by Calculated Risk on 10/22/2021 12:56:00 PM

Friday, October 22, 2021

The Coming Deceleration in House Price Growth

Today, in the Newsletter: The Coming Deceleration in House Price Growth

Excerpt:

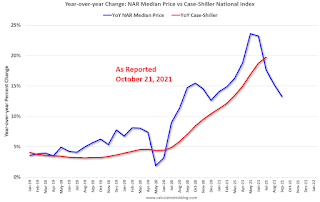

[This graph] - as of the NAR release yesterday - shows that Case-Shiller followed the median prices up, and that median prices are now falling.

...

This suggests that Case-Shiller will start to show some deceleration in the September or October reports (to be released in late November and December). emphasis added

Black Knight: "Forbearance Declines Hit Mid-Month Lull"

by Calculated Risk on 10/22/2021 10:41:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 19th.

From Andy Walden at Black Knight: Forbearance Declines Hit Mid-Month Lull

After two weeks of sizable drops in the number of active forbearance plans (as hundreds of thousands of homeowners reached the end of their allowable terms), we saw much more modest improvement this week – the same mid-month lull in removal activity that we’ve been reporting on for many months now.

According to our McDash Flash daily forbearance tracking dataset, the number of active forbearance plans fell by just 7,300 (-0.6%) this week, with declines of 10,500 among FHA/VA loans and 2,800 among GSE mortgages being partially offset by a 6,000 rise in plan volumes among portfolio and PLS mortgages. That’s substantially less than last week’s 143,000 (10%) drop.

As of October 19, 1.24 million mortgage holders remain in COVID-19 related forbearance plans, representing 2.3% of all active mortgages, including 1.3% of GSE, 3.9% of FHA/VA and 3% of portfolio held and privately securitized loans.

Click on graph for larger image.

Still, on a monthly basis, improvement remains strong, with forbearances declining by 356,000 (-22.3%) over the past 30 days, and the past few weeks have seen the fastest monthly rates of improvement since the start of the pandemic.

Some 432,000 homeowners left forbearance in the first 19 days of October, making it the largest single month in terms of exit volumes since October of last year. And with more than 280,000 plans still up for review through the end of October, significant opportunity remains for additional declines through the first few weeks of November.

emphasis added

Q3 GDP Forecasts: Around 2.5%

by Calculated Risk on 10/22/2021 10:33:00 AM

These are forecasts of the advance estimate of GDP to be released on Oct 28th.

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

| 10/1/21 | 4.1% | 4.25% | 2.3% |

| 10/8/21 | 2.0% | 3.25% | 1.3% |

| 10/15/21 | 2.0% | 3.25% | 1.2% |

| 10/22/21 | 2.5% | 3.25% | 0.5% |

From BofA Merrill Lynch:

We forecast 3Q GDP growth of 2.5% qoq saar, down from 6.7% qoq saar in 2Q as the effects of the Delta variant stifled consumption. [Oct 22 estimate]From Goldman Sachs:

emphasis added

We have been assuming higher home sales and home prices in September, and we left our Q3 GDP tracking estimate unchanged on a rounded basis at +3¼% (qoq ar). [Oct 21 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 0.5 percent on October 19, down from 1.2 percent on October 15. [Oct 19 estimate]

Black Knight: National Mortgage Delinquency Rate Decreased in September

by Calculated Risk on 10/22/2021 07:00:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: Foreclosure Starts Reverse Course in September, Pulling Back Despite Moratoria Expiration; Delinquency Rate Falls Below 4% for First Time Since Start of Pandemic

• The national delinquency rate fell to 3.91% in September – the first time it’s been below 4% in 18 months – marking a 2.3% decline from August and 41.3% from the same time last yearAccording to Black Knight's First Look report, the percent of loans delinquent decreased 2.3% in September compared to August, and decreased 41% year-over-year.

• What would have been stronger improvement was partially offset by delinquencies rising by 7,800 in FEMA-declared disaster areas in hurricane-impacted Louisiana and by 11,000 in the state as a whole

• Foreclosure starts also dipped in September after seeing a noticeable rise in August in the wake of the federal foreclosure moratoria expiration

• September’s 3,900 foreclosure starts was the third lowest monthly total on record and within 6% of the record low set back in April of this year

• likewise, the number of active foreclosures fell in September as well, hitting yet another all-time low

• With nearly 400,000 mortgage holders having exited forbearance plans in just the first two weeks of October alone, it will be essential to track foreclosure metrics closely in the coming months

• Some 1.2 million homeowners remain 90 or more days past due on their mortgages but are not yet in foreclosure, including those who are still in active forbearance plans

emphasis added

The percent of loans in the foreclosure process decreased 4.6% in September and were down 25% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.91% in September, down from 4.00% in August.

The percent of loans in the foreclosure process decreased in September to 0.26%, from 0.27% in August.

The number of delinquent properties, but not in foreclosure, is down 1,474,000 properties year-over-year, and the number of properties in the foreclosure process is down 46,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2021 | Aug 2021 | Sept 2020 | Sept 2019 | |

| Delinquent | 3.91% | 4.00% | 6.66% | 3.53% |

| In Foreclosure | 0.26% | 0.27% | 0.34% | 0.48% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,068,000 | 2,122,000 | 3,542,000 | 1,854,000 |

| Number of properties in foreclosure pre-sale inventory: | 135,000 | 142,000 | 181,000 | 252,000 |

| Total Properties | 2,203,000 | 2,264,000 | 3,722,000 | 2,106,000 |

Thursday, October 21, 2021

October 21st COVID-19: Progress

by Calculated Risk on 10/21/2021 03:49:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.2% | 56.7% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 189.9 | 188.3 | ≥2321 | |

| New Cases per Day3 | 73,079 | 86,045 | ≤5,0002 | |

| Hospitalized3 | 50,791 | 57,087 | ≤3,0002 | |

| Deaths per Day3 | 1,252 | 1,308 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Pennsylvania at 59.8%, Minnesota, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.4%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.9%, Indiana at 49.4%, South Carolina at 49.3%, Missouri at 49.2%, Oklahoma at 49.2% and Georgia at 47.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Hotels: Occupancy Rate Down 10% Compared to Same Week in 2019

by Calculated Risk on 10/21/2021 02:05:00 PM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel occupancy reached its highest level since mid-August, while room rates dipped from the previous week, according to STR‘s latest data through October 16.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

October 10-16, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 65.0% (-10%)

• verage daily rate (ADR): $134.03 (-1.4%)

• Revenue per available room (RevPAR): $87.15 (-11.3%)

Week-over-week demand growth came almost exclusively from the Sunday ahead of Columbus Day. Overall for the three-day holiday weekend (8-10 October), occupancy reached 72% as compared with 75% in 2019.

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

LA Area Port Traffic: Solid Imports, Weak Exports in September

by Calculated Risk on 10/21/2021 01:56:00 PM

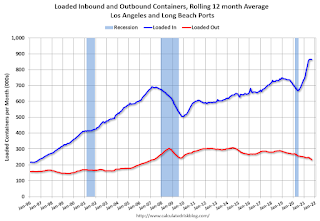

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, incoming port traffic is backed up significantly in the LA area with numerous ships at anchor waiting to unload.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.4% in September compared to the rolling 12 months ending in August. Outbound traffic was down 2.0% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down 4% YoY in September (recovered last year following the early months of the pandemic), and exports were down 23% YoY.

Median House Price Growth Decelerated for Fourth Consecutive Month

by Calculated Risk on 10/21/2021 10:57:00 AM

Today, in the Newsletter: Existing-Home Sales Increased to 6.29 million in September

Excerpt:

On prices, the NAR reported:The median existing-home price for all housing types in September was $352,800, up 13.3% from September 2020 ($311,500), as prices rose in each region.Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices), but this is the fourth consecutive month with a deceleration in the median price. The NAR reported median prices were up 23.6% YoY in May, 23.4% in June, 17.8% in July, 14.9% in August and 13.3% in September. This deceleration will probably show up in Case-Shiller and the FHFA indexes very soon.

...

The graph shows existing home sales by month for 2020 and 2021.

This was the second month this year with sales down year-over-year. This should continue through the rest of the year, since sales averaged 6.7million SAAR over the last three months of 2020. emphasis added

NAR: Existing-Home Sales Increased to 6.29 million in September

by Calculated Risk on 10/21/2021 10:12:00 AM

From the NAR: Existing-Home Sales Ascend 7.0% in September

Existing-home sales rebounded in September after seeing sales wane the previous month, according to the National Association of Realtors®. Each of the four major U.S. regions witnessed increases on a month-over-month basis. From a year-over-year timeframe, one region held steady while the three others each reported a decline in sales.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 7.0% from August to a seasonally adjusted annual rate of 6.29 million in September. However, sales decreased 2.3% from a year ago (6.44 million in September 2020).

...

Total housing inventory at the end of September amounted to 1.27 million units, down 0.8% from August and down 13.0% from one year ago (1.46 million). Unsold inventory sits at a 2.4-month supply at the present sales pace, down 7.7% from August and down from 2.7 months in September 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (6.29 million SAAR) were up 7.0% from last month, and were 2.3% below the September 2020 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.27 million in September from 1.28 million in August.

According to the NAR, inventory decreased to 1.27 million in September from 1.28 million in August.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 13.0% year-over-year in September compared to September 2020.

Inventory was down 13.0% year-over-year in September compared to September 2020. Months of supply was decreased to 2.4 months in September from 2.6 months in August.

This was above the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Decrease to 290,000

by Calculated Risk on 10/21/2021 08:34:00 AM

The DOL reported:

In the week ending October 16, the advance figure for seasonally adjusted initial claims was 290,000, a decrease of 6,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 3,000 from 293,000 to 296,000. The 4-week moving average was 319,750, a decrease of 15,250 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 750 from 334,250 to 335,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 319,750.

The previous week was revised up.

Regular state continued claims decreased to 2,481,000 (SA) from 2,603,000 (SA) the previous week.

Weekly claims were at the consensus forecast.