by Calculated Risk on 6/14/2021 03:58:00 PM

Monday, June 14, 2021

June 14th COVID-19 New Cases, Vaccinations, Hospitalizations; NY State and D.C. Meet 70% Goal

Congratulations to the residents of New York State and D.C. on joining the 70% club! Go for 80%!!!

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 310,645,827, as of yesterday 309,322,545. Daily: 1.32 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 64.5% | 64.4% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 144.9 | 143.91 | ≥1601 |

| New Cases per Day3 | 12,223 | 13,005 | ≤5,0002 |

| Hospitalized3 | 13,944 | 14,683 | ≤3,0002 |

| Deaths per Day3 | 331 | 337 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 14 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, New Hampshire, Maryland, Washington, New York and D.C. are all over 70%.

Next up are Illinois at 69.5%, Virginia at 69.1%, Minnesota at 68.7%, Delaware at 68.3%, Colorado at 67.9%, Oregon at 67.9% and Wisconsin at 64.1%.

Click on graph for larger image.

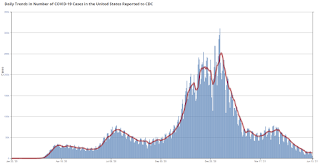

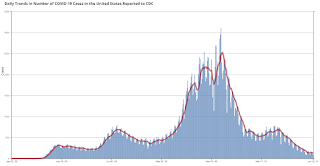

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Maryland Real Estate in May: Sales Up 46% YoY, Inventory Down 57% YoY

by Calculated Risk on 6/14/2021 11:57:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April and May 2020 due to the pandemic, so the YoY sales comparison is easy.

From the Maryland Realtors for the entire state:

Closed sales in May 2021 were 9,334, up 46.1% from 6,389 in May 2020.

Active Listings in May 2021 were 7,490, down 56.6% from 17,254 in May 2020.

Inventory in May was up 4.5% from last month, and up 21% from the all time low in March.

Months of Supply was 0.9 Months in May 2021, compared to 2.4 Months in May 2020.

Housing Inventory June 14th Update: Inventory Increased Week-over-week

by Calculated Risk on 6/14/2021 10:42:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 6/14/2021 08:26:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of June 13th.

The seven day average is down 27.7% from the same day in 2019 (72.3% of 2019). (Dashed line)

There was a slow increase from the bottom - and TSA data has picked up in 2021.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through June 9, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is picking up again. Florida and Texas are above 2019 levels.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $95 million last week, down about 53% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

The 4-week average occupancy is now above the horrible 2009 levels.

This data is through June 5th. Hotel occupancy is currently down 14% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, the 4-week average occupancy is still down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of June 4th, gasoline supplied was down about 14.1% (about 85.9% of the same week in 2019).

Two weeks ago was the first week this year with gasoline supplied up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through June 12th for the United States and several selected cities.

This data is through June 12th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 90% of the January 2020 level and moving up.

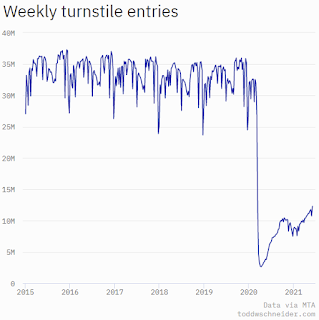

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, June 11th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, June 13, 2021

Sunday Night Futures

by Calculated Risk on 6/13/2021 07:52:00 PM

Weekend:

• Schedule for Week of June 13, 2021

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 5 and DOW futures are up 36 (fair value).

Oil prices were up over the last week with WTI futures at $70.99 per barrel and Brent at $72.80 per barrel. A year ago, WTI was at $36, and Brent was at $39 - so WTI oil prices are UP almost double year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.08 per gallon. A year ago prices were at $2.09 per gallon, so gasoline prices are up $0.99 per gallon year-over-year.

June 13th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/13/2021 04:18:00 PM

New cases per day (7-day average) is now the lowest since March 26, 2020. KUDOS to the vaccinated! Great job.

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 309,322,545, as of yesterday 308,112,728. Daily: 1.21 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 64.4% | 64.3% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 143.9 | 143.1 | ≥1601 |

| New Cases per Day3 | 12,836 | 13,588 | ≤5,0002 |

| Hospitalized3 | 14,683 | 15,304 | ≤3,0002 |

| Deaths per Day3 | 335 | 348 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 13 states that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, New Hampshire, Maryland, and Washington are all over 70%.

Next up are New York at 69.9%, D.C. at 69.7%, Illinois at 69.3%, Virginia at 69.1%, Minnesota at 68.5%, Delaware at 68.1%, Colorado at 67.8% and Oregon at 67.7%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

FOMC Preview

by Calculated Risk on 6/13/2021 08:47:00 AM

Expectations are there will be no change to rate policy when the FOMC meets on Tuesday and Wednesday this week, but that the FOMC will talk about the path of asset purchases.

Here are some comments from Merrill Lynch economists:

"Based on the FOMC minutes and subsequent speeches, we think Fed Chair Powell will note that Fed officials talked about the path of asset purchases, but that they are still very comfortable with the current program. He will reiterate that it is “some time” before substantial further progress in the economy has been made to justify a change in asset purchases. And finally he will note that starting to discuss the path for asset purchases is consistent with the idea that the Fed wants to give an abundance of guidance about changes to the policy ...For review, below are the March FOMC projections.

We expect the SEP forecasts to reveal a significant upward revision to core and headline PCE this year given the recent data; we are forecasting 3.1% and 3.5%, respectively, for this year (4Q/4Q change). The more important signal will be if the Fed also revises up core inflation for 2022 and 2023, which would suggest that they believe some of the gain in inflation will prove to be a bit more persistent — we think the risk is that 2022 increases to 2.1%. We also expect upward revisions to GDP this year but unlikely changes in the out years. We don’t expect significant changes to the unemployment rate."

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 5.8 to 6.6 | 3.0 to 3.8 | 2.0 to 2.5 | |

| Dec 2020 | 3.7 to 5.0 | 3.0 to 3.5 | 2.2 to 2.7 | |

Note that real GDP increased 6.4% annualized in Q1. And forecasts are for GDP to increase close to 10% in Q2.

The unemployment rate was at 5.8% in May.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 4.2 to 4.7 | 3.6 to 4.0 | 3.2 to 3.8 | |

| Dec 2020 | 4.7 to 5.4 | 3.8 to 4.6 | 3.5 to 4.3 | |

As of April 2021, PCE inflation was up 3.6% from April 2020. There was some base effect (since PCE inflation declined last year in the early months of the pandemic), but there was a clear pickup in inflation.

The FOMC will revise up their inflation projections. Merrill economists expect PCE inflation projections to be increased to around 3.1% for 2021.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 2.2 to 2.4 | 1.8 to 2.1 | 2.0 to 2.2 | |

| Dec 2020 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.1 | |

PCE core inflation was up 3.1% in April year-over-year and the projections for 2021 will be revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 2.0 to 2.3 | 1.9 to 2.1 | 2.0 to 2.2 | |

| Dec 2020 | 1.7 to 1.8 | 1.8 to 2.0 | 1.9 to 2.1 | |

It will be interesting to see if the FOMC projects an overshoot in inflation in 2022 or 2023.

Saturday, June 12, 2021

June 12th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/12/2021 07:03:00 PM

As expected the is a correlation between states with high vaccination rates, and low COVID cases. The top four vaccination states are Vermont, Hawaii, Massachusetts and Connecticut, with an average of 80.6% vaccinated (percent 18+ at least one dose) and 2.4 new cases per day per 100,000.

The bottom four vaccination states are Mississippi, Alabama, Louisiana and Wyoming, with an average of 46.2% vaccinated, and 6.3 new cases per day per 100,000.

Vaccines are free, safe and effective!

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 308,112,728, as of yesterday 306,509,795. Daily: 1.60 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 64.3% | 64.1% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 143.1 | 142.1 | ≥1601 |

| New Cases per Day3 | 13,295 | 14,138 | ≤5,0002 |

| Hospitalized3 | 15,304 | 15,717 | ≤3,0002 |

| Deaths per Day3 | 348 | 358 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 13 states that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, New Hampshire, Maryland, and Washington are all over 70%.

Next up are New York at 69.7%, D.C. at 69.6%, Illinois at 69.1%, Virginia at 68.9%, Minnesota at 68.4%, Delaware at 68.0%, Colorado at 67.7% and Oregon at 67.6%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Boston Real Estate in May: Sales Up 68% YoY, Inventory Down 20% YoY

by Calculated Risk on 6/12/2021 04:54:00 PM

Note: Remember sales were weak in April and May 2020 due to the pandemic. I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For Boston (single family and condos):

Schedule for Week of June 13, 2021

by Calculated Risk on 6/12/2021 08:11:00 AM

The key reports this week are May Retail sales and Housing Starts.

For manufacturing, the Industrial Production report, and the NY and Philly Fed manufacturing surveys, will be released this week.

The FOMC meets on Tuesday and Wednesday, and no change to policy is expected at this meeting.

No major economic releases scheduled.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.6% increase in core PPI.

8:30 AM: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of 22.0, down from 24.3.

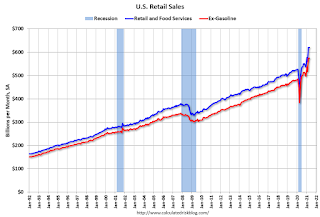

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for 0.4% decrease in retail sales.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for 0.4% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales ex-gasoline were up 0.1% in April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 75.1%.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 83, unchanged from 83 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Housing Starts for May.

8:30 AM ET: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.630 million SAAR, up from 1.569 million SAAR in April.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 365 thousand from 376 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 31.0, down from 31.5.

No major economic releases scheduled.