by Calculated Risk on 6/01/2021 09:23:00 PM

Tuesday, June 01, 2021

Wednesday: Mortgage Purchase Applications, Beige Book

From Matthew Graham at Mortgage News Daily: MBS RECAP: Bonds a Bit Nervous as Big Data Week Begins

... Bonds seem to be starting out the current week erring on the side of caution, in case the data reignites a bullish case for the labor market. [30 year fixed 3.13%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

June 1st COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/01/2021 04:37:00 PM

Congratulations to the residents of Maryland and California on joining the 70% club! Go for 80%!!!

According to the CDC, on Vaccinations.

Total doses administered: 296,404,240, as of two days ago 294,928,850. Per Day: 0.74 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 62.8% | 62.6% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 135.9 | 135.1 | ≥1601 |

| New Cases per Day3 | 15,961 | 17,606 | ≤5,0002 |

| Hospitalized3 | 19,355 | 20,064 | ≤3,0002 |

| Deaths per Day3 | 383 | 412 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the twelve states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania and New Hampshire, Maryland and California all over 70%.

Next up are Washington at 69.3%, D.C. at 68.4%, New York at 67.9%, Illinois at 67.6%, Minnesota at 67.5%, Virginia at 67.4%, Delaware at 66.7%, Colorado at 66.2% and Oregon at 66.0%.

MBA Survey: "Share of Mortgage Loans in Forbearance Slightly Decreases to 4.18%"

by Calculated Risk on 6/01/2021 04:00:00 PM

Note: This is as of May 23rd.

From the MBA: Share of Mortgage Loans in Forbearance Slightly Decreases to 4.18%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 4.19% of servicers’ portfolio volume in the prior week to 4.18% as of May 23, 2021. According to MBA’s estimate, 2.1 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 basis points to 2.19%. Ginnie Mae loans in forbearance decreased 4 basis points to 5.55%, while the forbearance share for portfolio loans and private-label securities (PLS) increased 11 basis points to 8.37%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 2 basis points to 4.36%, and the percentage of loans in forbearance for depository servicers declined 1 basis point to 4.34%.

“The share of loans in forbearance slightly declined, dropping by only 1 basis point, due to a slower pace of forbearance exits. This was the 13th straight week of declines,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Forbearance re-entries increased to almost 5.6 percent, as more homeowners who had canceled forbearance needed assistance again. There was also an increase in the share of PLS and portfolio loans in forbearance, while the share for Fannie Mae, Freddie Mac, and Ginnie Mae loans decreased.”

Added Fratantoni, “Housing market data continue to paint a picture of strong demand and constrained supply. The resulting rapid growth in home equity will benefit homeowners, whether they choose to retain or sell their properties.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.05%."

Update: Framing Lumber Prices Down from Recent Peak, Up Sharply Year-over-year

by Calculated Risk on 6/01/2021 12:45:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME framing futures through June 1st.

There are supply constraints, for example, sawmills cut production and inventory at the beginning of the pandemic, and the West Coast fires in 2020 damaged privately-owned timberland.

Construction Spending increased 0.2% in April

by Calculated Risk on 6/01/2021 10:21:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during April 2021 was estimated at a seasonally adjusted annual rate of $1,524.2 billion, 0.2 percent above the revised March estimate of $1,521.0 billion. The April figure is 9.8 percent above the April 2020 estimate of $1,387.9 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,180.7 billion, 0.4 percent above the revised March estimate of $1,175.4 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $343.5 billion, 0.6 percent below the revised March estimate of $345.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 7% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 6% above the previous peak in March 2009, and 31% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 29.7%. Non-residential spending is down 4.8% year-over-year. Public spending is down 2.2% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential will be under pressure. For example, lodging is down 21.8% YoY, multi-retail down 28.4% YoY, and office down 1.6% YoY.

ISM® Manufacturing index Increased to 61.2% in May

by Calculated Risk on 6/01/2021 10:06:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion in May. The PMI® was at 61.2% in May, up from 60.7% in April. The employment index was at 50.9%, down from 55.1% last month, and the new orders index was at 67.0%, up from 64.3%.

From ISM: May 2021 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in May, with the overall economy notching a 12th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.This was close to expectations.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The May Manufacturing PMI® registered 61.2 percent, an increase of 0.5 percentage point from the April reading of 60.7 percent. This figure indicates expansion in the overall economy for the 12th month in a row after contraction in April 2020. The New Orders Index registered 67 percent, increasing 2.7 percentage points from the April reading of 64.3 percent. The Production Index registered 58.5 percent, a decrease of 4 percentage points compared to the April reading of 62.5 percent. The Backlog of Orders Index registered 70.6 percent, 2.4 percentage points higher compared to the April reading of 68.2 percent. The Employment Index registered 50.9 percent; 4.2 percentage points lower than the April reading of 55.1 percent. The Supplier Deliveries Index registered 78.8 percent, up 3.8 percentage points from the April figure of 75 percent. The Inventories Index registered 50.8 percent, 4.3 percentage points higher than the April reading of 46.5 percent. The Prices Index registered 88 percent, down 1.6 percentage points compared to the April reading of 89.6 percent. The New Export Orders Index registered 55.4 percent, an increase of 0.5 percentage point compared to the April reading of 54.9 percent. The Imports Index registered 54 percent, a 1.8-percentage point increase from the April reading of 52.2 percent.”

emphasis added

This suggests manufacturing expanded at a slightly faster pace in May than in April.

CoreLogic: House Prices up 13% Year-over-year in April

by Calculated Risk on 6/01/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Multi-Generational Demand: US Home Prices Post Third Month of Double-Digit Growth in April, CoreLogic Reports

CoreLogic® ... released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for April 2021.

Sparse inventory and high demand continues to place upward pressure on home prices, creating challenges across generations as buyer preferences shift. Younger millennials continue to enter the market in droves while older millennials look to upgrade and upsize their homes. In a recent CoreLogic consumer survey, the need for more space was noted as the top driver (64%) for demand among these cohorts.

The increased competition among buyers may cause a ripple effect and create affordability challenges for baby boomers interested in downsizing or relocating. Notably, 72% of this cohort list the desire for a new location as the main reason for wanting to purchase a new home. However, in response to rising prices, baby boomers — who own 54% of the nation’s homes — may wait to sell, creating further inventory pressures for older millennials seeking move up-purchases.

“As older homeowners become more comfortable with listing their homes, they are faced with the reality that if they sell, they may get a smaller home for the same price as what they already have,” said Frank Martell, president and CEO of CoreLogic. “Rather than decreasing their financial burden and cashing out equity to support their retirement, baby boomers may choose to stay put — which could exacerbate inventory challenges.”

...

Nationally, home prices increased 13% in April 2021, compared with April 2020. On a month-over-month basis, home prices increased by 2.1% compared to March 2021.

At the state level, Idaho and Arizona continued to have the strongest price growth at 27.2% and 20.4%, respectively. South Dakota also had a 19.3% year-over-year increase as new home buyers seek out more affordable options, space and low property taxes.

emphasis added

Monday, May 31, 2021

Tuesday: ISM Manufacturing, Construction Spending, Vehicle Sales

by Calculated Risk on 5/31/2021 07:31:00 PM

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for April.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 61.0, up from 60.7 in April. The employment index was at 55.1% in April, and the new orders index was at 64.3%.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.6% increase in construction spending.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional surveys for May.

• All day, Light vehicle sales for May. The consensus is for light vehicle sales to be 18.0 million SAAR in May, down from 18.5 million in April (Seasonally Adjusted Annual Rate). Wards Auto is forecasting a decline in sales to 16.5 million SAAR.

Housing Inventory May 31st Update: Inventory Increased Week-over-week

by Calculated Risk on 5/31/2021 10:47:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 5/31/2021 08:40:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

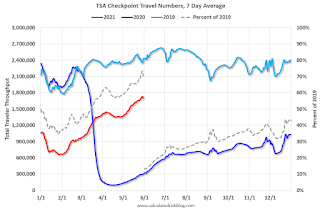

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of May 30th.

The seven day average is down 29.8% from the same day in 2019 (70.2% of 2019). (Dashed line)

There was a slow increase from the bottom - and TSA data has picked up in 2021.

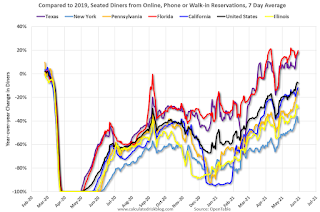

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through May 29, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is picking up again. Florida and Texas are above 2019 levels.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $20 million last week, down about 92% from the median for the week.

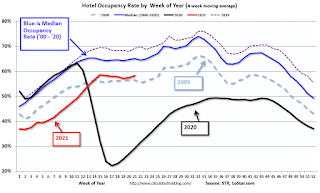

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is now slightly above the horrible 2009 levels.

This data is through May 22nd. Hotel occupancy is currently down 15% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of May 21st, gasoline supplied was up about 0.9% (about 100.9% of the same week in 2019).

This is the first week this year with gasoline supplied up compared to the same week in 2019.

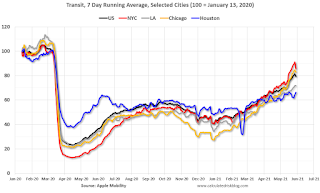

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through May 29th for the United States and several selected cities.

This data is through May 29th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 79% of the January 2020 level and moving up.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, May 28th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".