by Calculated Risk on 8/26/2021 07:15:00 PM

Thursday, August 26, 2021

Friday: Personal Income & Outlays, Fed Chair Powell Speaks

Friday:

• At 8:30 AM ET, Personal Income and Outlays, July 2021. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%.

• At 10:00 AM, Speech, Fed Chair Jerome Powell, The Economic Outlook, At the Jackson Hole Economic Policy Symposium

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 70.9.

August 26th COVID-19: Over 1,200 Deaths, Almost 90,000 Hospitalized, 165,000 Cases Reported Today

by Calculated Risk on 8/26/2021 05:28:00 PM

The 7-day average deaths is the highest since March 16th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.9% | 51.7% | 51.1% | ≥70.0%1 |

| Fully Vaccinated (millions) | 172.2 | 171.8 | 169.6 | ≥2321 |

| New Cases per Day3🚩 | 142,006 | 142,946 | 138,087 | ≤5,0002 |

| Hospitalized3🚩 | 87,297 | 86,406 | 77,516 | ≤3,0002 |

| Deaths per Day3🚩 | 864 | 844 | 778 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.7%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.2%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 48.8%, Ohio at 48.0%, Kentucky at 47.9%, Kansas at 47.7%, Arizona at 47.4%, Utah at 47.3%, Nevada at 47.2%, and Alaska at 46.9%.

Click on graph for larger image.

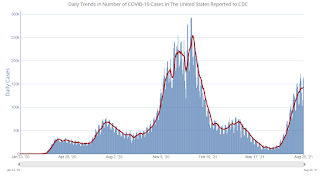

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Las Vegas Visitor Authority for July: Convention Attendance N/A, Visitor Traffic Down 10% Compared to 2019

by Calculated Risk on 8/26/2021 03:26:00 PM

From the Las Vegas Visitor Authority: July 2021 Las Vegas Visitor Statistics

July marked the strongest visitation month since the pandemic began as the destination hosted 3.3M visitors, up 11.2% MoM and down ‐10.4% from July 2019.

Hotel occupancy continued to ramp up, exceeding 79% (up 3.5 pts MoM, down ‐11.7 pts vs. July 2019), as Weekend occupancy came in at 88.1% (down ‐1.3 pts MoM) while Midweek occupancy increased to 74.6% (up 3.7 pts MoM, down ‐14.1 pts vs. July 2019.)

ADR came in very strong during the month, reaching $152, surpassing last month by 19%, and RevPAR beat comparable 2019 monthly levels for the first time as it reached $120.79, up +24.4% MoM and 4.5% ahead of July 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 10.4% compared to the same month in 2019.

How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?

by Calculated Risk on 8/26/2021 01:29:00 PM

I'm launching a newsletter focused solely on real estate. This newsletter will be ad free.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Hotels: Occupancy Rate Down 9% Compared to Same Week in 2019

by Calculated Risk on 8/26/2021 10:14:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 9.1% compared to the same week in 2019.

Reflecting seasonal demand patterns and concerns around the pandemic, U.S. hotel performance continued to decline from previous weeks, according to STR‘s latest data through August 21.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

August 15-21, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 63.7% (-9.1%)

• Average daily rate (ADR): $135.77 (+5.1%)

• Revenue per available room (RevPAR): $86.43 (-4.5%)

While none of the Top 25 Markets recorded an occupancy increase over 2019, Detroit came closest to its 2019 comparable (-0.7% to 69.3%).

...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Weekly Initial Unemployment Claims increase to 353,000

by Calculated Risk on 8/26/2021 08:41:00 AM

The DOL reported:

In the week ending August 21, the advance figure for seasonally adjusted initial claims was 353,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 348,000 to 349,000. The 4-week moving average was 366,500, a decrease of 11,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 250 from 377,750 to 378,000.This does not include the 117,709 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 108,081 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 366,500.

The previous week was revised up.

Regular state continued claims decreased to 2,862,000 (SA) from 2,865,000 (SA) the previous week.

Note: There are an additional 5,004,753 receiving Pandemic Unemployment Assistance (PUA) that increased from 4,900,047 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 3,793,956 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 3,846,045.

Weekly claims were slightly above the consensus forecast.

Q2 GDP Growth Revised up to 6.6% Annual Rate

by Calculated Risk on 8/26/2021 08:34:00 AM

From the BEA: Gross Domestic Product, 2nd Quarter 2021 (Second Estimate); Corporate Profits, 2nd Quarter 2021 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 6.6 percent in the second quarter of 2021, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 6.3 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 11.8% to 11.9%. Residential investment was revised down from -9.8% to -11.5%. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 6.5 percent. The update reflects upward revisions to nonresidential fixed investment and exports that were partly offset by downward revisions to private inventory investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, were revised down

emphasis added

Wednesday, August 25, 2021

Thursday: GDP, Unemployment Claims

by Calculated Risk on 8/25/2021 06:20:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2021 (second estimate). The consensus is that real GDP increased 6.7% annualized in Q2, up from the advance estimate of 6.5% in Q2.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a increase slightly to 350 thousand from 348 thousand last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

• Thursday through Saturday, Jackson Hole Economic Policy Symposium, Macroeconomic Policy in an Uneven Economy

August 25th COVID-19: 7-Day Average New Cases Highest Since January

by Calculated Risk on 8/25/2021 04:16:00 PM

The 7-day average deaths is the highest since March 17th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.7% | 51.6% | 51.0% | ≥70.0%1 |

| Fully Vaccinated (millions) | 171.8 | 171.4 | 169.2 | ≥2321 |

| New Cases per Day3🚩 | 142,029 | 141,091 | 134,091 | ≤5,0002 |

| Hospitalized3🚩 | 85,611 | 85,004 | 75,544 | ≤3,0002 |

| Deaths per Day3🚩 | 809 | 765 | 659 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.6%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.1%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 48.7%, Ohio at 47.9%, Kentucky at 47.8%, Kansas at 47.5%, Arizona at 47.3%, Utah at 47.2%, Nevada at 47.0%, and Alaska at 46.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Philly Fed: State Coincident Indexes Increased in 46 States in July

by Calculated Risk on 8/25/2021 11:34:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2021. Over the past three months, the indexes increased in 48 states, decreased in one state, and remained stable in one, for a three-month diffusion index of 94. Additionally, in the past month, the indexes increased in 46 states, decreased in one state, and remained stable in three, for a one-month diffusion index of 90. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 1.9 percent over the past three months and 0.8 percent in July.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is almost all positive on a three month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In July, 48 states had increasing activity including minor increases.