by Calculated Risk on 10/28/2021 12:58:00 PM

Thursday, October 28, 2021

Hotels: Occupancy Rate Down 9% Compared to Same Week in 2019

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel occupancy dipped a percentage point week over week, while room rates rose slightly, according to STR‘s latest data through October 23.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

October 17-23, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 63.9% (-9.1%)

• Average daily rate (ADR): $134.14 (-0.6%)

• Revenue per available room (RevPAR): $85.74 (-9.6%)

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

A Few Comments on Q3 GDP and Investment

by Calculated Risk on 10/28/2021 11:44:00 AM

Earlier from the BEA: Gross Domestic Product, Third Quarter 2021 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the third quarter of 2021, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 6.7 percent.On a Q3-over-Q3 basis, GDP was up 4.9%.

emphasis added

The advance Q2 GDP report, at 2.0% annualized, was below expectations, due to several factors - a sharp decline in Motor vehicles and parts (due to supply constraints), a decline in residential investment, a decline in government expenditures and a negative contribution from trade.

Personal consumption expenditures (PCE) increased at a 1.6% annualized rate in Q3, a much slower pace than the previous two quarters.

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern doesn't apply.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.Residential investment (RI) decreased at a 7.7% annual rate in Q3. Equipment investment decreased at a 3.2% annual rate, and investment in non-residential structures decreased at a 7.3% annual rate (after getting crushed over the previous year)..

On a 3 quarter trailing average basis, RI (red) is down slightly, equipment (green) is up, and nonresidential structures (blue) is still down.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP decreased in Q3.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

NAR: Pending Home Sales Decreased 2.3% in September

by Calculated Risk on 10/28/2021 10:03:00 AM

From the NAR: Pending Home Sales Dip 2.3% in September

Pending home sales dipped in September, retreating slightly following a previous month of growth, according to the National Association of Realtors®. Each of the four major U.S. regions saw contract activity decline month-over-month and year-over-year, with the Northeast weathering the largest yearly drop.This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, decreased 2.3% to 116.7 in September. Year-over-year, signings decreased 8.0%. An index of 100 is equal to the level of contract activity in 2001.

...

Month-over-month, the Northeast PHSI fell 3.2% to 93.1 in September, an 18.5% decline from a year ago. In the Midwest, the index dropped 3.5% to 111.4 last month, down 5.8% from September 2020.

Pending home sales transactions in the South decreased 1.8% to an index of 139.1 in September, down 5.8% from September 2020. The index in the West declined 1.4% in September to 105.3, down 7.2% from a year prior.

emphasis added

Weekly Initial Unemployment Claims Decrease to 281,000

by Calculated Risk on 10/28/2021 08:37:00 AM

The DOL reported:

In the week ending October 23, the advance figure for seasonally adjusted initial claims was 281,000, a decrease of 10,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 1,000 from 290,000 to 291,000. The 4-week moving average was 299,250, a decrease of 20,750 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 250 from 319,750 to 320,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 299,250.

The previous week was revised up.

Regular state continued claims decreased to 2,243,000 (SA) from 2,480,000 (SA) the previous week.

Weekly claims were below consensus forecast.

BEA: Real GDP increased at 2.0% Annualized Rate in Q3

by Calculated Risk on 10/28/2021 08:33:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2021 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the third quarter of 2021, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 6.7 percent. ...The advance Q3 GDP report, with 2.0% annualized growth, was below expectations.

The increase in real GDP in the third quarter reflected increases in private inventory investment, personal consumption expenditures (PCE), state and local government spending, and nonresidential fixed investment that were partly offset by decreases in residential fixed investment, federal government spending, and exports. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

I'll have more later ...

Wednesday, October 27, 2021

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 10/27/2021 09:00:00 PM

Goldman Sachs lowered their estimate for Q3 GDP today:

"We lowered our Q3 GDP tracking estimate by ½pp to 2¾% (qoq ar) ahead of tomorrow’s advance release."Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 295 thousand initial claims, up from 290 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 3rd quarter 2021 (advance estimate). The consensus is that real GDP increased 2.8% annualized in Q3, down from 6.7% in Q2.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is 0.5% increase in the index.

• At 11:00 AM, Kansas City Fed Survey of Manufacturing Activity for October. This is the last of the regional surveys for October.

"No one seems worried about a housing bubble"

by Calculated Risk on 10/27/2021 03:47:00 PM

The headline below "No one seems worried ... Just like last time the bubble burst" applies to government officials in the Bush administration and at the Fed (although there was some concern at the Fed, notably from Dr. Janet Yellen). Plenty of private forecasters were expressing concern in 2005 like Dean Baker (for example, see my post Speculation is the Key in early 2005).

Chris Isidore writes at CNN: No one seems worried about a housing bubble. Just like last time the bubble burst.

"I don't think we'll see prices fall 20% to 30% once again," said Dean Baker, senior economist and co-founder of the Center for Economic Policy and Research. "I don't think there's that kind of story out there." But he cautioned that even a modest rise in interest rates could lead home prices to slide between 5% and 8%.And from Mark Zandi:

"The housing market is out of whack. It's not sustainable. It is overvalued, stretched and vulnerable as [mortgage] rates rise, and affordability gets crushed," he said. "But I'm not concerned we're going to have a crash."And from Ivy Zelman:

Zelman doesn't believe there will be another collapse in housing prices like the last time. She said that a rise in the 30-year fixed rate mortgage from the current 2.9% to about 4% could be enough to send prices lower. "A lot of what we're seeing is scary," she said. "We don't know what will happen with interest rates."

October 27th COVID-19: Slow Progress

by Calculated Risk on 10/27/2021 03:32:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.5% | 57.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 191.0 | 189.5 | ≥2321 | |

| New Cases per Day3 | 68,151 | 77,011 | ≤5,0002 | |

| Hospitalized3 | 46,206 | 52,123 | ≤3,0002 | |

| Deaths per Day3 | 1,098 | 1,242 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Delaware at 59.7%, Minnesota, Hawaii, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio and Montana at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Oklahoma at 49.8%, Indiana at 49.7%, South Carolina at 49.7%, Missouri at 49.5%, Georgia at 48.0%, and Arkansas at 47.7%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

NMHC: October Apartment Market Tightness Index Very High

by Calculated Risk on 10/27/2021 01:59:00 PM

The National Multifamily Housing Council (NMHC) released their October survey data:

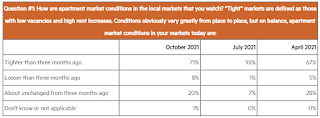

The Market Tightness Index decreased from 96 to 82 – indicating further tightening in market conditions (any reading above 50 indicates tighter conditions).

Most (71 percent) respondents reported tighter market conditions than in the July survey, compared to only 8 percent who reported looser conditions. Twenty percent of respondents felt that conditions were unchanged from 3 months ago.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Here is the question and the responses:

71% of respondents said their markets were tighter (lower vacancy / higher rents) than 3 months ago.

71% of respondents said their markets were tighter (lower vacancy / higher rents) than 3 months ago.Historically that is a very high percentage.

Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in August

by Calculated Risk on 10/27/2021 11:03:00 AM

Today, in the Real Estate Newsletter: Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in August; And a look at "Affordability"

Excerpt (there is much more):

This graph uses the year end Case-Shiller house price index - and the nominal median household income through 2020 (from the Census Bureau). 2021 median income is estimated at a 5% annual gain.

By all of the above measures, house prices appear elevated.