by Calculated Risk on 10/24/2021 07:08:00 PM

Sunday, October 24, 2021

Sunday Night Futures

Weekend:

• Schedule for Week of October 24, 2021

• Final Look: Local Housing Markets in September

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 8 and DOW futures are down 66 (fair value).

Oil prices were up over the last week with WTI futures at $83.98 per barrel and Brent at $85.62 per barrel. A year ago, WTI was at $40, and Brent was at $41 - so WTI oil prices are up more than double year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.36 per gallon. A year ago prices were at $2.15 per gallon, so gasoline prices are up $1.21 per gallon year-over-year.

Final Look: Local Housing Markets in September

by Calculated Risk on 10/24/2021 09:12:00 AM

Today, in the Real Estate Newsletter: Final Look: Local Housing Markets in September

Adding Alabama, Charlotte, Columbus, Miami, New York, Phoenix and the Twin Cities

Excerpt:

Key Points:

1. Inventory is still very low, and inventory in most areas is at a record low for the month of September.

2.There is significant divergence between markets.

3. It is possible inventory will be up year-over-year during the Winter, but still at very low levels.

Saturday, October 23, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 10/23/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Will 4% Mortgage Rates "Halt the Housing Market"? Some comments on an interview with Ivy Zelman

• 4th Look at Local Housing Markets in September Adding Austin, California, Des Moines, Houston and Maryland

• Most Housing Units Under Construction Since 1974 Housing Starts Decreased to 1.555 Million Annual Rate in September

• 'Some prospective buyers took a break' Existing Home Sales forecast, and adding Boston, Indiana, Rhode Island, and Washington D.C. September Data

• Existing-Home Sales Increased to 6.29 million in September

• The Coming Deceleration in House Price Growth Still, the August Case-Shiller National Index will be up about 20% YoY

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of October 24, 2021

by Calculated Risk on 10/23/2021 08:11:00 AM

The key reports this week are the advance estimate of Q3 GDP and September New Home sales.

Other key indicators include Personal Income and Outlays for September and Case-Shiller house prices for August.

For manufacturing, the Dallas, Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October.

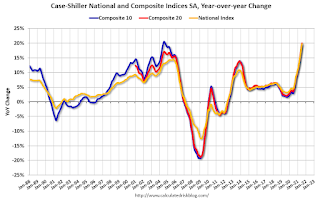

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 20.1% year-over-year.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 20.1% year-over-year.This graph shows the year-over-year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 760 thousand SAAR, up from 740 thousand in August.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 295 thousand initial claims, up from 290 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2021 (advance estimate). The consensus is that real GDP increased 2.8% annualized in Q3, down from 6.7% in Q2.

10:00 AM: Pending Home Sales Index for September. The consensus is 0.5% increase in the index.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for October. This is the last of the regional surveys for October.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.1% decrease in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 64.0, down from 64.7 in September.

10:00 AM: University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 71.6.

Friday, October 22, 2021

30 Year Mortgage Rates "Highest Since April" at 3.27%

by Calculated Risk on 10/22/2021 05:21:00 PM

From Matthew Graham at Mortgage News Daily: Highest Rates Since April, But There's a Catch

Over the past 30 days, interest rates have risen sharply. This is true for both mortgage rates and bond market benchmarks like 10yr Treasury yields. ...

Translation: at the beginning of the month, traders only saw a small chance of the first rate hike happening in September and no chance for June. Fast forward 3 weeks and September is seen as 100% likely and June is up to about a 60% chance. [30 year fixed 3.27%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac) since 2010.

October 22nd COVID-19: Still Over 70,000 New Cases per Day

by Calculated Risk on 10/22/2021 03:31:00 PM

"This paper supports vaccination as an important strategy for reducing infection and transmission, along with hand-washing, mask-wearing, and physical distancing.” ... “Other research has clearly and definitively established that the vaccines significantly reduce the risk of hospitalization and mortality.”

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.3% | 56.8% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 190.2 | 188.7 | ≥2321 | |

| New Cases per Day3 | 71,550 | 84,239 | ≤5,0002 | |

| Hospitalized3 | 49,864 | 56,177 | ≤3,0002 | |

| Deaths per Day3 | 1,257 | 1,306 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Pennsylvania at 59.9%, Minnesota, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.5%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.9%, Indiana at 49.5%, Oklahoma at 49.5%, South Carolina at 49.4%, Missouri at 49.3%, and Georgia at 47.6%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

The Coming Deceleration in House Price Growth

by Calculated Risk on 10/22/2021 12:56:00 PM

Today, in the Newsletter: The Coming Deceleration in House Price Growth

Excerpt:

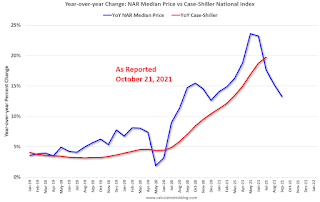

[This graph] - as of the NAR release yesterday - shows that Case-Shiller followed the median prices up, and that median prices are now falling.

...

This suggests that Case-Shiller will start to show some deceleration in the September or October reports (to be released in late November and December). emphasis added

Black Knight: "Forbearance Declines Hit Mid-Month Lull"

by Calculated Risk on 10/22/2021 10:41:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 19th.

From Andy Walden at Black Knight: Forbearance Declines Hit Mid-Month Lull

After two weeks of sizable drops in the number of active forbearance plans (as hundreds of thousands of homeowners reached the end of their allowable terms), we saw much more modest improvement this week – the same mid-month lull in removal activity that we’ve been reporting on for many months now.

According to our McDash Flash daily forbearance tracking dataset, the number of active forbearance plans fell by just 7,300 (-0.6%) this week, with declines of 10,500 among FHA/VA loans and 2,800 among GSE mortgages being partially offset by a 6,000 rise in plan volumes among portfolio and PLS mortgages. That’s substantially less than last week’s 143,000 (10%) drop.

As of October 19, 1.24 million mortgage holders remain in COVID-19 related forbearance plans, representing 2.3% of all active mortgages, including 1.3% of GSE, 3.9% of FHA/VA and 3% of portfolio held and privately securitized loans.

Click on graph for larger image.

Still, on a monthly basis, improvement remains strong, with forbearances declining by 356,000 (-22.3%) over the past 30 days, and the past few weeks have seen the fastest monthly rates of improvement since the start of the pandemic.

Some 432,000 homeowners left forbearance in the first 19 days of October, making it the largest single month in terms of exit volumes since October of last year. And with more than 280,000 plans still up for review through the end of October, significant opportunity remains for additional declines through the first few weeks of November.

emphasis added

Q3 GDP Forecasts: Around 2.5%

by Calculated Risk on 10/22/2021 10:33:00 AM

These are forecasts of the advance estimate of GDP to be released on Oct 28th.

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

| 10/1/21 | 4.1% | 4.25% | 2.3% |

| 10/8/21 | 2.0% | 3.25% | 1.3% |

| 10/15/21 | 2.0% | 3.25% | 1.2% |

| 10/22/21 | 2.5% | 3.25% | 0.5% |

From BofA Merrill Lynch:

We forecast 3Q GDP growth of 2.5% qoq saar, down from 6.7% qoq saar in 2Q as the effects of the Delta variant stifled consumption. [Oct 22 estimate]From Goldman Sachs:

emphasis added

We have been assuming higher home sales and home prices in September, and we left our Q3 GDP tracking estimate unchanged on a rounded basis at +3¼% (qoq ar). [Oct 21 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 0.5 percent on October 19, down from 1.2 percent on October 15. [Oct 19 estimate]

Black Knight: National Mortgage Delinquency Rate Decreased in September

by Calculated Risk on 10/22/2021 07:00:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: Foreclosure Starts Reverse Course in September, Pulling Back Despite Moratoria Expiration; Delinquency Rate Falls Below 4% for First Time Since Start of Pandemic

• The national delinquency rate fell to 3.91% in September – the first time it’s been below 4% in 18 months – marking a 2.3% decline from August and 41.3% from the same time last yearAccording to Black Knight's First Look report, the percent of loans delinquent decreased 2.3% in September compared to August, and decreased 41% year-over-year.

• What would have been stronger improvement was partially offset by delinquencies rising by 7,800 in FEMA-declared disaster areas in hurricane-impacted Louisiana and by 11,000 in the state as a whole

• Foreclosure starts also dipped in September after seeing a noticeable rise in August in the wake of the federal foreclosure moratoria expiration

• September’s 3,900 foreclosure starts was the third lowest monthly total on record and within 6% of the record low set back in April of this year

• likewise, the number of active foreclosures fell in September as well, hitting yet another all-time low

• With nearly 400,000 mortgage holders having exited forbearance plans in just the first two weeks of October alone, it will be essential to track foreclosure metrics closely in the coming months

• Some 1.2 million homeowners remain 90 or more days past due on their mortgages but are not yet in foreclosure, including those who are still in active forbearance plans

emphasis added

The percent of loans in the foreclosure process decreased 4.6% in September and were down 25% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.91% in September, down from 4.00% in August.

The percent of loans in the foreclosure process decreased in September to 0.26%, from 0.27% in August.

The number of delinquent properties, but not in foreclosure, is down 1,474,000 properties year-over-year, and the number of properties in the foreclosure process is down 46,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2021 | Aug 2021 | Sept 2020 | Sept 2019 | |

| Delinquent | 3.91% | 4.00% | 6.66% | 3.53% |

| In Foreclosure | 0.26% | 0.27% | 0.34% | 0.48% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,068,000 | 2,122,000 | 3,542,000 | 1,854,000 |

| Number of properties in foreclosure pre-sale inventory: | 135,000 | 142,000 | 181,000 | 252,000 |

| Total Properties | 2,203,000 | 2,264,000 | 3,722,000 | 2,106,000 |