by Calculated Risk on 8/17/2021 10:05:00 AM

Tuesday, August 17, 2021

NAHB: Builder Confidence Declined to 75 in August

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 75, down from 80 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence at 13-Month Low on Higher Material Costs, Home Prices

Builder sentiment in the market for newly-built single-family homes fell five points to 75 in August, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The index is at its lowest point since July 2020.

Higher construction costs and supply shortages have led to significant price growth, which in turn has caused prospective buyers to experience sticker shock. The decline in the buyer traffic index to its lowest level since July 2020 is evidence that supply-side constraints have begun to hold consumers back.

...

The HMI index gauging current sales conditions fell five points to 81 and the component measuring traffic of prospective buyers also posted a five-point decline to 60. The gauge charting sales expectations in the next six months held steady at 81.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 74, the Midwest dropped two points to 68, the South posted a three-point decline to 82 and the West registered a two-point drop to 85.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was well below the consensus forecast, but still a solid reading.

Industrial Production Increased 0.9 Percent in July

by Calculated Risk on 8/17/2021 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production increased 0.9 percent in July after moving up 0.2 percent in June. In July, manufacturing output rose 1.4 percent. About half of the gain in factory output is attributable to a jump of 11.2 percent for motor vehicles and parts, as a number of vehicle manufacturers trimmed or canceled their typical July shutdowns. Despite the large increase last month, vehicle assemblies continued to be constrained by a persistent shortage of semiconductors; the production of motor vehicles and parts in July was about 3-1/2 percent below its recent peak in January 2021. The output of utilities decreased 2.1 percent in July, while the index for mining rose 1.2 percent.

At 101.1 percent of its 2017 average, total industrial production in July was 6.6 percent above its year-earlier level but 0.2 percent below its pre-pandemic (February 2020) level. Capacity utilization for the industrial sector rose 0.7 percentage point in July to 76.1 percent, a rate that is 3.5 percentage points below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, but still below the level in February 2020.

Capacity utilization at 76.1% is 3.5% below the average from 1972 to 2020.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in July to 101.1. This is 0.2% below the February 2020 level.

The change in industrial production was above consensus expectations, probably due to vehicle manufacturers not shutting down in July.

Retail Sales Decreased 1.1% in July

by Calculated Risk on 8/17/2021 08:39:00 AM

On a monthly basis, retail sales were decreased 1.1% from June to July (seasonally adjusted), and sales were up 15.8 percent from July 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for July 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $617.7 billion, a decrease of 1.1 percent from the previous month, but 15.8 percent above July 2020. ... The May 2021 to June 2021 percent change was revised from up 0.6 percent to up 0.7 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 1.4% in July.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 14.2% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 14.2% on a YoY basis.Sales in July were below expectations, however sales in May and June were revised up.

Monday, August 16, 2021

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey and More

by Calculated Risk on 8/16/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Drifty Day, Treasuries Hold Weekly Gains, MBS Underperform

MBS underperformed, ultimately returning to 'unchanged' levels in the 4pm hour even as Treasuries remined slightly stronger on the day. ... [30 year fixed 2.93%]Tuesday:

emphasis added

• At 8:30 AM ET, Retail sales for July is scheduled to be released. The consensus is for 0.2% decrease in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 75.7%.

• At 10:00 AM, The August NAHB homebuilder survey. The consensus is for a reading of 80, unchanged from 80. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 12:00 PM, MBA Q2 National Delinquency Survey (expected)

• At 1:30 PM, Fed Chair Powell speaks: Conversation with the Chair: A Virtual Teacher Town Hall Meeting

August 16th COVID-19: Data reported on Monday is always low, and is revised up as data is received

by Calculated Risk on 8/16/2021 08:15:00 PM

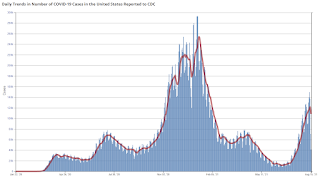

According to the CDC, on Vaccinations.

Total doses administered: 357,292,057, as of a week ago 351,933,175. Average doses last week: 0.77 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 50.8% | 50.7% | 50.3% | ≥70.0%1 |

| Fully Vaccinated (millions) | 168.7 | 168.4 | 166.7 | ≥2321 |

| New Cases per Day3 | 108,470 | 115,299 | 110,656 | ≤5,0002 |

| Hospitalized3🚩 | 65,935 | 67,640 | 54,857 | ≤3,0002 |

| Deaths per Day3 | 495 | 523 | 495 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 19 states have between 50% and 59.9% fully vaccinated: New Jersey at 59.8%, New Hampshire, Washington, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, Hawaii, California, Delaware, Pennsylvania, Wisconsin, Nebraska, Florida and Iowa at 50.4%.

Next up (total population, fully vaccinated according to CDC) are Illinois at 49.8%, Michigan at 49.6%, South Dakota at 47.9, Ohio at 47.4%, Kentucky at 46.8%, Arizona at 46.5%, Kansas at 46.5%, Alaska at 46.3%, Nevada at 46.0% and Utah at 45.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 3.26%"

by Calculated Risk on 8/16/2021 04:00:00 PM

Note: This is as of August 8th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 3.26%

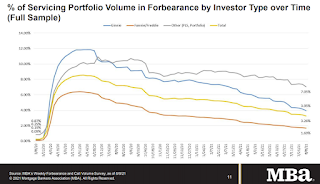

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 14 basis points from 3.40% of servicers’ portfolio volume in the prior week to 3.26% as of August 8, 2021. According to MBA’s estimate, 1.6 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 5 basis points to 1.69%. Ginnie Mae loans in forbearance decreased 23 basis points to 3.95%, while the forbearance share for portfolio loans and private-label securities (PLS) decreased 32 basis points to 7.05%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 17 basis points to 3.46%, and the percentage of loans in forbearance for depository servicers decreased 13 basis points to 3.36%.

“The largest decrease in a month in the share of loans in forbearance came from a jump in forbearance exits, as many homeowners are nearing the end of their forbearance terms. The forbearance share declined for all investor and servicer categories,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “New forbearance requests picked up slightly this week, particularly for Ginnie Mae loans, but overall trends remain positive. Incoming data continues to support our forecast of an improving job market in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.04% to 0.06%"

Boston Real Estate in July: Sales Up 14% YoY, Inventory Down 23% YoY

by Calculated Risk on 8/16/2021 03:10:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For Boston (single family and condos):

Housing Inventory August 16th Update: Inventory Increased Week-over-week, Up 38% from Low in early April

by Calculated Risk on 8/16/2021 11:16:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 8/16/2021 07:58:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of August 15th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 21.5% from the same day in 2019 (78.5% of 2019). (Dashed line)

There was a slow increase from the bottom starting in May 2020 - and then TSA data picked up in 2021 - but the dashed line has mostly sideways over the last seven weeks.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through August 14, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was generally picking up, but has moved down recently. The 7-day average for the US is down 11% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $93 million last week, down about 56% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is well above the horrible 2009 levels. With solid leisure travel, the Summer months have had decent occupancy - but it is uncertain what will happen in the Fall with business travel.

This data is through August 7th. The occupancy rate is down 8.3% compared to the same week in 2019. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of August 6th, gasoline supplied was down 5.1% compared to the same week in 2019.

There have been four weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through August 14th for the United States and several selected cities.

This data is through August 14th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 101% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, August 13th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, August 15, 2021

Sunday Night Futures

by Calculated Risk on 8/15/2021 06:21:00 PM

Weekend:

• Schedule for Week of August 15, 2021

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 29.0, down from 43.0.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 6 and DOW futures are down 53 (fair value).

Oil prices were down over the last week with WTI futures at $68.12 per barrel and Brent at $70.29 per barrel. A year ago, WTI was at $43, and Brent was at $45 - so WTI oil prices are UP over 50% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.18 per gallon. A year ago prices were at $2.16 per gallon, so gasoline prices are up $1.02 per gallon year-over-year.