by Calculated Risk on 9/16/2021 08:46:00 AM

Thursday, September 16, 2021

Retail Sales Increased 0.7% in August

On a monthly basis, retail sales were increased 0.7% from July to August (seasonally adjusted), and sales were up 15.1 percent from August 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for August 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $618.7 billion, an increase of 0.7 percent from the previous month, and 15.1 percent above August 2020 ... The June 2021 to July 2021 percent change was revised from down 1.1 percent to down 1.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.8% in August.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 13.4% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 13.4% on a YoY basis.Sales in August were above expectations, however sales in June and July were revised down, combined.

Weekly Initial Unemployment Claims increase to 332,000

by Calculated Risk on 9/16/2021 08:36:00 AM

The DOL reported:

In the week ending September 11, the advance figure for seasonally adjusted initial claims was 332,000, an increase of 20,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 310,000 to 312,000. The 4-week moving average was 335,750, a decrease of 4,250 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 500 from 339,500 to 340,000.This does not include the 28,456 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 94,638 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 335,750.

The previous week was revised up.

Regular state continued claims decreased to 2,656,747 (SA) from 2,662,844 (SA) the previous week.

Note (released with a 2 week delay): There were an additional 5,487,233 receiving Pandemic Unemployment Assistance (PUA) that increased from 5,090,524 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And were an additional 3,805,795 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 3,805,008.

Weekly claims were higher than the consensus forecast.

Wednesday, September 15, 2021

Thursday: Retail Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 9/15/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. There were 310 thousand initial claims last week.

• Also at 8:30 AM, Retail sales for August will be released. The consensus is for a 0.7% decrease in retail sales.

• Also at 8:30 AM, the Philly Fed manufacturing survey for September. The consensus is for a reading of 20.0, up from 19.4.

September 15th COVID-19: 2,000 Deaths Reported Today, Most since February

by Calculated Risk on 9/15/2021 05:22:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 54.1% | 53.3% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 179.7 | 177.1 | ≥2321 | |

| New Cases per Day3🚩 | 145,675 | 141,275 | ≤5,0002 | |

| Hospitalized3 | 90,593 | 93,243 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,358 | 1,125 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 15 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 59.4%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, and Kentucky at 50.3%.

Next up (total population, fully vaccinated according to CDC) are Arizona at 49.9%, Kansas at 49.8%, Ohio at 49.4%, Nevada at 49.4%, Texas at 49.4%, Utah at 49.0% and Alaska at 48.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

LA Area Port Traffic: Solid Imports, Weak Exports in August

by Calculated Risk on 9/15/2021 02:36:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, incoming port traffic is backed up significantly in the LA area with around 50 ships at anchor waiting to unload.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.1% in August compared to the rolling 12 months ending in July. Outbound traffic was down 1.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 1% YoY in August (recovered last year following the early months of the pandemic), and exports were down 14.0% YoY.

Another 5 Local Housing Markets in August

by Calculated Risk on 9/15/2021 10:55:00 AM

In the Newsletter: Another 5 Local Housing Markets in August

Active inventory, new listings and sales added for Boston, Des Moines, Jacksonville, Minnesota, South Carolina

So far sales are up 0.2% YoY, Not Seasonally Adjusted (NSA).

Industrial Production Increased 0.4 Percent in August

by Calculated Risk on 9/15/2021 09:21:00 AM

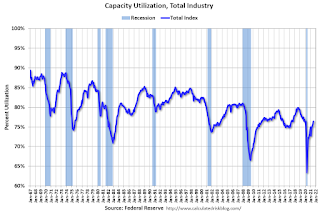

From the Fed: Industrial Production and Capacity Utilization

Industrial production increased 0.4 percent in August after moving up 0.8 percent in July. Late-month shutdowns related to Hurricane Ida held down the gain in industrial production by an estimated 0.3 percentage point. Although the hurricane forced plant closures for petrochemicals, plastic resins, and petroleum refining, overall manufacturing output rose 0.2 percent. Mining production fell 0.6 percent, reflecting hurricane-induced disruptions to oil and gas extraction in the Gulf of Mexico. The output of utilities increased 3.3 percent, as unseasonably warm temperatures boosted demand for air conditioning.

At 101.6 percent of its 2017 average, total industrial production in August was 5.9 percent above its year-earlier level and 0.3 percent above its pre-pandemic (February 2020) level. Capacity utilization for the industrial sector rose 0.2 percentage point in August to 76.4 percent, a rate that is 3.2 percentage points below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and slightly above the level in February 2020.

Capacity utilization at 76.4% is 3.2% below the average from 1972 to 2020.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in August to 101.6. This is 0.3% above the February 2020 level.

The change in industrial production was slightly below consensus expectations.

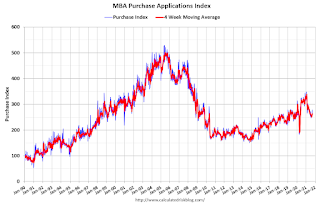

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 9/15/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 10, 2021. This week’s results include an adjustment for the Labor Day holiday.

... The Refinance Index decreased 3 percent from the previous week and was 3 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Purchase applications – after adjusting for the impact of Labor Day – increased over 7 percent last week to their highest level since April 2021. Compared to the same week last September, which was right in the middle of a significant upswing in home purchases, applications were down 11 percent – the smallest year-over-year decline in 14 weeks,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Both conventional and government purchase applications increased, and the average loan size for a purchase application rose to $396,800. The very competitive purchase market continues to put upward pressure on sales prices.”

Added Kan, “While the 30-year fixed rate was unchanged at just over 3 percent, it was not enough to drive more refinance activity. Refinance applications slipped to their slowest pace since early July, and the refinance share of applications fell to 65 percent, which was also the lowest since July.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) remained unchanged at 3.03 percent, with points decreasing to 0.32 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 14, 2021

Wednesday: NY Fed Mfg, Industrial Production

by Calculated Risk on 9/14/2021 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 18.6, up from 18.3.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 76.4%.

September 14th COVID-19: Almost 1 Million Doses per Day

by Calculated Risk on 9/14/2021 07:51:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 54.0% | 53.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 179.3 | 176.0 | ≥2321 | |

| New Cases per Day3 | 139,897 | 149,796 | ≤5,0002 | |

| Hospitalized3 | 90,651 | 93,201 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,262 | 1,147 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 15 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 59.3%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, and Kentucky at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Arizona at 49.8%, Kansas at 49.7%, Ohio at 49.3%, Nevada at 49.3%, Texas at 49.2%, Utah at 48.9% and Alaska at 48.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.