by Calculated Risk on 8/18/2021 12:45:00 PM

Wednesday, August 18, 2021

FOMC Minutes: "It could be appropriate to start reducing the pace of asset purchases this year"

From the Fed: Minutes of the Federal Open Market Committee, July 27-28, 2021. Excerpt on asset purchases:

Participants discussed aspects of the Federal Reserve's asset purchases, including progress made toward the Committee's maximum-employment and price-stability goals since the adoption of the asset purchase guidance in December 2020. They also considered the question of how asset purchases might be adjusted once economic conditions met the standards of that guidance. Participants agreed that their discussion at this meeting would be helpful background for the Committee's future decisions about modifying asset purchases. No decisions regarding future adjustments to asset purchases were made at this meeting.

...

In their discussion of considerations related to asset purchases, various participants noted that these purchases were an important part of the monetary policy toolkit and a critical aspect of the Federal Reserve's response to the economic effects of the pandemic, supporting smooth financial market functioning and accommodative financial conditions, which aided the flow of credit to households and businesses and supported the recovery. Participants discussed a broad range of labor market and inflation indicators. All participants assessed that the economy had made progress toward the Committee's maximum-employment and price-stability goals since the adoption of the guidance on asset purchases in December. Most participants judged that the Committee's standard of "substantial further progress" toward the maximum-employment goal had not yet been met. At the same time, most participants remarked that this standard had been achieved with respect to the price-stability goal. A few participants noted, however, that the transitory nature of this year's rise in inflation, as well as the recent declines in longer-term yields and in market-based measures of inflation compensation, cast doubt on the degree of progress that had been made toward the price-stability goal since December. Looking ahead, most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year because they saw the Committee's "substantial further progress" criterion as satisfied with respect to the price-stability goal and as close to being satisfied with respect to the maximum-employment goal. Various participants commented that economic and financial conditions would likely warrant a reduction in coming months. Several others indicated, however, that a reduction in the pace of asset purchases was more likely to become appropriate early next year because they saw prevailing conditions in the labor market as not being close to meeting the Committee's "substantial further progress" standard or because of uncertainty about the degree of progress toward the price-stability goal. Participants agreed that the Committee would provide advance notice before making changes to its balance sheet policy.

Participants expressed a range of views on the appropriate pace of tapering asset purchases once economic conditions satisfied the criterion laid out in the Committee's guidance. Many participants saw potential benefits in a pace of tapering that would end net asset purchases before the conditions currently specified in the Committee's forward guidance on the federal funds rate were likely to be met. At the same time, participants indicated that the standards for raising the target range for the federal funds rate were distinct from those associated with tapering asset purchases and remarked that the timing of those actions would depend on the course of the economy. Several participants noted that an earlier start to tapering could be accompanied by more gradual reductions in the purchase pace and that such a combination could mitigate the risk of an excessive tightening in financial conditions in response to a tapering announcement.

Participants exchanged views on what the composition of asset purchases should be during the tapering process. Most participants remarked that they saw benefits in reducing the pace of net purchases of Treasury securities and agency MBS proportionally in order to end both sets of purchases at the same time. These participants observed that such an approach would be consistent with the Committee's understanding that purchases of Treasury securities and agency MBS had similar effects on broader financial conditions and played similar roles in the transmission of monetary policy, or that these purchases were not intended as credit allocation. Some of these participants remarked, however, that they welcomed further discussion of the appropriate composition of asset purchases during the tapering process. Several participants commented on the benefits that they saw in reducing agency MBS purchases more quickly than Treasury securities purchases, noting that the housing sector was exceptionally strong and did not need either actual or perceived support from the Federal Reserve in the form of agency MBS purchases or that such purchases could be interpreted as a type of credit allocation.

Participants commented on other factors that were relevant for their consideration of future adjustments to the pace of asset purchases. Many participants noted that, when a reduction in the pace of asset purchases became appropriate, it would be important that the Committee clearly reaffirm the absence of any mechanical link between the timing of tapering and that of an eventual increase in the target range for the federal funds rate. A few participants suggested that the Committee would need to be mindful of the risk that a tapering announcement that was perceived to be premature could bring into question the Committee's commitment to its new monetary policy framework. With respect to the effects of the pandemic, several participants indicated that they would adjust their views on the appropriate path of asset purchases if the economic effects of new strains of the virus turned out to be notably worse than currently anticipated and significantly hindered progress toward the Committee's goals.

emphasis added

AIA: "Demand for design activity continues to expand" in July

by Calculated Risk on 8/18/2021 12:44:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Demand for design activity continues to expand

The Architecture Billings Index (ABI) recorded its sixth consecutive positive month, according to a new report today from The American Institute of Architects (AIA).

The ABI score for July was 54.6. While this was down slightly from June’s score of 57.1, it still indicates very strong business conditions overall (any score above 50 indicates an increase in billings from the prior month). Scoring for new project inquiries also declined in July but remained near its all-time high at 65.0. The score for new design contracts was essentially unchanged from June to July with a score of 58.0.

“In prior business cycles, architecture firms generally saw their project work soften quickly and then recover slowly,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “So the strength of this recovery is unprecedented. Firm leaders who have leaned into this economic upturn by reinvesting in their firms by hiring staff and upgrading their technology, will likely have a better year than those that anticipated a slower recovery.”

...

• Regional averages: Midwest (58.3); West (56.0); South (54.6); Northeast (54.1)

• Sector index breakdown: commercial/industrial (58.4); institutional (55.4); multi-family residential (54.7); mixed practice (54.4)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.6 in July, down from 57.1 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had been below 50 for eleven consecutive months, but has been solidly positive for the last six months.

Employment: Preliminary annual benchmark revision shows downward adjustment of 166,000 jobs

by Calculated Risk on 8/18/2021 10:36:00 AM

The BLS released the preliminary annual benchmark revision showing 166,000 fewer payroll jobs as of March 2021. The final revision will be published when the January 2022 employment report is released in February 2022. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2022 with the publication of the January 2022 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2021 was 166,000 lower than originally estimated. In February 2022, the payroll numbers will be revised down to reflect the final estimate. The number is then "wedged back" to the previous revision (March 2020).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus one-tenth of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2021 total nonfarm employment of -166,000 (-0.1 percent).

emphasis added

Construction was revised down by 44,000 jobs, and manufacturing revised down by 39,000 jobs.

This preliminary estimate showed 421,000 fewer private sector jobs, and 255,000 more government jobs (as of March 2021).

Comments on July Housing Starts

by Calculated Risk on 8/18/2021 10:29:00 AM

Earlier: Housing Starts decreased to 1.534 Million Annual Rate in July

The housing starts report showed total starts were down 7.0% in July compared to the previous month, and total starts were up 2.5% year-over-year compared to July 2020.

Click on graph for larger image.

Click on graph for larger image.Starts were up 2.5% in July compared to July 2020. The year-over-year comparison are more difficult starting in the second half of 2021.

In 2020, starts were off to a strong start before the pandemic, and with low interest rates, and little competing existing home inventory, starts finished 2020 strong.

Red is single family units. Currently there are 711 thousand single family units under construction (NSA). This is the highest level since 2006.

Red is single family units. Currently there are 711 thousand single family units under construction (NSA). This is the highest level since 2006.Blue is for 2+ units. Currently there are 686 thousand multi-family units under construction. Last month, at 691 thousand units, was the most since 1974.

Combined, there are 1.397 million units under construction. This is the most since July 2006.

Housing Starts decreased to 1.534 Million Annual Rate in July

by Calculated Risk on 8/18/2021 08:36:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in July were at a seasonally adjusted annual rate of 1,534,000. This is 7.0 percent below the revised June estimate of 1,650,000, but is 2.5 percent above the July 2020 rate of 1,497,000. Single‐family housing starts in July were at a rate of 1,111,000; this is 4.5 percent below the revised June figure of 1,163,000. The July rate for units in buildings with five units or more was 412,000.

Building Permits:

Privately‐owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,635,000. This is 2.6 percent above the revised June rate of 1,594,000 and is 6.0 percent above the July 2020 rate of 1,542,000. Single‐family authorizations in July were at a rate of 1,048,000; this is 1.7 percent below the revised June figure of 1,066,000. Authorizations of units in buildings with five units or more were at a rate of 532,000 in July

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in July compared to June. Multi-family starts were down 16% year-over-year in July.

Single-family starts (blue) decreased in July, and were up 12% year-over-year (starts slumped at the beginning of the pandemic, but picked up in July 2020).

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in July were well below expectations, however starts in May and June were revised up slightly.

I'll have more later …

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/18/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 13, 2021.

... The Refinance Index decreased 5 percent from the previous week and was 8 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 19 percent lower than the same week one year ago.

“Mortgage rates were at their highest levels in around a month, with the 30-year fixed rate increasing above 3 percent to 3.06 percent. Mortgage rates followed an overall increase in Treasury yields last week, which started higher from the strong July jobs report before slowing because of weaker consumer sentiment and concerns about rising COVID-19 cases,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The increase in mortgage rates caused a 5 percent decrease in refinancing, driven by a 7 percent drop in conventional refinance applications. Even though rates are 7 basis points lower than the same week a year ago, the refinance index is around 8 percent lower. The eligible pool of homeowners who stand to benefit from a refinance is smaller now.”

Added Kan, “Purchase applications also saw a mixed results, with conventional purchase applications down and government purchases up. Government purchase loans, such as FHA loans, are typically popular with first-time buyers. Despite a second-straight weekly decrease, average loan sizes remain close to record highs. This is a continuing sign that sales prices are still elevated, driven by stiff competition leading to accelerating home-price growth.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.06 percent from 2.99 percent, with points increasing to 0.34 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 19% year-over-year unadjusted.

According to the MBA, purchase activity is down 19% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 17, 2021

Wednesday: Housing Starts, Preliminary Employment Benchmark, FOMC Minutes

by Calculated Risk on 8/17/2021 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for July. The consensus is for 1.602 million SAAR, down from 1.643 million SAAR in June.

• At 10:00 AM, the Bureau of Labor Statistics (BLS) will release the preliminary estimate of the upcoming annual benchmark revision.

• During the day, The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, July 27-28, 2021

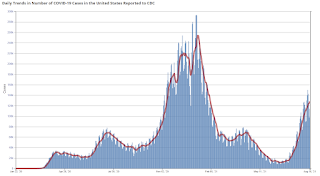

August 17th COVID-19: Wave Still Increasing

by Calculated Risk on 8/17/2021 05:02:00 PM

New data from Israel: A grim warning from Israel: Vaccination blunts, but does not defeat Delta (get vaccinated and mask up!)

The 7-day average deaths is the highest since May 14th.

According to the CDC, on Vaccinations.

Total doses administered: 357,894,995, as of a week ago 352,550,944. Average doses last week: 0.76 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 50.9% | 50.8% | 50.3% | ≥70.0%1 |

| Fully Vaccinated (millions) | 168.9 | 168.7 | 166.9 | ≥2321 |

| New Cases per Day3🚩 | 128,347 | 125,036 | 112,259 | ≤5,0002 |

| Hospitalized3🚩 | 72,874 | 71,266 | 57,307 | ≤3,0002 |

| Deaths per Day3🚩 | 553 | 547 | 501 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 19 states have between 50% and 59.9% fully vaccinated: New Jersey at 59.9%, New Hampshire, Washington, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, Hawaii, California, Delaware, Pennsylvania, Wisconsin, and Nebraska, Florida and Iowa all at 50.6%.

Next up (total population, fully vaccinated according to CDC) are Illinois at 49.9%, Michigan at 49.6%, South Dakota at 48.0, Ohio at 47.4%, Kentucky at 46.9%, Arizona at 46.6%, Kansas at 46.6%, Alaska at 46.3%, Nevada at 46.0% and Utah at 45.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

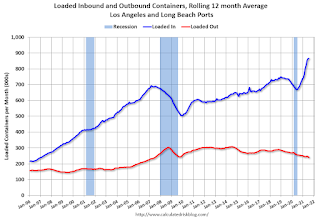

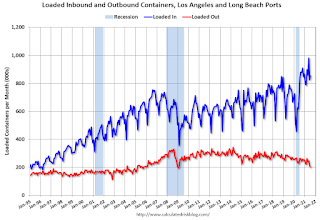

LA Area Port Traffic: Solid Imports, Weak Exports in July

by Calculated Risk on 8/17/2021 02:41:00 PM

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.2% in July compared to the rolling 12 months ending in June. Outbound traffic was down 2.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 2% YoY in July (recovered last year in July following the early months of the pandemic), and exports were down 24.0% YoY.

NAHB: Builder Confidence Declined to 75 in August

by Calculated Risk on 8/17/2021 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 75, down from 80 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence at 13-Month Low on Higher Material Costs, Home Prices

Builder sentiment in the market for newly-built single-family homes fell five points to 75 in August, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The index is at its lowest point since July 2020.

Higher construction costs and supply shortages have led to significant price growth, which in turn has caused prospective buyers to experience sticker shock. The decline in the buyer traffic index to its lowest level since July 2020 is evidence that supply-side constraints have begun to hold consumers back.

...

The HMI index gauging current sales conditions fell five points to 81 and the component measuring traffic of prospective buyers also posted a five-point decline to 60. The gauge charting sales expectations in the next six months held steady at 81.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 74, the Midwest dropped two points to 68, the South posted a three-point decline to 82 and the West registered a two-point drop to 85.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was well below the consensus forecast, but still a solid reading.