by Calculated Risk on 6/10/2021 02:25:00 PM

Thursday, June 10, 2021

Hotels: Occupancy Rate Down 14% Compared to Same Week in 2019

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 14.0% compared to the same week in 2019.

U.S. weekly hotel performance remained relatively flat from the previous week but still reached pandemic-era highs, according to STR‘s latest data through June 5.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

May 30 through June 5, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 61.9% (-14.0%)

• Average daily rate (ADR): US$123.49 (-6.7%)

• Revenue per available room (RevPAR): US$76.44 (-19.7%)

Each of the three key performance metrics were the highest of the pandemic era.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Fed's Flow of Funds: Household Net Worth Increased $5.0 Trillion in Q1

by Calculated Risk on 6/10/2021 12:31:00 PM

The Federal Reserve released the Q1 2021 Flow of Funds report today: Financial Accounts of the United States.

The net worth of households and nonprofits rose to $136.9 trillion during the first quarter of 2021. The value of directly and indirectly held corporate equities increased $3.2 trillion and the value of real estate increased $1.0 trillion.

Household debt increased 6.5 percent at an annual rate in the first quarter of 2021. Consumer credit grew at an annual rate of 3 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 5.4 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2021, household percent equity (of household real estate) was at 67.3% - up from 66.7% in Q4.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have less than 67.3% equity - and about 1.4 million homeowners still have negative equity.

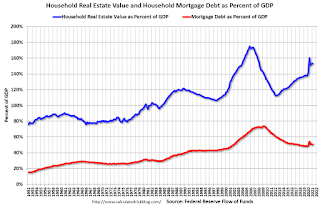

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.Mortgage debt increased by $117 billion in Q1.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 50.0% - down from Q4 - and down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, increased in Q1, and is above the average of the last 30 years.

Cleveland Fed: Key Measures Show Inflation Increased in May

by Calculated Risk on 6/10/2021 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

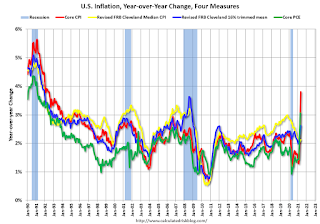

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% May. The 16% trimmed-mean Consumer Price Index rose 0.4% in May. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for May here. Car and truck rental was up 294% annualized! Used cars and trucks were up 132% annualized.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 2.6%, and the CPI less food and energy rose 3.8%. Core PCE is for April and increased 3.1% year-over-year.

Note: We saw negative Month-to-month (MoM) core CPI and CPI readings in March, April and May 2020. We also saw negative MoM PCE and core PCE reading in March and April 2020. Although inflation picked up in April and May this year, the year-over-year change was impacted by the base effect (decline last year).

Weekly Initial Unemployment Claims decrease to 376,000

by Calculated Risk on 6/10/2021 08:38:00 AM

The DOL reported:

In the week ending June 5, the advance figure for seasonally adjusted initial claims was 376,000, a decrease of 9,000 from the previous week's unrevised level of 385,000. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The 4-week moving average was 402,500, a decrease of 25,500 from the previous week's unrevised average of 428,000. This is the lowest level for this average since March 14, 2020 when it was 225,500.This does not include the 71,292 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 73,249 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 402,500.

The previous week was unrevised.

Regular state continued claims decreased to 3,499,000 (SA) from 3,757,000 (SA) the previous week.

Note: There are an additional 6,347,472 receiving Pandemic Unemployment Assistance (PUA) that decreased from 6,360,202 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,231,952 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 5,301,821.

Weekly claims were at the consensus forecast.

BLS: CPI increased 0.6% in May, Core CPI increased 0.7%

by Calculated Risk on 6/10/2021 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in May on a seasonally adjusted basis after rising 0.8 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment; this was the largest 12-month increase since a 5.4-percent increase for the period ending August 2008.CPI and core CPI were well above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for used cars and trucks continued to rise sharply, increasing 7.3 percent in May. This increase accounted for about one-third of the seasonally adjusted all items increase. The food index increased 0.4 percent in May, the same increase as in April. The energy index was unchanged in May, with a decline in the gasoline index again offsetting increases in the electricity and natural gas indexes.

The index for all items less food and energy rose 0.7 percent in May after increasing 0.9 percent in April. Many of the same indexes continued to increase, including used cars and trucks, household furnishings and operations, new vehicles, airline fares, and apparel. The index for medical care fell slightly, one of the few major component indexes to decline in May.

The all items index rose 5.0 percent for the 12 months ending May; it has been trending up every month since January, when the 12-month change was 1.4 percent. The index for all items less food and energy rose 3.8 percent over the last 12-months, the largest 12-month increase since the period ending June 1992. The energy index rose 28.5 percent over the last 12-months, and the food index increased 2.2 percent.

emphasis added

CoreLogic: 1.4 Million Homes with Negative Equity in Q1 2021

by Calculated Risk on 6/10/2021 08:00:00 AM

From CoreLogic: Nationwide Homeowner Equity Gains Hit $1.9 Trillion in Q1 2021, CoreLogic Reports

CoreLogic® ... today released the Homeowner Equity Report for the first quarter of 2021. The report shows U.S. homeowners with mortgages (which account for roughly 62% of all properties) have seen their equity increase by 19.6% year over year, representing a collective equity gain of over $1.9 trillion, and an average gain of $33,400 per borrower, since the first quarter of 2020.

While the coronavirus pandemic created economic uncertainty for many, the continued acceleration in home prices over the last year has meant existing homeowners saw a notable boost in home equity. The accumulation of equity has become critically important to homeowners deciding on their post-forbearance options. In contrast to the financial crisis, when many borrowers were underwater, borrowers today who are behind on mortgage payments can tap into their equity and sell their home rather than lose it through foreclosure. These conditions are reflected in a recent CoreLogic survey, with 74% of current homeowners with mortgages noting they are not concerned with owing more on their home than it is worth within the next five years.

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic,” said Frank Martell, president and CEO of CoreLogic. “These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who've experienced years of price appreciation."

“Double-digit home price growth in the past year has bolstered home equity to a record amount. The national CoreLogic Home Price Index recorded an 11.4% rise in the year through March 2021, leading to a $216,000 increase in the average amount of equity held by homeowners with a mortgage,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This reduces the likelihood for a large numbers of distressed sales of homeowners to emerge from forbearance later in the year.”

Negative equity, also referred to as underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the first quarter of 2021, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

• Quarterly change: From the fourth quarter of 2020 to the first quarter of 2021, the total number of mortgaged homes in negative equity decreased by 7% to 1.4 million homes, or 2.6% of all mortgaged properties.

• Annual change: In the fourth quarter of 2020, 1.8 million homes, or 3.4% of all mortgaged properties, were in negative equity. This number decreased by 24%, or 450,000 properties, in the first quarter of 2021.

• The national aggregate value of negative equity was approximately $273 billion at the end of the first quarter of 2021. This is down quarter over quarter by approximately $8.1 billion, or 2.9%, from $281.1 billion in the fourth quarter of 2020, and down year over year by approximately $13.3 billion, or 4.6%, from $286.3 billion in the first quarter of 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q1 to Q4 2020 equity distribution by LTV. There are still quite a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 1.8 million to 1.4 million.

Wednesday, June 09, 2021

Thursday: CPI, Unemployment Claims, Q1 Flow of Funds

by Calculated Risk on 6/09/2021 08:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 380 thousand from 385 thousand last week.

• At 8:30 AM, The Consumer Price Index for May from the BLS. The consensus is for 0.4% increase in CPI, and a 0.4% increase in core CPI.

• At 12:00 PM, Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

June 9th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/09/2021 05:07:00 PM

Congratulations to the residents of Massachusetts on joining the 80% club! Well done. Go for 90%!!!

According to the CDC, on Vaccinations.

Total doses administered: 304,753,476, as of yesterday 303,923,667. Daily: 0.83 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 63.9% | 63.8% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 141.0 | 140.4 | ≥1601 |

| New Cases per Day3 | 14,142 | 13,483 | ≤5,0002 |

| Hospitalized3 | 16,532 | 16,835 | ≤3,0002 |

| Deaths per Day3 | 360 | 370 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 13 states that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, New Hampshire, California, Maryland, and Washington are all over 70%.

Next up are D.C. at 69.3%, New York at 69.2%, Illinois at 68.7%, Virginia at 68.4%, Minnesota at 68.3%, Delaware at 67.6%, Colorado at 67.3% and Oregon at 67.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Houston Real Estate in May: Sales Up 56% YoY, Inventory Down 41% YoY

by Calculated Risk on 6/09/2021 01:35:00 PM

I'm tracking sales for many local markets. Note that sales slumped at the beginning of the pandemic, so the year-over-year increase in sales is crazy.

From the HAR: Houston Housing Blazes Its Way Through Uncharted Territory in May

Houston area home sales set new records in May as consumers took advantage of historically low interest rates in snapping up an ever-dwindling supply of properties for sale. What resulted was a nearly 50 percent jump in sales volume compared to the same month last year, when real estate was still in the process of recovering from coronavirus-related lockdown orders. Limited supply, strong buyer demand and increased construction costs all contributed to record high home prices.Single family inventory declined 40.6% year-over-year from 38,048 in May 2020 to 22,607 in May 2021. This is just 1.4 months of supply.

According to the latest Houston Association of Realtors (HAR) Market Update, single-family homes sales surged 48.2 percent compared to last May, with 9,702 units sold versus 6,546 a year earlier. That marks the greatest one-month year-over-year sales volume increase of all time and is the market’s twelfth consecutive positive month of sales. On a year-to-date basis, home sales are leading 2020’s record pace by 29.5 percent.

Homes priced from $750,000 and above led the way in May sales volume, shattering all previous measurements with a whopping 291.0 percent year-over-year increase. That was followed by the $500,000 to $750,000 segment, which rocketed 166.0 percent. This unprecedented surge in high-dollar homebuying is responsible for pushing pricing to record-setting levels. The single-family home average price rose 29.7 percent to $387,105 and the median price increased 21.7 percent to $304,000.

Sales of all property types totaled 12,100 – the second highest volume of all time. That is up 55.5 percent from May 2020. Total dollar volume for the month soared 100.5 percent to $4.4 billion.

“We are witnessing the most energized Houston real estate market in history,” said HAR Chairman Richard Miranda with Keller Williams Platinum. “Sellers maintain the upper hand, and buyers are not just meeting their demands. They are exceeding them, as we hear endless accounts of offers coming in that are thousands of dollars above list price. It’s difficult to predict how and when this incredible housing run will end.”

emphasis added

Note that inventory was down slightly in May compared to the previous month (April 2021) - and has essentially been flat for the last three months.

Housing and Demographics: The Next Big Shift

by Calculated Risk on 6/09/2021 10:35:00 AM

NOTE: This graph uses the Vintage 2019 estimates. There are questions about these estimates, and we will have much better data when the 2020 Decennial Census data is released.

Click on graph for larger image.

Click on graph for larger image.This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group last decade (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase further over this decade.

The current demographics are now very favorable for home buying - and will remain positive for most of the decade.

The next big housing shift will be when the Baby Boom generation starts to downsize and move to retirement communities. No cohort is monolithic - some people will age-in-place until they pass away, others will move in with family (or family will move in with their parents), and some will move to retirement communities.

There is no magic age that people reach and start to transition, but looking at prior generations, it seems to start when people are around 80 years old.

This graph shows the longer term trend for two key age groups: 60 to 79, and 80+.

This graph shows the longer term trend for two key age groups: 60 to 79, and 80+.This graph is from 2010 to 2060 (all data from BLS: current to 2060 is projected).