |||

This data is from the CDC.

Hotels: Occupancy Rate Down 15% Compared to Same Week in 2019

by Calculated Risk on 5/27/2021 11:39:00 AM

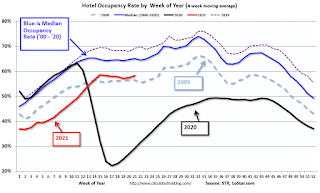

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

The occupancy rate is down 15.1% compared to the same week in 2019.

U.S. weekly hotel occupancy reached the 60% mark for the first time since the start of the pandemic, according to STR‘s latest data through May 22.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

May 16-22, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 60.3% (-15.1%)

• Average daily rate (ADR): US$115.57 (-13.6%)

• Revenue per available room (RevPAR): US$69.69 (-26.6%)

ADR also reached its highest point of the pandemic but was still US$18 less than the corresponding week in 2019. RevPAR also hit a high point when compared to 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAR: Pending Home Sales Decreased 4.4% in April

by Calculated Risk on 5/27/2021 10:03:00 AM

From the NAR: Pending Home Sales Drop 4.4% in April

Pending home sales took a step backward in April, according to the National Association of Realtors®. All four U.S. regions recorded year-over-year increases, but only the Midwest witnessed month-over-month gains in terms of pending home sales contract transactions.This was well below expectations of a 1.2% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 4.4% to 106.2 in April. Year-over-year, signings jumped 51.7% as last year's pandemic-related shutdowns slumped sales to an all-time low. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI declined 12.9% to 85.3 in April, a 96.5% jump from a year ago. In the Midwest, the index increased 3.5% to 101.1 last month, up 39.4% from April 2020.

Pending home sales transactions in the South fell 6.1% to an index of 128.9 in April, up 45.3% from April 2020. The index in the West decreased 2.6% in April to 92.0, up 57.3% from a year prior.

emphasis added

Weekly Initial Unemployment Claims decrease to 406,000

by Calculated Risk on 5/27/2021 08:40:00 AM

The DOL reported:

In the week ending May 22, the advance figure for seasonally adjusted initial claims was 406,000, a decrease of 38,000 from the previous week's unrevised level of 444,000. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The 4-week moving average was 458,750, a decrease of 46,000 from the previous week's unrevised average of 504,750. This is the lowest level for this average since March 14, 2020 when it was 225,500.This does not include the 93,546 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 95,142 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 458,750.

The previous week was unrevised.

Regular state continued claims decreased to 3,642,000 (SA) from 3,738,000 (SA) the previous week.

Note: There are an additional 6,515,657 receiving Pandemic Unemployment Assistance (PUA) that decreased from 6,606,198 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,191,642 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 5,142,370.

Weekly claims were lower than the consensus forecast.

Q1 GDP Growth Unchanged at 6.4% Annual Rate

by Calculated Risk on 5/27/2021 08:33:00 AM

From the BEA: Gross Domestic Product, 1st Quarter 2021 (Second Estimate); Corporate Profits, 1st Quarter 2021 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 6.4 percent in the first quarter of 2021 , according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2020, real GDP increased 4.3 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 10.7% to 11.3%. Residential investment was revised up from 10.8% to 12.7%. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was also 6.4 percent. Upward revisions to consumer spending and nonresidential fixed investment were offset by downward revisions to exports and private inventory investment. Imports, which are a subtraction in the calculation of GDP, were revised up

emphasis added

Wednesday, May 26, 2021

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 5/26/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 420 thousand from 444 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2021 (Second estimate). The consensus is that real GDP increased 6.5% annualized in Q1, up from the advance estimate of 6.4%.

• Also at 8:30 AM, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 1.2% increase in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

May 26th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 5/26/2021 04:09:00 PM

The economy will pick up speed as more and more people get vaccinated!

1) 61.8% of the population over 18 has had at least one dose (70% is the goal by July 4th).

2) 131.8 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all four of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000, and

4) average daily deaths under 50 (currently 435 per day).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 22,810, down from 23,183 reported yesterday, and below the post-summer surge low.

House Prices and Inventory

by Calculated Risk on 5/26/2021 01:37:00 PM

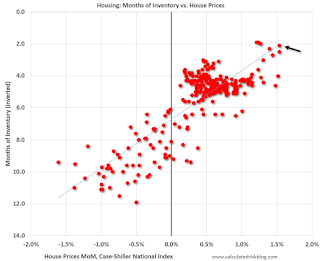

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Click on graph for larger image.

Click on graph for larger image.This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through March 2021).

In the April existing home sales report released last week, the NAR reported months-of-supply increased to 2.4 month in April. There is a seasonal pattern to inventory, but this is still very low - and prices are increasing sharply.