by Calculated Risk on 9/02/2021 03:01:00 PM

Thursday, September 02, 2021

September 2nd COVID-19: New Cases Still Increasing, Deaths Averaging Over 1,000 per Day

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 52.7% | 51.9% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 175.0 | 172.2 | ≥2321 | |

| New Cases per Day3🚩 | 153,245 | 146,086 | ≤5,0002 | |

| Hospitalized3🚩 | 91,590 | 87,966 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,046 | 1,009 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 14 states and D.C. have between 50% and 59.9% fully vaccinated: New Hampshire at 59.8%, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.6%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.4%, Kentucky at 48.8%, Ohio at 48.5%, Kansas at 48.5%, Arizona at 48.1%, Nevada at 48.1%, Utah at 47.8%, Texas at 47.8% and Alaska at 47.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

August Employment Preview

by Calculated Risk on 9/02/2021 02:09:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus is for 728 thousand jobs added, and for the unemployment rate to decrease to 5.2%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 5.7 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 374,000 private sector jobs, well below the consensus estimate of 638,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in August to 49.0%, down from 52.9% last month. This would suggest a decline in manufacturing employment of around 25,000 jobs in August. ADP showed 6,000 manufacturing jobs added.

The ISM® Services employment index will be released tomorrow.

• Unemployment Claims: The weekly claims report showed a decrease in the number of initial unemployment claims during the reference week (include the 12th of the month) from 424,000 in July to 349,000 in August. This would usually suggest fewer layoffs in August than in July, although this might not be very useful right now. In general, weekly claims have been close to expectations in August.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers hasn't increased as sharply.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers hasn't increased as sharply.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.

This data is only available back to 1994, so there is only data for three recessions. In July, the number of permanent job losers decreased to 2.930 million from 3.187 million in June. These jobs will likely be the hardest to recover.

• IMPORTANT: The employment report will probably show another increase in state and local government education hiring. Usually in August, about 250 thousand educators are hired as the school year starts in some areas. This year, it seems likely more educators will be hired in August, and this could boost overall employment by a couple hundred thousand in the August report.

• Conclusion: The data suggests a weaker than expected report in August. However, there are some seasonal factors that will boost the BLS report (especially related to education).

Hotels: Occupancy Rate Down 8% Compared to Same Week in 2019

by Calculated Risk on 9/02/2021 12:22:00 PM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 8.4% compared to the same week in 2019.

U.S. hotel performance continued to decline from previous weeks, according to STR‘s latest data through August 28.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

August 22-28, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 61.0% (-8.4%)

• Average daily rate (ADR): $131.91 (+3.2%)

• Revenue per available room (RevPAR): $80.53 (-5.5%)

Performance continues to reflect seasonality as well as the pandemic situation. Additionally, while data for August 27-28 showed a preliminary demand shift in the Gulf region, the impact of Hurricane Ida is expected to be more significant in future weeks of data.

...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

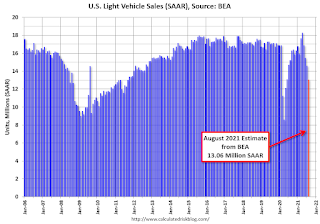

August Vehicles Sales Decreased to 13.06 Million SAAR

by Calculated Risk on 9/02/2021 10:26:00 AM

The BEA released their estimate of light vehicle sales for August this morning. The BEA estimates sales of 13.06 million SAAR in August 2021 (Seasonally Adjusted Annual Rate), down 10.7% from the July sales rate, and down 14.4% from August 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for August (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

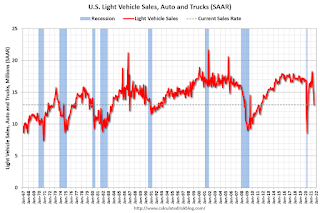

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate of 13.06 million SAAR.

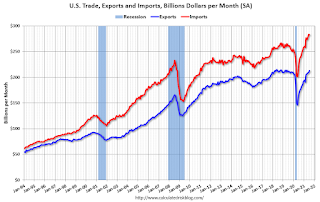

Trade Deficit Decreased to $70.1 Billion in July

by Calculated Risk on 9/02/2021 08:46:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $70.1 billion in July, down $3.2 billion from $73.2 billion in June, revised.

July exports were $212.8 billion, $2.8 billion more than June exports. July imports were $282.9 billion, $0.4 billion less than June imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in July.

Exports are up 25% compared to July 2020; imports are up 22% compared to July 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China decreased to $28.6 billion in July, from $31.6 billion in July 2020.

Weekly Initial Unemployment Claims decrease to 340,000

by Calculated Risk on 9/02/2021 08:35:00 AM

The DOL reported:

In the week ending August 28, the advance figure for seasonally adjusted initial claims was 340,000, a decrease of 14,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 1,000 from 353,000 to 354,000. The 4-week moving average was 355,000, a decrease of 11,750 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 250 from 366,500 to 366,750.This does not include the 102,405 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 116,425 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 355,000.

The previous week was revised up.

Regular state continued claims decreased to 2,748,000 (SA) from 2,908,000 (SA) the previous week.

Note: There are an additional 5,413,238 receiving Pandemic Unemployment Assistance (PUA) that increased from 5,004,753 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 3,800,000 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 3,793,956.

Weekly claims were close to the consensus forecast.

Wednesday, September 01, 2021

Thursday: Vehicle sales decline sharply in August, Weekly Claims, Trade Balance

by Calculated Risk on 9/01/2021 06:44:00 PM

From Wards Auto: Dried-Up Inventory Sinks U.S. Light-Vehicle Sales in August(pay content). Vehicle sales fell to 13.1 million SAAR (consensus was 15.0 million SAAR)

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease slightly to 350 thousand from 353 thousand last week.

• Also at 8:30 AM, Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be at $70.9 billion in July, from $75.7 billion in June.

September 1st COVID-19: New Cases May be Peaking at Average 150,000 per Day

by Calculated Risk on 9/01/2021 03:22:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 52.6% | 51.7% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 174.6 | 171.8 | ≥2321 | |

| New Cases per Day3🚩 | 149,767 | 146,021 | ≤5,0002 | |

| Hospitalized3🚩 | 91,592 | 86,712 | ≤3,0002 | |

| Deaths per Day3🚩 | 952 | 927 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 14 states and D.C. have between 50% and 59.9% fully vaccinated: New Hampshire at 59.7%, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.6%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.3%, Kentucky at 48.7%, Ohio at 48.5%, Kansas at 48.4%, Arizona at 48.0%, Nevada at 48.0%, Utah at 47.8%, Texas at 47.6% and Alaska at 47.3%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

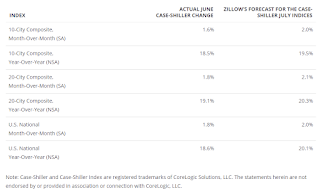

Zillow Case-Shiller House Price Forecast: 20%+ Year-over-year in July

by Calculated Risk on 9/01/2021 12:11:00 PM

The Case-Shiller house price indexes for June were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: June 2021 Case-Shiller Results & Forecast: Hot Growth Summer

The slow rise in inventory that marked the beginning of summer wasn’t enough to cool the sizzling market, with the already rapidly rising Case-Shiller indices hitting the gas accelerating into the middle of the year instead of tapping the brakes.

The national Case-Shiller Home Price Index rose 18.6% year-over-year in June. Annual growth in the smaller 20-city composite index exceeded the national pace (19.1%) and annual growth in the 10-city index (18.5%) almost matched national appreciation. The annual rate of growth was faster in June than in May in all three main indices. On a monthly (seasonally adjusted) basis, the national index was up 1.8% from May, while the 10- and 20-city indices were up 1.6% and 1.8% month-over-month, respectively.

...

Demand for housing continues to far outweigh the supply of homes for sale: Competition remains elevated, and homes are still going under contract more than a week faster than they were a year ago. But despite the enduring market competition, more-recent data indicate that the scalding hot housing market may have cooled slightly in recent weeks. The number of for-sale homes has risen meaningfully since the early spring and the increased listings have appeared to bring some balance back to the market. Sales volumes that were falling sequentially in the spring have recently leveled off and price growth has simultaneously softened. All told, home price growth remains sky high, but more signals are appearing that the housing market is likely to soon start coming back to earth.

Monthly and annual growth in July as reported by Case-Shiller is expected to accelerate from June and May 2020 in all three main indices. S&P Dow Jones Indices is expected to release data for the June S&P CoreLogic Case-Shiller Indices on Tuesday, September 28.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.1% in July, from 18.6% in June.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.1% in July, from 18.6% in June. The Zillow forecast is for the 20-City index to be up 20.3% YoY in July from 19.1% in June, and for the 10-City index to be up 19.5% YoY compared to 18.5% YoY in June.

Construction Spending increased 0.3% in July

by Calculated Risk on 9/01/2021 10:21:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during July 2021 was estimated at a seasonally adjusted annual rate of $1,568.8 billion, 0.3 percent above the revised June estimate of $1,563.4 billion. The July figure is 9.0 percent above the July 2020 estimate of $1,439.6 billion.Private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,231.0 billion, 0.3 percent above the revised June estimate of $1,227.8 billion. ...

In July, the estimated seasonally adjusted annual rate of public construction spending was $337.8 billion, 0.7 percent above the revised June estimate of $335.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 14% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 10% above the bubble era peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 4% above the peak in March 2009, and 29% above the austerity low in February 2014, but weak recently.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 27.0%. Non-residential spending is down 3.6% year-over-year. Public spending is down 5.1% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but some sectors of non-residential have been under pressure. For example, lodging is down 29.8% YoY, multi-retail down 3.4% YoY, and office down 6.1% YoY.