by Calculated Risk on 8/13/2021 08:22:00 AM

Friday, August 13, 2021

San Diego Real Estate in July: Sales Down 4% YoY, Inventory Down 42% YoY

I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the San Diego Realtors:

Closed sales (attached and detached) in July 2021 were 3,600, down 4.5% from 3,769

in July 2020.

Active Listings in July 2021 were 3349, down 41.9% from 5,763 in July 2020.

Months of Supply for attached was 1.0 Months in July 2021, compared to 1.9 Months in July 2020.

Inventory in July was down slightly from the previous month, and up 13.0% from the record low in March 2021.

Thursday, August 12, 2021

August 12th COVID-19: Crisis in Florida and Texas

by Calculated Risk on 8/12/2021 07:37:00 PM

First, on the economic impact of the delta variant from BofA today:

'Our big data business cycle indicator is at risk of a regime shift from "boom" to "soft patch" because of the Delta wave.'Florida and Texas are in a serious crisis (see graphs and comments at bottom).

The 7-day average deaths is the highest since May 22nd.

According to the CDC, on Vaccinations.

Total doses administered: 353,859,894, as of a week ago 348,966,419. Average doses last week: 0.70 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 71.5% | 71.3% | 70.4% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 167.4 | 167.1 | 165.6 | ≥1601 |

| New Cases per Day3🚩 | 114,190 | 112,751 | 96,453 | ≤5,0002 |

| Hospitalized3🚩 | 62,041 | 59,755 | 45,456 | ≤3,0002 |

| Deaths per Day3🚩 | 492 | 479 | 406 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 21 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts, Connecticut, Maine, New Jersey, New Mexico and Rhode Island are at 80%+, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado, Florida and D.C. are all over 70%.

Next up are Utah at 69.7%, Nebraska at 68.8%, Wisconsin at 68.5%, Kansas at 68.0%, South Dakota at 67.6%, Nevada at 67.4%, Texas at 67.1%, and Iowa at 66.8%.

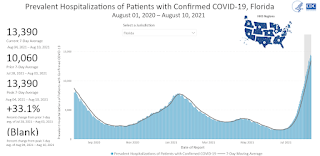

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Hospitalizations in Florida are already at a record level, and Florida is running out of ICU beds.

Hospitalizations in Florida are already at a record level, and Florida is running out of ICU beds.According to data from the HHS on hospital utilizations, over 90% of ICU beds in Florida are occupied, and more than half of those are COVID patients. Grim

And on Texas, from the Texas Tribune: “I am frightened by what is coming”: Texas hospitals could soon be overwhelmed by COVID-19 caseload, officials say

Texas hospitals are on the brink of catastrophe, close to being completely overwhelmed by COVID-19 patients, leaders of some of the state’s largest hospitals told state lawmakers Tuesday.

Official after official used their strongest descriptions to get the point across to legislators: Hospitalizations are rising too fast for them to keep up with, and it may be too late to do anything about it.

“While more vaccination is the only thing that can ultimately bring this pandemic to an end, we need more decisive actions now to prevent a catastrophe the likes of which we only imagined last year,” Dr. Esmaeil Porsa, CEO of Harris Health System in Houston, told the Texas Senate Health and Human Services Committee on Tuesday.

South Carolina Real Estate in July: Sales Down 10% YoY, Inventory Down 40% YoY

by Calculated Risk on 8/12/2021 02:14:00 PM

I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the South Carolina Realtors for the entire state:

Closed sales in July 2021 were 9,658, down 9.5% from 10,675 in July 2020.

Active Listings in July 2021 were 12,869,, down 40.4% from 21,592 in July 2020.

Months of Supply for attached was 1.4 Months in July 2021, compared to 2.6 Months in July 2020.

Inventory in July was up 15.3% from the previous month, and up 23.1% from the record low in May 2021.

Maryland Real Estate in July: Sales Down 3% YoY, Inventory Down 31% YoY

by Calculated Risk on 8/12/2021 12:06:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Maryland Realtors for the entire state:

Closed sales in July 2021 were 9,685, down 3.2% from 10,001 in July 2020.

Active Listings in July 2021 were 10,164, down 30.8% from 14,685 in July 2020.

Months of Supply was 1.1 Months in July 2021, compared to 2.0 Months in July 2020.

Inventory in July was up 18.9% from last month, and up 64% from the all time low in March 2021.

Hotels: Occupancy Rate Down 8% Compared to Same Week in 2019

by Calculated Risk on 8/12/2021 10:10:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 8.3% compared to the same week in 2019.

Reflecting seasonality and greater concern around the Delta variant, U.S. hotel occupancy and average daily rate (ADR) dipped from the previous weeks, according to STR‘s latest data through August 7.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

August 1-7, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 68.0% (-8.3%)

• Average daily rate (ADR): $140.97 (+5.1%)

• Revenue per available room (RevPAR): $95.89 (-3.6%)

...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Minnesota Real Estate in July: Sales Down 9% YoY, Inventory Down 30% YoY

by Calculated Risk on 8/12/2021 09:13:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Minnesota Realtors®:

Total Residential Units Sold in July 2021 were 9,615, down 8.7% from 10,530 in July 2020.

Active Residential Listings in July 2021 were 11,854, down 29.7% from 16,861 in July 2020.

Months of Supply was 1.5 Months in July 2021, compared to 2.3 Months in July 2020.

This graph from the Minnesota Realtors® shows inventory in Minnesota since 2012. Inventory had been trending down, and then was somewhat flat for a few years, and then declined significantly during the pandemic.

Active inventory was up 8.6% from the previous month, and up 43.3% seasonally from the all time low in February 2021. Usually, at this time of the year, we'd expect active inventory of around 23,000 in Minnesota, so current inventory is still extremely low.

Weekly Initial Unemployment Claims decrease to 375,000

by Calculated Risk on 8/12/2021 08:34:00 AM

The DOL reported:

In the week ending August 7, the advance figure for seasonally adjusted initial claims was 375,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 385,000 to 387,000. The 4-week moving average was 396,250, an increase of 1,750 from the previous week's revised average. The previous week's average was revised up by 500 from 394,000 to 394,500.This does not include the 104,572 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 94,427 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 394,000.

The previous week was revised up.

Regular state continued claims decreased to 2,866,000 (SA) from 2,980,000 (SA) the previous week.

Note: There are an additional 4,820,787 receiving Pandemic Unemployment Assistance (PUA) that decreased from 5,156,982 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 3,852,569 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 4,246,207.

Weekly claims were close to the consensus forecast.

Wednesday, August 11, 2021

Thursday: Unemployment Claims, PPI

by Calculated Risk on 8/11/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 370 thousand from 385 thousand last week.

• At 8:30 AM, The Producer Price Index for July from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.5% increase in core PPI.

August 11th COVID-19: Over 132 Thousand New Cases, 664 Deaths Reported Today

by Calculated Risk on 8/11/2021 06:54:00 PM

The 7-day average deaths is the highest since May 25th.

According to the CDC, on Vaccinations.

Total doses administered: 353,205,544, as of a week ago 348,102,478. Average doses last week: 0.73 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 71.3% | 71.2% | 70.1% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 167.1 | 166.9 | 165.3 | ≥1601 |

| New Cases per Day3🚩 | 113,357 | 109,539 | 91,192 | ≤5,0002 |

| Hospitalized3🚩 | 59,172 | 56,877 | 43,244 | ≤3,0002 |

| Deaths per Day3🚩 | 452 | 433 | 369 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 21 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts, Connecticut, Maine, New Jersey, New Mexico and Rhode Island are at 80%+, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado, Florida and D.C. are all over 70%.

Next up are Utah at 69.7%, Nebraska at 68.7%, Wisconsin at 68.4%, Kansas at 67.8%, South Dakota at 67.5%, Nevada at 67.3%, and Iowa at 66.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Des Moines Real Estate in July: Sales Down 9% YoY, Inventory Down 25% YoY

by Calculated Risk on 8/11/2021 05:30:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Des Moines Area Association of REALTORS®:

Closed sales in July 2021 were 1,703, down 8.7% from 1,866 in July 2020.

Active Listings in July 2021 were 2,086, down 25.1% from 2,785 in July 2020.

Inventory in July was up 13.5% from last month, and up 20% from the all time low in April 2021. Usually inventory peaks in the summer at between 3,500 and 4,100 in Des Moines, so this is still very low.