by Calculated Risk on 10/27/2021 09:00:00 PM

Wednesday, October 27, 2021

Thursday: GDP, Unemployment Claims, Pending Home Sales

Goldman Sachs lowered their estimate for Q3 GDP today:

"We lowered our Q3 GDP tracking estimate by ½pp to 2¾% (qoq ar) ahead of tomorrow’s advance release."Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 295 thousand initial claims, up from 290 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 3rd quarter 2021 (advance estimate). The consensus is that real GDP increased 2.8% annualized in Q3, down from 6.7% in Q2.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is 0.5% increase in the index.

• At 11:00 AM, Kansas City Fed Survey of Manufacturing Activity for October. This is the last of the regional surveys for October.

"No one seems worried about a housing bubble"

by Calculated Risk on 10/27/2021 03:47:00 PM

The headline below "No one seems worried ... Just like last time the bubble burst" applies to government officials in the Bush administration and at the Fed (although there was some concern at the Fed, notably from Dr. Janet Yellen). Plenty of private forecasters were expressing concern in 2005 like Dean Baker (for example, see my post Speculation is the Key in early 2005).

Chris Isidore writes at CNN: No one seems worried about a housing bubble. Just like last time the bubble burst.

"I don't think we'll see prices fall 20% to 30% once again," said Dean Baker, senior economist and co-founder of the Center for Economic Policy and Research. "I don't think there's that kind of story out there." But he cautioned that even a modest rise in interest rates could lead home prices to slide between 5% and 8%.And from Mark Zandi:

"The housing market is out of whack. It's not sustainable. It is overvalued, stretched and vulnerable as [mortgage] rates rise, and affordability gets crushed," he said. "But I'm not concerned we're going to have a crash."And from Ivy Zelman:

Zelman doesn't believe there will be another collapse in housing prices like the last time. She said that a rise in the 30-year fixed rate mortgage from the current 2.9% to about 4% could be enough to send prices lower. "A lot of what we're seeing is scary," she said. "We don't know what will happen with interest rates."

October 27th COVID-19: Slow Progress

by Calculated Risk on 10/27/2021 03:32:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.5% | 57.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 191.0 | 189.5 | ≥2321 | |

| New Cases per Day3 | 68,151 | 77,011 | ≤5,0002 | |

| Hospitalized3 | 46,206 | 52,123 | ≤3,0002 | |

| Deaths per Day3 | 1,098 | 1,242 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Delaware at 59.7%, Minnesota, Hawaii, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio and Montana at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Oklahoma at 49.8%, Indiana at 49.7%, South Carolina at 49.7%, Missouri at 49.5%, Georgia at 48.0%, and Arkansas at 47.7%.

Click on graph for larger image.

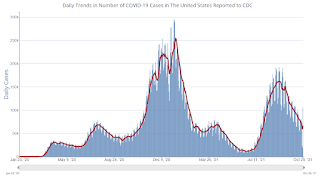

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

NMHC: October Apartment Market Tightness Index Very High

by Calculated Risk on 10/27/2021 01:59:00 PM

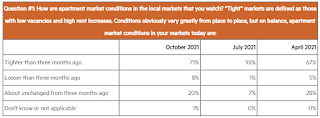

The National Multifamily Housing Council (NMHC) released their October survey data:

The Market Tightness Index decreased from 96 to 82 – indicating further tightening in market conditions (any reading above 50 indicates tighter conditions).

Most (71 percent) respondents reported tighter market conditions than in the July survey, compared to only 8 percent who reported looser conditions. Twenty percent of respondents felt that conditions were unchanged from 3 months ago.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Here is the question and the responses:

71% of respondents said their markets were tighter (lower vacancy / higher rents) than 3 months ago.

71% of respondents said their markets were tighter (lower vacancy / higher rents) than 3 months ago.Historically that is a very high percentage.

Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in August

by Calculated Risk on 10/27/2021 11:03:00 AM

Today, in the Real Estate Newsletter: Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in August; And a look at "Affordability"

Excerpt (there is much more):

This graph uses the year end Case-Shiller house price index - and the nominal median household income through 2020 (from the Census Bureau). 2021 median income is estimated at a 5% annual gain.

By all of the above measures, house prices appear elevated.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 10/27/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 22, 2021.

... The Refinance Index decreased 2 percent from the previous week and was 26 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 9 percent lower than the same week one year ago.

““Mortgage rates increased again last week, as the 30-year fixed rate reached 3.30 percent and the 15- year fixed rate rose to 2.59 percent – the highest for both in eight months. The increase in rates triggered the fifth straight decrease in refinance activity to the slowest weekly pace since January 2020. Higher rates continue to reduce borrowers’ incentive to refinance,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications picked up slightly, and the average loan size rose to its highest level in three weeks, as growth in the higher price segments continues to dominate purchase activity. Both new and existing-home sales last month were at their strongest sales pace since early 2021, but first-time home buyers are accounting for a declining share of activity. Home prices are still growing at a rapid clip, even if monthly growth rates are showing signs of moderation, and this is constraining sales in many markets, and particularly for first-timers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.30 percent from 3.23 percent, with points decreasing to 0.34 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains somewhat elevated - but the recent bump in rates has slowed activity to the lowest level since January 2020.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 9% year-over-year unadjusted.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity was strong in the second half of 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 26, 2021

Zillow Case-Shiller House Price Forecast: September Price Growth Will Remain Strong

by Calculated Risk on 10/26/2021 07:33:00 PM

The Case-Shiller house price indexes for August were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow Research: August 2021 Case-Shiller Results & Forecast: Beginning to Ease Off the Gas

House price growth through August sustained July’s unprecedented velocity, but autumn’s reports indicate that the market is easing off the gas pedal.

...

Compared to August, homes took a little bit longer to sell in September and the for-sale inventory inched higher. In other words, though extraordinary market conditions pushed house prices skyward between the Spring of 2020 and the Summer of 2021, the latest signs indicate that the market is relenting. And while house price appreciation will remain elevated for the next several months, further acceleration is unlikely.

Monthly growth in September as reported by Case-Shiller is expected to accelerate from August in both the 10- and 20-city indices, and slow in the national index. Annual growth in September is expected to accelerate in the 20-city and national index, and slow in the 10-city index. S&P Dow Jones Indices is expected to release data for the September S&P CoreLogic Case-Shiller Indices on Tuesday, November 30.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.2% in September, up from 19.8% in August.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.2% in September, up from 19.8% in August.

Case-Shiller National Index up Record 19.8% Year-over-year in August; The Deceleration is coming

by Calculated Risk on 10/26/2021 04:13:00 PM

Today, in the Newsletter: Case-Shiller National Index up Record 19.8% Year-over-year in August; The Deceleration is coming

Excerpt (there is much more):

Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in Case-Shiller was at 1.43%; still historically high, but lower than the previous five months. House prices started increasing sharply in the Case-Shiller index in August 2020, so the last 13 months have all been historically very strong, but the peak MoM growth is behind us.

October 26th COVID-19: 30 Days till Thanksgiving; Need to Get Daily Cases Down Before Holidays

by Calculated Risk on 10/26/2021 04:06:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.4% | 57.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 190.7 | 189.3 | ≥2321 | |

| New Cases per Day3 | 65,953 | 78,197 | ≤5,0002 | |

| Hospitalized3 | 46,777 | 52,815 | ≤3,0002 | |

| Deaths per Day3 | 1,159 | 1,242 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Delaware at 59.6%, Minnesota, Hawaii, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio and Montana at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Oklahoma at 49.7%, Indiana at 49.6%, South Carolina at 49.6%, Missouri at 49.5%, Arkansas at 47.7%, and Georgia at 47.6%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

New Home Sales: Record 106 thousand homes have not been started

by Calculated Risk on 10/26/2021 12:06:00 PM

Today, in the Newsletter: New Home Sales: Record 106 thousand homes have not been started

Excerpt (there is much more):

The inventory of completed homes for sale was at 36 thousand in September, just above the record low of 33 thousand in March, April, May and July 2021. That is about 0.5 months of completed supply (just above the record low).

The inventory of new homes under construction is at 3.6 months - slightly above the normal level.

However, a record 106 thousand homes have not been started - about 1.6 months of supply - almost double the normal level. emphasis added