by Calculated Risk on 7/22/2021 06:21:00 PM

Thursday, July 22, 2021

July 22nd COVID-19, New Cases, Hospitalizations, Vaccinations

According to the CDC, on Vaccinations.

Total doses administered: 339,763,765, as of a week ago 336,054,953. Average doses last week: 0.53 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 68.6% | 68.4% | 67.9% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 162.2 | 161.9 | 160.4 | ≥1601 |

| New Cases per Day3🚩 | 40,246 | 37,642 | 27,443 | ≤5,0002 |

| Hospitalized3🚩 | 21,153 | 20,286 | 15,712 | ≤3,0002 |

| Deaths per Day3🚩 | 223 | 206 | 204 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Utah at 67.1%, Florida at 66.9%, Wisconsin at 66.6%, Nebraska at 66.4%, South Dakota at 65.4%, and Iowa at 64.9%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Comments on June Existing Home Sales

by Calculated Risk on 7/22/2021 03:44:00 PM

Earlier: NAR: Existing-Home Sales Increased to 5.86 million in June

Two key points:

1) Existing home sales are still somewhat above pre-pandemic levels. Seasonally adjusted (SA) sales for May were the highest since 2006, and sales Not Seasonally Adjusted (NSA) in June 2021 were also the highest since 2006.

2) Inventory is very low, and was down 18.8% year-over-year (YoY) in May. Also, as housing economist Tom Lawler has noted, the local MLS data shows even a larger decline in active inventory (the NAR appears to include some pending sales in inventory). Lawler noted:

"As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months."

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales by month for 2020 and 2021.

The year-over-year comparison will be more difficult in the second half of the year.

The second graph shows existing home sales for each month, Not Seasonally Adjusted (NSA), since 2005.

Sales NSA in June (614,000) were 21.1% above sales in June 2020 (507,000).

Sales NSA in June (614,000) were 21.1% above sales in June 2020 (507,000).This was the highest sales for June, NSA, since 2006.

Black Knight: National Mortgage Delinquency Rate Decreased in June

by Calculated Risk on 7/22/2021 02:01:00 PM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: 1.55 Million Serious Delinquencies Remain; At Current Rate of Reduction, 1 Million Still Likely As September's Wave of Forbearance Expirations Begins

• The national delinquency rate hit its lowest level since the onset of the pandemic and is now back below its pre-Great Recession averageAccording to Black Knight's First Look report, the percent of loans delinquent decreased 7.6% in June compared to May, and decreased 42% year-over-year.

• Despite the improvement, there are more than 1.5 million homeowners 90 or more days past due on their mortgages but who are not in foreclosure, still nearly four times pre-pandemic levels

• Serious delinquency rates remain elevated by more than a full percentage point across all 50 states, with Hawaii and Nevada serious delinquency rates remaining elevated by 3.4 percentage points

• Though serious delinquencies remain significantly elevated, the share of mortgages in active foreclosure fell to yet another record low in June at 0.27%

• Recent pullbacks in interest rates resulted in prepayment activity edging upward for the first time in three months

emphasis added

The percent of loans in the foreclosure process decreased 1.7% in June and were down 24% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.37% in June, down from 4.73% in May.

The percent of loans in the foreclosure process decreased in June to 0.27%, from 0.28% in May.

The number of delinquent properties, but not in foreclosure, is down 1,714,000 properties year-over-year, and the number of properties in the foreclosure process is down 47,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2021 | May 2021 | June 2020 | June 2019 | |

| Delinquent | 4.37% | 4.73% | 7.59% | 3.73% |

| In Foreclosure | 0.27% | 0.28% | 0.36% | 0.50% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,320,000 | 2,511,000 | 4,034,000 | 1,950,000 |

| Number of properties in foreclosure pre-sale inventory: | 145,000 | 148,000 | 192,000 | 259,000 |

| Total Properties | 2,466,000 | 2,659,000 | 4,226,000 | 2,209,000 |

NMHC: July Apartment Market Tightness Index Highest on Record

by Calculated Risk on 7/22/2021 12:13:00 PM

The National Multifamily Housing Council (NMHC) released their July report: July Apartment Market Conditions Showed Improvement Across All Metrics

Apartment market conditions showed continued improvement in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for July 2021. For the first time since October 2015, the Market Tightness (96), Sales Volume (79), Equity Financing (69), and Debt Financing (71) indexes all came in above the breakeven level (50).

“We are witnessing strong, broad-based demand for apartments as the U.S. economy continues to recover,” noted NMHC Chief Economist Mark Obrinsky. “Many U.S. gateway metros, which were among those hardest hit during the coronavirus pandemic, have now seen their occupancy rates return to near-pre-pandemic levels. Meanwhile, rent growth remains particularly strong in a number of Sun Belt and Mountain markets.”

“Nearly all (92 percent) respondents this quarter observed tighter conditions in their apartment markets, signaling that the worst of the pandemic could be behind us. Apartment sales volume is strong as well, bolstered by continued low interest rates and strong availability of equity financing.”

...

The Market Tightness Index increased from 81 to 96 – the highest index number on record – indicating widespread agreement among respondents that market conditions have become tighter. Nearly all (92 percent) respondents reported tighter market conditions than three months prior, compared to only 1 percent who reported looser conditions. Seven percent of respondents felt that conditions were no different from last quarter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

NAR: Existing-Home Sales Increased to 5.86 million in June

by Calculated Risk on 7/22/2021 10:11:00 AM

From the NAR: Existing-Home Sales Expand 1.4% in June

Existing-home sales increased in June, snapping four consecutive months of declines, according to the National Association of Realtors®. Three of the four major U.S. regions registered small month-over-month gains, while the fourth remained flat. However, all four areas notched double-digit year-over-year gains.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 1.4% from May to a seasonally adjusted annual rate of 5.86 million in June. Sales climbed year-over-year, up 22.9% from a year ago (4.77 million in June 2020).

...

Total housing inventory at the end of June amounted to 1.25 million units, up 3.3% from May's inventory and down 18.8% from one year ago (1.54 million). Unsold inventory sits at a 2.6-month supply at the current sales pace, modestly up from May's 2.5-month supply but down from 3.9 months in June 2020.

emphasis added

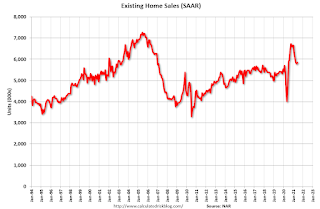

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.86 million SAAR) were up 1.4% from last month, and were 22.9% above the June 2020 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.25 million in June from 1.21 million in May.

According to the NAR, inventory increased to 1.25 million in June from 1.21 million in May.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 18.8% year-over-year in June compared to June 2020.

Inventory was down 18.8% year-over-year in June compared to June 2020. Months of supply increased to 2.6 months in June from 2.5 months in May.

This was slightly below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims increase to 419,000

by Calculated Risk on 7/22/2021 08:35:00 AM

The DOL reported:

In the week ending July 17, the advance figure for seasonally adjusted initial claims was 419,000, an increase of 51,000 from the previous week's revised level. The previous week's level was revised up by 8,000 from 360,000 to 368,000. The 4-week moving average was 385,250, an increase of 750 from the previous week's revised average. The previous week's average was revised up by 2,000 from 382,500 to 384,500.This does not include the 96,362 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 100,590 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 385,250.

The previous week was revised up.

Regular state continued claims decreased to 3,236,000 (SA) from 3,265,000 (SA) the previous week.

Note: There are an additional 5,133,938 receiving Pandemic Unemployment Assistance (PUA) that decreased from 5,687,188 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 4,134,716 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 4,710,359.

Weekly claims were higher than the consensus forecast.

Wednesday, July 21, 2021

Thursday: Unemployment Claims, Existing Home Sales

by Calculated Risk on 7/21/2021 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 348 thousand from 360 thousand last week.

• Also at 8:30 AM, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.90 million SAAR, up from 5.80 million last month. Housing economist Tom Lawler expects the NAR to report 5.79 million SAAR.

• At 11:00 AM, the Kansas City Fed manufacturing survey for July.

Existing Home Inventory in June: Local Markets

by Calculated Risk on 7/21/2021 03:50:00 PM

I'm gathering existing home data for many local markets, and I'm watching inventory very closely this year.

Note: California reported a 15.4% increase in active inventory from May to June, but they don't report the actual numbers - so California isn't include in the table below. But this is similar increase to most other areas.

As I noted in Some thoughts on Housing Inventory

The key for housing in 2021 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in house prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation.Although inventory in these areas is down about 43% year-over-year, inventory is up 12.6% month-to-month. Seasonally we'd usually expect an increase in inventory from May to June - so some of this increase is seasonal (as opposed to a shift in the market).

| Existing Home Inventory | |||||

|---|---|---|---|---|---|

| Jun-21 | May-21 | Jun-20 | YoY | MoM | |

| Alabama | 9,954 | 9,363 | 16,518 | -39.7% | 6.3% |

| Atlanta | 7,787 | 7,530 | 17,596 | -55.7% | 3.4% |

| Boston | 3,822 | 3,418 | 4,697 | -18.6% | 11.8% |

| Charlotte | 3,462 | 3,104 | 7,182 | -51.8% | 11.5% |

| Colorado | 9,191 | 7,034 | 22,230 | -58.7% | 30.7% |

| Denver1 | 3,122 | 2,075 | 6,383 | -51.1% | 50.5% |

| Houston | 24,225 | 22,607 | 35,281 | -31.3% | 7.2% |

| Indiana | 7,743 | 6,559 | 12,139 | -36.2% | 18.1% |

| Las Vegas | 3,029 | 2,560 | 6,695 | -54.8% | 18.3% |

| Maryland | 8,550 | 7,490 | 15,558 | -45.0% | 14.2% |

| Minnesota | 10,227 | 8,953 | 17,285 | -40.8% | 14.2% |

| New Hampshire | 2,505 | 1,959 | 3,613 | -30.7% | 27.9% |

| North Texas | 9,747 | 8,126 | 19,406 | -49.8% | 19.9% |

| Northwest | 6,358 | 5,533 | 9,670 | -34.3% | 14.9% |

| Phoenix | 5,866 | 5,218 | 8,792 | -33.3% | 12.4% |

| Portland | 2,722 | 2,339 | 4,109 | -33.8% | 16.4% |

| Rhode Island | 1,985 | 1,143 | 2,966 | -33.1% | 73.7% |

| Sacramento | 1,297 | 1267 | 1,495 | -13.2% | 2.4% |

| South Carolina | 11,578 | 11,278 | 22,676 | -48.9% | 2.7% |

| Total1 | 130,048 | 115,481 | 227,908 | -42.9% | 12.6% |

| 1excluding Denver (included in Colorado) | |||||

July 21st COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 7/21/2021 03:38:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 339,102,867, as of a week ago 335,487,779. Average doses last week: 0.52 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 68.4% | 68.3% | 67.8% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 161.9 | 161.6 | 160.1 | ≥1601 |

| New Cases per Day3🚩 | 37,673 | 35,512 | 24,709 | ≤5,0002 |

| Hospitalized3🚩 | 20,241 | 19,330 | 15,137 | ≤3,0002 |

| Deaths per Day3🚩 | 237 | 245 | 198 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 66.8%, Utah at 66.7%, Wisconsin at 66.5%, Nebraska at 66.4%, South Dakota at 65.2%, and Iowa at 64.9%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Alabama Real Estate in June: Sales Up 15% YoY, Inventory Down 40% YoY

by Calculated Risk on 7/21/2021 01:33:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For the entire state of Alabama:

Closed sales in June 2021 were 8,234, up 14.6% from 7,184 in June 2020.

Active Listings in June 2021 were 9,954, down 39.7% from 16,518 in June 2020.

Months of Supply was 1.2 Months in June 2021, compared to 2.3 Months in June 2020.

Inventory in June was up 6.3% from last month.