by Calculated Risk on 6/07/2021 08:30:00 AM

Monday, June 07, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of June 6th.

The seven day average is down 27.5% from the same day in 2019 (72.5% of 2019). (Dashed line)

There was a slow increase from the bottom - and TSA data has picked up in 2021.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through June 5 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is picking up again. Florida and Texas are above 2019 levels.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $119 million last week, down about 52% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

The 4-week average occupancy is now slightly above the horrible 2009 levels.

This data is through May 29th. Hotel occupancy is currently down 4% compared to same week in 2019 (due to the timing of Memorial Day). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, the 4-week average occupancy is still down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of May 28th, gasoline supplied was down about 3.1% (about 96.9% of the same week in 2019).

The previous week was the first week this year with gasoline supplied up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through June 5th for the United States and several selected cities.

This data is through June 5th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 83% of the January 2020 level and moving up.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, June 4th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, June 06, 2021

Sunday Night Futures

by Calculated Risk on 6/06/2021 07:58:00 PM

Weekend:

• Schedule for Week of June 6, 2021

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $69.66 per barrel and Brent at $71.89 per barrel. A year ago, WTI was at $39, and Brent was at $41 - so WTI oil prices are UP almost 75% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.05 per gallon. A year ago prices were at $2.02 per gallon, so gasoline prices are up $1.03 per gallon year-over-year.

June 6th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/06/2021 04:15:00 PM

Congratulations to the residents of Washington State on joining the 70% club at 70.4%! Go for 80%!!!

According to the CDC, on Vaccinations.

Total doses administered: 301,638,578, as of yesterday 300,268,730. Per Day: 1.37 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 63.5% | 63.4% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 139.0 | 138.1 | ≥1601 |

| New Cases per Day3 | 12,780 | 13,383 | ≤5,0002 |

| Hospitalized3 | 17,563 | 18,247 | ≤3,0002 |

| Deaths per Day3 | 367 | 346 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 13 states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, New Hampshire, California, Maryland, and Washington are all over 70%.

Next up are D.C. at 68.9%, New York at 68.7%, Illinois at 68.2%, Virginia at 68.2%, Minnesota at 68.0%, Delaware at 67.4%, Colorado at 66.9% and Oregon at 66.8%.

U.S. Heavy Truck Sales Near Record High in May

by Calculated Risk on 6/06/2021 09:53:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the May 2021 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 563 thousand SAAR in September 2019.

However heavy truck sales started declining in late 2019 due to lower oil prices.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Click on graph for larger image.

Heavy truck sales really declined at the beginning of the pandemic, falling to a low of 299 thousand SAAR in May 2020.

Heavy truck sales were at 553 thousand SAAR in May, up from 473 thousand SAAR in April, and up 85% from 299 thousand SAAR in May 2020.

Saturday, June 05, 2021

June 5th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/05/2021 05:17:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 300,268,730, as of yesterday 299,120,522. Per Day: 1.15 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 63.4% | 63.2% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 138.1 | 137.5 | ≥1601 |

| New Cases per Day3 | 13,381 | 13,972 | ≤5,0002 |

| Hospitalized3 | 18,247 | 18,770 | ≤3,0002 |

| Deaths per Day3 | 346 | 331 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 12 states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania, New Hampshire, Maryland, and California are all over 70%.

Next up are Washington at 69.9%, D.C. at 68.8%, New York at 68.6%, Illinois at 68.2%, Minnesota at 67.9%, Virginia at 67.9%, Delaware at 67.0%, Colorado at 66.7% and Oregon at 66.6%.

Schedule for Week of June 6, 2021

by Calculated Risk on 6/05/2021 08:11:00 AM

The key report this week is CPI.

Other key reports include April job openings, and the April trade balance.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for May.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. In March, exports were up 8.1% compared to March 2020; imports were up 18.1% compared to March 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports much more than exports).

The consensus is the trade deficit to be $69.0 billion. The U.S. trade deficit was at $74.4 Billion in March.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in March to 8.123 million from 7.526 million in February.

The number of job openings (yellow) were down 41% year-over-year, and Quits were up 21% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 380 thousand from 385 thousand last week.

8:30 AM: The Consumer Price Index for May from the BLS. The consensus is for 0.4% increase in CPI, and a 0.4% increase in core CPI.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

Friday, June 04, 2021

Q2 GDP Forecasts: Around 10%

by Calculated Risk on 6/04/2021 05:36:00 PM

From Merrill Lynch:

We continue to track 11% qoq saar for 2Q GDP. [June 4 estimate]From Goldman Sachs:

emphasis added

Following this morning's data, we left our Q2 GDP tracking estimate unchanged at +9.5% (qoq ar). [June 4 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 4.4% for 2021:Q2 and 5.4% for 2021:Q3. [June 4 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2021 is 10.3 percent on June 1, up from 9.3 percent on May 28. [June 1 estimate]

June 4th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/04/2021 05:30:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 299,120,522, as of yesterday 297,720,928. Per Day: 1.40 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 63.2% | 63.0% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 137.5 | 136.6 | ≥1601 |

| New Cases per Day3 | 13,907 | 14,546 | ≤5,0002 |

| Hospitalized3 | 18,770 | 19,289 | ≤3,0002 |

| Deaths per Day3 | 331 | 324 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the twelve states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania, New Hampshire, Maryland and California are all over 70%.

Next up are Washington at 69.9%, D.C. at 68.6%, New York at 68.4%, Illinois at 67.9%, Minnesota at 67.7%, Virginia at 67.7%, Delaware at 67.0%, Colorado at 66.7% and Oregon at 66.4%.

AAR: May Rail Carloads down, Intermodal Up Compared to 2019

by Calculated Risk on 6/04/2021 12:59:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

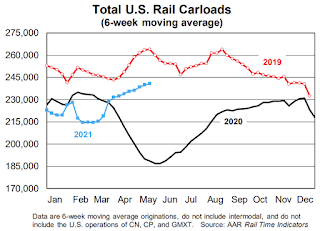

U.S. rail volumes in May 2021 were encouraging. Total originated carloads averaged 241,089 per week, the most since October 2019 and up 30.4% over May 2020.

...

Meanwhile, intermodal averaged 287,956 originated containers and trailers per week in May 2021. That’s down a bit from April — when the weekly average of 293,488 set a new all-time record — but it’s still the seventh most for any month in history and by far the most ever for May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2019, 2020 and 2021:

In May 2021, total U.S. rail carloads averaged 241,089 per week — up 30.4% over May 2020 and the most for any month since October 2019.

...

Carloads excluding coal were up 26.6% in May 2021 over May 2020 and down 1.2% from May 2019.

The second graph shows the six week average of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):For intermodal, volumes in May 2021 were up 26.2% over May 2020, averaging 287,956 containers and trailers per week. That’s down a bit from April 2021 — when the weekly average of 293,488 set a new all-time monthly record — but it’s still the seventh most for any month in history and by far the most ever for May.

Hotels: Occupancy Rate Down 4% Compared to Same Week in 2019

by Calculated Risk on 6/04/2021 11:46:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 4.2% compared to the same week in 2019 (skewed by timing of Memorial Day), but the 4-week average is still down significantly compared to normal.

Boosted by the Friday and Saturday of Memorial Day weekend, U.S. weekly hotel occupancy reached its highest level since late-February 2020, according to STR‘s latest data through 29 May.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

23-29 May 2021 (percentage change from comparable week in 2019*):

• Occupancy: 61.8% (-4.2%)

• Average daily rate (ADR): US$122.06 (-1.6%)

• Revenue per available room (RevPAR): US$75.42 (-5.7%)

Percentage changes were skewed more to the positive because the 2019 comparable was the week after Memorial Day. Regardless, this past Saturday’s 83.0% occupancy level was the country’s highest since October 2019. Weekly ADR and RevPAR were boosted to pandemic-era highs as well. STR analysts note that while the positives around leisure demand are obvious headed into the summer, the path to recovery remains a rollercoaster with a lack of business travel, both domestic and international, preventing hotels in many markets from making up more of the ground lost in 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.