by Calculated Risk on 9/28/2021 09:00:00 PM

Tuesday, September 28, 2021

Wednesday: Pending Home Sales, Fed Chair Powell

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is 1.3% increase in the index.

• At 11:45 AM, Discussion, Fed Chair Powell, Policy Panel Discussion, At the European Central Bank Forum on Central Banking

Zillow Case-Shiller House Price Forecast: National Index Growth to Increase Slightly to 20.0% in August

by Calculated Risk on 9/28/2021 07:57:00 PM

The Case-Shiller house price indexes for July were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: July 2021 Case-Shiller Results & Forecast: Scorching Hot

The slow rise in inventory that marked the beginning of summer wasn’t enough to cool the sizzling market, with the already rapidly rising Case-Shiller indices hitting the gas accelerating into the middle of the year instead of tapping the brakes.

...

Home price growth remained scorching hot as the housing market entered the dog days of summer, but data released in the weeks since indicate cooler days in the months to come. With mortgage rates still near historic lows, competition for the relatively few for-sale homes remain very stiff and home prices continue to rise sharply as a result. But the tight market conditions that have fueled the skyrocketing prices are finally showing signs of loosening. For-sale inventory levels charted their fourth consecutive monthly increase in August, and sellers appear to be taking a less aggressive approach when putting their homes on the market. Annual growth in list prices peaked in the spring and price cuts are becoming more common. And while still-strong price growth continues to present challenging conditions for many would-be buyers, the softening market conditions do appear to be offering some home shoppers a reprieve. Home sales volumes improved in August and applications for home purchase mortgages – a leading indicator of sales activity – has risen in four of the last five week to reach its highest level since April. Price growth remains about as hot as ever, but the housing market is gradually retreating towards a more balanced state.

Monthly and annual growth in August as reported by Case-Shiller is expected to accelerate from July in all three main indices. S&P Dow Jones Indices is expected to release data for the June S&P CoreLogic Case-Shiller Indices on Tuesday, October 26.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.0% in August, from 19.7% in July.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.0% in August, from 19.7% in July.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 9/28/2021 04:18:00 PM

A few key points:

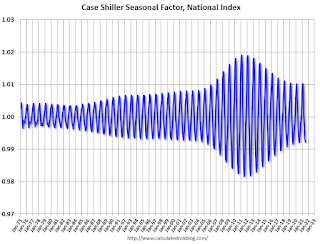

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now closer to normal (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Jed Kolko's article from 2014 (currently Chief Economist at Indeed) "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through July 2021). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings declined following the bubble, however the recent price surge changed the month-over-month pattern.

The swings in the seasonal factors have decreased, and the seasonal factors has been moving back towards more normal levels.

Comments on House Prices

by Calculated Risk on 9/28/2021 11:51:00 AM

Today, in the Newsletter: House Prices Increase Sharply in July

Excerpt:

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through July 2021).

In July, the months-of-supply was at 2.6 months, and the Case-Shiller National Index (SA) increased 1.55% month-over-month. The black arrow points to the July 2021 dot.

Case-Shiller: National House Price Index increased 19.7% year-over-year in July

by Calculated Risk on 9/28/2021 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports Record High 19.7% Annual Home Price Gain In July

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.7% annual gain in July, up from 18.7% in the previous month. The 10-City Composite annual increase came in at 19.1%, up from 18.5% in the previous month. The 20-City Composite posted a 19.9% year-over-year gain, up from 19.1% in the previous month.

Phoenix, San Diego, and Seattle reported the highest year-over-year gains among the 20 cities in July. Phoenix led the way with a 32.4% year-over-year price increase, followed by San Diego with a 27.8% increase and Seattle with a 25.5% increase. Seventeen of the 20 cities reported higher price increases in the year ending July 2021 versus the year ending June 2021.

...

Before seasonal adjustment, the U.S. National Index posted an 1.6% month-over-month increase in July, while the 10-City and 20-City Composites both posted increases of 1.3% and 1.5%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.5%, and the 10-City and 20-City Composites both posted increases of 1.4% and 1.5%, respectively. In July, all 20 cities reported increases before and after seasonal adjustments.

“July 2021 is the fourth consecutive month in which the growth rate of housing prices set a record, says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “The National Composite Index marked its fourteenth consecutive month of accelerating prices with a 19.7% gain from year-ago levels, up from 18.7% in June and 16.9% in May. This acceleration is also reflected in the 10- and 20-City Composites (up 19.1% and 19.9%, respectively). The last several months have been extraordinary not only in the level of price gains, but in the consistency of gains across the country. In July, all 20 cities rose, and 17 gained more in the 12 months ended in July than they had gained in the 12 months ended in June. Home prices in 19 of our 20 cities now stand at all-time highs, with the sole outlier (Chicago) only 0.3% below its 2006 peak. The National Composite, as well as the 10- and 20-City indices, are likewise at their all-time highs.

“July’s 19.7% price gain for the National Composite is the highest reading in more than 30 years of S&P CoreLogic Case-Shiller data. This month, New York joined Boston, Charlotte, Cleveland, Dallas, Denver, and Seattle in recording their all-time highest 12-month gains. Price gains in all 20 cities were in the top quintile of historical performance; in 15 cities, price gains were in the top five percent of historical performance.

“We have previously suggested that the strength in the U.S. housing market is being driven in part by a reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes. July’s data are consistent with this hypothesis. This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years. Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing. More time and data will be required to analyze this question

emphasis added

Click on graph for larger image.

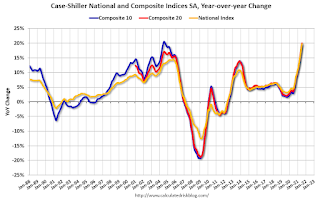

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.4% in July (SA).

The Composite 20 index is up 1.5% (SA) in July.

The National index is 43% above the bubble peak (SA), and up 1.5% (SA) in July. The National index is up 93% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 19.2% compared to July 2020. The Composite 20 SA is up 20.0% year-over-year.

The National index SA is up 19.7% year-over-year.

Price increases were close to expectations. I'll have more later.

Monday, September 27, 2021

Tuesday: Case-Shiller House Prices, Fed Chair Powell Testimony

by Calculated Risk on 9/27/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: Highest Mortgage Rates in Nearly 3 Months

Mortgage rates continued somewhat higher on Monday as bond markets lost ground over the weekend, adding to the heavier losses seen on Thursday and Friday last week. ... This improves the outlook for the economy and further steels the resolve of the Federal Reserve to announce another instance of "tapering" (a reduction in the pace of the Fed's rate-friendly bond buying efforts). Unlike 2013, markets are much more prepared this time around, and in fact, we can credit tapering expectations for some of the weakness in rates seen earlier this year.Tuesday:

The average lender is at an eighth to a quarter of a percent higher in conventional 30yr fixed rates compared to the beginning of last week. [30 year fixed 3.14%]

emphasis added

• At 9:00 AM ET, FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for July. The consensus is for a 20.0% year-over-year increase in the Comp 20 index for July.

• At 10:00 AM, the Richmond Fed manufacturing survey for September. This is the last of the regional surveys for September.

• Also at 10:00 AM, Testimony, Fed Chair Powell, Coronavirus and CARES Act, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

Freddie Mac: Mortgage Serious Delinquency Rate decreased in August

by Calculated Risk on 9/27/2021 04:50:00 PM

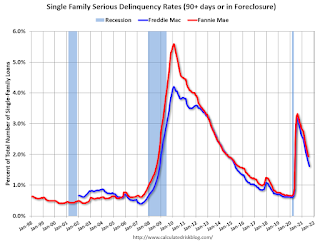

Freddie Mac reported that the Single-Family serious delinquency rate in August was 1.62%, down from 1.74% in July. Freddie's rate is down year-over-year from 3.17% in August 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.12%, down from 0.15% in July, and down from the peak of 0.20% in April 2021.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 2.96%"

by Calculated Risk on 9/27/2021 04:00:00 PM

Note: This is as of September 19th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 2.96%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 4 basis points from 3.00% of servicers’ portfolio volume in the prior week to 2.96% as of September 19, 2021. According to MBA’s estimate, 1.5 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 3 basis points to 1.44%. Ginnie Mae loans in forbearance increased 3 basis points to 3.42%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 4 basis points to 6.91%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 1 basis point relative to the prior week to 3.24%, and the percentage of loans in forbearance for depository servicers decreased 4 basis points to 3.06%.

“The share of loans in forbearance continued to decrease last week, dropping below 3 percent for the first time since March 2020,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “However, there was a slight increase in the forbearance share for Ginnie Mae loans, and this increase was seen for both depository and IMB servicers. New forbearance requests and re-entries continue to run at a higher rate for Ginnie Mae loans as well as for portfolio and PLS loans, which include many delinquent FHA, VA, and USDA loans that have been bought out of Ginnie Mae pools.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.05%."

September 27th COVID-19: Data reported on Monday is always low, and will be revised up as data is received

by Calculated Risk on 9/27/2021 03:58:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 55.4% | 54.7% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 183.9 | 181.7 | ≥2321 | |

| New Cases per Day3 | 95,228 | 134,500 | ≤5,0002 | |

| Hospitalized3 | 75,112 | 86,009 | ≤3,0002 | |

| Deaths per Day3 | 1,332 | 1,508 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 21 states have between 50% and 59.9% fully vaccinated: Colorado at 59.2%, California, Minnesota, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, Kentucky, Arizona, Kansas, Texas, Nevada, Alaska, Utah and Ohio at 50.1%.

Next up (total population, fully vaccinated according to CDC) are North Carolina 49.6%, Indiana at 48.3% and Montana at 48.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Mortgage Rates Increasing

by Calculated Risk on 9/27/2021 12:48:00 PM

Today, in the Newsletter: Mortgage Rates Increasing

Excerpt:

With the ten year yield close to 1.50%, and based on an historical relationship, 30-year rates should currently be around 3.4%.

Mortgage News Daily reports that the most prevalent 30 year fixed rate is now at 3.13% for top tier scenarios. So mortgage rates are a little lower than expected.

The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.