by Calculated Risk on 5/30/2021 04:23:00 PM

Sunday, May 30, 2021

May 30th COVID-19 New Cases, Vaccinations, Hospitalizations

According to the CDC, on Vaccinations.

Total doses administered: 294,928,850, as of yesterday 293,705,050. Day: 1.22 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 62.6% | 62.4% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 135.1 | 134.4 | ≥1601 |

| New Cases per Day3 | 18,913 | 20,277 | ≤5,0002 |

| Hospitalized3 | 20,780 | 21,571 | ≤3,0002 |

| Deaths per Day3 | 442 | 454 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the ten states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania and New Hampshire all over 70%.

Next up are Maryland at 69.9%, California at 69.8%, Washington at 69.1%, D.C. at 68.2%, and New York at 67.7%, Minnesota at 67.4%, Illinois at 67.3%, and Virginia at 67.2%.

The Atlantic: "Why You Should Wait Out the Wild Housing Market"

by Calculated Risk on 5/30/2021 11:12:00 AM

I'm quoted several times in this article from Derek Thompson at the Atlantic: Why You Should Wait Out the Wild Housing Market

“In my time studying housing markets, I’ve seen bubbles and I’ve seen busts,” says Bill McBride, an economics writer who famously predicted the 2007 housing crash. “But I’ve never seen anything quite like this. It’s a perfect storm.”In the article, I suggested waiting ... but I'd like to add, if you do buy now, be careful about location (like near a busy street) because that can't be fixed. Also bad layouts are difficult and expensive to fix.

...

“It’s not clear at all to me that things are going to slow down significantly in the near future,” he said. “In 2005, I had a strong sense that the hot market would turn and that, when it turned, things would get very ugly. Today, I don’t have that sense at all, because all of the fundamentals are there. Demand will be high for a while, because Millennials need houses. Prices will keep rising for a while, because inventory is so low.”

Defective homes will make you unhappy, and they are also hard to sell in a normal market (you might have to wait for the next boom).

Hot markets are when the defective homes (bad location, bad layout, etc.) are sold. Don’t buy one of those!

Saturday, May 29, 2021

May 29th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 5/29/2021 05:10:00 PM

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 293,705,050, as of yesterday 292,099,778. Day: 1.61 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 62.4% | 62.2% | 70.0%1,2 |

| Fully Vaccinated (millions) | 134.4 | 133.5 | 1601 |

| New Cases per Day3 | 20,277 | 20,901 | 5,0002 |

| Hospitalized3 | 21,571 | 21,928 | 3,0002 |

| Deaths per Day3 | 447 | 453 | 502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the ten states that have already achieved the 70% goal: Vermont and Hawaii over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania and New Hampshire all over 70%.

Next up are Maryland at 69.9%, California at 69.6%, Washington at 68.8%, D.C. at 68.0%, and New York at 67.5%.

Schedule for Week of May 30, 2021

by Calculated Risk on 5/29/2021 08:11:00 AM

The key report scheduled for this week is the May employment report.

Other key reports include the May ISM Manufacturing and Service surveys, and May Vehicle Sales.

All US markets will be closed in observance of Memorial Day.

8:00 AM: Corelogic House Price index for April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 61.0, up from 60.7 in April. The employment index was at 55.1% in April, and the new orders index was at 64.3%.

10:00 AM: Construction Spending for April. The consensus is for a 0.6% increase in construction spending.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional surveys for May.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 18.0 million SAAR in May, down from 18.5 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 18.0 million SAAR in May, down from 18.5 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 650,000 payroll jobs added in May, down from 742,000 in April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 395 thousand from 406 thousand last week.

10:00 AM: the ISM Services Index for May. The consensus is for a reading of 63.0, up from 62.7.

7:00 AM: Speech, Fed Chair Jerome Powell, Central banks and climate change, At the Green Swan 2021 Global Virtual Conference

8:30 AM: Employment Report for May. The consensus is for 650,000 jobs added, and for the unemployment rate to decrease to 5.9%.

8:30 AM: Employment Report for May. The consensus is for 650,000 jobs added, and for the unemployment rate to decrease to 5.9%.There were 266,000 jobs added in April, and the unemployment rate was at 6.1%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

Friday, May 28, 2021

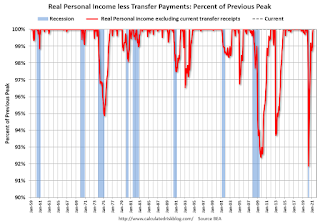

Real Personal Income less Transfer Payments Above Previous Peak

by Calculated Risk on 5/28/2021 03:48:00 PM

Government transfer payments decreased sharply in April compared to March, but were still almost $1.4 trillion (on SAAR basis) above the February 2020 level (pre-pandemic). Most of the increase in transfer payments - compared to the levels prior to the crisis - is from unemployment insurance and "other" (includes direct payments).

This table shows the amount of unemployment insurance and "Other" transfer payments since February 2020 (pre-crisis level). The increase in "Other" was mostly due to parts of the relief acts including direct payments.

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Feb-20 | $506 | $28 |

| Mar-20 | $515 | $74 |

| Apr-20 | $3,379 | $493 |

| May-20 | $1,360 | $1,356 |

| Jun-20 | $758 | $1,405 |

| Jul-20 | $760 | $1,331 |

| Aug-20 | $692 | $636 |

| Sep-20 | $936 | $359 |

| Oct-20 | $732 | $304 |

| Nov-20 | $620 | $281 |

| Dec-20 | $654 | $304 |

| Jan-21 | $2,354 | $556 |

| Feb-21 | $777 | $535 |

| Mar-21 | $4,747 | $541 |

| Apr-21 | $1,400 | $495 |

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

Click on graph for larger image.

Click on graph for larger image.This graph shows real personal income less transfer payments since 1990.

This measure of economic activity increased 0.5% in April, compared to March, and was up 0.3% compared to February 2020 (previous peak).

Another way to look at this data is as a percent of the previous peak.

Another way to look at this data is as a percent of the previous peak.Real personal income less transfer payments was off 8.1% in April 2020. That was a larger decline than the worst of the great recession.

Currently personal income less transfer payments are at a new peak.

This is the first of the key NBER measures - GDP, Employment, Industrial Production, Real Personal Income less Transfer Payments - that is above pre-recession levels. GDP will be above pre-recession levels in Q2.

May 28th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 5/28/2021 03:42:00 PM

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 292,099,778, as of yesterday 290,724,607. Day: 1.38 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 62.2% | 62.0% | 70.0%1,2 |

| Fully Vaccinated (millions) | 133.5 | 132.8 | 1601 |

| New Cases per Day3 | 20,882 | 21,659 | 5,0002 |

| Hospitalized3 | 21,928 | 22,443 | 3,0002 |

| Deaths per Day3 | 453 | 437 | 502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the ten states that have already achieved the 70% goal: Vermont, Hawaii, Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania and New Hampshire.

Next up are Maryland at 69.6%, California at 69.3%, and Washington at 68.2%.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in April

by Calculated Risk on 5/28/2021 01:32:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 2.38% in April, from 2.58% in March. The serious delinquency rate is up from 0.70% in April 2020.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble, and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.44% are seriously delinquent (down from 5.66% in March). For loans made in 2005 through 2008 (2% of portfolio), 9.33% are seriously delinquent (down from 9.65%), For recent loans, originated in 2009 through 2021 (96% of portfolio), 1.94% are seriously delinquent (down from 2.13%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

Q2 GDP Forecasts: Around 10%

by Calculated Risk on 5/28/2021 11:17:00 AM

From Merrill Lynch:

We continue to track 11% qoq saar after robust capex data this week [May 28 estimate]From Goldman Sachs:

emphasis added

We lowered our Q2 GDP tracking estimate by 0.5pp to +9.5% (qoq ar) to reflect the higher price deflator and the composition of the nominal spending revisions. [May 28 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 4.3% for 2021:Q2. [May 28 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2021 is 9.3 percent on May 28, up from 9.1 percent on May 27. [May 28 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased

by Calculated Risk on 5/28/2021 09:28:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of May 25th.

From Black Knight: Forbearance Volumes Increase Again, Moderate Opportunity for Additional Improvement in Early June

The country saw another week of forbearance increases this week, with volumes rising by another 16k (+0.73%). This marked the second consecutive week of increases after a sustained downward trend. Despite the raising volume, this is still only the third overall increase over the past 12 weeks. As of May 25, 2.2M (4.1% of) homeowners remain in COVID-19 related forbearance plans, including 2.4% of GSE, 7.3% of FHA/VA and 4.8% of portfolio/PLS loans.

Click on graph for larger image.

After seeing improvement accelerate as early forbearance entrants went through the 12-month review process in March and April, exit activity has since returned to more “normal” levels. Mid- to late-month increases in forbearance plan volumes like we’ve seen in the past two weeks have been very common during the recovery to-date.

Plan starts hit their highest level in nine weeks, primarily driven by elevated levels of restart activity. while new plans starts still remain low, they edged slightly upward, hitting their highest level in nine weeks as well.

...

Nearly 145k plans are still listed with May 2021 expirations, providing a moderate opportunity for additional improvements over the next two weeks and, more acutely, in early June. Another 780k plans are currently slated for review for extension/removal in June, the final quarterly review before early forbearance entrants begin to reach their 18-month plan expirations later this year.

June will mark the 15-month review point for many of the early forbearance entrants, so we will be watching exit velocity closely during that time.

emphasis added

Personal Income Decreased 13.1% in April, Spending increased 2.4%

by Calculated Risk on 5/28/2021 08:37:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income decreased $3.21 trillion (13.1 percent) in April according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $3.22 trillion (14.6 percent) and personal consumption expenditures (PCE) increased $80.3 billion (0.5 percent).The April PCE price index increased 3.6 percent year-over-year and the April PCE price index, excluding food and energy, increased 3.1 percent year-over-year.

Real DPI decreased 15.1 percent in April and Real PCE decreased 0.1 percent; goods decreased 1.3 percent and services increased 0.6 percent. The PCE price index increased 0.6 percent. Excluding food and energy, the PCE price index increased 0.7 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through April 2021 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations, and the increase in PCE was at expectations.