by Calculated Risk on 10/21/2021 03:49:00 PM

Thursday, October 21, 2021

October 21st COVID-19: Progress

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.2% | 56.7% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 189.9 | 188.3 | ≥2321 | |

| New Cases per Day3 | 73,079 | 86,045 | ≤5,0002 | |

| Hospitalized3 | 50,791 | 57,087 | ≤3,0002 | |

| Deaths per Day3 | 1,252 | 1,308 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Pennsylvania at 59.8%, Minnesota, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.4%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.9%, Indiana at 49.4%, South Carolina at 49.3%, Missouri at 49.2%, Oklahoma at 49.2% and Georgia at 47.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Hotels: Occupancy Rate Down 10% Compared to Same Week in 2019

by Calculated Risk on 10/21/2021 02:05:00 PM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel occupancy reached its highest level since mid-August, while room rates dipped from the previous week, according to STR‘s latest data through October 16.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

October 10-16, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 65.0% (-10%)

• verage daily rate (ADR): $134.03 (-1.4%)

• Revenue per available room (RevPAR): $87.15 (-11.3%)

Week-over-week demand growth came almost exclusively from the Sunday ahead of Columbus Day. Overall for the three-day holiday weekend (8-10 October), occupancy reached 72% as compared with 75% in 2019.

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

LA Area Port Traffic: Solid Imports, Weak Exports in September

by Calculated Risk on 10/21/2021 01:56:00 PM

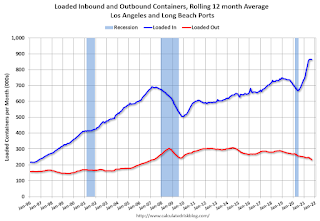

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, incoming port traffic is backed up significantly in the LA area with numerous ships at anchor waiting to unload.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.4% in September compared to the rolling 12 months ending in August. Outbound traffic was down 2.0% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down 4% YoY in September (recovered last year following the early months of the pandemic), and exports were down 23% YoY.

Median House Price Growth Decelerated for Fourth Consecutive Month

by Calculated Risk on 10/21/2021 10:57:00 AM

Today, in the Newsletter: Existing-Home Sales Increased to 6.29 million in September

Excerpt:

On prices, the NAR reported:The median existing-home price for all housing types in September was $352,800, up 13.3% from September 2020 ($311,500), as prices rose in each region.Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices), but this is the fourth consecutive month with a deceleration in the median price. The NAR reported median prices were up 23.6% YoY in May, 23.4% in June, 17.8% in July, 14.9% in August and 13.3% in September. This deceleration will probably show up in Case-Shiller and the FHFA indexes very soon.

...

The graph shows existing home sales by month for 2020 and 2021.

This was the second month this year with sales down year-over-year. This should continue through the rest of the year, since sales averaged 6.7million SAAR over the last three months of 2020. emphasis added

NAR: Existing-Home Sales Increased to 6.29 million in September

by Calculated Risk on 10/21/2021 10:12:00 AM

From the NAR: Existing-Home Sales Ascend 7.0% in September

Existing-home sales rebounded in September after seeing sales wane the previous month, according to the National Association of Realtors®. Each of the four major U.S. regions witnessed increases on a month-over-month basis. From a year-over-year timeframe, one region held steady while the three others each reported a decline in sales.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 7.0% from August to a seasonally adjusted annual rate of 6.29 million in September. However, sales decreased 2.3% from a year ago (6.44 million in September 2020).

...

Total housing inventory at the end of September amounted to 1.27 million units, down 0.8% from August and down 13.0% from one year ago (1.46 million). Unsold inventory sits at a 2.4-month supply at the present sales pace, down 7.7% from August and down from 2.7 months in September 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (6.29 million SAAR) were up 7.0% from last month, and were 2.3% below the September 2020 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.27 million in September from 1.28 million in August.

According to the NAR, inventory decreased to 1.27 million in September from 1.28 million in August.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 13.0% year-over-year in September compared to September 2020.

Inventory was down 13.0% year-over-year in September compared to September 2020. Months of supply was decreased to 2.4 months in September from 2.6 months in August.

This was above the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Decrease to 290,000

by Calculated Risk on 10/21/2021 08:34:00 AM

The DOL reported:

In the week ending October 16, the advance figure for seasonally adjusted initial claims was 290,000, a decrease of 6,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 3,000 from 293,000 to 296,000. The 4-week moving average was 319,750, a decrease of 15,250 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 750 from 334,250 to 335,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 319,750.

The previous week was revised up.

Regular state continued claims decreased to 2,481,000 (SA) from 2,603,000 (SA) the previous week.

Weekly claims were at the consensus forecast.

Wednesday, October 20, 2021

Thursday: Unemployment Claims, Phily Fed Mfg, Existing Home Sales

by Calculated Risk on 10/20/2021 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 290 thousand initial claims, down from 293 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of 24.5, down from 30.7.

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 6.06 million SAAR, up from 5.88 million in August.

'Some prospective buyers took a break'

by Calculated Risk on 10/20/2021 05:28:00 PM

Today, in the Newsletter: 'Some prospective buyers took a break'

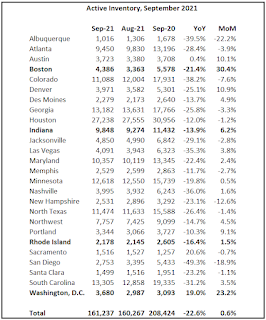

Existing Home Sales forecast, and adding Boston, Indiana, Rhode Island, and Washington D.C. September Data

Excerpt:

From the Rhode Island Association of Realtors®“The single-family home market has been incredibly competitive and the properties that are available for sale are put under contract so quickly, that it appears some prospective buyers took a break. Also, the spread of the delta variant affected the market last quarter, keeping some buyers at home and making some prospective sellers think twice about listing their home,” said Leann D’Ettore, President of the Rhode Island Association of Realtors.

emphasis added

October 20th COVID-19: 3 States Now at or Above 70% of Total Population Vaccinated

by Calculated Risk on 10/20/2021 03:58:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.1% | 56.6% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 189.5 | 187.9 | ≥2321 | |

| New Cases per Day3 | 75,988 | 87,507 | ≤5,0002 | |

| Hospitalized3 | 51,698 | 57,977 | ≤3,0002 | |

| Deaths per Day3 | 1,256 | 1,297 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Pennsylvania at 59.6%, Minnesota, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.3%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.8%, Indiana at 49.4%, Missouri at 49.1%, Oklahoma at 49.1% and South Carolina at 49.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Fed's Beige Book: "Residential real estate activity was unchanged or slowed slightly"

by Calculated Risk on 10/20/2021 02:03:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Richmond based on information collected on or before October 8th, 2020. "

Economic activity grew at a modest to moderate rate, according to the majority of Federal Reserve Districts. Several Districts noted, however, that the pace of growth slowed this period, constrained by supply chain disruptions, labor shortages, and uncertainty around the Delta variant of COVID-19. A majority of Districts indicated positive growth in consumer spending; however, auto sales were widely reported as declining due to low inventory levels and rising prices. Travel and tourism activity varied by District with some seeing continued or strengthening leisure travel while others saw declines that coincided with rises in COVID cases and the start of the school year. Manufacturing grew moderately to robustly in most parts of the country, as did trucking and freight. Growth in nonmanufacturing activity ranged from slight to moderate for most Districts. Loan demand was generally reported as flat to modest this period. Residential real estate activity was unchanged or slowed slightly but the market remained healthy, overall. Reports on nonresidential real estate varied across Districts and market segments. Agriculture conditions were mixed and energy markets were little changed, on balance. Outlooks for near-term economic activity remained positive, overall, but some Districts noted increased uncertainty and more cautious optimism than in previous months.

...

Employment increased at a modest to moderate rate in recent weeks, as demand for workers was high, but labor growth was dampened by a low supply of workers. Transportation and technology firms saw particularly low labor supply, while many retail, hospitality, and manufacturing firms cut hours or production because they did not have enough workers. Firms reported high turnover, as workers left for other jobs or retired. Child-care issues and vaccine mandates were widely cited as contributing to the problem, along with COVID-related absences. Many firms offered increased training to expand the candidate pool. In some cases, firms increased automation to help offset labor shortages. The majority of Districts reported robust wage growth. Firms reported increasing starting wages to attract talent and increasing wages for existing workers to retain them. Many also offered signing and retention bonuses, flexible work schedules, or increased vacation time to incentivize workers to remain in their positions.

emphasis added