by Calculated Risk on 11/28/2021 06:41:00 PM

Sunday, November 28, 2021

Monday: Pending Home Sales

Weekend:

• Schedule for Week of November 28, 2021

Monday:

• At 10:00 AM ET, Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 31 and DOW futures are up 180 (fair value).

Oil prices were down over the last week with WTI futures at $70.30 per barrel and Brent at $74.67 per barrel. A year ago, WTI was at $46, and Brent was at $47 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.38 per gallon. A year ago prices were at $2.11 per gallon, so gasoline prices are up $1.27 per gallon year-over-year.

Philly Fed: State Coincident Indexes Increased in 48 States in October

by Calculated Risk on 11/28/2021 12:01:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2021. Over the past three months, the indexes increased in 49 states and decreased in one state, for a three-month diffusion index of 96. Additionally, in the past month, the indexes increased in 48 states and decreased in two states, for a one-month diffusion index of 92. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 1.4 percent over the past three months and 0.4 percent in October.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is almost all positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In October, 48 states had increasing activity including minor increases.

Saturday, November 27, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 11/27/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Four House Price Topics Case-Shiller and the FHFA Indexes will be released on Tuesday

• New Home Sales: Record 109 thousand homes have not been started Prices Are Up Sharply Year-over-year

• Final Look: Local Housing Markets in October No Sign of a Slowing Market

• Existing-Home Sales Increased to 6.34 million in October

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of November 28, 2021

by Calculated Risk on 11/27/2021 08:11:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include the September Case-Shiller house price index, the November ISM manufacturing and services indexes, and November vehicle sales.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

9:00 AM: FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index. The 2022 Conforming loan limits will also be announced.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 19.3% year-over-year increase in the Composite 20 index for September.

9:45 AM: Chicago Purchasing Managers Index for November.

10:00 AM: Testimony, Fed Chair Jerome Powell, Coronavirus and CARES Act, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

10:30 AM: FDIC Quarterly Banking Profile, Third quarter.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 525,000 jobs added, down from 571,000 in October.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 61.0%, up from 60.8%.

10:00 AM: Construction Spending for October. The consensus is for 0.4% increase in spending.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 13.2 million SAAR in November, up from the BEA estimate of 13.0 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 199 thousand last week.

8:30 AM: Employment Report for November. The consensus is for 563 thousand jobs added, and for the unemployment rate to decrease to 4.5%.

8:30 AM: Employment Report for November. The consensus is for 563 thousand jobs added, and for the unemployment rate to decrease to 4.5%.There were 531 thousand jobs added in October, and the unemployment rate was at 4.6%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the "Great Recession".

10:00 AM: the ISM Services Index for November.

Friday, November 26, 2021

Energy expenditures as a percentage of PCE

by Calculated Risk on 11/26/2021 02:11:00 PM

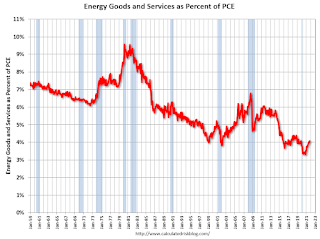

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all-time low. Here is an update through the recently released October PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through October 2021.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In general, energy expenditures as a percent of PCE have been trending down for years.

At the beginning of the pandemic, energy expenditures as a percentage of PCE, fell to a record low of 3.3% in May 2020.

Four House Price Topics

by Calculated Risk on 11/26/2021 10:27:00 AM

Today, in the Real Estate Newsletter: Four House Price Topics

Brief excerpt:

Even though the September index will show another very strong YoY gain, I expect house price growth to decelerate in coming months.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

...

The following graph shows YoY price changes for the NAR median house prices, Case-Shiller National price index, and the FHFA purchase-only index (Fannie and Freddie loans only).

Most of the time, the NAR median price leads the Case-Shiller index, and I expect the Case-Shiller index to show a lower growth rate (but still robust) in coming months.

...

In the October existing home sales report released last week, the NAR reported months-of-supply was unchanged at 2.4 months in October. There is a seasonal pattern to inventory, but this is still very low - and prices will remain solid as long as inventories stay low.

Q4 GDP Forecasts: Moving Up

by Calculated Risk on 11/26/2021 08:06:00 AM

These forecasts are prior to the news on the B.1.1.529 variant: Heavily mutated coronavirus variant puts scientists on alert

Goldman Sachs also put out a note prior to the variant news:

“We now expect the Fed to announce at its December meeting that it is doubling the pace of tapering to $30bn per month starting in January. ... While this faster pace of tapering would allow the FOMC to consider a rate hike as early as March, our best guess is that it will wait until June, when a few additional employment reports will be available. We now expect hikes in June, September, and December …”From BofA:

4Q GDP tracking remains at 6.0% qoq saar, supported by the strong data this week. [November 24 estimate]From Goldman Sachs

emphasis added

We boosted our Q4 GDP tracking estimate by 1pt to +6.0% (qoq ar). This change embeds larger expected contributions from inventories and goods exports, and it also reflects the strong Q3 pace of gross domestic income (+6.7% annualized). [November 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 8.6 percent on November 24, up from 8.2 percent on November 17. [November 24 estimate]

Thursday, November 25, 2021

Five Economic Reasons to be Thankful

by Calculated Risk on 11/25/2021 11:05:00 AM

First, thanks to all the healthcare workers and first responders who have been - and still are - on the front lines saving lives. Thank you!

Here are five economic reasons to be thankful this Thanksgiving. (Hat Tip to Neil Irwin who started doing this several years ago)

1) A Falling Unemployment Rate.

The unemployment rate is down from 6.9% a year ago (October 2020).

2) Falling unemployment claims.

This graph shows the 4-week moving average of weekly claims since 1971.

This graph shows the 4-week moving average of weekly claims since 1971.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 252,250 - the lowest since March 2020.

This is a huge decline in regular unemployment claims.

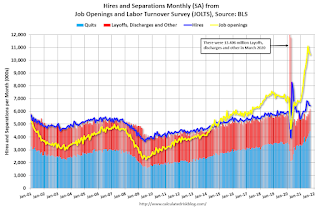

3) Job Openings Near Series High.

There were 10.4 million job openings in September, just below the record 11.1 million in July 2021.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. The number of job openings (yellow) were up 58% year-over-year.

Quits were up 34% year-over-year to a new record high. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

A large number of job openings, and rising quits, are positive signs for workers.

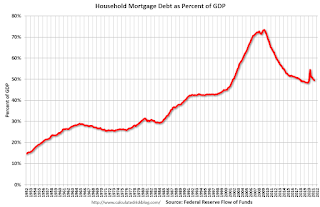

4) Mortgage Debt as a Percent of GDP is much lower than during Housing Bubble

This graph shows household mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.

This graph shows household mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.Mortgage debt increased by $222 billion in Q2 2021. This was the largest quarterly increase in mortgage debt since 2006.

Mortgage debt is up $573 billion from the peak during the housing bubble, but, as a percent of GDP is at 49.6% - down from Q1 - and down from a peak of 73.3% of GDP during the housing bubble.

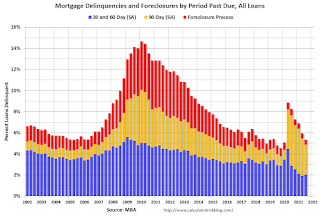

5) Mortgage Delinquency Rate Declining Quickly

Two graphs for this one. The first graph, based on data from the MBA through Q3 2021, shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q3.

The sharp increase last year in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The sharp increase last year in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).The percent of loans in the foreclosure process declined further, and was at the lowest level since 1981.

And from Freddie Mac for October:

Freddie Mac reported that the Single-Family serious delinquency rate in October was 1.32%, down year-over-year from 2.89% in October 2020.

Freddie Mac reported that the Single-Family serious delinquency rate in October was 1.32%, down year-over-year from 2.89% in October 2020.Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure". Mortgages in forbearance are being counted as delinquent in this monthly report, but are not reported to the credit bureaus.

Happy Thanksgiving to All!

Wednesday, November 24, 2021

November Vehicle Sales Forecast: Increase to 13.6 million SAAR

by Calculated Risk on 11/24/2021 03:43:00 PM

From WardsAuto: U.S. Light-Vehicle Sales to Continue Growth in November; More Strength Likely in December (pay content)

Low inventories and supply issues continue to impacting vehicle sales, but sales are bouncing back.

This graph shows actual sales from the BEA (Blue), and Wards forecast for November (Red).

The Wards forecast of 13.6 million SAAR, would be up about 4.7% from last month, and down 14% from a year ago (sales were solid in November 2020, as sales recovered from the depths of the pandemic).

November 24th COVID-19: New Cases and Hospitalizations Increasing

by Calculated Risk on 11/24/2021 03:40:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 59.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 196.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 94,266 | 85,927 | ≤5,0002 | |

| Hospitalized3🚩 | 43,896 | 40,950 | ≤3,0002 | |

| Deaths per Day3 | 982 | 982 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 59.3%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.5%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 49.4%, Tennessee at 49.4%, Arkansas at 49.1%, Louisiana at 48.7% and North Dakota at 48.6%.

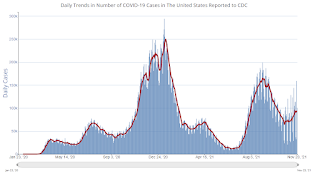

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.