by Calculated Risk on 7/06/2021 11:06:00 AM

Tuesday, July 06, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of July 5th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 18.9% from the same day in 2019 (81.1% of 2019). (Dashed line)

There was a slow increase from the bottom - and TSA data has picked up in 2021.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through July 4th, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is generally picking up, but was down 13% in the US (7-day average compared to 2019). Florida and Texas are above 2019 levels.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $140 million last week, down about 54% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is now above the horrible 2009 levels and weekend occupancy (leisure) has been solid.

This data is through June 26th. Hotel occupancy is currently down 7% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, the 4-week average occupancy is still down from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

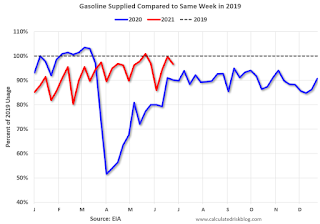

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of June 25th, gasoline supplied was down 3.4% compared to the same week in 2019 (about 96.6% of the same week in 2019).

Five weeks ago was the only week this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through July 4th for the United States and several selected cities.

This data is through July 4th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 94% of the January 2020 level and moving up.

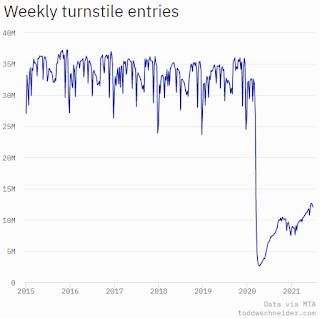

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, July 2nd.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

ISM® Services Index Decreased to 60.1% in June

by Calculated Risk on 7/06/2021 10:06:00 AM

(Posted with permission). The June ISM® Services index was at 60.1%, up from 64.0% last month. The employment index decreased to 49.3%, from 55.3%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in June for the 13th month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.The employment index decreased to 49.3%, from 55.3% in May.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI registered 60.1 percent, which is 3.9 percentage points lower than May’s all-time high reading of 64 percent. The June reading indicates the 13th straight month of growth for the services sector, which has expanded for all but two of the last 137 months.

“The Supplier Deliveries Index registered 68.5 percent, down 1.9 percentage points from May’s reading of 70.4 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Prices Index registered 79.5 percent, 1.1 percentage points lower than the May reading of 80.6 percent, indicating that prices increased in June, and at a slightly slower rate.

“According to the Services PMI®, 16 services industries reported growth. The composite index indicated growth for the 13th consecutive month after a two-month contraction in April and May 2020. The rate of expansion in the services sector remains strong, despite the slight pullback in the rate of growth from the previous month’s all-time high. Challenges with materials shortages, inflation, logistics and employment resources continue to be an impediment to business conditions,” says Nieves.

emphasis added

CoreLogic: House Prices up 15.4% Year-over-year in May

by Calculated Risk on 7/06/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Torrid Demand and Scarce Inventory Fuels Double-Digit Home Price Growth in May, CoreLogic Reports

CoreLogic® ... released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2021.

Converging pressures of severe inventory shortages and sustained demand pushed home prices to record highs in May, with the year-over-year increase in home prices at its highest level since 2005. While many millennials and Gen Z home buyers continue to move into the hot market thanks to low borrowing rates, high prices are likely deterring increasing numbers of prospective buyers — especially first-time and low-income families. Currently, 82% of consumers note housing affordability as a key problem, according to a recent CoreLogic survey. Additionally, 33% of respondents noted they would wait to buy or not buy at all rather than make sacrifices on their purchase.

“First-time buyers are hitting a wall in many places around the country as the pace of home price rises outpace the benefits of lower borrowing costs. Younger and first-time buyers, including younger millennials, are faced with the challenge of having sufficient savings for a down payment, closing costs and cash reserves,” said Frank Martell, president and CEO of CoreLogic. “As we look to the balance of 2021, we expect price rises to continue which could very well push prospective buyers out of the market in many areas and slow home price growth over the next year.”

“There are marked differences in today’s run up in prices compared to 2005, which was a bubble fueled by risky loans and lenient underwriting,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Today, loans with high-risk features are absent and mortgage underwriting is prudent. However, demand and supply imbalances — fueled by a drop in mortgage rates to less than one-half what they were in 2005 and a scarcity of for-sale homes — has fed the latest run up in sales prices.”

...

Nationally, home prices increased 15.4% in May 2021, compared with May 2020. On a month-over-month basis, home prices increased by 2.3% compared to April 2021.

At the state level, Idaho and Arizona continued to have the strongest price growth at 30.3% and 23.4%, respectively. Utah also had a 20.4% year-over-year increase as home buyers seek out more affordable locations with lower population density and attractive outdoor amenities.

emphasis added

Monday, July 05, 2021

Tuesday: ISM Services

by Calculated Risk on 7/05/2021 09:58:00 PM

Weekend:

• Schedule for Week of July 4, 2021

• Housing Inventory July 5th Update: Inventory Increased Week-over-week

• Homebuilder Comments in June: “It’s not fun to be a builder anymore.”

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for May.

• At 10:00 AM, the ISM Services Index for June. The consensus is for a reading of 63.9, down from 64.0.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are unchanged and DOW futures are up 60 (fair value).

Oil prices were up over the last week with WTI futures at $76.62 per barrel and Brent at $77.45 per barrel. A year ago, WTI was at $41, and Brent was at $43 - so WTI oil prices are UP about 90% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.12 per gallon. A year ago prices were at $2.18 per gallon, so gasoline prices are up $0.94 per gallon year-over-year.

Homebuilder Comments in June: “It’s not fun to be a builder anymore.”

by Calculated Risk on 7/05/2021 02:27:00 PM

Some twitter comments from Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting:

Analyzing June new home sales & pricing figures from our monthly builder survey. As one builder noted: “It’s not fun to be a builder anymore.” Lumber relief is nice but pick your poison on other issues. Market commentary from across the country to follow...

#Richmond builder: “It's not fun to be a builder anymore. Cost pressure is killing us. Not only will builders like myself who take 12-24 months to build a house lose margin from increases, but the affordability is becoming a major issue.”

#Atlanta builder: “Costs have driven up prices & we’re no longer preselling. We will not sell a home until frame stage, so our sales numbers are off for June while awaiting framing stage.”

#Jacksonville builder: “Home buyers are more sophisticated than in years past, watching & understanding commodity prices. Some buyers have paused their house searches waiting for the decreases in hopes builders in turn lower prices.”

#Sarasota builder: “We are feeling some buyer hesitancy because of significant price increases & timing. We can't start a new buyer's home until February 2022.”

#WestPalmBeach builder: “Cost increases are still coming in daily. Materials continue to be delayed coming on site. Cycle times are increasing as much as 50%. Windows & trusses remain the biggest issue.”

#Chicago builder: “Haven’t bid a new project this year as cost increases are too great to be competitive in the infill spec market. Doing remodeling work until things settle down.”

#Indianapolis builder: “Major concern is ability to develop enough lots to supply the market. Pipe shortage & labor shortages by development contractors are creating a bottleneck.”

#Charlotte builder: “We would not let our sales team sell during the month of June. We needed to take a "pause" from mid-May to the end of June to let our design and construction teams get caught up.”

#Wilmington builder: “Sales slow as we are not offering product for sale until we have our costs set. Delivery times for trusses are now 15 weeks. Drop in lumber prices could be partially due to truss availability. Builders can't purchase lumber until trusses delivered.”

#Knoxville builder: “Only reason we have such a slow sales rate in June is we have nothing to sell. We are no longer listing any new starts for sale until drywall is in.”

#Nashville builder: “Lumber supply including Truss joists, I-joists, glue lam beams, & oriented strand board are restricting starts & sales.”

#Sacramento builder: “Severely disrupted supply chain & supply shortages are causing us to change specs to more expensive products.”

#RiversideSanBernardino builder: “Shortages are creating many "go backs." Subs have caught on and are increasing labor to cover "go backs." It's hell right now to finish a home in a proper manner. Subs have reached capitulation.”

#Portland builder: “Lumber theft is a big deal. Thieves are now stealing staged material on 2nd floors of homes under construction.”

#Bend builder: “Sherwin Williams told us they are out of exterior base paint until later in July. Appliances must be ordered 6-9 months in advance. Seeing signs of price ceiling, namely upper end of market.”

#Philadelphia builder: “Cost increases are out of control. Scary to think delays will keep our houses sitting waiting for trusses/lumber & siding. Windows just got extended to 15-17 weeks out. Short staffing of contractors is a problem too.”

#Austin builder: “Might have seen a peak in lumber but labor is going to explode & create huge bottlenecks due to all the starts over the last month. Skilled labor is going to be a huge issue.”

#Dallas builder: “Hard to get lumber, windows, air conditioning coils, etc. Air conditioning coils are in short supply and many are backordered, causing delays in getting inspections.”

#FortWorth builder: “Experiencing windows, brick, & now paint shortages. Some prospective buyers have put off purchasing to see if prices will come down.”

#Houston builder: “We’ve seen roughly $8-10K on average of cost increases each month for the past 4-5 months. Lumber has been the key cost driver, but plumbing, electrical, insulation, & virtually every other component has also increased much faster than historical levels.”

#SanAntonio builder: “Sales rate dropped only because we cut off new sales. We are selling too fast & burning through our lots. As of now, we are only selling spec homes. Otherwise, our sales pace would still be increasing month over month.”

#ColoradoSprings builder: “In addition to higher costs, we have had delays in construction & are questioning our ability to hit our closing numbers, despite strong sales.”

#Denver builder: “While lumber is beginning to come down, we anticipate a number of increases in other product categories. Starts exceed sales because we’re waiting to release homes until we have at least ordered lumber & know the cost.”

#SaltLakeCity builder: “Our cameras see theft almost every other night. Getting price increase letters at least weekly. Everyone is taking advantage of every crisis they can. Plumbing supplier said COVID has caused a 75% decrease in production because of being short staffed."

#Phoenix builder: “Appliance back orders through General Electric are still a major issue at closings. Cost of plywood still out of control. Shortage of labor, & especially qualified workers is getting worse. HVAC is the farthest behind labor & material trade.” END

Housing Inventory July 5th Update: Inventory Increased Week-over-week

by Calculated Risk on 7/05/2021 12:10:00 PM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube. Altos Research has also seen a significant pickup in price decreases, although still well below a normal rate for June.

Employment: June Diffusion Indexes

by Calculated Risk on 7/05/2021 09:57:00 AM

For manufacturing, the diffusion index was at 62.0, down from 63.3 in May.

Think of this as a measure of how widespread job gains or losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Click on graph for larger image.

Click on graph for larger image.Both indexes declined sharply in March 2020, and collapsed to new record lows in April 2020 due to the impact from COVID-19. Then the indexes increased as the economy bounced back.

Sunday, July 04, 2021

July 4th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 7/04/2021 04:44:00 PM

Note: According to the CDC, "In observance of Independence Day, the COVID Data Tracker will not update on Monday, July 5th, 2021. Updates will resume on Tuesday, July 6th, 2021."

According to the CDC, on Vaccinations.

Total doses administered: 330,604,253, as of a week ago 323,327,328. Average doses last week: 1.04 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 67.1% | 67.0% | 66.0% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 157.3 | 157.0 | 153.0 | ≥1601 |

| New Cases per Day3🚩 | 13,241 | 12,914 | 11,969 | ≤5,0002 |

| Hospitalized3 | 11,904 | 12,101 | 12,125 | ≤3,0002 |

| Deaths per Day3 | 215 | 213 | 238 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing week-over-week | ||||

KUDOS to the residents of the 20 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, Maryland, California, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Colorado, Oregon and D.C. are all over 70%.

Next up are Wisconsin at 65.7%, Nebraska at 65.3%, Florida at 65.1%, Utah at 64.4%, South Dakota at 64.3%, and Iowa at 64.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 7/04/2021 11:40:00 AM

Note: I used to post this monthly, but I stopped during the COVID-19 pandemic. I've received a number of requests lately to post this again, so here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

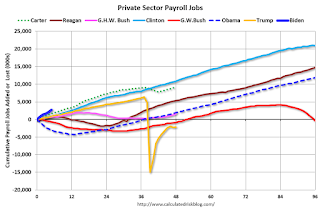

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter, George H.W. Bush and Trump only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. And there was a pandemic related recession in 2020.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 824,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 387,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,511,000 under President G.H.W. Bush (light purple), 20,970,000 under President Clinton (light blue), and 11,828,000 under President Obama (dark dashed blue). During Trump's term (Orange), the economy lost 2,135,000 private sector jobs.

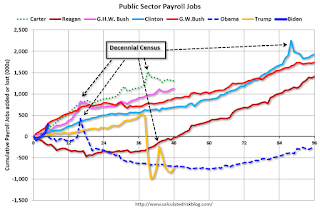

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 271,000 jobs). During Trump's term, the economy lost 741,000 public sector jobs.

Saturday, July 03, 2021

July 3rd COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 7/03/2021 05:38:00 PM

Congratulations to the residents of Colorado and Oregon on joining the 70% club! Go for 80%!!!

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 329,970,551, as of a week ago 322,123,103. Average doses last week: 1.12 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 67.0% | 66.8% | 65.9% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 157.0 | 156.3 | 152.2 | ≥1601 |

| New Cases per Day3🚩 | 13,241 | 12,914 | 11,969 | ≤5,0002 |

| Hospitalized3 | 12,101 | 12,015 | 12,125 | ≤3,0002 |

| Deaths per Day3 | 215 | 213 | 238 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing week-over-week | ||||

KUDOS to the residents of the 20 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, Maryland, California, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Colorado, Oregon and D.C. are all over 70%.

Next up are Wisconsin at 65.6%, Nebraska at 65.3%, Florida at 64.8%, South Dakota at 64.3%, and Utah at 64.3%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.