by Calculated Risk on 11/30/2021 11:08:00 AM

Tuesday, November 30, 2021

More on Case-Shiller and FHFA House Price Increases

Today, in the Newsletter: Case-Shiller National Index up 19.5% Year-over-year in September

Excerpt:

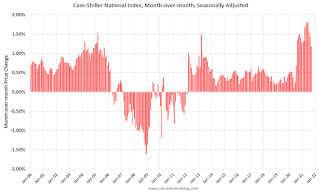

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for September were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in Case-Shiller was at 1.18%; still historically high, but lower than the previous 13 months. House prices started increasing sharply in the Case-Shiller index in August 2020, so the last 14 months have all been historically very strong, but the peak MoM growth is behind us - and the year-over-price growth is starting to decelerate.

...

As I discussed in How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?, the FHFA HPI is used to determine the increase in the Conforming Loan Limit. The relevant quarterly index, the Expanded-Data Indexes (Estimated using Enterprise, FHA, and Real Property County Recorder Data Licensed from DataQuick for sales below the annual loan limit ceiling), was released this morning, and it was up 18.04% YoY. The actual 2022 CLL will be released later.

emphasis added

Case-Shiller: National House Price Index increased 19.5% year-over-year in September

by Calculated Risk on 11/30/2021 09:14:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3-month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports 19.5% Annual Home Price Gain in September

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.5% annual gain in September, down from 19.8% in the previous month. The 10-City Composite annual increase came in at 17.8%, down from 18.6% in the previous month. The 20- City Composite posted a 19.1% year-over-year gain, down from 19.6% in the previous month.

Phoenix, Tampa, and Miami reported the highest year-over-year gains among the 20 cities in September. Phoenix led the way with a 33.1% year-over-year price increase, followed by Tampa with a 27.7% increase and Miami with a 25.2% increase. Six of the 20 cities reported higher price increases in the year ending September 2021 versus the year ending August 2021.

...

Before seasonal adjustment, the U.S. National Index posted a 1.0% month-over-month increase in September, while the 10-City and 20-City Composites both posted increases of 0.7% and 0.8%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.2%, and the 10-City and 20-City Composites both posted increases of 0.8% and 1.0%, respectively. In September, 19 of the 20 cities reported increases before seasonal adjustments while all 20 cities reported increases after seasonal adjustments.

“If I had to choose only one word to describe September 2021’s housing price data, the word would be ‘deceleration,’ says Craig J. Lazzara, Managing Director at S&P DJI. “Housing prices continued to show remarkable strength in September, though the pace of price increases declined slightly.The National Composite Index rose 19.5% from year-ago levels, with the 10- and 20-City Composites up 17.8% and 19.1%, respectively. This month, however, the rate of price growth began to decline, as each of our three composites rose less in September than in August.

...

“We have previously suggested that the strength in the U.S. housing market is being driven by households’ reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes. More data will be required to understand whether this demand surge represents simply an acceleration of purchases that would have occurred over the next several years, or reflects a secular change in locational preferences. September’s report is consistent with either explanation.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.8% in September (SA).

The Composite 20 index is up 1.0% (SA) in September.

The National index is 46% above the bubble peak (SA), and up 1.2% (SA) in September. The National index is up 98% from the post-bubble low set in February 2012 (SA).

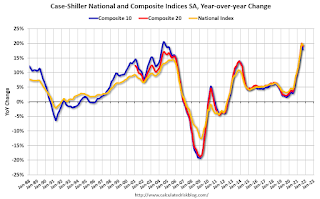

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 17.8% year-over-year. The Composite 20 SA is up 19.1% year-over-year.

The National index SA is up 19.5% year-over-year.

Price increases were slightly below expectations. I'll have more later.

Monday, November 29, 2021

Tuesday: Case-Shiller House Prices, FHFA Conforming Loan Limits, Fed Chair Powell Testimony and More

by Calculated Risk on 11/29/2021 09:02:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Bonds Find Footing After Shaky Start

This morning we found ourselves in the uncomfortable position of watching the bond market backtrack on massive gains at the end of the previous week. This is always a risk when the market goes on a big run--especially on a Friday. But rather than continue to erase Friday's gains, bonds found their footing in the 10am hour as a part of a broader "risk-off" move. [30 year fixed 3.21%]Tuesday:

emphasis added

• At 9:00 AM ET, FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index. The 2022 Conforming loan limits will also be announced.

• At 9:00 AM, S&P/Case-Shiller House Price Index for September. The consensus is for a 19.3% year-over-year increase in the Composite 20 index for September.

• At 9:45 AM, Chicago Purchasing Managers Index for November.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Coronavirus and CARES Act, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

• At 10:30 AM, FDIC Quarterly Banking Profile, Third quarter.

November 29th COVID-19: Holiday Impacted Data

by Calculated Risk on 11/29/2021 08:41:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 59.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 196.8 | --- | ≥2321 | |

| New Cases per Day3 | 72,008 | 91,497 | ≤5,0002 | |

| Hospitalized3 | 41,442 | 42,596 | ≤3,0002 | |

| Deaths per Day3 | 719 | 962 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 59.5%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.6%.

Next up (total population, fully vaccinated according to CDC) are Tennessee at 49.5%, Georgia at 49.4%, Arkansas at 49.3%, Louisiana at 48.9% and North Dakota at 48.7%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

2022 Housing Forecasts

by Calculated Risk on 11/29/2021 06:33:00 PM

Today, in the Newsletter: 2022 Housing Forecasts: Second Look

Excerpt:

The key in 2022 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation. Towards the end of each year, I collect some housing forecasts for the following year.

...

For house prices, there is a very wide spread. As of August, Case-Shiller house prices were up 19.8% year-over-year.

emphasis added

Fed Chair Powell: "Factors pushing inflation upward will linger well into next year"

by Calculated Risk on 11/29/2021 04:42:00 PM

From Fed Chair Powell's prepared testimony: Coronavirus and CARES Act, Excerpt on inflation:

Most forecasters, including at the Fed, continue to expect that inflation will move down significantly over the next year as supply and demand imbalances abate. It is difficult to predict the persistence and effects of supply constraints, but it now appears that factors pushing inflation upward will linger well into next year. In addition, with the rapid improvement in the labor market, slack is diminishing, and wages are rising at a brisk pace.And on the new COVID variant:

emphasis added

The recent rise in COVID-19 cases and the emergence of the Omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation. Greater concerns about the virus could reduce people's willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.Powell will provide his testimony tomorrow at 10AM ET: Coronavirus and CARES Act, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

Black Knight: Number of Mortgages in Forbearance Increased Slightly

by Calculated Risk on 11/29/2021 01:10:00 PM

This data is as of November 23rd.

From Andy Walden at Black Knight: November Forbearance Exits Steady Heading Into Thanksgiving

Active forbearance plan numbers remained relatively steady heading into the Thanksgiving holiday, holding true to the established mid-month pattern.

According to our McDash Flash daily forbearance tracking dataset, the number of active forbearance plans increased by 1,000 this week. A decline among FHA/VA loans (-4,000) was offset by another 5,000 rise in plan volumes among portfolio and PLS mortgages as GSE plans held steady. Both plan extensions and renewals remained steady, but low, in keeping with the typical mid-month lull.br />

As of November 23, 1.01 million mortgage holders (1.9%) of mortgage holders, remain in COVID-19 related forbearance plans, including 1.2% of GSE, 3.0% of FHA/VA and 2.5% of portfolio held and privately securitized loans.

Click on graph for larger image.

Overall, the number of forbearance plans is still down by 214,000 (-17%) from the same time last month, with the potential for additional improvements as we enter December. New plan starts, which have been relatively flat since the end of March, jumped almost 8,000 week over week, a number that will bear closer scrutiny in coming weeks to determine whether this is an anomaly or an inflection point.

emphasis added

Housing Inventory Nov 29th Update: Inventory Down 2.6% Week-over-week

by Calculated Risk on 11/29/2021 11:09:00 AM

Tracking existing home inventory is very important this year and in 2022.

This inventory graph is courtesy of Altos Research.

NAR: Pending Home Sales Increased 7.5% in October

by Calculated Risk on 11/29/2021 10:04:00 AM

From the NAR: Pending Home Sales Jump 7.5% in October

Pending home sales increased in October, rebounding after a decline the month prior, according to the National Association of Realtors®. Contract activity rose month-over-month in each of the four major U.S. regions. On a year-over-year basis, however, transactions were split, as two regions reported drops and two others posted gains.This was well above expectations of a 1.0% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, rose 7.5% to 125.2 in October. Year-over-year, signings fell 1.4%. An index of 100 is equal to the level of contract activity in 2001.

...

Compared to the previous month, contract signings rose at the strongest pace in the Midwest and South regions. Month-over-month, the Northeast PHSI increased 6.9% to 99.5 in October, a 10% drop from a year ago. In the Midwest, the index climbed 11.8% to 124.6 last month, up 5.1% from October 2020.

Pending home sales transactions in the South rose 8.0% to an index of 149.7 in October, up 0.6% from October 2020. The index in the West grew 2.1% in October to 107.5, down 6.2% from a year prior.

emphasis added

Seven High Frequency Indicators for the Economy

by Calculated Risk on 11/29/2021 08:16:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of November 28th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.1% from the same day in 2019 (87.9% of 2019). (Dashed line)

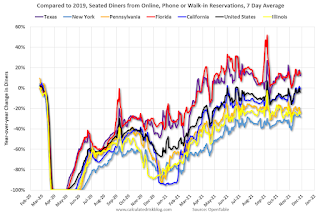

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through November 27, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - and is mostly moving sideways. The 7-day average for the US is down 4% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $127 million last week, down about 53% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through November 13th. The occupancy rate was down 4.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of November 19th, gasoline supplied was up 1.4% compared to the same week in 2019.

There was the tenth week this year that gasoline supplied was up compared to the same week in 2019 - so consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through November 24th

This data is through November 24th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 114% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, November 26th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".