by Calculated Risk on 8/03/2021 12:36:00 PM

Tuesday, August 03, 2021

30 Year Mortgage Rates Decline to 2.80%

From Matthew Graham at Mortgage News Daily: MBS RECAP: Bonds Surge Into August Despite Headwinds

It was an interesting juxtaposition to see a Fed speaker talking about tapering being announced as early as September while bond yields hit the 3pm close at the lowest levels since February. Headwinds are definitely present, whether we're talking about tapering risk or simply the selling opportunity presented by such low yields at a time when the economy may soon suggest a bounce. But tailwinds remain because that suggestion has yet to be made. ... [30 year fixed 2.80%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac).

NY Fed Q2 Report: Total Household Debt Increased in Q2 2021

by Calculated Risk on 8/03/2021 11:13:00 AM

From the NY Fed: Total Household Debt Climbs in Q2 2021, New Extensions of Credit Hit Series Highs

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit . The report shows that total household debt increased by $313 billion (2.1%) to $14.96 trillion in the second quarter of 2021. The total debt balance is now $812 billion higher than at the end of 2019. The 2.1% increase in aggregate balances was the largest seen since Q4 2013 and marked the largest nominal increase in debt balances since Q2 2007. The Report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative random sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

Mortgage balances—the largest component of household debt—rose by $282 billion and stood at $10.44 trillion at the end of June. Credit card balances started to tick back up, increasing by $17 billion in the second quarter. Despite the increase, credit card balances were still $140 billion lower than they had been at the end of 2019. Auto loans increased by $33 billion, while student loan balances decreased by $14 billion. In total, non-housing balances (including credit card, auto loan, student loan, and other debts) grew by $44 billion, with increases in auto loans and credit card balances offsetting the decline in student loan balances.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q2. Household debt previously peaked in 2008, and bottomed in Q3 2013. Unlike following the great recession, there wasn't a huge decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $313 billion in the second quarter of 2021, a 2.1% rise from 2021Q1, and now stand at $14.96 trillion. Balances are $812 billion higher than at the end of 2019 and $691 billion higher than 2020Q2. The 2.1% increase in aggregate balances was the largest seen since 2013Q4 and marked the largest nominal increase in debt balances since 2007Q2.

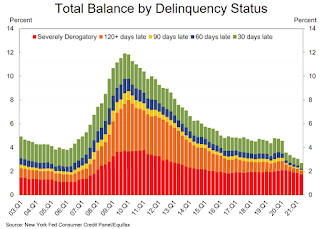

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased in Q2. From the NY Fed:

Aggregate delinquency rates have remained low and declining since the beginning of the pandemic recession, reflecting an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments. As of late June, 2.7% of outstanding debt was in some stage of delinquency, a 2.0 percentage point decrease from the fourth quarter of 2019, just before the Covid pandemic hit the United States. Of the $405 billion of debt that is delinquent, $316 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders’ books but upon which they continue to attempt collection).

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Median mortgage origination credit scores were roughly flat, with the median credit score of newly originated mortgages at 786, reflecting a continuing high quality of underwriting standards and higher shares of refinances. ... There was $1.22 trillion in newly originated mortgage debt in 2021Q2, with 71% of it originated to borrowers with credit scores over 760.There is much more in the report.

CoreLogic: House Prices up 17.2% Year-over-year in June

by Calculated Risk on 8/03/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Annual Home Price Growth of 17.2% — the Highest Level Since the Late-1970s

CoreLogic® ... released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for June 2021.

Despite the economic ups and downs brought on by the pandemic, the housing market is still going strong. As supply and demand pressures endure and construction costs spike, in June, home price gains reached the highest annual growth since 1979. While affordability challenges intensify, low mortgage rates, rising savings and an improving labor market are helping to keep homeownership within reach for many prospective buyers. However, CoreLogic projects home price gains may slow over the next 12 months as demand moderates and for-sale inventory rises.

“Home prices have been rising in the mid-single digits for some years now. The recent surge to double-digit price jumps reflect the convergence of exceptional demand and persistent low supply,” said Frank Martell, president and CEO of CoreLogic. “With plenty of cash on the sidelines, along with very low mortgage rates, prices are heading up and affordability will become a more acute issue for the foreseeable future.”

...

Nationally, home prices increased 17.2% in June 2021, compared to June 2020. On a month-over-month basis, home prices increased by 2.3% compared to May 2021.

...

“The pandemic sparked an increase in buyer desire for lower density neighborhoods and more living space — both inside and outside their home,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Communities with single-family detached houses fill this need. Detached homes had the highest annual growth in June since the inception of the CoreLogic Home Price Index in 1976.”

emphasis added

Monday, August 02, 2021

Tuesday: Vehicle Sales, NY Fed Quarterly Report on Household Debt and Credit

by Calculated Risk on 8/02/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Bonds Surge Into August Despite Headwinds

It was an interesting juxtaposition to see a Fed speaker talking about tapering being announced as early as September while bond yields hit the 3pm close at the lowest levels since February. Headwinds are definitely present, whether we're talking about tapering risk or simply the selling opportunity presented by such low yields at a time when the economy may soon suggest a bounce. But tailwinds remain because that suggestion has yet to be made. ... [30 year fixed 2.80%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for June.

• All Day, Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 15.7 million SAAR in July, up from 15.4 million in June (Seasonally Adjusted Annual Rate).

• At 11:00 AM: NY Fed: Q2 Quarterly Report on Household Debt and Credit

Fed Survey: Banks reported Eased Standards, Increased Demand for Residential Real Estate Loans

by Calculated Risk on 8/02/2021 05:50:00 PM

From the Federal Reserve: The July 2021 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July 2021 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the second quarter of 2021.

Regarding loans to businesses, respondents to the July survey, on balance, reported easier standards and stronger demand for commercial and industrial (C&I) loans to firms of all sizes over the second quarter.2 For commercial real estate (CRE), standards on multifamily and construction and land development loans eased, while standards on loans secured by nonfarm nonresidential properties remained basically unchanged. Banks reported stronger demand for all CRE loan categories.

For loans to households, banks eased standards across most categories of residential real estate (RRE) loans, on net, and reported stronger demand for most types of RRE loans over the second quarter. Banks also eased standards and reported stronger demand across all three consumer loan categories—credit card loans, auto loans, and other consumer loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residnetial Real Estate lending is from the Senior Loan Officer Survey Charts.

This shows that banks have eased standards (tightened for subprime), and that there is increased demand for RRE loans.

August 2nd COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 8/02/2021 05:36:00 PM

Note: Data reported on Monday is always low, and is revised up as data is received.

According to the CDC, on Vaccinations.

Total doses administered: 346,924,345, as of a week ago 342,212,051. Average doses last week: 0.67 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 70.0% | 69.9% | 69.0% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 164.9 | 164.8 | 163.2 | ≥1601 |

| New Cases per Day3🚩 | 63,250 | 68,326 | 55,822 | ≤5,0002 |

| Hospitalized3🚩 | 35,236 | 35,649 | 26,508 | ≤3,0002 |

| Deaths per Day3🚩 | 284 | 294 | 253 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 69.2%, Utah at 68.0%, Nebraska at 67.6%, Wisconsin at 67.5%, Kansas at 66.6%, South Dakota at 66.4%, Nevada at 65.9%, and Iowa at 65.7%.

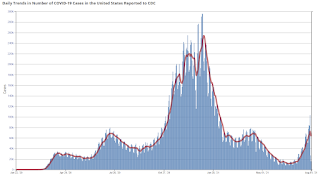

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

MBA Survey: "Share of Mortgage Loans in Forbearance Slightly Decreases to 3.47%"

by Calculated Risk on 8/02/2021 04:00:00 PM

Note: This is as of July 25th.

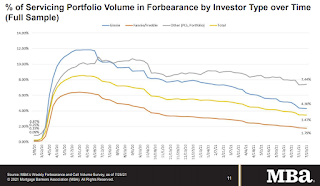

From the MBA: Share of Mortgage Loans in Forbearance Slightly Decreases to 3.47%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 3.48% of servicers’ portfolio volume in the prior week to 3.47% as of July 25, 2021. According to MBA’s estimate, 1.74 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 basis points to 1.79%. Ginnie Mae loans in forbearance decreased 5 basis points to 4.30%, while the forbearance share for portfolio loans and private-label securities (PLS) increased 6 basis points to 7.44%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 1 basis point to 3.67%, and the percentage of loans in forbearance for depository servicers decreased 2 basis points to 3.59%.

“Forbearance exits remained low, and there was another increase in new forbearance requests, particularly for Ginnie Mae and portfolio and PLS loans. The net result was another slight decline in the share of loans in forbearance,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While the overall number of loans in forbearance has changed little in recent weeks, forbearance re-entries have increased, reaching 7.2% this week. Recent economic data continue to show improvement, but it’s clear many homeowners in forbearance still need the relief that is being provided.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.04% to 0.06%."

Black Knight Mortgage Monitor for June; Large Number of Forbearance Plans Expire in Sept and Oct

by Calculated Risk on 8/02/2021 12:12:00 PM

Black Knight released their Mortgage Monitor report for June today. According to Black Knight, 4.37% of mortgage were delinquent in June, down from 4.73% of mortgages in May, and down from 7.59% in June 2020. Black Knight also reported that 0.27% of mortgages were in the foreclosure process, down from 0.36% a year ago.

This gives a total of 5.01% delinquent or in foreclosure.

Press Release: Black Knight: Servicers Face Operational Challenge of Processing Up To 18,000 Forbearance Plans Per Day as Newly Detailed Forbearance Timelines Frontload Expirations to the Fall

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. Considering recently updated forbearance expiration timelines announced by FHFA, FHA, VA, and USDA, this month’s report looks at the impact of the many varying allowable forbearance periods. According to Black Knight Data & Analytics President Ben Graboske, due to the complexity of the expiration matrices across different agencies, the operational challenge mortgage servicers were already facing this fall has been compounded even more.

“Prior to the agencies issuing clarifying guidance on allowable forbearance periods, some 950,000 plans were set to expire over the final six months of the year – representing about half of all loans in forbearance,” said Graboske. “That estimate assumed a blanket 18-month maximum allowable forbearance period. However, now we have detailed matrices of differing forbearance periods across the various agencies. Depending upon the specific agency and when forbearance was initially requested by the homeowner, a plan can have a 6-, 12-, 15- or 18-month limit. Assuming borrowers stay in for the maximum allowable term, this means plans that started as much as seven months apart are now scheduled to expire simultaneously, frontloading expirations of forbearance plans sooner than estimated.

“As a result, 65% of active plans – representing approximately 1.2 million homeowners – are now set to expire over the rest of 2021, including nearly 80% of all FHA and VA loans in forbearance. Nearly three quarters of a million plans would expire in September and October alone. Over the course of just two months this fall, the nation’s mortgage servicers would have to process up to approximately 18,000 expiring plans per business day, guiding borrowers through complex loss mitigation waterfalls directed by changing regulatory requirements. The operational challenge this represents is staggering, even before noting the oversized share of FHA and VA loans. Given the heightened challenges those borrowers may face in returning to making mortgage payments as compared to those in GSE loans, effective loss mitigation efforts and automated processes become even more critically important.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph on delinquencies from Black Knight:

• After a calendar-related setback in May, mortgage delinquencies returned to their trend of improvement in June, falling to 4.37% from 4.73% the month prior

• The national delinquency rate is now back below its 2000-2005 pre-Great Recession average for this time of year and currently stands 1.17 percentage points above the record low reached just before the onset of the pandemic

• While the overall delinquency rate remains on pace to return to pre-pandemic levels by early 2022, serious delinquencies continue to improve at a much slower rate

And on estimated expiration of forbearance plans from Black Knight:

And on estimated expiration of forbearance plans from Black Knight: • Prior to the clarifying guidance on allowable forbearance periods, Black Knight had estimated some 950K plans were set to expire over the final six months of the year – representing about half of all loans in forbearanceThere is much more in the mortgage monitor.

• However, under the current matrices 65% of active plans – representing approximately 1.2 million homeowners – are now set to expire over the rest of 2021, including nearly 80% of all FHA and VA loans in forbearance

• While some borrowers will elect to leave forbearance early between now and their final expiration, servicers are still facing significant operational challenges, especially with FHA loans which may take additional processing time due to the complexities of post-forbearance workouts

• Under the current matrices, the nation’s mortgage servicers would have to process up to 18K expiring plans per business day in September and October alone, guiding borrowers through complex loss mitigation waterfalls directed by changing regulatory requirements

Housing Inventory August 2nd Update: Inventory Increased Slightly Week-over-week, Up 33% from Low in early April

by Calculated Risk on 8/02/2021 10:55:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Construction Spending increased 0.1% in June

by Calculated Risk on 8/02/2021 10:30:00 AM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during June 2021 was estimated at a seasonally adjusted annual rate of $1,552.2 billion, 0.1 percent above the revised May estimate of $1,551.2 billion. The June figure is 8.2 percent above the June 2020 estimate of $1,435.0 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,215.2 billion, 0.4 percentabove the revised May estimate of $1,210.3 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $337.0 billion, 1.2 percent below the revised May estimate of $340.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 13% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 9% above the bubble era peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 4% above the previous peak in March 2009, and 29% above the austerity low in February 2014, but weak recently.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 29.3%. Non-residential spending is down 6.0% year-over-year. Public spending is down 7.5% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but some sectors of non-residential have been under pressure. For example, lodging is down 26.5% YoY, multi-retail down 5.2% YoY, and office down 9.1% YoY.