by Calculated Risk on 8/04/2021 09:00:00 PM

Wednesday, August 04, 2021

Thursday: Trade Deficit, Unemployment Claims

Thursday:

• At 8:30 AM ET, Trade Balance report for June from the Census Bureau. The consensus is the trade deficit to be $73.9 billion. The U.S. trade deficit was at $71.2 Billion the previous month.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 390 thousand from 400 thousand last week.

August 4th COVID-19: Second Worst Wave for Cases and Hospitalizations

by Calculated Risk on 8/04/2021 04:21:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 348,102,478, as of a week ago 343,361,524. Average doses last week: 0.68 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 70.1% | 70.1% | 69.3% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 165.3 | 165.1 | 163.6 | ≥1601 |

| New Cases per Day3🚩 | 89,463 | 85,825 | 62,432 | ≤5,0002 |

| Hospitalized3🚩 | 42,938 | 40,935 | 29,601 | ≤3,0002 |

| Deaths per Day3🚩 | 354 | 333 | 261 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 69.6%, Utah at 68.5%, Nebraska at 67.8%, Wisconsin at 67.6%, Kansas at 66.9%, South Dakota at 66.7%, Nevada at 66.2%, and Iowa at 66.0%.

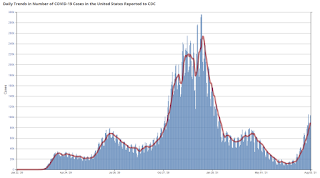

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Denver Real Estate in July: Sales Down 21% YoY, Active Inventory Down 37% YoY

by Calculated Risk on 8/04/2021 01:22:00 PM

While still in a robust seller's market, the July 2021 report indicates that as we head into fall, buyers will start to have more time to review properties and less competition on the number of offers overall. The July residential real estate market reported an increased inventory of 29.92 percent, while it also represented a decrease in closings of 12.30 percent compared to the previous month, indicating a supply increase and demand decrease.Active inventory in Denver is up 111% from the record low in March 2021.

“The real estate market continuously changes,” said Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “It appears that, for now, we are back to drawing within the lines. For buyers, this can be beneficial by having more normal expectations of what it takes to buy. For sellers with grandiose dreams of what their house could be worth, now is the time to come back to reality and use the data to help make an educated decision.”

emphasis added

ISM® Services Index Increased to 64.1% in July

by Calculated Risk on 8/04/2021 10:04:00 AM

(Posted with permission). The July ISM® Services index was at 64.1%, up from 60.1% last month. The employment index increased to 53.8%, from 49.3%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in July for the 14th month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.This was above the consensus forecast, and the employment index increased to 53.8%, from 49.3% the previous month.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI® registered another all-time high of 64.1 percent, which is 4 percentage points higher than the June reading of 60.1 and eclipses the previous record of 64 percent in May 2021. The July reading indicates the 14th straight month of growth for the services sector, which has expanded for all but two of the last 138 months.

“The Supplier Deliveries Index registered 72 percent, up 3.5 percentage points from June’s reading of 68.5 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Prices Index registered 82.3 percent, up 2.8 percentage points from the June figure of 79.5 percent and its second-highest reading ever, behind September 2005 (83.5 percent).

“According to the Services PMI®, 17 services industries reported growth. The composite index indicated growth for the 14th consecutive month after a two-month contraction in April and May 2020. The rate of expansion in the services sector recorded another all-time high. The Employment Index reflected growth, even though the constrained labor pool continues to be an issue. Materials shortages, inflation and logistics continue to negatively impact the continuity of supply,” says Nieves.

emphasis added

July Vehicles Sales Decreased to 14.75 Million SAAR

by Calculated Risk on 8/04/2021 08:40:00 AM

The BEA released their estimate of light vehicle sales for July this morning. The BEA estimates sales of 14.75 million SAAR in July 2021 (Seasonally Adjusted Annual Rate), down 4.1% from the June sales rate, and up 0.3% from July 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for July (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate of 14.75 million SAAR.

ADP: Private Employment increased 330,000 in July

by Calculated Risk on 8/04/2021 08:21:00 AM

Private sector employment increased by 330,000 jobs from June to July according to the July ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well below the consensus forecast of 675,000 for this report.

“The labor market recovery continues to exhibit uneven progress, but progress nonetheless. July payroll data reports a marked slowdown from the second quarter pace in jobs growth,” said Nela Richardson, chief economist, ADP. “For the fifth straight month the leisure and hospitality sector is the fastest growing industry, though gains have softened. The slowdown in the recovery has also impacted companies of all sizes. Bottlenecks in hiring continue to hold back stronger gains, particularly in light of new COVID-19 concerns tied to viral variants. These barriers should ebb in coming months, with stronger monthly gains ahead as a result."

emphasis added

The BLS report will be released Friday, and the consensus is for 900 thousand non-farm payroll jobs added in July. The ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/04/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 30, 2021.

... The Refinance Index decreased 2 percent from the previous week and was 3 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 18 percent lower than the same week one year ago.

“Interest rates drifted lower globally last week, as markets assessed the latest concerns regarding the delta variant. 30-year mortgage rates dropped below 3 percent in our survey for the first time since this February, presenting an opportunity for many homeowners who have not yet refinanced to lower their rate and their payments. Refinance application volume slightly decreased, following an 11 percent jump last week,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Purchase application volume decreased again, reflecting the ongoing lack of inventory that continues to drive rapid home-price appreciation across the country.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 2.97 percent from 3.01 percent, with points decreasing to 0.33 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

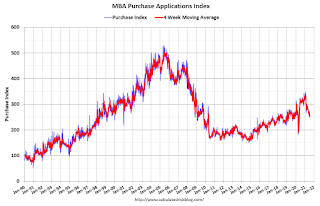

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 03, 2021

Wednesday: ADP Employment, ISM Services

by Calculated Risk on 8/03/2021 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 675 thousand payroll jobs added in July, down from 692 thousand added in June.

• At 10:00 AM, the ISM Services Index for July. The consensus is for a reading of 60.4, up from 60.1.

August 3rd COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 8/03/2021 04:07:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 347,377,149, as of a week ago 342,607,540. Average doses last week: 0.68 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 70.1% | 70.0% | 69.1% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 165.1 | 164.9 | 163.3 | ≥1601 |

| New Cases per Day3🚩 | 84,389 | 80,424 | 58,086 | ≤5,0002 |

| Hospitalized3🚩 | 40,453 | 36,688 | 28,016 | ≤3,0002 |

| Deaths per Day3🚩 | 354 | 333 | 261 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 69.4%, Utah at 68.0%, Nebraska at 67.7%, Wisconsin at 67.5%, Kansas at 66.7%, South Dakota at 66.6%, Nevada at 66.0%, and Iowa at 65.9%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Update: Framing Lumber Prices Down Year-over-year

by Calculated Risk on 8/03/2021 03:40:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through Aug 3rd.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.There were supply constraints over the last year, for example, sawmills cut production and inventory at the beginning of the pandemic, and the West Coast fires in 2020 damaged privately-owned timberland.