by Calculated Risk on 9/17/2021 08:34:00 AM

Friday, September 17, 2021

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of September 14th.

From Andy Walden at Black Knight: Forbearances Below 1.6M For First Time Since Start of Pandemic

The number of active forbearance plans fell by 22K (-1.4%) this week, bringing the total number of U.S. homeowners in COVID-19 forbearance below 1.6M for the first time since the start of the pandemic.

Matching 15,000 declines in plans among both GSE and FHA/VA loans were partially offset by an 8,000 rise in PLS/portfolio plans. Overall, forbearances are now down 156K (-8.9%) from the same time last month.

As of September 14, nearly 1.6 million mortgage holders remain in COVID-19 related forbearance plans, representing 3% of all active mortgages, including 1.7% of GSE, 5.2% of FHA/VA and 3.8% of portfolio held and privately securitized loans.

Both new forbearance plans and plan restarts rose this week, with new plan starts trending higher since mid-August.

The rise in new plan starts is almost solely limited to FHA/VA loans, coinciding with the deadline for entry into forbearance for such loans expiring at the end of September. That said, unemployment benefits lapsed over the Labor Day weekend and COVID caseloads continue to rise, so it’s difficult to pinpoint the exact cause.

With two weeks left in the month, we have already seen 218,000 plan exits over just the first half of September. Meanwhile, plan extensions are at their lowest since the onset of the pandemic, with only 45,000 plans extended this week.

With more than 462,000 plans scheduled for review for extension/removal in September, exit volumes could be poised to rise sharply at the start of October. As many as 330,000 are set to reach their final plan expirations based on current allowable forbearance term lengths.

emphasis added

Thursday, September 16, 2021

September 16th COVID-19: Over 180 Million Fully Vaccinated

by Calculated Risk on 9/16/2021 04:59:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 54.2% | 53.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 180.1 | 177.4 | ≥2321 | |

| New Cases per Day3🚩 | 146,182 | 137,783 | ≤5,0002 | |

| Hospitalized3 | 89,132 | 93,255 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,233 | 1,447 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 16 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 59.5%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, Kentucky and Arizona at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Kansas at 49.9%, Nevada at 49.5%, Texas at 49.5%, Ohio at 49.3%, Utah at 49.1% and Alaska at 48.6%.

Click on graph for larger image.

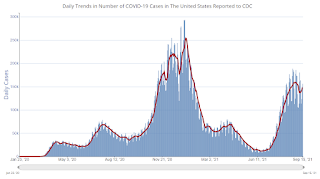

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Household Formation Drives Housing Demand

by Calculated Risk on 9/16/2021 01:32:00 PM

In the Newsletter: Household Formation Drives Housing Demand

If all the missing households from 2020 were formed in 2021, we’d expect about 2.3 million additional households formed this year!

Hotels: Occupancy Rate Down 13.6% Compared to Same Week in 2019

by Calculated Risk on 9/16/2021 11:12:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic.

U.S. hotel performance fell slightly from the previous week, according to STR‘s latest data through September 11.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

September 5-11, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 60.0% (-13.6%)

• Average daily rate (ADR): $130.82 (-1.4%)

• Revenue per available room (RevPAR): $78.46 (-14.8%)

Despite the week-over-week dip, performance levels were solid on an absolute basis considering it was the week of Labor Day as well as Rosh Hashanah from Monday through Wednesday. Neither of those holidays were a factor in the corresponding week two years ago, thus creating steeper declines in comparison with 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Retail Sales Increased 0.7% in August

by Calculated Risk on 9/16/2021 08:46:00 AM

On a monthly basis, retail sales were increased 0.7% from July to August (seasonally adjusted), and sales were up 15.1 percent from August 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for August 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $618.7 billion, an increase of 0.7 percent from the previous month, and 15.1 percent above August 2020 ... The June 2021 to July 2021 percent change was revised from down 1.1 percent to down 1.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.8% in August.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 13.4% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 13.4% on a YoY basis.Sales in August were above expectations, however sales in June and July were revised down, combined.

Weekly Initial Unemployment Claims increase to 332,000

by Calculated Risk on 9/16/2021 08:36:00 AM

The DOL reported:

In the week ending September 11, the advance figure for seasonally adjusted initial claims was 332,000, an increase of 20,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 310,000 to 312,000. The 4-week moving average was 335,750, a decrease of 4,250 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 500 from 339,500 to 340,000.This does not include the 28,456 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 94,638 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 335,750.

The previous week was revised up.

Regular state continued claims decreased to 2,656,747 (SA) from 2,662,844 (SA) the previous week.

Note (released with a 2 week delay): There were an additional 5,487,233 receiving Pandemic Unemployment Assistance (PUA) that increased from 5,090,524 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And were an additional 3,805,795 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 3,805,008.

Weekly claims were higher than the consensus forecast.

Wednesday, September 15, 2021

Thursday: Retail Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 9/15/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. There were 310 thousand initial claims last week.

• Also at 8:30 AM, Retail sales for August will be released. The consensus is for a 0.7% decrease in retail sales.

• Also at 8:30 AM, the Philly Fed manufacturing survey for September. The consensus is for a reading of 20.0, up from 19.4.

September 15th COVID-19: 2,000 Deaths Reported Today, Most since February

by Calculated Risk on 9/15/2021 05:22:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 54.1% | 53.3% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 179.7 | 177.1 | ≥2321 | |

| New Cases per Day3🚩 | 145,675 | 141,275 | ≤5,0002 | |

| Hospitalized3 | 90,593 | 93,243 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,358 | 1,125 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 15 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 59.4%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, and Kentucky at 50.3%.

Next up (total population, fully vaccinated according to CDC) are Arizona at 49.9%, Kansas at 49.8%, Ohio at 49.4%, Nevada at 49.4%, Texas at 49.4%, Utah at 49.0% and Alaska at 48.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

LA Area Port Traffic: Solid Imports, Weak Exports in August

by Calculated Risk on 9/15/2021 02:36:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, incoming port traffic is backed up significantly in the LA area with around 50 ships at anchor waiting to unload.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.1% in August compared to the rolling 12 months ending in July. Outbound traffic was down 1.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 1% YoY in August (recovered last year following the early months of the pandemic), and exports were down 14.0% YoY.

Another 5 Local Housing Markets in August

by Calculated Risk on 9/15/2021 10:55:00 AM

In the Newsletter: Another 5 Local Housing Markets in August

Active inventory, new listings and sales added for Boston, Des Moines, Jacksonville, Minnesota, South Carolina

So far sales are up 0.2% YoY, Not Seasonally Adjusted (NSA).