by Calculated Risk on 10/04/2021 04:00:00 PM

Monday, October 04, 2021

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 2.89%"

Note: This is as of September 26th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 2.89%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 2.96% of servicers’ portfolio volume in the prior week to 2.89% as of September 26, 2021. According to MBA’s estimate, 1.4 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 6 basis points to 1.38%. Ginnie Mae loans in forbearance decreased 7 basis points to 3.35%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 14 basis points to 6.77%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 5 basis points relative to the prior week to 3.19%, and the percentage of loans in forbearance for depository servicers decreased 13 basis points to 2.93%.

“The share of loans in forbearance declined at a faster rate last week, dropping by 7 basis points, as exits increased and new requests and re-entries declined,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While 1.4 million homeowners remained in forbearance as of September 26th , this number is expected to drop sharply over the next few weeks as many are reaching the 18-month expiration point of their forbearance terms. Most borrowers exiting forbearance through a workout are opting for a deferral plan, which allows them to resume their original payment, while moving the forborne amount to the end of the loan.”

Added Fratantoni, “Although call volume dropped in the last week of September, we expect that servicers will be very busy through October.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.05% to 0.04%."

Housing Inventory Oct 4th Update: Inventory Down 1% Week-over-week, Up 40% from Low in early April

by Calculated Risk on 10/04/2021 02:40:00 PM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Real Personal Income: Transfer Payments

by Calculated Risk on 10/04/2021 01:05:00 PM

The BEA released the Personal Income and Outlays, August 2021 report on Friday. The report showed that government transfer payments were still almost $770 billion (on SAAR basis) above the February 2020 level (pre-pandemic) Note: Seasonal adjustment doesn't make sense with one time payments, but that is how the data is presented.

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Jan-20 | $511 | $26 |

| Feb-20 | $506 | $26 |

| Mar-20 | $516 | $67 |

| Apr-20 | $3,393 | $435 |

| May-20 | $1,373 | $1,287 |

| Jun-20 | $743 | $1,396 |

| Jul-20 | $750 | $1,366 |

| Aug-20 | $697 | $612 |

| Sep-20 | $950 | $325 |

| Oct-20 | $714 | $296 |

| Nov-20 | $580 | $285 |

| Dec-20 | $604 | $319 |

| Jan-21 | $2,317 | $574 |

| Feb-21 | $735 | $558 |

| Mar-21 | $4,706 | $566 |

| Apr-21 | $1,345 | $516 |

| May-21 | $806 | $492 |

| Jun-21 | $744 | $433 |

| Jul-21 | $920 | $380 |

| Aug-21 | $939 | $365 |

Black Knight Mortgage Monitor for August: "the longer borrowers remain in forbearance, the higher the post-forbearance non-performance rate"

by Calculated Risk on 10/04/2021 10:38:00 AM

This gives a total of 4.27% delinquent or in foreclosure.

Press Release: Strong Equity Stakes Alone May Not Be Enough to Stave Off Foreclosure Starts, But Will Reduce Inflow of Distressed Properties Into Housing Market

Today, the Data & Analytics division of Black Knight, Inc. (NYSE:BKI) released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. Given Black Knight’s recent analysis of the strong equity positions of borrowers in forbearance, even when adding 18 months of deferred payments to their debt loads, this month’s report explores the relationship between such equity positions and downstream foreclosure start rates and – ultimately – distressed liquidations. According to Black Knight Data & Analytics President Ben Graboske, the data suggests that the healthy stores of equity in the hands of homeowners currently in forbearance may not be sufficient on its own to ward off foreclosure activity.

“An analysis of our McDash loan-level mortgage performance dataset back to 2007 shows that holding equity in one’s home might not be a blanket backstop to foreclosure activity,” said Graboske. “Borrowers with limited equity were much more likely to be referred to foreclosure during the early stages of the Great Recession than those with strong equity positions. But foreclosure start rates on homeowners who were 120 or more days past due have been relatively similar regardless of equity stakes from 2010 on, with borrowers in the strongest positions only slightly less likely to be referred to foreclosure. So, while we may see some variation in foreclosure activity based on the equity levels of borrowers who are unable to return to making payments post-forbearance, those with strong equity won’t necessarily be immune to foreclosure referral.

“The same data also shows that borrowers with strong equity stakes are more than 40% less likely to face the involuntary liquidation of their homes than borrowers with weaker equity positions, limiting both potential losses on such mortgages and distressed inflow into the housing market. Still, even among borrowers with 40% equity stakes who are referred to foreclosure, some 30% in recent years have lost their home to foreclosure sale, short sale, deed in lieu, etc. What the data doesn’t tell us is why so many people who could avoid involuntary liquidation by selling through traditional channels simply do not end up doing so. Whether that’s due to lack of understanding of their equity positions or the foreclosure process in general is unclear. But given the large number of high equity homeowners currently struggling to make their payments, this represents a significant challenge for the industry: how to educate struggling homeowners on the post-forbearance, foreclosure and – if needed – home sale processes, to limit unneeded stress on homeowners and the market alike.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph on delinquencies from Black Knight:

• At 4% in August, the national mortgage delinquency rate is now at its lowest level since the onset of the pandemic early last year

• A 108K loan decline in serious delinquencies in August was partially offset by 14K and 11K rises in 30-day and 60-day delinquencies, respectively

• Despite the overall improvement, serious delinquencies remain more than 3X (+930K) pre-pandemic levels, while early-stage delinquencies (30/60 days) remain approximately 40% below pre-pandemic levels

• At the current rate of improvement, the overall national delinquency rate would be on pace to return to pre-pandemic levels by early 2022

And on the current status of loans that have exited forbearance:

And on the current status of loans that have exited forbearance: • Nearly 3.7M borrowers exited forbearance plans in 2020, with the largest volumes in July and October as early entrants reached the three- and six- month points in their plansThere is much more in the mortgage monitor.

• Exit volumes tapered off in early 2021, but picked up with 338K exits in August, and are expected to rise in coming months as early plan entrants reach their final expirations

• Post-forbearance performance among those who've exited has varied, with borrowers who remained in plans longer – and exited later – having more trouble getting back to making payments

• A large share of recent exits remains in active loss mitigation, working through post-forbearance options, so it will be a few weeks before August/September exit performance trends become more discernible

• That said, a clear pattern has emerged: the longer borrowers remain in forbearance, the higher the post-forbearance non-performance rate, with the current high-water mark the 9% non-performance rate seen among July plan exits

• Non-performance rates among those borrowers facing final plan expirations in coming months will dictate the ultimate downstream impacts on both foreclosure activity as well as the broader housing market

Seven High Frequency Indicators for the Economy

by Calculated Risk on 10/04/2021 08:34:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 3rd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 23.1% from the same day in 2019 (76.9% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 2, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - but might be picking up a little again. The 7-day average for the US is down 7% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $50 million last week, down about 63% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through September 25th. The occupancy rate was down 11.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of September 24th, gasoline supplied was up 2.7% compared to the same week in 2019.

There have been six weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 2nd for the United States and several selected cities.

This data is through October 2nd for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 116% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, October 1st.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, October 03, 2021

Sunday Night Futures

by Calculated Risk on 10/03/2021 07:06:00 PM

Weekend:

• Schedule for Week of October 3, 2021

• Measuring Rents

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 15 and DOW futures are up 100 (fair value).

Oil prices were up over the last week with WTI futures at $76.00 per barrel and Brent at $79.42 per barrel. A year ago, WTI was at $37, and Brent was at $38 - so WTI oil prices are UP 100%+ year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.19 per gallon. A year ago prices were at $2.18 per gallon, so gasoline prices are up $1.01 per gallon year-over-year.

Measuring Rents

by Calculated Risk on 10/03/2021 05:30:00 PM

Today, in the Newsletter: Measuring Rents

Excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through Aug 2021, except ApartmentList is through Sept 2021.

The Zillow measure is up 7.4% YoY as of August, and the ApartmentList measure is up 15.1% as of September.

Saturday, October 02, 2021

Newsletter Articles this Week

by Calculated Risk on 10/02/2021 02:11:00 PM

At the Calculated Risk Newsletter this week:

• The Home ATM, aka Mortgage Equity Withdrawal (MEW)

• Mortgage Rates Increasing, Mortgage Rates and the Ten Year Yield

• House Prices Increase Sharply in July, Case-Shiller National Index up Record 19.7% Year-over-year in July

• Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in July, And a look at "Affordability"

• As Forbearance Ends

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Schedule for Week of October 3, 2021

by Calculated Risk on 10/02/2021 08:11:00 AM

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM Services index and the August trade deficit.

No major economic releases scheduled.

8:00 AM ET: Corelogic House Price index for August

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $70.5 billion in August, from $70.1 billion in July.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $70.5 billion in August, from $70.1 billion in July.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

10:00 AM: the ISM Services Index for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 430,000 jobs added, up from 374,000 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 345 thousand initial claims, down from 362 thousand last week.

8:30 AM: Employment Report for September. The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.

8:30 AM: Employment Report for September. The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.There were 235 thousand jobs added in August, and the unemployment rate was at 5.2%.

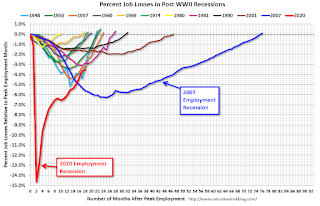

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

Friday, October 01, 2021

September Vehicles Sales Decreased to 12.2 Million SAAR

by Calculated Risk on 10/01/2021 06:30:00 PM

Wards Auto released their estimate of light vehicle sales for September this evening. Wards Auto estimates sales of 12.18 million SAAR in September 2021 (Seasonally Adjusted Annual Rate), down 6.7% from the August sales rate, and down 25.2% from September 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for September (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |