by Calculated Risk on 12/14/2021 09:12:00 AM

Tuesday, December 14, 2021

Missing Workers by Age Group

In November, Goldman Sachs economists put out a research note on the labor force participation rate: Why Isn’t Labor Force Participation Recovering?

While the unemployment rate continues to fall quickly, labor force participation has made no progress since August 2020. ... Most of the 5.0mn persons who have exited the labor force since the start of the pandemic are over age 55 (3.4mn), largely reflecting early (1.5mn) and natural (1mn) retirements that likely won’t reverse. The outlook for prime-age persons who have exited the labor force (1.7mn) is more positive, since very few are discouraged and most still view their exits as temporary.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 634,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

Click on graph for larger image.

Click on graph for larger image.This data is comparing November 2021 to November 2019, using Not Seasonally Adjusted (NSA) data (I compared to November 2019 to minimize the seasonal impact when using NSA data).

Almost all of the missing employed workers - by this method - are in the 25 to 29 and in the 45 to 59 age groups.

Note: this is over a 2-year period, and there have been some demographic shifts between cohorts.

This data would suggest most of the missing workers are prime age or took early retirement (the missing workers in their '50s).

Monday, December 13, 2021

Tuesday: PPI

by Calculated Risk on 12/13/2021 08:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Start Lower, But Could See Some Volatility This Week

... today's effective rates were a bit lower versus Friday afternoon. Improvement mostly followed a bond rally which, in turn, followed weakness in the stock market. Low volume contributed to the size of the move, which is to say it would have been even smaller during a busier time of the year for financial markets.Tuesday:

Nonetheless, things will probably get fairly busy in the middle of the week after the Federal Reserve releases its new policy statement. The Fed is expected to announce that it will curtail its rate-friendly bond purchases at a faster pace. [30 year fixed 3.17%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for November.

• At 8:30 AM, The Producer Price Index for November from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.5% increase in core PPI.

And on COVID:

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 60.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 202.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 116,742 | 106,952 | ≤5,0002 | |

| Hospitalized3🚩 | 54,311 | 51,633 | ≤3,0002 | |

| Deaths per Day3 | 1,131 | 1,144 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

3rd Look at Local Housing Markets in November

by Calculated Risk on 12/13/2021 04:28:00 PM

Today, in the Real Estate Newsletter: 3rd Look at Local Housing Markets in November

Excerpt:

Looks like we will see new record low inventories this winter

...

Here is a summary of active listings for these housing markets in November. Inventory was down 14.7% in November month-over-month (MoM) from October, and down 28.7% year-over-year (YoY).

Inventory almost always declines seasonally in November, so the MoM decline is not a surprise. Last month, these markets were down 25.4% YoY, so the YoY decline in November is larger than in October. This isn’t indicating a slowing market..

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3. Totals do not include Denver (included in state totals).

A Few Comments on Inflation

by Calculated Risk on 12/13/2021 12:19:00 PM

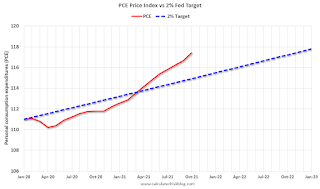

Click on graph for larger image.

Click on graph for larger image.The recent increase in inflation has led to some analysts to call for the Fed to raise rates. For example, from CNBC this morning: El-Erian says ‘transitory’ was the ‘worst inflation call in the history’ of the Fed

“If I were them, I would do three things, which they will not do,” [El-Erian] said during a “Squawk Box” interview. “I would 1) be very open and honest as to why I got the inflation call wrong and try to regain the inflation narrative. 2) I would go even further than doubling the rate of taper, and 3) I would open it up to the possibility that rate hikes may come faster than what the market has. They’re not gonna do that."The FOMC will likely announce a faster pace of tapering assets purchases at the meeting this week, and asset purchases will probably end in March (if not sooner).

The second graph is from January 2005 (just an arbitrary date).

The second graph is from January 2005 (just an arbitrary date).This shows that inflation has been below target for years. If we were doing price targeting (we aren't), then prices would just be getting back to the target.

The graphs for core PCE inflation show the same pattern, but core PCE is even further below the trend line.

The question is not will some prices "stick", but rather will YoY inflation ease back towards the Fed's target? Or will inflation stay elevated?

My sense is inflation will ease back towards the Fed's target over the next year.

Housing Inventory December 13th Update: Inventory Down 3.3% Week-over-week

by Calculated Risk on 12/13/2021 10:14:00 AM

Tracking existing home inventory is very important this year and in 2022.

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 12/13/2021 08:20:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of December 12th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 16.2% from the same day in 2019 (83.8% of 2019). (Dashed line)

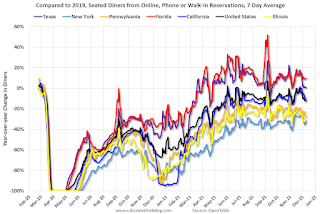

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through December 9, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend but declined after the holiday - and is mostly moving sideways. The 7-day average for the US is down 12% compared to 2019.

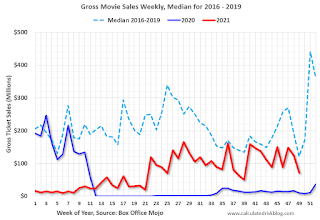

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $70 million last week, down about 42% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through December 4th. The occupancy rate was down 8.8% compared to the same week in 2019. Although down compared to 2019, the 4-week average of the occupancy rate is close to the median rate for the previous 20 years (Blue).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of December 3rd, gasoline supplied was up 0.9% compared to the same week in 2019.

This was the 11th week this year that gasoline supplied was up compared to the same week in 2019 - so consumption is running close to 2019 levels now.

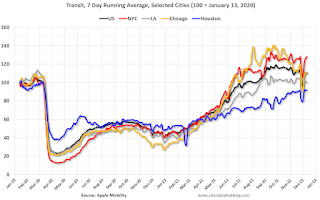

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through December 10th

This data is through December 10th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 111% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, December 10th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, December 12, 2021

Sunday Night Futures

by Calculated Risk on 12/12/2021 07:24:00 PM

Weekend:

• Schedule for Week of December 12, 2021

• FOMC Preview: Accelerated Taper Announcement Expected

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 10 and DOW futures are up 90 (fair value).

Oil prices were up over the last week with WTI futures at $72.55 per barrel and Brent at $75.92 per barrel. A year ago, WTI was at $47, and Brent was at $50 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.32 per gallon. A year ago prices were at $2.14 per gallon, so gasoline prices are up $1.18 per gallon year-over-year.

FOMC Preview: Accelerated Taper Announcement Expected

by Calculated Risk on 12/12/2021 08:11:00 AM

Expectations are the FOMC will announce a faster pace of tapering assets purchases at the meeting this week.

From Goldman Sachs:

"The FOMC is very likely to double the pace of tapering to $30bn per month at its December meeting next week, putting it on track to announce the last two tapers at the January FOMC meeting and to implement the last taper in March. We now expect the FOMC to deliver rate hikes next year in May, July, and November (vs. June, September, and December previously)."Analysts will also be looking for comments on inflation and on rate hikes in 2022.

Wall Street forecasts are for GDP to increase at close to a 6.5% annual rate in Q4 that would put Q4-over-Q4 at around 5.4% - so the FOMC projections for 2021 are now a little on the high side compared to Wall Street.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 5.8 to 6.0 | 3.4 to 4.5 | 2.2 to 2.5 | 2.0 to 2.2 |

| June 2021 | 6.8 to 7.3 | 2.8 to 3.8 | 2.0 to 2.5 | |

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 4.6 to 4.8 | 3.6 to 4.0 | 3.3 to 3.7 | 3.3 to 3.6 |

| June 2021 | 4.4 to 4.8 | 3.5 to 4.0 | 3.2 to 3.8 | |

As of October 2021, PCE inflation was up 5.0% from October 2020. This is above the top end of the projected range for Q4, and projections will be revised up.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 4.0 to 4.3 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

| June 2021 | 3.1 to 3.5 | 1.9 to 2.3 | 2.0 to 2.2 | |

PCE core inflation was up 4.1% in October year-over-year. Core PCE projections will be revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 3.6 to 3.8 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

| June 2021 | 2.9 to 3.1 | 1.9 to 2.3 | 2.0 to 2.2 | |

Saturday, December 11, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 12/11/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 2nd Look at Local Housing Markets in November Adding Houston, Jacksonville, Nashville, New Hampshire, North Texas, Portland and Santa Clara

• The Home ATM in Q3 2021 aka Mortgage Equity Withdrawal (MEW)

• Lawler: Updates on Key Drivers of US Population Growth Lowest Growth in over a Century from 7/1/2020 to 7/1/2021

• 1st Look at Local Housing Markets in November "2022 will be a wild and competitive ride"

• As Forbearance Ends

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of December 12, 2021

by Calculated Risk on 12/11/2021 08:11:00 AM

The key economic reports this week are November Retail Sales and Housing Starts.

For manufacturing, November Industrial Production, and the December New York, Philly and Kansas City Fed surveys, will be released this week.

The FOMC meets this week, and the FOMC is expected to announce a faster taper pace for asset purchases.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for November.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.5% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 1.4% increase in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 1.4% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 25.0, down from 30.9.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 84, up from 83. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce a faster taper pace for asset purchases.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 184 thousand last week.

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.570 million SAAR, up from 1.520 million SAAR.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 27.0, down from 39.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

11:00 AM: the Kansas City Fed manufacturing survey for December.

10:00 AM: State Employment and Unemployment (Monthly) for November