by Calculated Risk on 9/13/2021 09:47:00 PM

Monday, September 13, 2021

September 13th COVID-19: Data reported on Monday is always low, and will be revised up as data is received

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 53.8% | 53.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 178.7 | 176.0 | ≥2321 | |

| New Cases per Day3 | 117,622 | 152,402 | ≤5,0002 | |

| Hospitalized3 | 87,848 | 93,421 | ≤3,0002 | |

| Deaths per Day3 | 1,077 | 1,213 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 15 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 59.2%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, and Kentucky at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Arizona at 49.7%, Kansas at 49.5%, Ohio at 49.2%, Nevada at 49.1%, Texas at 49.0%, Utah at 48.8% and Alaska at 48.3%.

Click on graph for larger image.

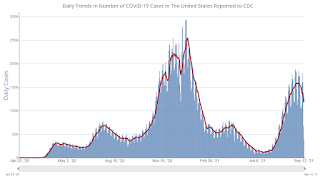

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Tuesday: CPI

by Calculated Risk on 9/13/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Flat to Start The Week

Mortgage rates were fairly flat to start the new week. This leaves the average lender in the high 2% range for top tier conventional 30yr fixed scenarios (i.e. 20%+ equity, 740+ FICO, owner-occupied, single-family, detached homes). This is just a bit higher than the all-time lows seen at the beginning of the year when rates were in the mid-2% range. [30 year fixed 2.94%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for August.

• At 8:30 AM, The Consumer Price Index for August from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.3% increase in core CPI.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 3.08%"

by Calculated Risk on 9/13/2021 04:00:00 PM

Note: This is as of September 5th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 3.08%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 15 basis points from 3.23% of servicers’ portfolio volume in the prior week to 3.08% as of September 5, 2021. According to MBA’s estimate, 1.5 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 11 basis points to 1.52%. Ginnie Mae loans in forbearance decreased 24 basis points to 3.39%, while the forbearance share for portfolio loans and private-label securities (PLS) decreased 25 basis points to 7.27%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 16 basis points to 3.33%, and the percentage of loans in forbearance for depository servicers decreased 18 basis points to 3.15%.

“The share of loans in forbearance decreased by 15 basis points last week, as forbearance exits jumped to their fastest pace since March. The fast pace of exits outweighed the slight increase in new forbearance requests and re-entries,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Servicer call volume jumped last week as summer came to an end and many borrowers reached the end of their forbearance terms. We anticipate a similarly fast pace of exits in the weeks ahead, which should lead to increased call volume and a further decline in the forbearance share.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.04% to 0.05%."

Second Home Market: South Lake Tahoe in August

by Calculated Risk on 9/13/2021 01:57:00 PM

Early this year, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and will track those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through August 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12 month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but solidly above the record low set five months ago, and prices are up sharply YoY. This will be interesting to watch.

5 Additional Local Housing Markets in August: Albuquerque, Colorado, Houston, Memphis and Nashville

by Calculated Risk on 9/13/2021 11:09:00 AM

Starting this month, I'm going to post local market data (Sales, Active Inventory, New listings) several times during the month on the CalculatedRisk Newsletter.

Here are 5 more of about 30 local markets that I track: 5 More Local Housing Markets in August

This includes Albuquerque, Colorado, Houston, Memphis and Nashville.

Housing Inventory Sept 13th Update: Inventory Down 1.4% Week-over-week, Up 41% from Low in early April

by Calculated Risk on 9/13/2021 10:29:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 9/13/2021 08:10:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of September 12th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 23.2% from the same day in 2019 (76.8% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through September 11, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday. The 7-day average for the US is down 6% compared to 2019.

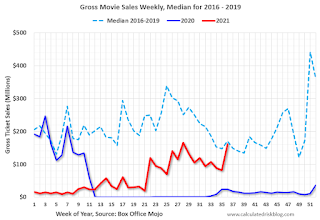

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $162 million last week, down only about 5% from the median for the week due to the blockbuster "Shang-Chi and the Legend of the Ten Rings".

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is above the horrible 2009 levels. With solid leisure travel, the Summer months and Labor Day had decent occupancy - but it is uncertain what will happen in the Fall with business travel.

This data is through September 4th. The occupancy rate was unchanged compared to the same week in 2019, boosted by Labor Day demand and Hurricane Ida. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of September 3rd, gasoline supplied was down 2.0% compared to the same week in 2019.

There have been five weeks so far this year when gasoline supplied was up compared to the same week in 2019.

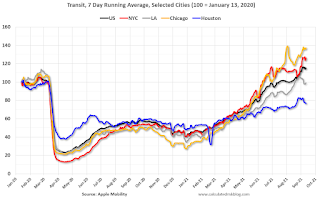

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through September 11th for the United States and several selected cities.

This data is through September 11th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 115% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, September 10th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, September 12, 2021

Sunday Night Futures

by Calculated Risk on 9/12/2021 06:30:00 PM

Weekend:

• Schedule for Week of September 12, 2021

• The Rapid Increase in Rents

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 9 and DOW futures are up 70 (fair value).

Oil prices were up over the last week with WTI futures at $69.75 per barrel and Brent at $72.94 per barrel. A year ago, WTI was at $37, and Brent was at $39 - so WTI oil prices are UP 90% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.16 per gallon. A year ago prices were at $2.16 per gallon, so gasoline prices are up $1.00 per gallon year-over-year.

The Rapid Increase in Rents

by Calculated Risk on 9/12/2021 01:05:00 PM

The Rapid Increase in Rents

NOTE: This is the new Newsletter that focuses solely on Real Estate. It is completely Free at this time. Please subscribe!

This Newsletter article discusses:

What is happening with rents?

Why are rents increasing rapidly?

What will happen?

Saturday, September 11, 2021

Newsletter Articles this Week

by Calculated Risk on 9/11/2021 02:59:00 PM

Note: I've started a newsletter focused solely on real estate. This newsletter is currently completely FREE and also ad free.

At the Calculated Risk Newsletter this week:

• Housing: A Look at "Affordability" Indexes

• Forbearance Will Not Lead to a Huge Wave of Foreclosures

• Homebuilder Comments in August: “Supply shortages are getting worse."

• 6 Local Housing Markets in August: Denver, Las Vegas, San Diego, North Texas (Dallas/Ft. Worth), Northwest (Seattle), Santa Clara (San Jose)

• 4 More Local Housing Markets in August: Atlanta, New Hampshire, Portland, Sacramento

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).