by Calculated Risk on 10/15/2021 12:15:00 PM

Friday, October 15, 2021

Q3 GDP Forecasts: Around 2%

These are forecasts of the advance estimate of GDP to be released on Oct 28th.

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

| 10/1/21 | 4.1% | 4.25% | 2.3% |

| 10/8/21 | 2.0% | 3.25% | 1.3% |

| 10/15/21 | 2.0% | 3.25% | 1.2% |

From BofA Merrill Lynch:

We continue to track 2% for 3Q GDP [Oct 15 estimate]From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged after rounding at +3¼% (qoq ar). [Oct 15 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 1.2 percent on October 15, down from 1.3 percent on October 8. [Oct 15 estimate]

Black Knight: "Significant" Decline in Number of Homeowners in COVID-19-Related Forbearance Plans

by Calculated Risk on 10/15/2021 10:41:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 12th.

From Andy Walden at Black Knight: Another Week of Significant Forbearance Declines

As expected, we saw another significant drop in the number of active forbearances this week, as the first wave of final plan expirations continues.

According to our McDash Flash daily forbearance tracking dataset, active plans fell by another 10%, for an overall reduction of 143,000 since last Tuesday – on top of last week’s 177,000 (-11%) drop.

Once again, declines were seen across all investor classes, led by an 88,000 (-19%) plan drop among loans held in bank portfolios and private label securities. The number of homeowners in GSE and FHA/VA loans in forbearance saw matching 6% declines, for 22,000 and 33,000 reductions respectively.

As of October 12, 1.25 million mortgage holders remain in COVID-19 related forbearance plans, representing 2.4% of all active mortgages, including 1.3% of GSE, 4% of FHA/VA and 3% of portfolio held and privately securitized loans.

Click on graph for larger image.

More than 450,000 homeowners have exited their forbearance plans over the past two weeks alone. With some 47,000 September month-end expirations still left to process and another 329K scheduled for review for extension or removal in October, the potential for further, substantial declines will continue into early November.

emphasis added

Retail Sales Increased 0.7% in September

by Calculated Risk on 10/15/2021 08:38:00 AM

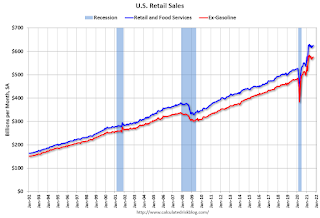

On a monthly basis, retail sales were increased 0.7% from August to September (seasonally adjusted), and sales were up 13.9 percent from September 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $625.4 billion, an increase of 0.7 percent from the previous month, and 13.9 percent above September 2020. ... The July 2021 to August 2021 percent change was revised from up 0.7 percent to up 0.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 12.1% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 12.1% on a YoY basis.Sales in September were above expectations, and sales in July and August were revised up.

Thursday, October 14, 2021

Friday: Retail Sales, NY Fed Mfg

by Calculated Risk on 10/14/2021 08:01:00 PM

Friday:

• At 8:30 AM ET, Retail sales for September will be released. The consensus is for a 0.2% decrease in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 27.0, down from 34.3.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for October).

October 14th COVID-19: 42 Days till Thanksgiving; Need to Get Daily Cases Down Before Holidays

by Calculated Risk on 10/14/2021 07:08:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.7% | 56.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 188.3 | 186.4 | ≥2321 | |

| New Cases per Day3 | 84,555 | 96,666 | ≤5,0002 | |

| Hospitalized3 | 56,817 | 64,388 | ≤3,0002 | |

| Deaths per Day3 | 1,241 | 1,434 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Minnesota at 59.0%, Pennsylvania, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.0%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.3%, Indiana at 49.1%, Missouri at 48.9%, Oklahoma at 48.8% and South Carolina at 48.7%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

House Prices to National Average Wage Index

by Calculated Risk on 10/14/2021 01:07:00 PM

Today, in the Newsletter: House Prices to National Average Wage Index

Excerpt:

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index for 2020 was released yesterday). This uses the annual average National Case-Shiller index since 1976 (and an estimate for 2021). ...Please subscribe!

As of 2021, house prices were well above the median historical ratio - and not far below the bubble peak.

Hotels: Occupancy Rate Down 9.6% Compared to Same Week in 2019

by Calculated Risk on 10/14/2021 10:40:00 AM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

Lifted by the long Columbus Day weekend, U.S. hotel performance rose to a level similar to late summer, according to STR‘s latest data through October 9.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

October 3-9, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 63.9% (-9.6%)

• Average daily rate (ADR): US$134.63 (+2.4%)

• Revenue per available room (RevPAR): US$86.02 (-7.4%)

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Weekly Initial Unemployment Claims Decrease to 293,000

by Calculated Risk on 10/14/2021 08:36:00 AM

The DOL reported:

In the week ending October 9, the advance figure for seasonally adjusted initial claims was 293,000, a decrease of 36,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 3,000 from 326,000 to 329,000. The 4-week moving average was 334,250, a decrease of 10,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 750 from 344,000 to 344,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 334,250.

The previous week was revised up.

Regular state continued claims decreased to 2,593,000 (SA) from 2,727,000 (SA) the previous week.

Weekly claims were lower than the consensus forecast.

Wednesday, October 13, 2021

Thursday: Unemployment Claims, PPI

by Calculated Risk on 10/13/2021 08:14:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 315 thousand initial claims, down from 326 thousand last week.

• Also at 8:30 AM, The Producer Price Index for September from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.5% increase in core PPI.

October 13th COVID-19: Progress

by Calculated Risk on 10/13/2021 05:09:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.6% | 56.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 187.9 | 186.4 | ≥2321 | |

| New Cases per Day3 | 86,181 | 97,773 | ≤5,0002 | |

| Hospitalized3 | 57,734 | 65,668 | ≤3,0002 | |

| Deaths per Day3 | 1,252 | 1,452 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Minnesota at 58.9%, Pennsylvania, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.0%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.3%, Indiana at 49.1%, Missouri at 48.7%, Oklahoma at 48.6% and South Carolina at 48.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.