by Calculated Risk on 9/20/2021 08:35:00 AM

Monday, September 20, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of September 19th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 26.8% from the same day in 2019 (73.2% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through September 18, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday. The 7-day average for the US is down 13% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $80 million last week, down only about 46% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through September 11th. The occupancy rate was down 13.6% compared to the same week in 2019. The comparison to 2019 was difficult this week due to the timing of Labor Day. Last week the occupancy rate was unchanged year-over-year. If we average the last two weeks, occupancy is down about 7% compared to the same two weeks in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

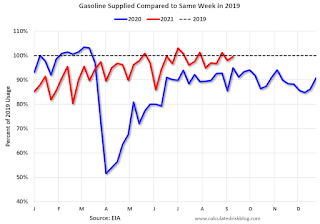

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of September 10th, gasoline supplied was down 0.5% compared to the same week in 2019.

There have been five weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through September 18th for the United States and several selected cities.

This data is through September 18th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 1157 of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, September 17th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, September 19, 2021

Monday: NAHB Homebuilder Survey

by Calculated Risk on 9/19/2021 07:20:00 PM

Weekend:

• Schedule for Week of September 19, 2021

• FOMC Preview: Tapering "Advance Notice" Likely

Monday:

• 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 74, down from 75 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 10 and DOW futures are down 103 (fair value).

Oil prices were up over the last week with WTI futures at $71.78 per barrel and Brent at $75.16 per barrel. A year ago, WTI was at $41, and Brent was at $42 - so WTI oil prices are UP 75% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.18 per gallon. A year ago prices were at $2.16 per gallon, so gasoline prices are up $1.02 per gallon year-over-year.

FOMC Preview: Tapering "Advance Notice" Likely

by Calculated Risk on 9/19/2021 11:20:00 AM

Expectations are there will be no change to rate policy when the FOMC meets on Tuesday and Wednesday this week. However, there is an expectation that the FOMC will make it clear that they intend to start the tapering of asset purchases soon.

Here are some comments from Goldman Sachs economists on the timing of tapering:

The FOMC is likely to provide the promised “advance notice” that tapering is coming at its September meeting, paving the way to announce the start of tapering at its November meeting. Specifically, we expect the September FOMC statement to say something along the lines of, “The Committee expects to begin reducing the pace of its asset purchases relatively soon, provided that the economy evolves broadly as anticipated.”Analysts will also be looking for comments on inflation, although the Fed is probably not overly concerned with inflation right now. Some of the recent increase in inflation was due to base effects (prices declined at the beginning of the pandemic), and some probably due to transitory effects related to supply bottlenecks. However, the recent surge in COVID cases has probably extended the supply chain disruptions, and there is growing concern that rising rents will spill through to Owners' Equivalent Rent (OER) - a large component of CPI and PCE prices - and push up PCE inflation in 2022.

Updated projections will be released at this meeting. For review, here are the June FOMC projections.

Wall Street forecasts were for GDP to increase at a 8.6% annual rate in Q2 (came in at 6.6%) and forecasts for Q3 have been downgraded recently. So the FOMC GDP projections are now too high and will likely be revised back down to around the March projection range for 2021.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| June 2021 | 6.8 to 7.3 | 2.8 to 3.8 | 2.0 to 2.5 | |

| Mar 2021 | 5.8 to 6.6 | 3.0 to 3.8 | 2.0 to 2.5 | |

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| June 2021 | 4.4 to 4.8 | 3.5 to 4.0 | 3.2 to 3.8 | |

| Mar 2021 | 4.2 to 4.7 | 3.6 to 4.0 | 3.2 to 3.8 | |

As of July 2021, PCE inflation was up 4.2% from July 2020. Projections for PCE inflation in 2021 will be revised up closer to 4%.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| June 2021 | 3.1 to 3.5 | 1.9 to 2.3 | 2.0 to 2.2 | |

| Mar 2021 | 2.2 to 2.4 | 1.8 to 2.1 | 2.0 to 2.2 | |

PCE core inflation was up 3.6% in July year-over-year. Core PCE inflation projections for 2021 will also be revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| June 2021 | 2.9 to 3.1 | 1.9 to 2.3 | 2.0 to 2.2 | |

| Mar 2021 | 2.0 to 2.3 | 1.9 to 2.1 | 2.0 to 2.2 | |

Saturday, September 18, 2021

Newsletter Articles this Week

by Calculated Risk on 9/18/2021 02:00:00 PM

At the Calculated Risk Newsletter this week:

Analysis:

• The Rapid Increase in Rents; What is happening? Why? And what will happen.

• House Price to Median Income; New Data for 2020 Income

• Household Formation Drives Housing Demand; Some preliminary data and analysis

Local Real Estate data:

• 5 More Local Housing Markets in August; Alabama, Austin, Maryland, Phoenix, Rhode Island

• Another 5 Local Housing Markets in August; Boston, Des Moines, Jacksonville, Minnesota, South Carolina

• 5 Additional Local Housing Markets in August; Albuquerque, Colorado, Houston, Memphis and Nashville

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Schedule for Week of September 19, 2021

by Calculated Risk on 9/18/2021 08:11:00 AM

The key reports this week are August Housing Starts, and New and Existing Home sales.

The FOMC meets this week, and no change to policy is expected.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 74, down from 75 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.560 million SAAR, up from 1.534 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

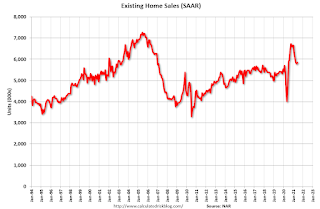

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.81 million SAAR, down from 5.99 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.81 million SAAR, down from 5.99 million in July.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 5.88 million SAAR.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 320 thousand initial claims, down from 332 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

11:00 AM: the Kansas City Fed manufacturing survey for September.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 714 thousand SAAR, up from 708 thousand in July.

10:00 AM: Opening Remarks, Fed Chair Jerome Powell, At Fed Listens: Perspectives on the Pandemic Recovery

Friday, September 17, 2021

Urban Institute: Median 95% LTV for New Mortgage Originations (Only 5% Downpayment)

by Calculated Risk on 9/17/2021 04:54:00 PM

NYU Stern professor Arpit Gupta tweeted today:

A common intuition is that borrowers put 20% down on a home.He included a chart from the Urban Institute showing the median LTV for new mortgage loan originations is 95% - and has been at that level for the last 12 years.

The median down payment is actually closer to 5%, and has been for 12 years.

Here is the chart that also includes FICO and Debt-to-income (DTI). The median DTI is at 37.5%.

September 17th COVID-19: Over 180 Million Fully Vaccinated

by Calculated Risk on 9/17/2021 04:09:00 PM

Note: There will be no weekend updates.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 54.4% | 53.6% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 180.6 | 177.9 | ≥2321 | |

| New Cases per Day3🚩 | 142,736 | 139,221 | ≤5,0002 | |

| Hospitalized3 | 88,506 | 93,097 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,464 | 1,253 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 18 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 59.6%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, Kentucky, Arizona and Kansas at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Texas at 49.8%, Nevada at 49.6%, Ohio at 49.4%, Utah at 49.2%, Alaska at 48.8% and North Carolina at 48.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/17/2021 01:43:00 PM

From housing economist Tom Lawler (see important comments on inventory):

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.90 million in August, down 1.5% from July’s preliminary pace and down 1.2% from last August’s seasonally adjusted pace. Unadjusted sales should show a very small YOY gain, with the SA/NSA difference reflecting this August’s higher business day count relative to last August’s.

Local realtor reports, as well as reports from national inventory trackers, suggest that while the inventory of existing homes for sale remained low last month, the YOY decline in August was significantly less than in July. What this means for the NAR’s inventory estimate for August, however, is unclear. As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for most of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months. Having said that, however, it is clear that seasonally adjusted inventories have been trending higher over the past several months.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 14.7% from last August.

CR Note: The National Association of Realtors (NAR) is scheduled to release August existing home sales on Wednesday, September 22, 2021 at 10:00 AM ET. The consensus is for 5.88 million SAAR.

5 More Local Housing Markets in August

by Calculated Risk on 9/17/2021 12:55:00 PM

In the Newsletter: 5 More Local Housing Markets in August

This brings the total to 25 local markets for August. This includes active inventory, new listings and sales added for Alabama, Austin, Maryland, Phoenix, Rhode Island

So far active inventory is down 1.1% compared to July for these markets

Q3 GDP Forecasts: Around 4.5%

by Calculated Risk on 9/17/2021 10:46:00 AM

GDP forecasts had been downgraded sharply for Q3 due to COVID, but now seem to have stabilized.

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

From BofA Merrill Lynch:

We continue to track 4.5% qoq saar for 3Q GDP following the retail sales data as our forecast was far above consensus. [Sept 17 estimate]From Goldman Sachs:

emphasis added

Following the stronger-than-expected retail sales report, we boosted our Q3 GDP tracking estimate by 1pp at +4.5% (qoq ar). We are also lowering our 2021Q4 and 2022Q2 GDP forecasts by 0.5pp to reflect a smaller rebound from 2021Q3. [Sept 16 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 3.6 percent on September 16, down from 3.7 percent on September 10 after rounding. [Sept 16 estimate]