by Calculated Risk on 11/10/2021 04:20:00 PM

Wednesday, November 10, 2021

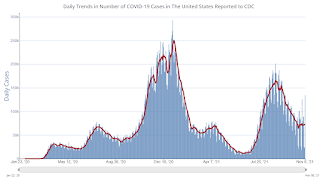

November 10th COVID-19: New Cases Increasing

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.5% | 58.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 194.4 | 192.7 | ≥2321 | |

| New Cases per Day3🚩 | 74,584 | 70,960 | ≤5,0002 | |

| Hospitalized3 | 39,852 | 42,552 | ≤3,0002 | |

| Deaths per Day3 | 1,078 | 1,125 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 58.8%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 48.8%, Tennessee at 48.7%, Arkansas at 48.5%, Louisiana at 48.1% and North Dakota at 48.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Housing: Inventory will Tell the Tale

by Calculated Risk on 11/10/2021 02:01:00 PM

Today, in the Real Estate Newsletter: Inventory will Tell the Tale

Excerpt:

We are being flooded with housing stories. Will house prices decline or will price growth just slow? Does the US have a housing shortage? If mortgage rates rise to 4%, will that “halt the housing market” as Ivy Zelman said on CNBC?You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Although my crystal ball is cloudy at this point, I believe inventory will tell the tale. That is why I watch inventory closely. Not just the monthly existing home sales report from the National Association of Realtors (NAR) and the monthly new home sales report from the Census Bureau. I also use weekly data from Altos Research (See Altos’ Mike Simonsen’s weekly presentation on YouTube).

And I track inventory and sales for 30+ local markets each month.

...

My Spidey senses are tingling, however it isn't obvious why this time - or what the outcome will be.

But I believe one thing is certain: inventory will tell the tale!

Cleveland Fed: Median CPI increased 0.6% and Trimmed-mean CPI increased 0.7% in October

by Calculated Risk on 11/10/2021 11:56:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.6% in October. The 16% trimmed-mean Consumer Price Index increased 0.7% in October. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for September here. "Fuel oil and other fuels" were up 193% annualized.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

MBA: "Mortgage Delinquencies Decrease in the Third Quarter of 2021"

by Calculated Risk on 11/10/2021 10:11:00 AM

From the MBA: Mortgage Delinquencies Decrease in the Third Quarter of 2021

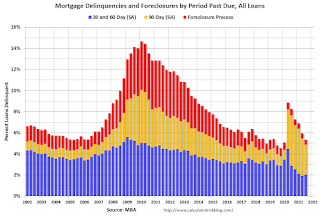

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.88 percent of all loans outstanding at the end of the third quarter of 2021, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate was down 59 basis points from the second quarter of 2021 and down 277 basis points from one year ago.

“For the fifth consecutive quarter, the mortgage delinquency rate declined, commensurate with a decline in the U.S. unemployment rate over the same time period,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The improvement was driven entirely by a decline in later-stage delinquent loans – those loans that are 90 days or past due, but not in foreclosure. By the end of the third quarter, many borrowers were approaching the 18-month expiration point of their forbearance terms and were being placed in permanent home retention solutions, such as modifications and loan deferrals.”

Walsh added, “Once these borrowers entered permanent post-forbearance workouts and resumed payments, they moved from delinquent to current status.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q3.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate increased 10 basis points to 1.51 percent, the 60-day delinquency rate remained unchanged at 0.52 percent, and the 90-day delinquency bucket decreased 68 basis points to 2.85 percent.This sharp increase last year in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 0.46 percent, down 5 basis points from the second quarter of 2021 and 13 basis points lower than one year ago. This is the lowest foreclosure inventory rate since the fourth quarter of 1981. The percentage of loans on which foreclosure actions were started in the third quarter fell by 1 basis point to 0.03 percent, which is the lowest starts rate reported in the survey and consistent with the last three quarters of 2020.

The percent of loans in the foreclosure process declined further, and was at the lowest level since 1981.

Weekly Initial Unemployment Claims Decrease to 267,000

by Calculated Risk on 11/10/2021 08:37:00 AM

The DOL reported:

In the week ending November 6, the advance figure for seasonally adjusted initial claims was 267,000, a decrease of 4,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 2,000 from 269,000 to 271,000. The 4-week moving average was 278,000, a decrease of 7,250 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 500 from 284,750 to 285,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 278,000.

The previous week was revised up.

Regular state continued claims increased to 2,160,000 (SA) from 2,101,000 (SA) the previous week.

Weekly claims were above consensus forecast.

BLS: CPI increased 0.9% in October, Core CPI increased 0.6%

by Calculated Risk on 11/10/2021 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.9 percent in October on a seasonally adjusted basis after rising 0.4 percent in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.2 percent before seasonal adjustment.Both CPI and core CPI were well above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The monthly all items seasonally adjusted increase was broad-based, with increases in the indexes for energy, shelter, food, used cars and trucks, and new vehicles among the larger contributors. The energy index rose 4.8 percent over the month, as the gasoline index increased 6.1 percent and the other major energy component indexes also rose. The food index increased 0.9 percent as the index for food at home rose 1.0 percent.

The index for all items less food and energy rose 0.6 percent in October after increasing 0.2 percent in September. Most component indexes increased over the month. Along with shelter, used cars and trucks, and new vehicles, the indexes for medical care, for household furnishing and operations, and for recreation all increased in October. The indexes for airline fares and for alcoholic beverages were among the few to decline over the month.

The all items index rose 6.2 percent for the 12 months ending October, the large st 12-month increase since the period ending November 1990. The index for all items less food and energy rose 4.6 percent over the last 12 months, the largest 12-month increase since the period ending August 1991. The energy index rose 30.0 percent over the last 12 months, and the food index increased 5.3 percent.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 11/10/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 5, 2021.

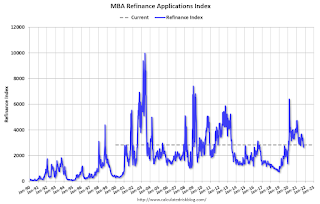

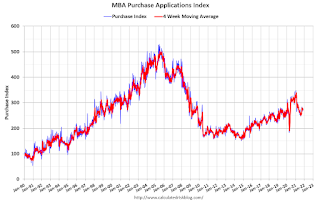

... The Refinance Index increased 7 percent from the previous week and was 28 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 0.1 percent compared with the previous week and was 4 percent lower than the same week one year ago.

“Mortgage rates moved lower for the second week in a row for all loan types. The 30-year fixed rate decreased to 3.16 percent and has declined 14 basis points over the past two weeks. Although overall activity remains close to January 2020 lows, homeowners acted on the decrease in rates. Refinance activity was up 7 percent overall, with gains in both conventional and government refinances. Additionally, the average loan balance for a refinance application was the highest in a month,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications were also strong last week, increasing just under 3 percent and down only 4 percent from last year’s pace. The dip in rates might have helped to bring some buyers back into the market, but housing inventory is still extremely low and price growth remains elevated.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.16 percent from 3.24 percent, with points remaining unchanged at 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains somewhat elevated, and the recent decline in rates has given the index a slight boost.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 4% year-over-year unadjusted.

According to the MBA, purchase activity is down 4% year-over-year unadjusted.This is the smallest year-over-year decline in some time (purchase activity was strong in the 2nd half of 2020). However, this week last year was weak - so it is likely the year-over-year decline will be larger in coming weeks.

Note: Red is a four-week average (blue is weekly).

Tuesday, November 09, 2021

Wednesday: CPI, Unemployment Claims

by Calculated Risk on 11/09/2021 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for a 0.6% increase in CPI, and a 0.4% increase in core CPI.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, down from 269 thousand last week.

November 9th COVID-19: 16 Days till Thanksgiving and New Cases Stuck at 70,000+ per Day

by Calculated Risk on 11/09/2021 04:24:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.5% | 58.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 194.2 | 192.6 | ≥2321 | |

| New Cases per Day3 | 73,312 | 75,209 | ≤5,0002 | |

| Hospitalized3 | 39,841 | 43,056 | ≤3,0002 | |

| Deaths per Day3 | 1,078 | 1,211 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Wisconsin at 58.7%, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio, Montana, Oklahoma, South Carolina, Indiana, and Missouri at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 48.8%, Arkansas at 48.4%, Tennessee at 48.1% and Louisiana at 48.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

2nd Look at Local Housing Markets in October: Memphis, Nashville, New Hampshire, North Texas (Dallas) and San Diego.

by Calculated Risk on 11/09/2021 01:31:00 PM

Today, in the Real Estate Newsletter: 2nd Look at Local Housing Markets in October

Excerpt:

Here is a summary of active listings for the housing markets that have reported so far in October. For these markets, inventory was down 9.6% in October MoM from September, and down 30.4% YoY.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Inventory in San Diego is at an all time low!

Inventory almost always declines seasonally in October, so the MoM decline is not a surprise. Last month, these eight markets were down 27.4% YoY, so the YoY decline in October is larger than in September. This is not indicating a slowing market (but this is just 8 early reporting markets).