by Calculated Risk on 11/15/2021 10:38:00 AM

Monday, November 15, 2021

Housing Inventory Nov 15th Update: Inventory Down 1.7% Week-over-week

Tracking existing home inventory will be very important this year.

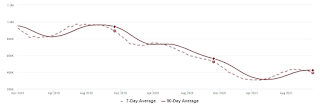

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 11/15/2021 08:26:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

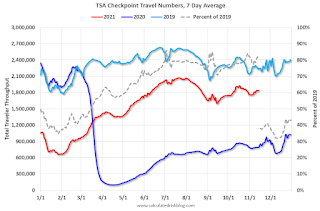

The TSA is providing daily travel numbers.

This data is as of November 14th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 17.9% from the same day in 2019 (82.1% of 2019). (Dashed line)

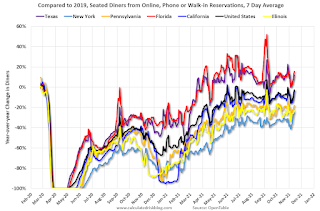

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through November 13, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - and appears to be declining again. The 7-day average for the US is down 3% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $151 million last week, down about 29% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through November 6th. The occupancy rate was down 13.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of November 5th, gasoline supplied was down 0.7% compared to the same week in 2019.

There have been eight weeks so far this year when gasoline supplied was up compared to the same week in 2019 - and consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through November 13th

This data is through November 13th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 112% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, November 12th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, November 14, 2021

Sunday Night Futures

by Calculated Risk on 11/14/2021 07:01:00 PM

Weekend:

• Schedule for Week of November 14, 2021

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 20.1, up from 10.5.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 10 and DOW futures are up 67 (fair value).

Oil prices were down over the last week with WTI futures at $81.17 per barrel and Brent at $82.45 per barrel. A year ago, WTI was at $40, and Brent was at $42 - so WTI oil prices are up double year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.40 per gallon. A year ago prices were at $2.12 per gallon, so gasoline prices are up $1.28 per gallon year-over-year.

The Labor Force Participation Rate

by Calculated Risk on 11/14/2021 02:13:00 PM

On Friday, Goldman Sachs economists put out a research note on the labor force participation rate: Why Isn’t Labor Force Participation Recovering?

While the unemployment rate continues to fall quickly, labor force participation has made no progress since August 2020. ... Most of the 5.0mn persons who have exited the labor force since the start of the pandemic are over age 55 (3.4mn), largely reflecting early (1.5mn) and natural (1mn) retirements that likely won’t reverse. The outlook for prime-age persons who have exited the labor force (1.7mn) is more positive, since very few are discouraged and most still view their exits as temporary.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 634,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

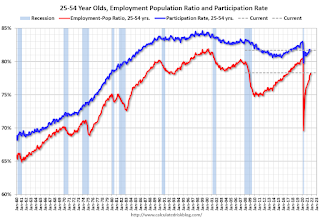

Click on graph for larger image.

Click on graph for larger image.The Labor Force Participation Rate was unchanged at 61.6% in October, from 61.6% in September. This is the percentage of the working age population in the labor force.

The Employment-Population ratio increased to 58.8% from 58.7% (black line).

Since the overall participation rate has declined due to the pandemic and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to the pandemic and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in October to 81.7% from 81.6% in September, and the 25 to 54 employment population ratio increased to 78.3% from 78.0% in September.

Here is a graph of the change in the participation rate by age cohort (October 2019, October 2020, and October 2021 NSA).

Here is a graph of the change in the participation rate by age cohort (October 2019, October 2020, and October 2021 NSA).Saturday, November 13, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 11/13/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• A Zillow Flip that Flopped

• Homebuilder Comments in October: “Builders are lifting sales caps" "Lack of lots & land development will hold back growth in 2022"

• 2nd Look at Local Housing Markets in October Inventory in San Diego is at an all time low

• Inventory will Tell the Tale

• "The deal of the Century ..." Best to all Veterans

• 3rd Look at Local Housing Markets in October Albuquerque, Atlanta, Colorado, Georgia, Houston, Jacksonville, Minnesota, Portland, Sacramento and Santa Clara

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of November 14, 2021

by Calculated Risk on 11/13/2021 08:11:00 AM

The key economic reports this week are October Retail Sales and Housing Starts.

For manufacturing, October industrial production, and the November New York, Philly and Kansas City Fed surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 20.1, up from 10.5.

8:30 AM ET: Retail sales for October will be released.

8:30 AM ET: Retail sales for October will be released.The consensus is for a 1.1% increase in retail sales.

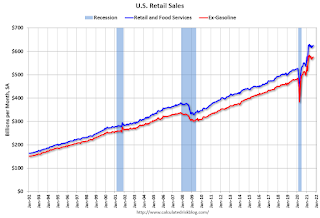

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 75.7%.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 80, unchanged from 80. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.580 million SAAR, up from 1.555 million SAAR.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, down from 267 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 24.0, up from 23.8.

11:00 AM: the Kansas City Fed manufacturing survey for November.

10:00 AM: State Employment and Unemployment (Monthly) for October 2021 (And State Job Openings)

Friday, November 12, 2021

Mortgage Rates Increased This Week

by Calculated Risk on 11/12/2021 05:29:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Are Actually Much Higher This Week

This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac) since 2010.

November 12th COVID-19: New Cases Stuck Above 70,000 per Day

by Calculated Risk on 11/12/2021 04:20:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.7% | 58.2% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 194.7 | 193.2 | ≥2321 | |

| New Cases per Day3🚩 | 73,218 | 71,249 | ≤5,0002 | |

| Hospitalized3 | 39,359 | 41,692 | ≤3,0002 | |

| Deaths per Day3 | 999 | 1,101 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 58.9%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 48.8%, Tennessee at 48.8%, Arkansas at 48.6%, Louisiana at 48.2% and North Dakota at 48.1%.

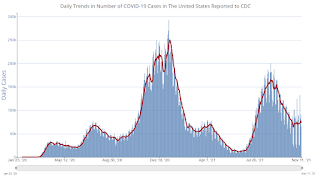

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Q4 GDP Forecasts: Around 5% to 6%

by Calculated Risk on 11/12/2021 12:13:00 PM

From BofA:

Our 3Q GDP tracking estimate increased to 2.5% qoq saar from 2.1%, following positive inventory revisions. We remain at 6.0% for 4Q [November 12 estimate]From Goldman Sachs

emphasis added

We boosted our past-quarter GDP tracking estimate for Q3 by one tenth to +2.2% (qoq ar) but left our Q4 GDP tracking estimate unchanged at +4.5% (qoq ar). [November 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 8.2 percent on November 10, down from 8.5 percent on November 4. [November 10 estimate]

BLS: Job Openings "Little Changed" at 10.4 Million in September

by Calculated Risk on 11/12/2021 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

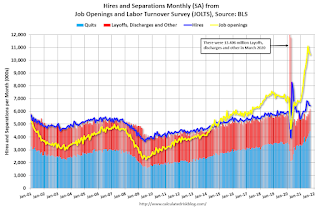

The number of job openings was little changed at 10.4 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.5 million and 6.2 million, respectively. Within separations, the quits level and rate increased to a series high of 4.4 million and 3.0 percent, respectively. The layoffs and discharges rate was unchanged at 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings decreased in September to 10.438 million from 10.629 million in August.

The number of job openings (yellow) were up 58% year-over-year.

Quits were up 34% year-over-year to a new record high. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").