by Calculated Risk on 7/03/2021 10:46:00 AM

Saturday, July 03, 2021

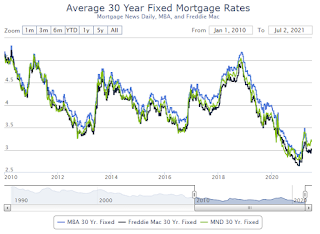

30 Year Mortgage Rates at 3.16%

From Matthew Graham at Mortgage News Daily: Rates Defy Jobs Report (And Other Weekly Highlights)

Rates had a good week, with most lenders at or near their best levels since mid June at the very least. 10yr Treasury yields trickled to their best levels in months by Friday afternoon after managing to break the 1.44% floor that had turned away several recent attempts. [30YR FIXED - 3.16%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac). Go to MND and you can adjust the graph for different time periods.

Schedule for Week of July 4, 2021

by Calculated Risk on 7/03/2021 08:11:00 AM

This will be a light week for economic data.

The focus will be on Job Openings.

All US markets will be closed in observance of Independence Day.

8:00 AM: Corelogic House Price index for May.

10:00 AM: the ISM non-Manufacturing Index for June. The consensus is for a reading of 63.9, down from 64.0.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in April to a record 9.286 million from 8.288 million in March.

The number of job openings (yellow) were up 100% year-over-year, and Quits were up 88% year-over-year (compared to worst of pandemic).

2:00 PM: FOMC Minutes, Meeting of June 15-16, 2021

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 350 thousand from 364 thousand last week.

No major economic releases scheduled.

Friday, July 02, 2021

July 2nd COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 7/02/2021 03:47:00 PM

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 328,809,470, as of a week ago 321,199,379. Average doses last week: 1.09 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 66.8% | 66.7% | 65.8% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 156.3 | 155.9 | 151.6 | ≥1601 |

| New Cases per Day3,4🚩 | 12,878 | 12,528 | 11,733 | ≤5,0002 |

| Hospitalized3 | 12,015 | 11,974 | 12,235 | ≤3,0002 |

| Deaths per Day3,4 | 214 | 205 | 226 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 4Cases and Deaths updated Mon - Fri 🚩 Increasing week-over-week | ||||

KUDOS to the residents of the 18 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, Maryland, California, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota and D.C. are all over 70%.

Next up are Colorado at 69.9%, Oregon at 69.8%, Wisconsin at 65.5%, Nebraska at 65.3%, Florida at 64.7%, South Dakota at 64.3%, and Utah at 64.3%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

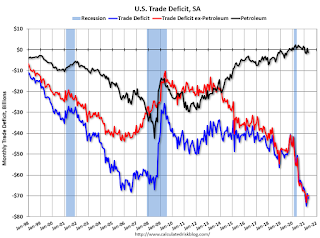

Trade Deficit Increased to $71.2 Billion in May

by Calculated Risk on 7/02/2021 01:59:00 PM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $71.2 billion in May, up $2.2 billion from $69.1 billion in April, revised.

May exports were $206.0 billion, $1.3 billion more than April exports. May imports were $277.3 billion, $3.5 billion more than April imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in May.

Exports are up 41% compared to May 2020; imports are up 38% compared to May 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China decreased to $26.3 billion in May, from $26.9 billion in May 2020.

Q2 GDP Forecasts: Revised Down, under 10%

by Calculated Risk on 7/02/2021 01:34:00 PM

From BofA:

The construction spending data sliced another 0.5pp from 2Q GDP tracking, leaving us at a still impressive 9.5% qoq saar. [July 2 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +8.5% (qoq ar). [July 2 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.2% for 2021:Q2 and 3.9% for 2021:Q3. [July 2 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2021 is 7.8 percent on July 2, down from 8.6 percent on July 1. [July 2 estimate]

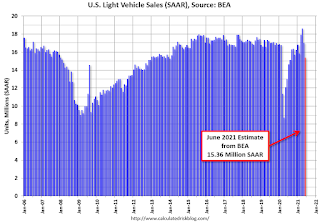

June Vehicles Sales Decreased Sharply to 15.36 Million SAAR

by Calculated Risk on 7/02/2021 11:14:00 AM

The BEA released their estimate of light vehicle sales for June this morning. The BEA estimates sales of 15.36 million SAAR in June 2021 (Seasonally Adjusted Annual Rate), down 9.8% from the May sales rate, and up 18% from June 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for June (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

Since April 2020, sales have increased, and were close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 15.36 million SAAR.

Note: dashed line is current estimated sales rate of 15.36 million SAAR.Comments on June Employment Report

by Calculated Risk on 7/02/2021 09:51:00 AM

The headline jobs number in the June employment report was above expectations, and employment for the previous two months was revised up. However, the participation rate was unchanged and the unemployment rate increased slightly to 5.9%.

Earlier: June Employment Report: 850 Thousand Jobs, 5.9% Unemployment Rate

In June, the year-over-year employment change was 7.919 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

In June, the number of permanent job losers decreased to 3.187 million from 3.234 million in May.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in June to 81.7% from 81.3% in May, and the 25 to 54 employment population ratio increased to 77.2% from 77.1% in May.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons decreased by 644,000 to 4.6 million in June. This decline reflected a drop in the number of persons whose hours were cut due to slack work or business conditions. The number of persons employed part time for economic reasons is up by 229,000 since February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in June to 4.627 million from 5.271 million in May.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 9.8% from 10.2% in May. This is down from the record high in April 22.9% for this measure since 1994 and close to pre-recession lows.

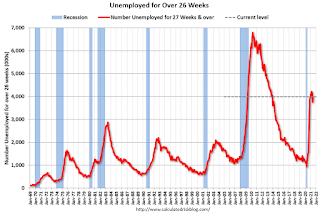

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.985 million workers who have been unemployed for more than 26 weeks and still want a job, up from 3.752 million in May.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was above expectations, and the previous two months were revised up by 15,000 combined. However, the headline unemployment rate increased slightly to 5.9%.

June Employment Report: 850 Thousand Jobs, 5.9% Unemployment Rate

by Calculated Risk on 7/02/2021 08:42:00 AM

From the BLS:

Total nonfarm payroll employment rose by 850,000 in June, and the unemployment rate was little changed at 5.9 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, public and private education, professional and business services, retail trade, and other services.

...

The change in total nonfarm payroll employment for April was revised down by 9,000, from +278,000 to +269,000, and the change for May was revised up by 24,000, from +559,000 to +583,000. With these revisions, employment in April and May combined is 15,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In June, the year-over-year change was 7.919 million jobs. This was up significantly - since employment collapsed in April 2020.

Total payrolls increased by 850 thousand in June. Private payrolls increased by 662 thousand.

Payrolls for April and May were revised up 15 thousand, combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 61.6% in June, from 61.6% in May. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 61.6% in June, from 61.6% in May. This is the percentage of the working age population in the labor force. The Employment-Population ratio was unchanged at 58.0% from 58.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

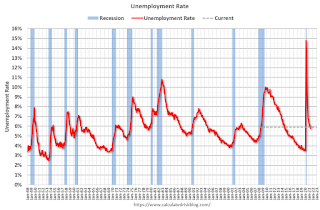

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in June to 5.9% from 5.8% in May.

This was above consensus expectations, and April and May were revised up by 15,000 combined.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 7/02/2021 08:12:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of June 29th.

From Andy Walden at Black Knight: Mild Forbearance Improvement as Quarterly Reviews Continue

As we mentioned last week, there were still more than 300,000 homeowners in forbearance whose plans were scheduled for review by the end of June. Well, of the roughly 146,000 plans reviewed for extension or removal over the past week, 44,000 homeowners left forbearance, while the plans of the other 102,000 were extended.

All in all, we wound up with a net decline of 6,000 plans. Not overly impactful, but it does set us up nicely for what could be a larger improvement next week as some 218,000 plans were still scheduled for review by Wednesday, June 30.

Our weekly snapshots run through Tuesday, though. As of June 29, our McDash Flash daily loan-level performance dataset showed 2.05 million homeowners – representing 3.9% of mortgaged properties – remaining in COVID-19 related forbearance plans.

Click on graph for larger image.

This puts the overall number of active plans down 145,000, a 6.6% decline from the same time last month with the rate of improvement picking up from 6% last week and 5.4% the week before.

A 5,000 reduction in the number of active GSE forbearance plans and a 2,000 drop in FHA/VA plans were partially offset by a rise of 1,000 among portfolio and privately held mortgages.

Plan starts continued to fall over the last seven days. In fact, last week saw the lowest total starts in five weeks (since the shortened business week of Memorial Day). There have been about 9% fewer starts over the last four weeks than there were in the preceding four-week period..

emphasis added

Thursday, July 01, 2021

Friday: Employment Report, Trade Deficit

by Calculated Risk on 7/01/2021 08:55:00 PM

My June Employment Preview

Goldman June Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for June. The consensus is for 675,000 jobs added, and for the unemployment rate to decrease to 5.6%.

• Also at 8:30 AM, Trade Balance report for May from the Census Bureau. The consensus is the trade deficit to be $70.8 billion. The U.S. trade deficit was at $68.9 billion the previous month.