by Calculated Risk on 8/06/2021 09:16:00 AM

Friday, August 06, 2021

Comments on July Employment Report

The headline jobs number in the July employment report was slightly above expectations, and employment for the previous two months was revised up significantly. The participation rate increased slightly and the unemployment rate decreased sharply to 5.4%.

Earlier: July Employment Report: 943 Thousand Jobs, 5.4% Unemployment Rate

In July, the year-over-year employment change was 7.255 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

In July, the number of permanent job losers decreased to 2.930 million from 3.187 million in June.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in July to 81.8% from 81.7% in June, and the 25 to 54 employment population ratio increased to 77.8% from 77.2% in June.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"In July, the number of persons employed part time for economic reasons, at 4.5 million, was about unchanged. There were 4.4 million persons in this category in February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in July to 4.483 million from 4.627 million in June. This is back close to pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 9.2% from 9.8% in June. This is down from the record high in April 22.9% for this measure since 1994. This measure was at 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.425 million workers who have been unemployed for more than 26 weeks and still want a job, down from 3.985 million in June.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was slightly above expectations, and the previous two months were revised up by 119,000 combined. And the headline unemployment rate decreased to 5.4%.

July Employment Report: 943 Thousand Jobs, 5.4% Unemployment Rate

by Calculated Risk on 8/06/2021 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 943,000 in July, and the unemployment rate declined by 0.5 percentage point to 5.4 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, in local government education, and in professional and business services.

...

The change in total nonfarm payroll employment for May was revised up by 31,000, from +583,000 to +614,000, and the change for June was revised up by 88,000, from +850,000 to +938,000. With these revisions, employment in May and June combined is 119,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In July, the year-over-year change was 7.255 million jobs. This was up significantly year-over-year.

Total payrolls increased by 943 thousand in July. Private payrolls increased by 703 thousand.

Payrolls for May and June were revised up 119 thousand, combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 61.7% in June, from 61.6% in June. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 61.7% in June, from 61.6% in June. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 58.4% from 58.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in July to 5.4% from 5.9% in June.

This was slightly above consensus expectations, and May and June were revised up by 119,000 combined.

Thursday, August 05, 2021

Friday: Employment Report

by Calculated Risk on 8/05/2021 09:00:00 PM

My July Employment Preview

Goldman July Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for July. The consensus is for 900,000 jobs added, and for the unemployment rate to decrease to 5.7%.

Goldman July Payrolls Preview

by Calculated Risk on 8/05/2021 04:21:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 1,150k in July ... Labor supply constraints eased further due to the wind-down of federal unemployment top-ups in some states and the addition of over 2 million youth job seekers in June and July. ... We estimate a 0.4pp drop in the unemployment rate to 5.5% (vs. consensus 5.7%), reflecting a strong household employment gain offset by a sizable rise in the participation rate.CR Note: The consensus is for 900 thousand jobs added, and for the unemployment rate to decrease to 5.7%.

emphasis added

Northwest Real Estate in July: Sales up 11% YoY, Inventory down 23% YoY

by Calculated Risk on 8/05/2021 04:06:00 PM

The Northwest Multiple Listing Service reported Home buyers are finding some relief, but Northwest MLS brokers say it is temporary

Competition for homes eased slightly in July across much of Washington state, but brokers from Northwest Multiple Listing Service expect the respite to be short-lived, with inventory still tight and prices still climbing.The press release is for the Northwest MLS area. There were 10,919 closed sales in July 2021, up 11.0% from 9,840 sales in July 2020. Active inventory for the Northwest is down 22.5%.

"Although the local market is intense, buyers can find some relief because there aren't as many offers to compete with compared to earlier this year," observed J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. He noted the number of listings brokers added last month outgained the number of homes going under contract by a small margin in most areas in the report.

...

At month end, there were 7,948 total listings offered for sale, down 22.5% from the year-ago total of 10,259. That was the highest level since October when inventory totaled 8,623 properties, including single family homes and condominiums.

emphasis added

In King County, sales were up 18.4% year-over-year, and active inventory was down 30.9% year-over-year.

In Seattle, sales were up 27.8% year-over-year, and inventory was down 22.7% year-over-year. This puts the months-of-supply in Seattle at just 0.93 months.

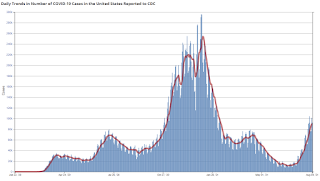

August 5th COVID-19

by Calculated Risk on 8/05/2021 03:46:00 PM

Congratulations to the residents of Maine and New Jersey on joining the 80% club! Well done. Go for 90%!!!

The 7-day average deaths is the highest since June 8th.

According to the CDC, on Vaccinations.

Total doses administered: 348,966,419, as of a week ago 344,071,595. Average doses last week: 0.70 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 70.4% | 70.1% | 69.4% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 165.6 | 165.3 | 163.9 | ≥1601 |

| New Cases per Day3🚩 | 89,976 | 89,663 | 67,273 | ≤5,0002 |

| Hospitalized3🚩 | 44,865 | 43,037 | 31,331 | ≤3,0002 |

| Deaths per Day3🚩 | 377 | 355 | 279 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts, Connecticut, Maine and New Jersey are at 80%+, and New Mexico, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 69.9%, Utah at 68.5%, Nebraska at 68.1%, Wisconsin at 67.7%, Kansas at 67.0%, South Dakota at 66.8%, Nevada at 66.4%, and Iowa at 66.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

July Employment Preview

by Calculated Risk on 8/05/2021 11:45:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for 900 thousand jobs added, and for the unemployment rate to decrease to 5.7%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 6.8 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 330,000 private sector jobs, well below the consensus estimate of 675,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in July to 52.9%, up from 49.9% last month. This would suggest little change in manufacturing employment in July. ADP showed 8,000 manufacturing jobs added.

The ISM® Services employment index increased in July to 53.8%, from 49.3% last month. This would suggest about 175,000 service jobs added in April. ADP showed 318,000 service jobs added.

In general, the ISM indexes suggest employment growth below expectations.

• Unemployment Claims: The weekly claims report showed a small increase in the number of initial unemployment claims during the reference week (include the 12th of the month) from 418,000 in June to 424,000 in July. This would usually suggest about the same turnover in July as in June, although this might not be very useful right now. In general, weekly claims have been close to expectations in July.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.

This data is only available back to 1994, so there is only data for three recessions. In June, the number of permanent job losers decreased to 3.187 million from 3.234 million in May. These jobs will likely be the hardest to recover.

• IMPORTANT: The employment report will probably show a large increase in state and local government education hiring. This is because of a quirk in the seasonal adjustment due to fewer educators hired this year due to the pandemic, so fewer educators will be let go in July.

• Conclusion: The data suggests a weaker than expected report in July. There are some seasonal factors that will boost the BLS report (especially related to education).

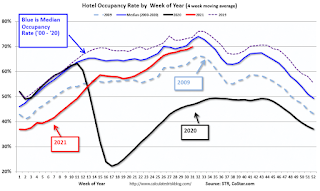

Hotels: Occupancy Rate Down 6% Compared to Same Week in 2019

by Calculated Risk on 8/05/2021 10:28:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 6.2% compared to the same week in 2019.

U.S. weekly hotel occupancy dipped from the previous week, while room rates were up slightly, according to STR‘s latest data through July 31.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

July 25-31, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 70.1% (-6.2%)

• Average daily rate (ADR): $142.76 (+6.8%)

• Revenue per available room (RevPAR): $100.07 (+0.1%)

ADR remained at an all-time high on a nominal basis but not when adjusted for inflation ($135).

...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Trade Deficit Increased to $75.7 Billion in June

by Calculated Risk on 8/05/2021 08:47:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $75.7 billion in June, up $4.8 billion from $71.0 billion in May, revised.

June exports were $207.7 billion, $1.2 billion more than May exports. June imports were $283.4 billion, $6.0 billion more than May imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in June.

Exports are up 31% compared to June 2020; imports are up 35% compared to June 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China decreased to $27.8 billion in June, from $28.3 billion in June 2020.

Weekly Initial Unemployment Claims decrease to 385,000

by Calculated Risk on 8/05/2021 08:36:00 AM

The DOL reported:

In the week ending July 31, the advance figure for seasonally adjusted initial claims was 385,000, a decrease of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 400,000 to 399,000. The 4-week moving average was 394,000, a decrease of 250 from the previous week's revised average. The previous week's average was revised down by 250 from 394,500 to 394,250.This does not include the 94,476 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 93,060 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 394,000.

The previous week was revised down.

Regular state continued claims decreased to 2,930,000 (SA) from 3,296,000 (SA) the previous week.

Note: There are an additional 5,156,982 receiving Pandemic Unemployment Assistance (PUA) that decreased from 5,246,162 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 4,246,207 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 4,233,883.

Weekly claims were close to the consensus forecast.