by Calculated Risk on 8/10/2021 12:17:00 PM

Tuesday, August 10, 2021

Second Home Market: South Lake Tahoe in July

Five months ago, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and will track those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through July 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12 month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Note that inventory was high while prices were declining - and significantly lower inventory in 2012 suggested the bust was over. (Tracking inventory helped me call the bottom for housing way back in February 2012, see:The Housing Bottom is Here)

Currently inventory is still very low, but solidly above the record low set four months ago, and prices are up sharply YoY. This will be interesting to watch.

Atlanta Real Estate in July: Sales Down 6% YoY, Inventory Down 44% YoY

by Calculated Risk on 8/10/2021 10:17:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the GAMLS for Atlanta:

Total Residential Units Sold in July 2021 were 9,683, down 5.7% from 10,270 in July 2020.

Active Residential Listings in July 2021 were 8,668, down 43.9% from 15,442 in July 2020.

Months of Supply was 0.99 Months in July 2021, compared to 2.00 Months in July 2020.

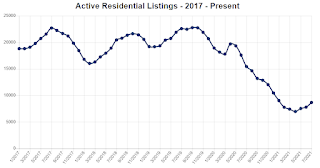

This graph from the Georgia MLS shows inventory in Atlanta over the last several years - and the sharp decline in inventory at the start of the pandemic.

Inventory in Atlanta in July was up 11.3% from the previous month, and was 24.5% above the record low in April 2021.

New Hampshire Real Estate in July: Sales Down 15% YoY, Inventory Down 37% YoY

by Calculated Risk on 8/10/2021 08:11:00 AM

I'm posting data for many local markets around the U.S.

From the New Hampshire Realtors for the entire state:

Inventory in July was down 8.8% from last month, but up 26.5% from the record low in February 2021.

Monday, August 09, 2021

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 3.40%"

by Calculated Risk on 8/09/2021 04:00:00 PM

Note: This is as of August 1st.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 3.40%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 3.47% of servicers’ portfolio volume in the prior week to 3.40% as of August 1, 2021. According to MBA’s estimate, 1.7 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 5 basis points to 1.74%. Ginnie Mae loans in forbearance decreased 12 basis points to 4.18%, while the forbearance share for portfolio loans and private-label securities (PLS) decreased 7 basis points to 7.37%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 4 basis points to 3.63%, and the percentage of loans in forbearance for depository servicers decreased 10 basis points to 3.49%.

“Forbearance exits increased as August began and new forbearance requests declined, resulting in the largest decrease in the share of loans in forbearance in three weeks,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “1.7 million homeowners remain in forbearance, 13% of whom were current on their payments as of August 1st. Of those who exited forbearance last week, more than 10.5% were current. Forbearance has surely provided both insurance and assurance for many of these homeowners who worried about ongoing hardships, and it is positive to see so many continue to be able to make their payments while in forbearance.”

Added Fratantoni, “Delinquency rates have increased slightly for borrowers who have exited forbearance and began repayment plans, deferral plans, or modifications over the course of the pandemic. However, July’s strong job market report provides evidence of a rebounding economy, which should provide further support for homeowners exiting forbearance in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.06% to 0.04%."

August 9th COVID-19: New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 8/09/2021 03:50:00 PM

Note: Data reported on Monday is always low, and is revised up as data is received.

According to the CDC, on Vaccinations.

Total doses administered: 351,933,175, as of a week ago 346,924,345. Average doses last week: 0.72 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 71.1% | 71.0% | 70.0% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 166.7 | 166.5 | 164.9 | ≥1601 |

| New Cases per Day3🚩 | 97,399 | 100,830 | 84,338 | ≤5,0002 |

| Hospitalized3🚩 | 49,586 | 50,764 | 38,987 | ≤3,0002 |

| Deaths per Day3🚩 | 456 | 457 | 321 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 21 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts, Connecticut, Maine, New Jersey and New Mexico are at 80%+, and Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado, Florida and D.C. are all over 70%.

Next up are Utah at 69.0%, Nebraska at 68.5%, Wisconsin at 68.3%, Kansas at 67.6%, South Dakota at 67.2%, Nevada at 67.1%, and Iowa at 66.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Fannie and Freddie: REO inventory declined in Q2, Down 49% Year-over-year

by Calculated Risk on 8/09/2021 01:03:00 PM

Fannie and Freddie earlier reported results for Q2 2021. Here is some information on single-family Real Estate Owned (REOs).

"The decline in single-family REO properties in the first half of 2021 compared with the first half of 2020 was due to the suspension of foreclosures that began in March 2020 as a result of the COVID-19 pandemic. In response to the pandemic and with instruction from FHFA, we have prohibited our servicers from completing foreclosures on our single-family loans through July 31, 2021, except in the case of vacant or abandoned properties." emphasis added

For Freddie, this is down 98% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 6,363 at the end of Q2 2021 compared to 12,675 at the end of Q2 2020.

For Fannie, this is down 96% from the 166,787 peak number of REOs in Q3 2010.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q2 2021, and combined inventory is down 49% year-over-year.

This is well below a normal level of REOs for Fannie and Freddie.

North Texas Real Estate in July: Sales Down 16% YoY, Inventory Down 33% YoY

by Calculated Risk on 8/09/2021 12:35:00 PM

I'm posting data for many local markets around the U.S.

From the NTREIS for North Texas (including Dallas/Ft. Worth):

Single Family Homes sold in July 2021 were 11,299, down 17.4% from 11,896 in July 2020.

Combined, sales were down 16.0% year-over-year.

Single Family Active Listings in July 2021 were 11,105, down 31.4% from 16,177 in July 2020.

Combined, active listings declined 33.1% year-over-year.

Although down sharply year-over-year, active inventory was up 26.8% compared to last month, and up 72.7% from the record low in March 2021.

Housing Inventory August 9th Update: Inventory Increased Slightly Week-over-week, Up 34% from Low in early April

by Calculated Risk on 8/09/2021 11:09:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

BLS: Job Openings Increase to Series High 10.1 Million in June

by Calculated Risk on 8/09/2021 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to a series high of 10.1 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Hires rose to 6.7 million and total separations edged up to 5.6 million. Within separations, the quits rate increased to 2.7 percent. The layoffs and discharges rate was unchanged at 0.9 percent, matching the series low reached last month.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in June to 10.073 million from 9.483 million in May. This is a new record high for this series.

The number of job openings (yellow) were up 65% year-over-year.

Quits were up 46% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Seven High Frequency Indicators for the Economy

by Calculated Risk on 8/09/2021 08:18:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of August 8th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 21.7% from the same day in 2019 (78.3% of 2019). (Dashed line)

There was a slow increase from the bottom starting in May 2020 - and then TSA data picked up in 2021 - but the dashed line has mostly sideways over the last six weeks.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through August 7, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was generally picking up, but has moved sideways or down recently. The 7-day average for the US is down 9% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $119 million last week, down about 47% from the median for the week.

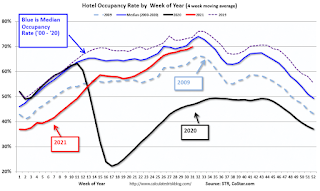

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is well above the horrible 2009 levels. With solid leisure travel, the Summer months have had decent occupancy - but it is uncertain what will happen in the Fall with business travel.

This data is through July 31st. The occupancy rate is down 6.2% compared to the same week in 2019. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of July 30th, gasoline supplied was up 1.3% compared to the same week in 2019.

This is the 4th week so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through August 7th for the United States and several selected cities.

This data is through August 7th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 99.8% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

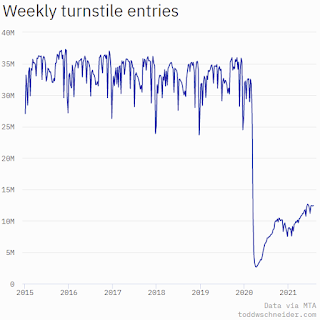

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, August 6th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".