by Calculated Risk on 11/16/2021 08:16:00 PM

Tuesday, November 16, 2021

Wednesday: Housing Starts, Architecture Billings Index

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for October. The consensus is for 1.580 million SAAR, up from 1.555 million SAAR.

• During the day, The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

November 16th COVID-19: New Cases Increasing, Above 83K per Day

by Calculated Risk on 11/16/2021 04:15:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.9% | 58.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 195.4 | 193.8 | ≥2321 | |

| New Cases per Day3🚩 | 83,671 | 73,349 | ≤5,0002 | |

| Hospitalized3 | 39,884 | 40,419 | ≤3,0002 | |

| Deaths per Day3 | 1,029 | 1,072 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 59.0%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.3%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 49.0%, Tennessee at 48.9%, Arkansas at 48.8%, Louisiana at 48.3% and North Dakota at 48.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

October California Home Sales

by Calculated Risk on 11/16/2021 02:04:00 PM

Today, in the Real Estate Newsletter: October California Home Sales

Excerpt:

Sales Down 10.4% YoY. Active Listings down 18.3%You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

...

California is a key market, and sometimes we see trends in California early. Unfortunately the C.A.R. doesn’t release monthly sales or inventory numbers. Not Seasonally Adjusted (NSA).

...

"October’s sales pace dipped 0.9 percent on a monthly basis from 438,190 in September and was down 10.4 percent from a year ago, when 484,510 homes were sold on an annualized basis."

"California’s Unsold Inventory Index (UII) dipped on a month-to-month basis for the first time in four months, as active listings fell 18.3 percent from last year."

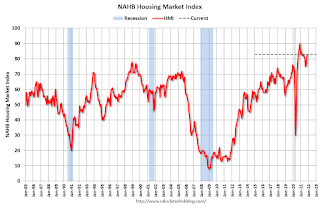

NAHB: Builder Confidence Increased to 83 in November

by Calculated Risk on 11/16/2021 10:07:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 83, up from 80 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Up on Strong Demand Even as Supply Side Challenges Persist

Low existing inventories and strong buyer demand helped push builder confidence higher for the third consecutive month even as supply-side challenges — including building material bottlenecks and lot and labor shortages — remain stubbornly persistent. Builder sentiment in the market for newly built single-family homes moved three points higher to 83 in November, according to the NAHB/Wells Fargo Housing Market Index (HMI) released today.

“The solid market for home building continued in November despite ongoing supply-side challenges,” said NAHB Chairman Chuck Fowke. “Lack of resale inventory combined with strong consumer demand continues to boost single-family home building.”

“In addition to well publicized concerns over building materials and the national supply chain, labor and building lot access are key constraints for housing supply,” said NAHB Chief Economist Robert Dietz. “Lot availability is at multi-decade lows and the construction industry currently has more than 330,000 open positions. Policymakers need to focus on resolving these issues to help builders produce more housing to meet strong market demand.”

...

The HMI index gauging current sales conditions rose three points to 89 and the gauge charting traffic of prospective buyers also posted a three-point gain to 68. The component measuring sales expectations in the next six months held steady at 84.

Looking at the three-month moving averages for regional HMI scores, the Midwest rose four points to 72, the South registered a four-point gain to 84 and the West rose one point to 84. The Northeast fell two points to 70.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a strong reading.

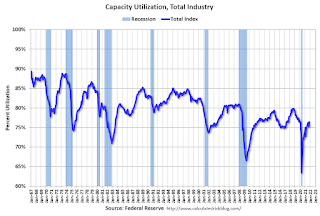

Industrial Production Increased 1.6 Percent in October; Back to Pre-pandemic Levels

by Calculated Risk on 11/16/2021 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 1.6 percent in October after falling 1.3 percent in September; about half of the gain in October reflected a recovery from the effects of Hurricane Ida. Manufacturing output increased 1.2 percent in October; excluding a large gain in the production of motor vehicles and parts, factory output moved up 0.6 percent. The output of utilities rose 1.2 percent, and mining output stepped up 4.1 percent.

At 101.6 percent of its 2017 average, total industrial production in October was 5.1 percent above its year-earlier level and at its highest reading since December 2019. In October, capacity utilization for the industrial sector increased 1.2 percentage points to 76.4 percent; even so, it was still 3.2 percentage points below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and back to the level in February 2020 (pre-pandemic).

Capacity utilization at 76.4% is 3.2% below the average from 1972 to 2020. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 100.0. This is slightly above the February 2020 level.

The change in industrial production was above consensus expectations.

Retail Sales Increased 1.7% in October

by Calculated Risk on 11/16/2021 08:37:00 AM

On a monthly basis, retail sales were increased 1.7% from September to October (seasonally adjusted), and sales were up 16.3 percent from October 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for October 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $638.2 billion, an increase of 1.7 percent from the previous month, and 16.3 percent above October 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 1.5% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 13.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 13.9% on a YoY basis.Sales in October were above expectations, and sales in August and September were revised up.

Monday, November 15, 2021

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey

by Calculated Risk on 11/15/2021 07:36:00 PM

From Matthew Graham at Mortgage News Daily: Upward Momentum Continues For Mortgage Rates

After hitting the lowest levels in over a month last Tuesday, mortgage rates have been moving higher fairly quickly each day since then. Most of the damage occurred on Wednesday and Friday of last week (markets were closed on Thursday), but today got progressively worse as the hours ticked by. [30 year fixed 3.23%]Tuesday:

emphasis added

• At 8:30 AM ET, Retail sales for October will be released. The consensus is for a 1.1% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 75.7%.

• At 10:00 AM, The November NAHB homebuilder survey. The consensus is for a reading of 80, unchanged from 80. Any number above 50 indicates that more builders view sales conditions as good than poor.

HUD: FHA'S 2021 Annual Report Shows Increase in Capital Reserves; DTI Remains Elevated

by Calculated Risk on 11/15/2021 04:49:00 PM

The U.S. Department of Housing and Urban Development (HUD) today released its fiscal year (FY) 2021 report to Congress on the financial health of the Federal Housing Administration (FHA) Mutual Mortgage Insurance Fund. In addition to its emphasis on delivering relief options to homeowners financially impacted by the COVID-19 pandemic, FHA continued to deliver on its mission of enabling homeownership for first-time and low- and moderate-income, and households of color.From the report: Credit scores are decent, but DTI ratio remains elevated.

The MMI Fund supports FHA’s Single Family mortgage insurance programs, including all forward mortgage purchase and refinance transactions, as well as mortgages insured under the Home Equity Conversion Mortgage (HECM) reverse mortgage program. The report illustrates that the MMI Fund increased its overall Capital Ratio, ending the fiscal year at 8.03 percent, an increase of 1.93 percentage points over the previous fiscal year. For the first time since 2015, the HECM reverse mortgage program has a strong positive ratio, primarily due to strong national home price appreciation. As the recovery from the pandemic continues, the Fund remains well positioned to withstand future economic events and endure the outcomes from the pandemic induced delinquencies that remain in forbearance or are seriously delinquent.

“The strength of the fund is a promising sign and solidifies the important role FHA fulfills in making homeownership a reality for first-time homebuyers and those with lower incomes.” said U.S. Department of Housing and Urban Development Secretary Marcia L. Fudge. “This year, our Administration took unprecedented steps to deliver relief to those devastated by the pandemic. Managing the strong fiscal health and performance of the FHA program is a top priority, and I am encouraged to see the MMI Fund remain resilient through the events of the past year. Looking ahead, we will ensure FHA is well positioned to provide broad and equitable access to homeownership, especially for those who have been historically underserved in the mortgage market.”

Click on graph for larger image.

Click on graph for larger image.Exhibit III-8 above illustrates the distribution of credit scores for borrowers obtaining FHA endorsements. The share of endorsements with credit scores between 620 and 679 increased slightly in from 53.13 percent in FY 2020 to 57.16 percent in FY 2021. The share of endorsements on mortgages with credit scores of 720 or higher decreased from 14.69 percent in FY 2020 to 13.33 percent in FY 2021.

The average Debt-to-Income (DTI) ratio for borrowers with FHA-insured purchase mortgages increased slightly, from 43.08 percent in FY 2020 to 43.18 percent in FY 2021, as illustrated in Exhibit III-9 above. The percentage of borrowers with DTI ratios of 50 percent or greater in FY 2021 was at 23.71 percent, a decline from 24.20 percent in FY 2020 and a sign of slightly improving economic circumstances for FHA’s traditional borrowers.

November 15th COVID-19: New Cases Increasing, Above 80K per Day

by Calculated Risk on 11/15/2021 02:42:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.8% | 58.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 195.3 | 193.8 | ≥2321 | |

| New Cases per Day3🚩 | 80,823 | 72,204 | ≤5,0002 | |

| Hospitalized3 | 38,332 | 40,676 | ≤3,0002 | |

| Deaths per Day3 | 1,043 | 1,071 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 59.0%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.3%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 48.8%, Tennessee at 48.8%, Arkansas at 48.8%, Louisiana at 48.3% and North Dakota at 48.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

4th Look at Local Housing Markets in October

by Calculated Risk on 11/15/2021 01:26:00 PM

Today, in the Real Estate Newsletter: 4th Look at Local Housing Markets in October

Excerpt:

This is the fourth look at local markets in October. This update adds Des Moines, Maryland, South Carolina, and Washington, D.C..You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

...

Here is a summary of active listings for the housing markets that have reported so far in October. For these markets, inventory was down 6.9% in October MoM from September, and down 25.2% YoY.

Of the markets that have reported so far, inventories in Jacksonville and San Diego are at record lows. Sacramento and Washington, D.C. are the only markets so far with inventory up YoY in October.

nventory almost always declines seasonally in October, so the MoM decline is not a surprise. Last month, these markets were down 23.1% YoY, so the YoY decline in October is slightly larger than in September. This is not indicating a slowing market.