by Calculated Risk on 11/04/2021 09:00:00 PM

Thursday, November 04, 2021

Friday: Employment Report

My October Employment Preview

Goldman October Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for October. The consensus is for 450 thousand jobs added, and for the unemployment rate to decrease to 4.7%.

Goldman October Payrolls Preview

by Calculated Risk on 11/04/2021 04:08:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 525k in October ... tomorrow’s report reflects the first full month of hiring following the expiration of federal enhanced unemployment benefits. Our forecast also reflects improving public health, strong labor demand, and a partial education rebound as schools gradually fill positions left open at the start of the school year. On the negative side, the seasonal factors may have evolved to fit the strong October 2020 data, raising the seasonal hurdle in tomorrow’s report. ... We estimate a one-tenth drop in the unemployment rate to 4.7%.CR Note: The consensus is for 450 thousand jobs added, and for the unemployment rate to decrease to 4.7%.

emphasis added

November 4th COVID-19: Over 70,000 New Cases per Day

by Calculated Risk on 11/04/2021 03:30:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.1% | 57.6% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 192.9 | 191.2 | ≥2321 | |

| New Cases per Day3 | 70,431 | 71,450 | ≤5,0002 | |

| Hospitalized3 | 41,850 | 45,892 | ≤3,0002 | |

| Deaths per Day3 | 1,109 | 1,216 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Hawaii at 59.9%, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio, Montana, Oklahoma, and South Carolina at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Indiana at 49.9%, Missouri at 49.9%, Georgia at 48.4%, and Arkansas at 48.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

October Employment Preview

by Calculated Risk on 11/04/2021 01:37:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus is for 450 thousand jobs added, and for the unemployment rate to decrease to 4.7%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 5.0 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 571,000 private sector jobs, above the consensus estimate of 400,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be above expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in October to 52.0%, up from 50.2% last month. This would suggest a decline in manufacturing employment of around 8,000 jobs in October. ADP showed 53,000 manufacturing jobs added.

The ISM® Services employment index decreased in October to 51.6%, down from 53.0% last month. This would suggest an increase in service employment of around 115,000 jobs in September.

Combined, the ISM indexes suggest a weaker than expected employment report.

• Unemployment Claims: The weekly claims report showed a sharp decline in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 351,000 in September to 291,000 in October. This would usually suggest fewer layoffs in October than in September, although this might not be very useful right now. In general, weekly claims have been falling, and have been below expectations in October.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.This data is only available back to 1994, so there is only data for three recessions. In September, the number of permanent job losers decreased to 2.251 million from 2.487 million in August. These jobs will likely be the hardest to recover, so it is a positive that the number of permanent job losers is declining rapidly

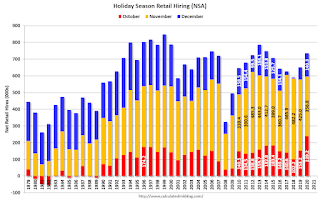

• Seasonal Retail Hiring: Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. But only a few temporary workers are hired in December. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

• Seasonal Retail Hiring: Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. But only a few temporary workers are hired in December. Here is a graph that shows the historical net retail jobs added for October, November and December by year.In 2020, retailers hired 239,200 employees (NSA) in October (most seasonal, but some bounce back during pandemic). That translated to a gain of 106,000 jobs SA.

• Conclusion: There is significant optimism concerning the October employment report, and many analysts are expecting a strong report. We have to be a little cautious because some of the apparent pickup in hiring might be for seasonal retail jobs.

Hotels: Occupancy Rate Down 6% Compared to Same Week in 2019

by Calculated Risk on 11/04/2021 11:20:00 AM

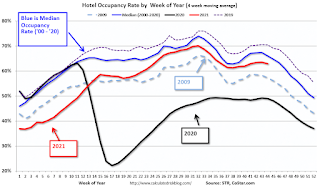

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

As anticipated ahead of Halloween, U.S. hotel performance fell week over week, according to STR‘s latest data through 30 October.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Oct. 24-30, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 58.9% (-5.7%)

• Average daily rate (ADR): US$127.70 (+1.5%)

• evenue per available room (RevPAR): US$75.28 (-4.3%)

Even with a drop in performance levels from previous weeks, comparisons with the matching week in 2019 improved because Halloween that year fell on a Thursday and created a more significant disruption in business travel and groups.

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Trade Deficit Increased to $80.9 Billion in September

by Calculated Risk on 11/04/2021 08:48:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $80.9 billion in September, up $8.1 billion from $72.8 billion in August, revised.

September exports were $207.6 billion, $6.4 billion less than August exports. September imports were $288.5 billion, $1.7 billion more than August imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in September.

Exports are up 17% compared to September 2020; imports are up 20% compared to September 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $36.5 billion in September, from $29.7 billion in September 2020.

Weekly Initial Unemployment Claims Decrease to 269,000

by Calculated Risk on 11/04/2021 08:33:00 AM

The DOL reported:

In the week ending October 30, the advance figure for seasonally adjusted initial claims was 269,000, a decrease of 14,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 2,000 from 281,000 to 283,000. The 4-week moving average was 284,750, a decrease of 15,000 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 500 from 299,250 to 299,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 284,750.

The previous week was revised up.

Regular state continued claims decreased to 2,105,000 (SA) from 2,239,000 (SA) the previous week.

Weekly claims were below consensus forecast.

Wednesday, November 03, 2021

Thursday: Unemployment Claims, Trade Deficit

by Calculated Risk on 11/03/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 281 thousand last week.

• Also a 8:30 AM, Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $74.1 billion in September, from $73.3 billion in August.

Vehicle Sales, Sales Mix and Heavy Trucks

by Calculated Risk on 11/03/2021 05:34:00 PM

The BEA released their estimate of light vehicle sales for October today. The BEA estimates sales of 12.99 million SAAR in October 2021 (Seasonally Adjusted Annual Rate), up 6.3% from the September sales rate, and down 20.8% from October 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 1967 from the BEA. The dashed line is sales for the current month.

The impact of COVID-19 was significant, and April 2020 was the worst month.

After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

This second graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs through October 2021.

Over time the mix has changed more and more towards light trucks and SUVs.

Over time the mix has changed more and more towards light trucks and SUVs.Only when oil prices are high, does the trend slow or reverse.

The percent of light trucks and SUVs was at 80.1% in October 2021 - an all time high.

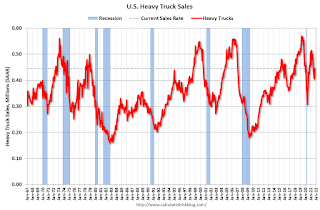

The third graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2021 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 563 thousand SAAR in September 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales really declined at the beginning of the pandemic, falling to a low of 299 thousand SAAR in May 2020.

Heavy truck sales really declined at the beginning of the pandemic, falling to a low of 299 thousand SAAR in May 2020. November 3rd COVID-19: Over 70,000 New Cases per Day

by Calculated Risk on 11/03/2021 05:32:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.1% | 57.5% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 192.7 | 191.0 | ≥2321 | |

| New Cases per Day3🚩 | 71,029 | 70,265 | ≤5,0002 | |

| Hospitalized3 | 42,358 | 46,452 | ≤3,0002 | |

| Deaths per Day3 | 1,130 | 1,213 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Hawaii at 59.8%, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio, Montana, Oklahoma, and South Carolina at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Indiana at 49.9%, Missouri at 49.8%, Georgia at 48.2%, and Arkansas at 48.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.