by Calculated Risk on 9/09/2021 08:35:00 AM

Thursday, September 09, 2021

Weekly Initial Unemployment Claims decrease to 310,000

The DOL reported:

In the week ending September 4, the advance figure for seasonally adjusted initial claims was 310,000, a decrease of 35,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 5,000 from 340,000 to 345,000. The 4-week moving average was 339,500, a decrease of 16,750 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 1,250 from 355,000 to 356,250.This does not include the 96,198 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 102,521 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 339,500.

The previous week was revised up.

Regular state continued claims decreased to 2,662,831 (SA) from 2,796,781 (SA) the previous week.

Note: There are an additional 5,090,524 receiving Pandemic Unemployment Assistance (PUA) that decreased from 5,413,238 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 3,807,646 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 3,800,000.

Weekly claims were lower than the consensus forecast.

Wednesday, September 08, 2021

Las Vegas Real Estate in August: Sales up 14% YoY, Inventory down 36% YoY

by Calculated Risk on 9/08/2021 08:09:00 PM

The Las Vegas Realtors reported Southern Nevada home prices pause at record level; LVR housing statistics for August 2021

A report released Wednesday by Las Vegas REALTORS® (LVR) shows local home prices holding steady as families were preoccupied getting their kids in school, graduates off to college and all the seasonal reasons that cause what LVR leaders called a momentary pause while the market readies for its last surge before the expected holiday slowdown begins.1) Overall sales (single family and condos) were up 14.0% year-over-year from 3,594 in August 2020 to 4,098 in August 2021.

Meanwhile, the local housing supply continues to grow slowly, making August the seventh straight month when there were more properties available without offers than in the previous month.

...

LVR reported a total of 4,098 existing local homes, condos and townhomes sold during August. Compared to one year ago, August sales were up 10.3% for homes and up 29.8% for condos and townhomes. So far this year, local home sales are on pace to exceed last year’s total.

…

By the end of August, LVR reported 3,256 single-family homes listed for sale without any sort of offer. While up from the previous month, that’s down 29.8% from the same time last year. The 687 condos and townhomes listed without offers in August was down 55.5% from one year ago.

...

With eviction and foreclosure bans still in place, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.3% of all existing local property sales in August. That compares to 1.2% of all sales one year ago, 2.1% of all sales two years ago, 2.5% three years ago and 6.1% four years ago.

emphasis added

2) Active inventory (single-family and condos) is down 36.2% from a year ago, from a total of 6,183 in August 2020 to 3,943 in August 2021. And months of inventory is extremely low.

3) Active inventory is up 7.5% from the previous month (July 2021), and up 68% from the all time low in February 2021 (2,352 single family and condos active listings).

Homebuilder Comments in August: “Supply shortages are getting worse."

by Calculated Risk on 9/08/2021 03:56:00 PM

Some twitter comments in the newsletter from Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

Homebuilder Comments in August: “Supply shortages are getting worse."

September 8th COVID-19: Cases Might Have Peaked

by Calculated Risk on 9/08/2021 03:40:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 53.3% | 52.6% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 177.1 | 174.6 | ≥2321 | |

| New Cases per Day3 | 140,058 | 155,826 | ≤5,0002 | |

| Hospitalized3🚩 | 92,545 | 92,401 | ≤3,0002 | |

| Deaths per Day3 | 1,022 | 1,129 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 13 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 58.7%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.9%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.8%, Kentucky at 49.5%, Arizona at 49.3%, Kansas at 49.1%, Ohio at 48.9%, Nevada at 48.7%, Texas at 48.5%, Utah at 48.3% and Alaska at 48.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Fed's Beige Book: "Economic growth downshifted slightly to a moderate pace"

by Calculated Risk on 9/08/2021 02:06:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of New York based on information collected on or before August 30, 2021."

Economic growth downshifted slightly to a moderate pace in early July through August. The stronger sectors of the economy of late included manufacturing, transportation, nonfinancial services, and residential real estate. The deceleration in economic activity was largely attributable to a pullback in dining out, travel, and tourism in most Districts, reflecting safety concerns due to the rise of the Delta variant, and, in a few cases, international travel restrictions. The other sectors of the economy where growth slowed or activity declined were those constrained by supply disruptions and labor shortages, as opposed to softening demand. In particular, weakness in auto sales was widely ascribed to low inventories amidst the ongoing microchip shortage, and restrained home sales activity was attributed to low supply. Growth in non-auto retail sales slowed a bit in some Districts, rising at a modest pace, on balance, across the nation. Residential construction was up slightly, on balance, and nonresidential construction picked up modestly. Trends in loan volumes varied widely across Districts, ranging from down modestly to up strongly. Reports on the agriculture and energy sectors were mixed across Districts but, on balance, positive. Looking ahead, businesses in most Districts remained optimistic about near-term prospects, though there continued to be widespread concern about ongoing supply disruptions and resource shortages.

...

All Districts continued to report rising employment overall, though the characterization of the pace of job creation ranged from slight to strong. Demand for workers continued to strengthen, but all Districts noted extensive labor shortages that were constraining employment and, in many cases, impeding business activity. Contributing to these shortages were increased turnover, early retirements (especially in health care), childcare needs, challenges in negotiating job offers, and enhanced unemployment benefits. Some Districts noted that return-to-work schedules were pushed back due to the increase in the Delta variant. With persistent and extensive labor shortages, a number of Districts reported an acceleration in wages, and most characterized wage growth as strong—including all of the midwestern and western regions. Several Districts noted particularly brisk wage gains among lower-wage workers. Employers were reported to be using more frequent raises, bonuses, training, and flexible work arrangements to attract and retain workers.

emphasis added

Black Knight Mortgage Monitor for July; Tappable Equity Rises to All-Time High of $9.1 Trillion

by Calculated Risk on 9/08/2021 11:12:00 AM

Black Knight released their Mortgage Monitor report for July today. According to Black Knight, 4.14% of mortgage were delinquent in July, down from 4.37% of mortgages in June, and down from 6.91% in July 2020. Black Knight also reported that 0.26% of mortgages were in the foreclosure process, down from 0.36% a year ago.

This gives a total of 4.40% delinquent or in foreclosure.

Press Release: Black Knight: Tappable Equity Rises $1 Trillion in Q2 2021 Alone to Hit All-Time High of $9.1 Trillion; Quarter Also Sees Largest Volume of Cash-Out Refis in 15 Years

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. With full Q2 data in and analyzed, this month’s report looks at incredible growth in the nation’s levels of tappable equity – the amount available for homeowners with mortgages to borrow against while still retaining at least 20% equity in their homes. According to Black Knight Data & Analytics President Ben Graboske, continued heat in the housing market drove tappable equity levels to never-before-seen heights in the second quarter of 2021.

“Tappable equity grew an astonishing 37% year-over-year in Q2 2021, driven by increasing gains in home values over the quarter,” said Graboske. “According to our Black Knight HPI, as of the end of June, home values had risen nearly 20% from the year before and 7.4% in Q2 alone. As a result, already at a record high of $8.1 trillion at the end of Q1, U.S. homeowners with mortgages gained another $1 trillion in tappable equity in the second quarter alone. This is by far the strongest growth we’ve ever seen and equates to some $173,000 in equity available to the average mortgage holder, a $20,000 increase in just three months.

“A rising tide lifts all boats as they say, including homeowners in forbearance – whose ability to return to making payments when forbearance ends will likely be a key driver in the nation’s overall COVID-19 economic recovery. Some 98% of homeowners in forbearance now have at least 10% equity in their homes. Even when we add in 18 months of forborne payments – including principal, interest, taxes and insurance – the share with less than 10% equity only climbs to 7%, about 135,000 homeowners. This is a drastically different dynamic than during the worst of the Great Recession, when more than 40% of all mortgage holders had less than 10% equity and 28% were fully underwater. Such strong equity positions should help limit the volume of distressed inflow into the real estate market as well as provide strong incentive for homeowners to return to making mortgage payments – even if needing to be reduced through modification.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph on delinquencies from Black Knight:

• The national delinquency rate saw a 5% reduction in July, and at 4.14% is within a single percentage point of its pre-pandemic level

• While overall delinquency volumes continue to edge closer to pre-pandemic levels, some 1.45 million borrowers remained 90 or more days past due – but not yet in foreclosure – at the end of July

And on tappable equity from Black Knight:

And on tappable equity from Black Knight: • Despite rising equity withdrawals, the housing market continues to drive skyrocketing borrower equity positionsThere is much more in the mortgage monitor.

• Tappable equity – the amount available for homeowners with mortgages to borrow against while still retaining at least 20% equity in their homes – was already at a record high of $8.1T at the end of Q1

• According to our Black Knight HPI, as of the end of June, home values had risen nearly 20% from the year before and 7.4% in Q2 alone

• As a result, U.S. homeowners with mortgages gained another $1T in tappable equity in Q2 alone to make an astonishing 37% year-over-year gain

...

• The 1.1M cash-outs originated in Q2 were the largest quarterly volume in nearly 15 years, with more than $63B in equity withdrawn in the quarter – the most since mid-2007

BLS: Job Openings Increase to Series High 10.9 Million in July

by Calculated Risk on 9/08/2021 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to a series high of 10.9 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.7 million and 5.8 million, respectively. Within separations, the quits rate was unchanged at 2.7 percent while the layoffs and discharges rate was little changed at 1.0 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in July to 10.934 million from 10.185 million in June. This is a new record high for this series.

The number of job openings (yellow) were up 63% year-over-year.

Quits were up 25% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Forbearance Will Not Lead to a Huge Wave of Foreclosures

by Calculated Risk on 9/08/2021 08:17:00 AM

At the Calculated Risk Newsletter: Forbearance Will Not Lead to a Huge Wave of Foreclosures

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/08/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 3, 2021.

... The Refinance Index decreased 3 percent from the previous week and was 4 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 18 percent lower than the same week one year ago.

“Mortgage application volume fell last week to its lowest level since mid-July, as mortgage rates have stayed just above 3% for several weeks. Refinance volume has been moderating, while purchase volume continues to be lower than expected given the lack of homes on the market,” said Mike Fratantoni, MBA's Senior Vice President and Chief Economist. “Economic data has sent mixed signals, with slower job growth but a further drop in the unemployment rate in August. We expect that further improvements will lead to a tapering of Fed MBS purchases by the end of the year, which should put some upward pressure on mortgage rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) remained unchanged at 3.03 percent, with points decreasing to 0.33 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

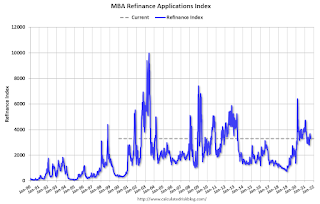

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 07, 2021

Wednesday: Job Openings, Beige Book

by Calculated Risk on 9/07/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Begin The Week Slightly Higher

Mortgage rates moved slightly higher to begin the holiday-shortened week. ... The damage is minimal in the bigger picture. On average, lenders are quoting the same rates seen last week, but with slightly higher closing costs today. Most of the weakness in the underlying bond market is centered on US Treasuries as opposed to the mortgage-backed securities (MBS) that serve as the foundation for mortgage rates. The Treasury-specific weakness is likely due to the presence of several big Treasury auctions this week in addition to heavy corporate bond issuance (which tends to hurt Treasuries more than MBS). [30 year fixed 2.97%]Tuesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for July from the BLS.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.