by Calculated Risk on 6/08/2021 12:24:00 PM

Tuesday, June 08, 2021

New Hampshire Real Estate in May: Sales Up 12% YoY, Inventory Down 55% YoY

Note: Remember sales were weak in April and May 2020 due to the pandemic. I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the New Hampshire Realtors for the entire state:

Inventory in May was up 5.8% from last month.

Las Vegas Real Estate in May: Sales up 98% YoY, Inventory down 66% YoY

by Calculated Risk on 6/08/2021 11:01:00 AM

Remember - sales slumped in April and May 2020, so the year-over-year sales comparisons are crazy.

The Las Vegas Realtors reported Southern Nevada home prices reach new heights while supply stays low; LVR housing statistics for May 2021

A report released Tuesday by Las Vegas REALTORS® (LVR) shows local home prices continuing to reach new heights while the local housing supply remains near historically low levels.1) Overall sales (single family and condos) were up 97.6% year-over-year from 2,075 in May 2020 to 4,100 in May 2021.

...

LVR reported a total of 4,100 existing local homes, condos and townhomes sold during May. Compared to the same time last year, May sales were up 87.3% for homes and up 144.9% for condos and townhomes. So far this year, local home sales are on pace to exceed last year’s total.

…

By the end of May, LVR reported 2,031 single-family homes listed for sale without any sort of offer. Although down 65.0% from the same time last year, Martinez noted the number of homes listed without offers actually increased for the third straight month. For condos and townhomes, the 529 properties listed without offers in May were slightly more than were listed during the previous month, though that inventory is still down 70.1% from the same time last year.

...

With eviction and foreclosure bans still in place, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.7% of all existing local property sales in May. That compares to 1.5% of all sales one year ago, 2.0% of all sales two years ago, 2.6% three years ago and 6.8% four years ago. Martinez suggested that these percentages may rise slightly when government moratoriums are lifted.

emphasis added

2) Active inventory (single-family and condos) is down 66.2% from a year ago, from a total of 7,567 in May 2020 to 2,560 in May 2021. And months of inventory is extremely low.

3) Active inventory is up 9.1% from the previous month (April 2021).

BLS: Job Openings Increased to Record 9.3 Million in April

by Calculated Risk on 6/08/2021 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings reached a series high of 9.3 million on the last business day of April, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 6.1 million. Total separations increased to 5.8 million. Within separations, the quits rate reached a series high of 2.7 percent while the layoffs and discharges rate decreased to a series low of 1.0 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in April to 9.286 million from 8.288 million in March. This is a new record high for this series.

The number of job openings (yellow) were up 100% year-over-year. This is a comparison to the worst of the pandemic.

Quits were up 88% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits"). This is a record high for Quits too.

Trade Deficit Decreased to $68.9 Billion in April

by Calculated Risk on 6/08/2021 08:42:00 AM

From the Department of Commerce reported:

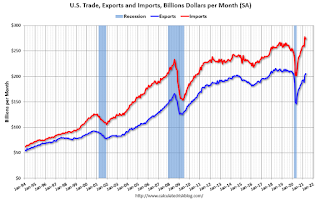

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $68.9 billion in April, down $6.1 billion from $75.0 billion in March, revised.

April exports were $205.0 billion, $2.3 billion more than March exports. April imports were $273.9 billion, $3.8 billion less than March imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in April.

Exports are up 36.6% compared to April 2020; imports are up 34.9% compared to April 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports much more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $25.8 billion in April, from $22.3 billion in April 2020.

Monday, June 07, 2021

Tuesday: Trade Balance, Job Openings

by Calculated Risk on 6/07/2021 08:58:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Sideways to Start The Week, But That's Still a Victory

[W]e did see a bit of weakness today, it was almost too small to count. That's a victory considering Friday's gains, but volume and volatility were so low that we arguably haven't seen a representative sample of traders show up for the week. [30 year fixed 3.13%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for May.

• At 8:30 AM, Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $69.0 billion. The U.S. trade deficit was at $74.4 Billion in March.

• At 10:00 AM, Job Openings and Labor Turnover Survey for April from the BLS.

Northwest Real Estate in May: Sales up 57% YoY, Inventory down 47% YoY

by Calculated Risk on 6/07/2021 06:12:00 PM

The Northwest Multiple Listing Service reported May marked a month of new records for some Northwest MLS market indicators

May was a month of record-setting highs and lows for some key housing market indicators tracked by Northwest Multiple Listing Service.The press release is for the Northwest MLS area. There were 9,374 closed sales in May 2021, up 57.4% from 5,957 sales in May 2020. Active inventory for the Northwest is down 46.6%.

Northwest MLS director Robb Wasser, branch manager at Windermere Real Estate/East in Bellevue, noted the number of active listings for single family homes dropped from April to May for the first time in at least 20 years. The month-to-month decline was small (only 83 listings), but compared to 12 months ago, May's inventory plummeted by 4,824 listings (down 46.6%).

Months of inventory of homes and condominiums fell to just over two weeks (0.59 months) system-wide, which encompasses 26 of Washington's 39 counties. Only March 2021 and December 2020 have been lower when both months ended with only 0.53 months of supply.

Year-over-year price increases measured by percentages appeared to hit a new high with the median price on last month's 9,374 closed sales soaring 30% from a year ago.

emphasis added

In King County, sales were up 83.3% year-over-year, and active inventory was down 42.5% year-over-year.

In Seattle, sales were up 104.5% year-over-year, and inventory was down 16.9% year-over-year. (inventory in Seattle was extremely low last year). This puts the months-of-supply in Seattle at just 0.85 months.

June 7th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/07/2021 04:11:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 302,851,917, as of yesterday 301,638,578. Daily: 1.21 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 63.7% | 63.5% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 139.7 | 139.0 | ≥1601 |

| New Cases per Day3 | 13,276 | 13,476 | ≤5,0002 |

| Hospitalized3 | 16,585 | 17,563 | ≤3,0002 |

| Deaths per Day3 | 378 | 369 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 13 states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, New Hampshire, California, Maryland, and Washington are all over 70%.

Next up are D.C. at 69.1%, New York at 68.9%, Illinois at 68.5%, Virginia at 68.2%, Minnesota at 68.1%, Delaware at 67.5%, Colorado at 67.1% and Oregon at 66.8%.

MBA Survey: "Share of Mortgage Loans in Forbearance Slightly Decreases to 4.16%"

by Calculated Risk on 6/07/2021 04:00:00 PM

Note: This is as of May 30th.

From the MBA: Share of Mortgage Loans in Forbearance Slightly Decreases to 4.18%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 4.18% of servicers’ portfolio volume in the prior week to 4.16% as of May 30, 2021. According to MBA’s estimate, 2.1 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 2.18%. Ginnie Mae loans in forbearance decreased 1 basis points to 5.54%, while the forbearance share for portfolio loans and private-label securities (PLS) decreased 6 basis points to 8.31%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 2 basis points to 4.34%, and the percentage of loans in forbearance for depository servicers decreased 1 basis point to 4.33%.

“The share of loans in forbearance declined for the 14th straight week, with small drops across most investor types and all servicer types,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Forbearance exits dropped to 6 basis points, the lowest weekly level since mid-February, but new forbearance requests, at 4 basis points, matched the recent weekly low from early May.”

Added Fratantoni, “Although the headline employment growth number for May was lower than many had anticipated, other data show evidence of a strengthening job market. That is good news for homeowners who have been struggling and are looking for work, as more families can regain their incomes and start making their mortgage payments again.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.05% to 0.04%."

Black Knight Mortgage Monitor for April; Highest Annual Home Price Increase on Record

by Calculated Risk on 6/07/2021 12:18:00 PM

Black Knight released their Mortgage Monitor report for April today. According to Black Knight, 4.66% of mortgage were delinquent in April, down from 5.02% of mortgages in March, and down from 6.45% in April 2020. Black Knight also reported that 0.29% of mortgages were in the foreclosure process, down from 0.40% a year ago.

This gives a total of 4.95% delinquent or in foreclosure.

Press Release: Black Knight: Persistent Constraints in For-Sale Inventory Drive Home Prices Up a Record-Breaking 14.8% Annually in April, Making Housing Least Affordable Since Late 2018

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. As constraints in residential for-sale inventory persist, this month’s report looks at how recent and aggressive home price gains are impacting housing affordability. According to Black Knight Data & Analytics President Ben Graboske, a dwindling inventory of homes for sale is pushing home price growth rates to previously unseen levels.

“Home prices grew at 14.8% on an annual basis in April,” said Graboske. “That’s the highest annual home price growth rate we’ve ever seen – and Black Knight’s been tracking the metric for almost 30 years now. Single-family homes saw the greatest gains, with prices up 15.6% from last April, also an all-time high, while condo prices are up 10%. Driving this growth are two key elements: historically low interest rates and – more acutely – the lack of available for-sale inventory. The total number of active listings was down 60% from the 2017 to 2019 average for April. It’s not getting any better, either. Data from our Collateral Analytics group showed there was two months’ worth of single-family inventory nationwide in March, the lowest share on record and trending downward. In fact, there were 26% fewer newly listed properties in April as compared to pre-pandemic seasonal levels.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph on delinquencies from Black Knight:

• The national delinquency rate fell to 4.66% in April, just 0.5% above its pre-Great Recession average and 1.5% above its pre-pandemic level

• That said, the overall delinquency rate has been improving at a much faster rate than later stage delinquencies

• At their respective current rates of improvement, overall delinquencies would normalize by the end of 2021, but 90+ day delinquencies would take roughly three years to normalize

• That scenario is unlikely, however – 90-day delinquencies will reach an inflection point later this year as forbearance plans expire and many homeowners return to making mortgage payments

• As of the end of April, there are still 1.8M such serious delinquencies, 1.3M more than prior to the pandemic

And on existing home inventory from Black Knight:

And on existing home inventory from Black Knight: • The number of active for-sale listings was down 53% in April from the same time last year and 60% off the 2017-2019 average for April, for a deficit of nearly 750,000 available homes for saleThere is much more in the mortgage monitor.

• Black Knight’s Collateral Analytics group found just two months’ worth of single-family inventory nationwide in March, the lowest supply on record and trending downward

• While new listings in April were up 33% year-over-year, that was from a pandemic stricken April 2020, when listing volumes had fallen off significantly

• There were 26% fewer newly listed properties in April as compared to pre-pandemic seasonal levels, roughly on par with the 26-29% deficits seen over the first three months of the year

Housing Inventory June 7th Update: Inventory Increased Week-over-week

by Calculated Risk on 6/07/2021 10:38:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.