by Calculated Risk on 11/03/2021 02:03:00 PM

Wednesday, November 03, 2021

FOMC Statement: Taper!

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months, but the summer's rise in COVID-19 cases has slowed their recovery. Inflation is elevated, largely reflecting factors that are expected to be transitory. Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In light of the substantial further progress the economy has made toward the Committee's goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities. Beginning later this month, the Committee will increase its holdings of Treasury securities by at least $70 billion per month and of agency mortgage‑backed securities by at least $35 billion per month. Beginning in December, the Committee will increase its holdings of Treasury securities by at least $60 billion per month and of agency mortgage-backed securities by at least $30 billion per month. The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook. The Federal Reserve's ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

emphasis added

The Market Impact of the Closure of Zillow Offers

by Calculated Risk on 11/03/2021 12:21:00 PM

Today, in the Real Estate Newsletter: The Market Impact of the Closure of Zillow Offers

Excerpt:

Many people are discussing the Zillow’s business decision to discontinue Zillow Offers. This was a essentially a house flipping program. My question is what - if any - will be the market impact of the closure.

...

But the bottom line is inventories are very low, mortgage rates are still historically low, and demographics are currently favorable for home buying.

If the housing market slows - for whatever reason - I think the slowdown will show up in active existing home inventory. This is why I track local market inventory so closely every month. Some markets have seen inventories increase, but overall active inventory was at a record low for September.

We should get some local October inventory numbers soon.

ISM® Services Index Increased to 66.7% in October

by Calculated Risk on 11/03/2021 10:05:00 AM

(Posted with permission). The October ISM® Services index was at 66.79%, up from 61.9% last month. The employment index decreased to 51.6%, from 53.0%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: Services PMI® at 66.7%

October 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in October for the 17th month in a row — with the rate of expansion setting a record for the fourth time in 2021 — say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.This was above the consensus forecast, however the employment index decreased to 51.6%, from 53.0% the previous month.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In October, the Services PMI® registered another all-time high of 66.7 percent, 4.8 percentage points above September’s reading of 61.9 percent. This figure exceeds the former all-time high of 64.1 percent in July; previous records were set in May (64 percent) and March (63.7 percent). The data quickly explains the elevated Services PMI® reading, as two of the four equally weighted subindexes that directly factor into the composite index set all-time highs: The Business Activity Index reached 69.8 percent, an increase of 7.5 percentage points compared to the reading of 62.3 percent in September, and the New Orders Index hit 69.7 percent, up 6.2 percentage points from last month’s figure of 63.5 percent. (The other two subindexes are Employment and Supplier Deliveries, both also in expansion territory in October.)

emphasis added

ADP: Private Employment increased 571,000 in October

by Calculated Risk on 11/03/2021 08:19:00 AM

Private sector employment increased by 571,000 jobs from September to October according to the October ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was well above the consensus forecast of 400,000 for this report.

“The labor market showed renewed momentum last month, with a jump from the third quarter average of 385,000 monthly jobs added, marking nearly 5 million job gains this year,” said Nela Richardson, chief economist, ADP. “Service sector providers led the increase and the goods sector gains were broad based, reporting the strongest reading of the year. Large companies fueled the stronger recovery in October, marking the second straight month of impressive growth.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is revving back up as the Delta wave of the pandemic winds down. Job gains are accelerating across all industries, and especially among large companies. As long as the pandemic remains contained, more big job gains are likely in coming months.”

emphasis added

The BLS report will be released Friday, and the consensus is for 413 thousand non-farm payroll jobs added in October. The ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/03/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

— Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 29, 2021.

... The Refinance Index decreased 4 percent from the previous week and was 33 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 9 percent lower than the same week one year ago.

“Mortgage rates decreased for the first time since August, as concerns about supply-chain bottlenecks, waning consumer confidence, weaker economic growth, and rising inflation pushed Treasury yields lower. Most of the decline in rates came later in the week, which is likely why refinance applications declined to the lowest level since January 2020, and the overall share of activity fell to the lowest since July 2021,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Government refinance applications fell for the sixth straight week, as it becomes evident that an increasing number of borrowers have already refinanced.”

Added Kan, “Purchase activity continues to be held back by high prices and low for-sale inventory, but current applications levels still point to healthy housing demand. MBA is forecasting for a record $1.6 billion in purchase mortgage originations this year, and sustained demand leading to another record year in 2022.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.24 percent from 3.30 percent, with points remaining unchanged at 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains somewhat elevated - but the recent bump in rates has slowed activity to the lowest level since January 2020.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 9% year-over-year unadjusted.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity was strong in the second half of 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, November 02, 2021

Wednesday: FOMC Announcement, ADP Employment, ISM Services

by Calculated Risk on 11/02/2021 09:00:00 PM

Here is my FOMC Preview: Taper Announcement Expected.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 400,000 jobs added, down from 568,000 in September.

• At 10:00 AM, the ISM Services Index for October. The consensus is for a decrease to 59.5 from 61.9.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce tapering of asset purchases at this meeting.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

October Vehicles Sales Increased to 13.0 Million SAAR

by Calculated Risk on 11/02/2021 06:29:00 PM

Wards Auto released their estimate of light vehicle sales for October. Wards Auto estimates sales of 12.99 million SAAR in October 2021 (Seasonally Adjusted Annual Rate), up 6.8% from the September sales rate, and down 20.8% from October 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for October (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

Q3 2021 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 11/02/2021 05:35:00 PM

The BEA released the underlying details for the Q3 advance GDP report on Friday.

The BEA reported that investment in non-residential structures increased at a 2.4% annual pace in Q3. Note that weakness in non-residential structures started in 2019, before the pandemic.

Investment in petroleum and natural gas structures increased sharply in Q3 compared to Q2, and was up 67% year-over-year.

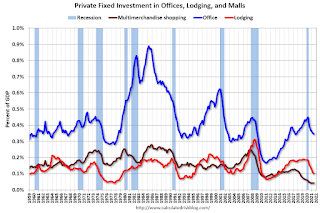

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices (blue) increased slightly in Q3, and was down 4.9% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 2% year-over-year in Q3 - and near a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased slightly in Q3 compared to Q2, and lodging investment was down 29% year-over-year.

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).Even though investment in single family structures has increased from the bottom, single family investment is just approaching normal levels as a percent of GDP.

Investment in single family structures was $411 billion (SAAR) (about 1.8% of GDP), and up 38% year-over-year.

Investment in multi-family structures decreased slightly in Q3.

Investment in home improvement was at a $324 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.4% of GDP). Home improvement spending has been strong during the pandemic.

November 2nd COVID-19: 23 Days till Thanksgiving and Red Flags Flying

by Calculated Risk on 11/02/2021 02:50:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.0% | 57.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 192.6 | 190.7 | ≥2321 | |

| New Cases per Day3🚩 | 74,798 | 67,184 | ≤5,0002 | |

| Hospitalized3 | 42,186 | 47,283 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,190 | 1,174 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 22 states have between 50% and 59.9% fully vaccinated: Minnesota at 59.9%, Delaware, Hawaii, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio, Montana, Oklahoma, and South Carolina at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Indiana at 49.9%, Missouri at 49.8%, Georgia at 48.2%, and Arkansas at 48.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 11/02/2021 11:56:00 AM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through November 2nd.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.There were supply constraints over the last year, for example, sawmills cut production and inventory at the beginning of the pandemic, and the West Coast fires in 2020 damaged privately-owned timberland (and maybe again in 2021).