by Calculated Risk on 11/13/2021 08:11:00 AM

Saturday, November 13, 2021

Schedule for Week of November 14, 2021

The key economic reports this week are October Retail Sales and Housing Starts.

For manufacturing, October industrial production, and the November New York, Philly and Kansas City Fed surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 20.1, up from 10.5.

8:30 AM ET: Retail sales for October will be released.

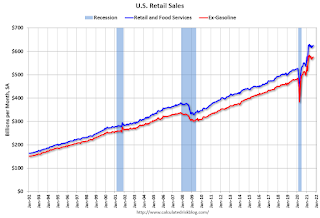

8:30 AM ET: Retail sales for October will be released.The consensus is for a 1.1% increase in retail sales.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 75.7%.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 80, unchanged from 80. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.580 million SAAR, up from 1.555 million SAAR.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, down from 267 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 24.0, up from 23.8.

11:00 AM: the Kansas City Fed manufacturing survey for November.

10:00 AM: State Employment and Unemployment (Monthly) for October 2021 (And State Job Openings)

Friday, November 12, 2021

Mortgage Rates Increased This Week

by Calculated Risk on 11/12/2021 05:29:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Are Actually Much Higher This Week

This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac) since 2010.

November 12th COVID-19: New Cases Stuck Above 70,000 per Day

by Calculated Risk on 11/12/2021 04:20:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.7% | 58.2% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 194.7 | 193.2 | ≥2321 | |

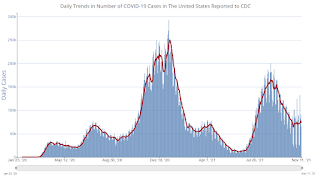

| New Cases per Day3🚩 | 73,218 | 71,249 | ≤5,0002 | |

| Hospitalized3 | 39,359 | 41,692 | ≤3,0002 | |

| Deaths per Day3 | 999 | 1,101 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 58.9%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 48.8%, Tennessee at 48.8%, Arkansas at 48.6%, Louisiana at 48.2% and North Dakota at 48.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Q4 GDP Forecasts: Around 5% to 6%

by Calculated Risk on 11/12/2021 12:13:00 PM

From BofA:

Our 3Q GDP tracking estimate increased to 2.5% qoq saar from 2.1%, following positive inventory revisions. We remain at 6.0% for 4Q [November 12 estimate]From Goldman Sachs

emphasis added

We boosted our past-quarter GDP tracking estimate for Q3 by one tenth to +2.2% (qoq ar) but left our Q4 GDP tracking estimate unchanged at +4.5% (qoq ar). [November 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 8.2 percent on November 10, down from 8.5 percent on November 4. [November 10 estimate]

BLS: Job Openings "Little Changed" at 10.4 Million in September

by Calculated Risk on 11/12/2021 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

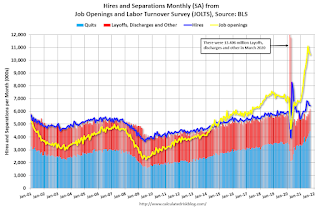

The number of job openings was little changed at 10.4 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.5 million and 6.2 million, respectively. Within separations, the quits level and rate increased to a series high of 4.4 million and 3.0 percent, respectively. The layoffs and discharges rate was unchanged at 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings decreased in September to 10.438 million from 10.629 million in August.

The number of job openings (yellow) were up 58% year-over-year.

Quits were up 34% year-over-year to a new record high. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Black Knight: Number of Mortgages in Forbearance Declines

by Calculated Risk on 11/12/2021 08:29:00 AM

This data is as of November 9th.

From Andy Walden at Black Knight: Mortgage Loans in Forbearance Drop Below 2% Entering November

Forbearance plan exit volumes increased week-over-week heading into November as the share of mortgage loans in forbearance fell below 2% for the first time since the early stages of the pandemic.

According to our McDash Flash daily mortgage performance dataset, the number of loans in active forbearance fell 123,000 (-10.8%). The week’s strongest declines were among loans held in bank portfolios and private label securities, which recorded a reduction of 59,000 (-15.9%). FHA/VA plans also showed significant improvement, declining by 48,000 (-11.3), while GSE loans in forbearance plans decreased by 16,000 (-4.8%).

As of November 9, 1.01 million mortgage holders remain in COVID-19 related forbearance plans, representing 1.9% of all active mortgages, including 1.2% of GSE, 3.1% of FHA/VA and 2.4% of portfolio/PLS loans.

Click on graph for larger image.

Nearly 300,000 borrowers have left their plans over the past two weeks down from 455,000 over the same two-week period last month as we hit the downslope of exit activity. That said, more than 250,000 plans are still listed with October/November reviews for extension/removal. Half of those are expected to reach final expiration, which could lead to continued improvement, albeit at a slower pace, in the weeks ahead.

Plan entries were down 9% from a week ago, logging one of the lowest weeks in terms of new entries since the onset of the pandemic.

emphasis added

Thursday, November 11, 2021

Friday: Job Openings

by Calculated Risk on 11/11/2021 08:01:00 PM

Friday:

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for September from the BLS. Jobs openings decreased in August to 10.439 million from 11.098 million in July.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for November).

3rd Look at Local Housing Markets in October

by Calculated Risk on 11/11/2021 01:36:00 PM

Today, in the Real Estate Newsletter: 3rd Look at Local Housing Markets in October

Excerpt:

This is the third look at local markets in October. This update adds Albuquerque, Atlanta, Colorado, Houston, Jacksonville, Minnesota, Portland, Sacramento and Santa Clara.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

...

Here is a summary of active listings for the housing markets that have reported so far in October. For these markets, inventory was down 7.9% in October MoM from September, and down 25.1% YoY.

Of the markets that have reported so far, inventories in Jacksonville and San Diego are at record lows. Sacramento is the only market so far with inventory up YoY in October.

Inventory almost always declines seasonally in October, so the MoM decline is not a surprise. Last month, these markets were down 22.9% YoY, so the YoY decline in October is slightly larger than in September. This is not indicating a slowing market.

Hotels: Occupancy Rate Down 13% Compared to Same Week in 2019

by Calculated Risk on 11/11/2021 11:12:00 AM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel performance increased slightly from the previous week, according to STR‘s latest data through November 6.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

October 31 through November 6, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 59.8% (-13.0%)

• Average daily rate (ADR): $128.14 (-3.2%)

• Revenue per available room (RevPAR): $76.61 (-15.8%)

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

"The deal of the Century ..."

by Calculated Risk on 11/11/2021 08:50:00 AM

This morning, in the Real Estate Newsletter: "The deal of the Century ..."

A few real estate words of wisdom from my dad, and a salute to all veterans!