by Calculated Risk on 9/21/2021 03:22:00 PM

Tuesday, September 21, 2021

Prime Age Participation Rate

Here is an initial look at the prime age (25 to 54) participation rate.

The first graph shows the prime age participation rate since 1948.

There are two clear long term trends:

1. The participation rate for prime age women increased significantly from around 34% in the '40s to around 77% in 2000 (and then started declining).

2. The participation rate for prime age men has gradually been decreasing, from close to 97% in the '40s to around 88% in 2014.

The second graphs show the trend since 2010.

Comments on August Housing Starts

by Calculated Risk on 9/21/2021 11:24:00 AM

In the Newsletter I have additional comments on August housing starts

Currently there are also 702 thousand multi-family units under construction. This is the highest level since 1974! For multi-family, construction delays are a factor. The completion of these units should help with rent pressure.

Housing Starts increased to 1.615 Million Annual Rate in August

by Calculated Risk on 9/21/2021 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in August were at a seasonally adjusted annual rate of 1,615,000. This is 3.9 percent above the revised July estimate of 1,554,000 and is 17.4 percent above the August 2020 rate of 1,376,000. Single‐family housing starts in August were at a rate of 1,076,000; this is 2.8 percent below the revised July figure of 1,107,000. The August rate for units in buildings with five units or more was 530,000

Building Permits:

Privately‐owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,728,000. This is 6.0 percent above the revised July rate of 1,630,000 and is 13.5 percent above the August 2020 rate of 1,522,000. Single‐family authorizations in August were at a rate of 1,054,000; this is 0.6 percent above the revised July figure of 1,048,000. Authorizations of units in buildings with five units or more were at a rate of 632,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in August compared to July. Multi-family starts were up 53% year-over-year in August.

Single-family starts (blue) decreased in August, and were up 5% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. The second graph shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in August were above expectations, and starts in June and July were revised up slightly.

I'll have more later …

Monday, September 20, 2021

Tuesday: Housing Starts

by Calculated Risk on 9/20/2021 07:25:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Surprise Snowball Rally as Stocks Swoon Over Global Risks

It remains to be seen how long the stock swoon continues as there is some disagreement about whether the Evergrande drama deserves as much credit as it received today. Either way, bonds simply endured an in-range correction, and they remain more susceptible to Wednesday's Fed when it comes to volatility risks on the horizon. [30 year fixed 3.00%]Tuesday:

emphasis added

• At 8:30 AM ET, Housing Starts for August. The consensus is for 1.560 million SAAR, up from 1.534 million SAAR.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 3.00%"

by Calculated Risk on 9/20/2021 04:00:00 PM

Note: This is as of September 12th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 3.00%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 8 basis points from 3.08% of servicers’ portfolio volume in the prior week to 3.00% as of September 12, 2021. According to MBA’s estimate, 1.5 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 5 basis points to 1.47%. Ginnie Mae loans in forbearance remained the same relative to the prior week at 3.39%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 32 basis points to 6.95%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 8 basis points to 3.25%, and the percentage of loans in forbearance for depository servicers decreased 5 basis points to 3.10%.

“The share of loans in forbearance decreased by 8 basis points last week, as forbearance exits remained elevated and new forbearance requests and re-entries were unchanged,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “20% of loans in forbearance are either new forbearance requests or re-entries. At this point, borrowers in forbearance extensions are exiting at a faster rate as they near – or reach – the expiration of their maximum forbearance term.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.05%."

September 20th COVID-19: Data reported on Monday is always low, and will be revised up as data is received

by Calculated Risk on 9/20/2021 02:45:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 54.7% | 53.8% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 181.7 | 178.7 | ≥2321 | |

| New Cases per Day3 | 118,878 | 138,246 | ≤5,0002 | |

| Hospitalized3 | 80,444 | 92,196 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,353 | 1,342 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 18 states and D.C. have between 50% and 59.9% fully vaccinated: Virginia at 59.7%, District of Columbia, Colorado, California, Minnesota, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, Kentucky, Arizona, Kansas and Texas at 50.3%.

Next up (total population, fully vaccinated according to CDC) are Nevada at 49.9%, Ohio at 49.7%, Utah at 49.5%. Alaska at 49.2% and North Carolina 48.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Housing Inventory Sept 20th Update: Inventory Up 1.2% Week-over-week, Up 42% from Low in early April

by Calculated Risk on 9/20/2021 11:26:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

NAHB: Builder Confidence Increased to 76 in September

by Calculated Risk on 9/20/2021 10:04:00 AM

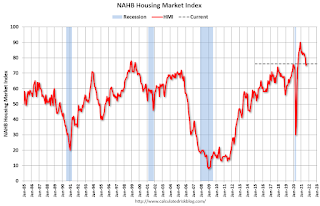

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 76, up from 75 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Steadies as Material and Labor Challenges Persist

Builder confidence inched up in September on lower lumber prices and strong housing demand, even as the housing sector continues to grapple with building material supply chain issues and labor challenges. Ending a three-month decline, builder sentiment in the market for newly built single-family homes edged up one point to 76 in September, according to the NAHB/Wells Fargo Housing Market Index (HMI) released today.

“Builder sentiment has been gradually cooling since the HMI hit an all-time high reading of 90 last November,” said NAHB Chairman Chuck Fowke. “The September data show stability as some building material cost challenges ease, particularly for softwood lumber. However, delivery times remain extended and the chronic construction labor shortage is expected to persist as the overall labor market recovers.”

“The single-family building market has moved off the unsustainably hot pace of construction of last fall and has reached a still hot but more stable level of activity, as reflected in the September HMI,” said NAHB Chief Economist Robert Dietz. “While building material challenges persist, the rate of cost growth has eased for some products, but the job openings rate in construction is trending higher.”

...

The HMI index gauging current sales conditions rose one point to 82, the component measuring traffic of prospective buyers posted a two-point gain to 61 and the gauge charting sales expectations in the next six months held steady at 81.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell two points to 72, the South dropped two points to 80 and the West registered a two-point decline to 83. The Midwest remained unchanged at 68.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a solid reading.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 9/20/2021 08:35:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of September 19th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 26.8% from the same day in 2019 (73.2% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through September 18, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday. The 7-day average for the US is down 13% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $80 million last week, down only about 46% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through September 11th. The occupancy rate was down 13.6% compared to the same week in 2019. The comparison to 2019 was difficult this week due to the timing of Labor Day. Last week the occupancy rate was unchanged year-over-year. If we average the last two weeks, occupancy is down about 7% compared to the same two weeks in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

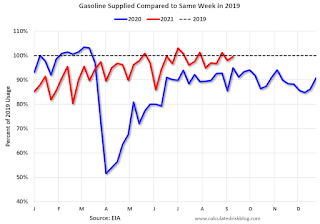

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of September 10th, gasoline supplied was down 0.5% compared to the same week in 2019.

There have been five weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through September 18th for the United States and several selected cities.

This data is through September 18th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 1157 of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, September 17th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, September 19, 2021

Monday: NAHB Homebuilder Survey

by Calculated Risk on 9/19/2021 07:20:00 PM

Weekend:

• Schedule for Week of September 19, 2021

• FOMC Preview: Tapering "Advance Notice" Likely

Monday:

• 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 74, down from 75 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 10 and DOW futures are down 103 (fair value).

Oil prices were up over the last week with WTI futures at $71.78 per barrel and Brent at $75.16 per barrel. A year ago, WTI was at $41, and Brent was at $42 - so WTI oil prices are UP 75% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.18 per gallon. A year ago prices were at $2.16 per gallon, so gasoline prices are up $1.02 per gallon year-over-year.