by Calculated Risk on 11/09/2021 11:17:00 AM

Tuesday, November 09, 2021

NY Fed Q3 Report: Total Household Debt Climbs to Over $15 trillion

From the NY Fed: Total Household Debt Climbs to Over $15 trillion in Q3 2021, Driven by New Extensions of Credit

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows that total household debt increased by $286 billion (1.9%) to $15.24 trillion in the third quarter of 2021. The total debt balance is now $1.1 trillion higher than at the end of 2019. It is also $890 billion higher than in Q3 2020, and $2.57 trillion higher, in nominal terms, than the $12.68 trillion peak seen in 2008. The Report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative random sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

Mortgage balances—the largest component of household debt—rose by $230 billion and stood at $10.67 trillion at the end of September. Credit card balances increased by $17 billion, the same size increase as in the second quarter. Despite the increase, credit card balances remain $123 billion lower than they had been at the end of 2019. Auto loan balances increased by $28 billion in the third quarter. Student loan balances grew by $14 billion, coinciding with the academic borrowing year. In total, non-housing balances grew by $61 billion, with gains across all debt types.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows aggregate consumer debt increased in Q3. Household debt previously peaked in 2008, and bottomed in Q3 2013. Unlike following the great recession, there wasn't a huge decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $286 billion in the third quarter of 2021, a 1.9% rise from 2021Q2, and now stand at $15.24 trillion. Balances are $1.1 trillion higher than at the end of 2019 and $890 billion higher than in 2020Q3, and $2.57 trillion higher, in nominal terms, than the $12.68 trillion peak seen in 2008.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased in Q3. From the NY Fed:

Aggregate delinquency rates have remained low and declining since the beginning of the pandemic, reflecting an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments. As of late September, 2.7% of outstanding debt was in some stage of delinquency, a 2.0 percentage point decrease from the fourth quarter of 2019, just before the COVID-19 pandemic hit the United States. Of the $412 billion of debt that is delinquent, $302 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders’ books but upon which they continue to attempt collection).

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

The credit scores of newly originated mortgages had increased in the early part of the pandemic, and although they edged down slightly, they still remain very high and reflect a continuing high quality of newly opened mortgages as well as a higher share of refinances. ... There was $1.11 trillion in newly originated mortgage debt in 2021Q3, with 69% of it originated to borrowers with credit scores over 760. 2% of newly originated mortgages were originated to subprime borrowers, a sharp contrast to the 12% average seen between 2003-2007.There is much more in the report.

Second Home Market: South Lake Tahoe in October

by Calculated Risk on 11/09/2021 08:37:00 AM

With the pandemic, there was a surge in 2nd home buying. In response, Fannie made some lending changes, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through October 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12 month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low - above the record low set early in 2021, but down YoY - and prices are up sharply YoY.

Monday, November 08, 2021

Tuesday: PPI, Quarterly Report on Household Debt and Credit

by Calculated Risk on 11/08/2021 09:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Lower Despite Bond Market Weakness

Mortgage rates are directly based on trading levels in the bond market, so it's almost a given that rates will move in the same direction as bond yields on any given day. But for a variety of reasons, it doesn't happen like that every day. Today was just such a day.Tuesday:

...

Keep in mind that we're talking about extremely small movement. Between Friday and today, you'd likely see the exact same "note rate" for any given conventional 30yr fixed scenario. The improvements would only be detectable in the form of upfront costs. [30 year fixed 3.07%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for October.

• At 8:30 AM, The Producer Price Index for October from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.5% increase in core PPI.

• At 11:00 AM, NY Fed: Q3 Quarterly Report on Household Debt and Credit

November 8th COVID-19: New Cases Stuck at 70,000+ per Day

by Calculated Risk on 11/08/2021 06:00:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.4% | 58.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 193.8 | 192.5 | ≥2321 | |

| New Cases per Day3🚩 | 71,867 | 71,470 | ≤5,0002 | |

| Hospitalized3 | 38,570 | 43,574 | ≤3,0002 | |

| Deaths per Day3 | 1,068 | 1,176 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Wisconsin at 58.7%, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio, Montana, Oklahoma, South Carolina, Indiana, and Missouri at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 48.6%, Arkansas at 48.4%, Louisiana at 48.0%, and Tennessee at 48.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 2.06%"

by Calculated Risk on 11/08/2021 04:00:00 PM

Note: This is as of October 31st.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 2.06%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 9 basis points from 2.15% of servicers’ portfolio volume in the prior week to 2.06% as of October 31, 2021. According to MBA’s estimate, 1 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 5 basis points to 0.92%. Ginnie Mae loans in forbearance decreased 13 basis points to 2.52%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 13 basis points to 5.00%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 15 basis points relative to the prior week to 2.28%, and the percentage of loans in forbearance for depository servicers decreased 5 basis points to 2.02%.

“One million homeowners remained in forbearance as we reached the end of October, but the forbearance share continued to decline, with larger declines for portfolio and PLS loans,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “More borrowers who exited forbearance the last week of October went into modifications, a sign that they have not yet regained their pre-pandemic level of income.”

Added Fratantoni, “The strong job market report from October, with another drop in the unemployment rate and a pickup in wage growth, is a positive sign for homeowners still struggling to get back on their feet.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. The number of forbearance plans is decreasing rapidly recently since many homeowners have reached the end of the 18-month term.

Homebuilder Comments in October: “Builders are lifting sales caps"

by Calculated Risk on 11/08/2021 02:43:00 PM

Today, in the Real Estate Newsletter: Homebuilder Comments in October: “Builders are lifting sales caps"

Excerpt (much more in newsletter):

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

...

#Dallas builder: “Due to a large number of sales in 2021, we’ll have declines in 2022. This is due to land availability. Huge number of communities coming online in 2023. Supply chain issues are getting worse & have spread to land development.”.

#Seattle builder: “Sales & closings in 2022 will be negatively impacted by limited supply of lots being delivered to the market in early 2022 with recovery in late 2022. No demand impacts are forecasted to impact sales or closings in 2022.”

#Atlanta builder: “We pulled so many extra sales & starts into 2021 that we're going to be severely short on vacant developed lots in the first half of 2022, hence the huge projected slowdowns in sales & starts in 2022.”

Fed Survey: Banks reported Eased Standards, Weaker Demand for Residential Real Estate Loans

by Calculated Risk on 11/08/2021 02:24:00 PM

From the Federal Reserve: The October 2021 Senior Loan Officer Opinion Survey on Bank Lending Practices

The October 2021 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2021.

Regarding loans to businesses, respondents to the October survey, on balance, reported easier standards and stronger demand for commercial and industrial (C&I) loans to large and middle-market firms over the third quarter. Banks also reported easier standards for C&I loans to small firms, while demand from small firms remained basically unchanged.2 For commercial real estate (CRE), banks reported easier standards for all loan categories. Banks also reported stronger demand for multifamily loans and for loans secured by nonfarm nonresidential properties, while demand for construction and land development loans remained basically unchanged. For loans to households, banks eased standards across most categories of residential real estate (RRE) loans, on net, and reported weaker demand for most types of RRE loans over the third quarter. Banks also eased standards across all three consumer loan categories—credit card loans, auto loans, and other consumer loans—while reports on demand for consumer loans were mixed.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate lending is from the Senior Loan Officer Survey Charts.

This shows that banks have eased standards (tightened for subprime), and that there is decreased demand for RRE loans.

Housing Inventory Nov 8th Update: Inventory Down 3.1% Week-over-week

by Calculated Risk on 11/08/2021 01:44:00 PM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Fed Governor Bowman: The U.S. Housing and Mortgage Market: Risks and Resilience

by Calculated Risk on 11/08/2021 12:08:00 PM

From Fed Governor Michelle Bowman, At the Women in Housing and Finance Public Policy Luncheon, Washington, D.C., The U.S. Housing and Mortgage Market: Risks and Resilience. Bowman comments on house prices and the end of the forbearance programs. Here are here comments on house prices:

Home prices had been rising at a moderate rate since 2012, but since mid-2020, their growth has accelerated significantly. In total, home prices in September were 21 percent higher than in June 2020. Home price increases are also widespread. In September, about 90 percent of American cities had experienced rising home prices over the past three months, and the home price increases were substantial in most of these cities.

These sharp increases raise the concern that housing is overvalued and that home prices may decline. Historically, large home price increases are somewhat less concerning if they are supported by economic fundamentals rather than speculation. Fundamentals certainly seem to be a large part of the story behind the increases we've seen since the middle of last year. The demand for housing has risen for several reasons. Interest rates are low, families have accumulated savings, and income growth in the past 18 months has been quite strong. Families are also reconsidering where, and in what kind of home, they want to live. Purchases of second homes, for example, have been somewhat high in the past 18 months. Meanwhile, the supply of new homes has been held back by shortages of materials, labor, and developed lots.

Another reason to be less concerned about the recent escalation in home prices is that we do not see much of the decline in underwriting standards that fueled the home price bubble in the mid-2000s. Mortgage underwriting standards have remained conservative relative to the mid-2000s, in part because of the mortgage policy reforms that were put in place in the aftermath of the housing crisis. Investor activity is subdued relative to that time as well.

Nonetheless, home prices do decline from time to time. In inflation-adjusted terms, U.S. home prices fell from 1979 to 1982 and from 1989 to 1993, although by much less than from 2006 to 2012. Although the declines in national home prices were modest in some of these episodes, some areas of the country experienced sharp declines. As we all know, home price declines cause problems and strain throughout the economy. To give just one example, families and small business owners borrow against their homes to fund big-ticket purchases and business expansions, and house price declines make it harder to use homes as loan collateral. This effect can be amplified if a credit crunch occurs, in which lenders react to the decline in house prices by pulling back on their lending. With banks and the broader financial system currently quite robust, such a credit crunch seems unlikely. Nonetheless, I know how painful these declines can be, especially in certain markets. For example, from my experience living in rural Kansas, I understand how smaller communities with a less diversified housing and employment base can take a long time to recover from a fall in home prices. I wonder also about communities with a sizable share of second-home owners. So I will continue to watch the incoming data closely.

Falling home prices would certainly be very dramatic, but continued outsized increases could also be problematic. First, high home prices make it more difficult for low- to moderate-income households to become homeowners, as larger down payments and other financing requirements effectively lock these households out of the housing market. Second, and related to one of the Federal Reserve's monetary policy goals, rising home prices and rents raise the cost of housing. Because housing costs are a large share of living expenses for most people, these increases are adding to current inflationary pressures in the economy. Indeed, we are already seeing sizable increases in rent and owners' equivalent rent in many parts of the country.

emphasis added

Seven High Frequency Indicators for the Economy

by Calculated Risk on 11/08/2021 08:28:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of November 7th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 20.2% from the same day in 2019 (79.8% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through November 6, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - and appears to be declining again. The 7-day average for the US is down 14% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $88 million last week, down about 50% from the median for the week.

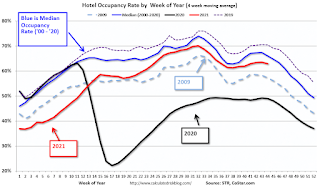

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through October 30th. The occupancy rate was down 5.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of October 29th, gasoline supplied was up 3.9% compared to the same week in 2019.

This was the eighth week so far this year when gasoline supplied was up compared to the same week in 2019 - and consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through November 6th

This data is through November 6th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 111% of the January 2020 level.

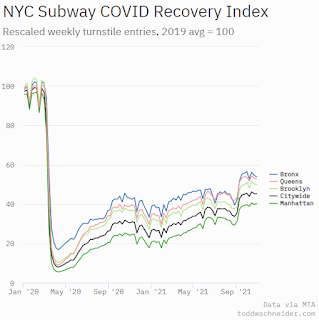

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, November 5th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".