by Calculated Risk on 8/30/2021 11:09:00 AM

Monday, August 30, 2021

Housing Inventory August 30th Update: Inventory Unchanged Week-over-week, Up 41% from Low in early April

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

NAR: Pending Home Sales Decreased 1.8% in July

by Calculated Risk on 8/30/2021 10:04:00 AM

From the NAR: Pending Home Sales Wane 1.8% In July

Pending home sales dipped modestly in July, noting two consecutive months of declines, according to the National Association of Realtors®. Only the West region registered a month-over-month gain in contract activity, while the other three major U.S. regions reported drops. All four regions saw transactions decrease year-over-year.This was below expectations of a 0.4% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, declined 1.8% to 110.7 in July. Year-over-year, signings fell 8.5%. An index of 100 is equal to the level of contract activity in 2001.

...

Month-over-month, the Northeast PHSI fell 6.6% to 92.0 in July, a 16.9% decrease from a year ago. In the Midwest, the index dropped 3.3% to 104.6 last month, down 8.5% from July 2020.

Pending home sales transactions in the South declined 0.9% to an index of 130.9 in July, down 6.7% from July 2020. The index in the West rose 1.9% in July to 99.8, but still down 5.7% from a year prior.

emphasis added

Seven High Frequency Indicators for the Economy

by Calculated Risk on 8/30/2021 08:21:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of August 29th.

Click on graph for larger image.

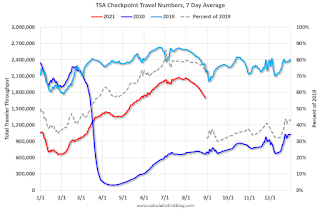

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 23.7% from the same day in 2019 (76.3% of 2019). (Dashed line)

There was a slow increase from the bottom starting in May 2020 - and then TSA data picked up in 2021 - but the dashed line has moved down a little recently.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through August 28, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was generally picking up, but has moved down recently. The 7-day average for the US is down 9% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $88 million last week, down about 43% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is above the horrible 2009 levels, but, according to STR, occupancy is declining due to both seasonal factors and "concerns around the pandemic". With solid leisure travel, the Summer months had decent occupancy - but it is uncertain what will happen in the Fall with business travel - especially with the sharp increase in COVID pandemic cases and hospitalizations.

This data is through August 21st. The occupancy rate is down 9.1% compared to the same week in 2019. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of August 20th, gasoline supplied was down 3.3% compared to the same week in 2019.

There have been four weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through August 28th for the United States and several selected cities.

This data is through August 28th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 109% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, August 27th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, August 29, 2021

Monday: Pending Home Sales, Dallas Fed Mfg

by Calculated Risk on 8/29/2021 06:46:00 PM

Weekend:

• Schedule for Week of August 29, 2021

Monday:

• At 10:00 AM ET, Pending Home Sales Index for July. The consensus is for a 0.4% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August. This is the last of the regional Fed manufacturing surveys for August.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 43 and DOW futures are up 260 (fair value).

Oil prices were up over the last week with WTI futures at $69.33 per barrel and Brent at $73.42 per barrel. A year ago, WTI was at $43, and Brent was at $45 - so WTI oil prices are UP about 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.13 per gallon. A year ago prices were at $2.22 per gallon, so gasoline prices are up $0.91 per gallon year-over-year.

August 29th COVID-19: Posting on Weekdays Only Going Forward

by Calculated Risk on 8/29/2021 03:48:00 PM

The 7-day average deaths is the highest since March 14th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 52.3% | 52.0% | 51.5% | ≥70.0%1 |

| Fully Vaccinated (millions) | 173.5 | 172.6 | 170.8 | ≥2321 |

| New Cases per Day3🚩 | 147,030 | 144,761 | 142,514 | ≤5,0002 |

| Hospitalized3🚩 | 88,009 | 87,585 | 79,393 | ≤3,0002 |

| Deaths per Day3🚩 | 949 | 902 | 815 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 16 states and D.C. have between 50% and 59.9% fully vaccinated: New York State and New Mexico at 59.9%, New Hampshire, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.4%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.1%, Ohio at 48.3%, Kentucky at 48.3%, Kansas at 48.1%, Arizona at 47.7%, Nevada at 47.6%, Utah at 47.5%, Texas at 47.2% and Alaska at 47.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Energy expenditures as a percentage of PCE

by Calculated Risk on 8/29/2021 10:17:00 AM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the recently released July PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through July 2021.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In general, energy expenditures as a percent of PCE have been trending down for years.

At the beginning of the pandemic, energy expenditures as a percentage of PCE, fell to a record low of 3.3% in May 2020.

Saturday, August 28, 2021

Real Personal Income: Transfer Payments

by Calculated Risk on 8/28/2021 06:46:00 PM

The BEA released the Personal Income and Outlays, July 2021 report yesterday. The report showed that government transfer payments were still almost $1.0 trillion (on SAAR basis) above the February 2020 level (pre-pandemic) Note: Seasonal adjustment doesn't make sense with one time payments, but that is how the data is presented.

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Jan-20 | $511 | $26 |

| Feb-20 | $506 | $26 |

| Mar-20 | $516 | $67 |

| Apr-20 | $3,393 | $435 |

| May-20 | $1,373 | $1,287 |

| Jun-20 | $743 | $1,396 |

| Jul-20 | $750 | $1,366 |

| Aug-20 | $697 | $612 |

| Sep-20 | $950 | $325 |

| Oct-20 | $714 | $296 |

| Nov-20 | $580 | $285 |

| Dec-20 | $604 | $319 |

| Jan-21 | $2,317 | $574 |

| Feb-21 | $735 | $558 |

| Mar-21 | $4,706 | $566 |

| Apr-21 | $1,344 | $516 |

| May-21 | $802 | $492 |

| Jun-21 | $736 | $433 |

| Jul-21 | $907 | $381 |

Schedule for Week of August 29, 2021

by Calculated Risk on 8/28/2021 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the August ISM manufacturing and services indexes, August auto sales, Case-Shiller house prices for June, and the July trade deficit.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.4% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August. This is the last of the regional Fed manufacturing surveys for August.

9:00 AM: S&P/Case-Shiller House Price Index for June.

9:00 AM: S&P/Case-Shiller House Price Index for June.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.6% year-over-year increase in the Comp 20 index for June.

9:00 AM: FHFA House Price Index for June. This was originally a GSE only repeat sales, however there is also an expanded index.

9:45 AM: Chicago Purchasing Managers Index for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 638,000 payroll jobs added in August, up from 330,000 added in July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 58.5, down from 59.5 in July.

10:00 AM: Construction Spending for July. The consensus is for a 0.3% increase in construction spending.

Late: Light vehicle sales for August. The consensus is for light vehicle sales to be 15.0 million SAAR in August, up from 14.75 million in July (Seasonally Adjusted Annual Rate).

Late: Light vehicle sales for August. The consensus is for light vehicle sales to be 15.0 million SAAR in August, up from 14.75 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease slightly to 350 thousand from 353 thousand last week.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $70.9 billion in July, from $75.7 billion in June.

8:30 AM: Employment Report for August. The consensus is for 728 thousand jobs added, and for the unemployment rate to decrease to 5.2%.

8:30 AM: Employment Report for August. The consensus is for 728 thousand jobs added, and for the unemployment rate to decrease to 5.2%.There were 943 thousand jobs added in July, and the unemployment rate was at 5.4%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

10:00 AM: ISM Services Index for August.

Friday, August 27, 2021

CalculatedRisk Newsletter

by Calculated Risk on 8/27/2021 06:08:00 PM

I'm launching a newsletter focused solely on real estate. This newsletter will be ad free.

• Forbearance, Delinquencies and Foreclosure: Will the end of the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, lead to a surge in foreclosures and impact house prices, as happened following the housing bubble?

• How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?

• New Home Sales Increase to 708,000 Annual Rate in July

• Existing-Home Sales Increased to 5.99 million in July

• Housing Starts decreased to 1.534 Million Annual Rate in July

• Housing and Demographics: The Next Big Shift

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

August 27th COVID-19: Cases Might be Peaking

by Calculated Risk on 8/27/2021 03:52:00 PM

The 7-day average deaths is the highest since March 16th.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 52.0% | 51.9% | 51.2% | ≥70.0%1 |

| Fully Vaccinated (millions) | 172.6 | 172.2 | 170.0 | ≥2321 |

| New Cases per Day3🚩 | 144,138 | 143,835 | 140,242 | ≤5,0002 |

| Hospitalized3🚩 | 88,009 | 87,585 | 79,393 | ≤3,0002 |

| Deaths per Day3🚩 | 906 | 860 | 803 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.8%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.3%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 48.8%, Ohio at 48.1%, Kentucky at 48.0%, Kansas at 47.8%, Arizona at 47.5%, Utah at 47.3%, Nevada at 47.3%, and Alaska at 47.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.