by Calculated Risk on 12/16/2021 09:22:00 AM

Thursday, December 16, 2021

Industrial Production Increased 0.5 Percent in November

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.5 percent in November. The indexes for both manufacturing and mining increased 0.7 percent, while the index for utilities decreased 0.8 percent.

At 102.3 percent of its 2017 average, total industrial production in November was 5.3 percent above its year-earlier level and at its highest reading since September 2019. Capacity utilization for the industrial sector increased 0.3 percentage point to 76.8 percent; even so, it was 2.8 percentage points below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

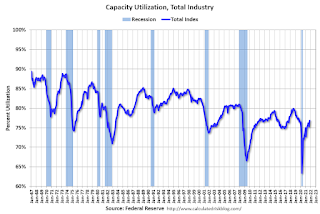

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 76.8% is 2.8% below the average from 1972 to 2020. This was at consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 102.3. This is above the February 2020 level.

The change in industrial production was slightly below consensus expectations.

Weekly Initial Unemployment Claims Increase to 206,000

by Calculated Risk on 12/16/2021 08:45:00 AM

The DOL reported:

In the week ending December 11, the advance figure for seasonally adjusted initial claims was 206,000, an increase of 18,000 from the previous week's revised level. The previous week's level was revised up by 4,000 from 184,000 to 188,000. The 4-week moving average was 203,750, a decrease of 16,000 from the previous week's revised average. This is the lowest level for this average since November 15, 1969 when it was 202,750. The previous week's average was revised up by 1,000 from 218,750 to 219,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 203,750.

The previous week was revised up.

Regular state continued claims decreased to 1,845,000 (SA) from 1,999,000 (SA) the previous week.

Weekly claims were sligthly above the consensus forecast.

Housing Starts Increased to 1.679 million Annual Rate in November

by Calculated Risk on 12/16/2021 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in November were at a seasonally adjusted annual rate of 1,679,000. This is 11.8 percent above the revised October estimate of 1,502,000 and is 8.3 percent above the November 2020 rate of 1,551,000. Single‐family housing starts in November were at a rate of 1,173,000; this is 11.3 percent above the revised October figure of 1,054,000. The November rate for units in buildings with five units or more was 491,000.

Building Permits:

Privately‐owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,712,000. This is 3.6 percent above the revised October rate of 1,653,000 and is 0.9 percent above the November 2020 rate of 1,696,000. Single‐family authorizations in November were at a rate of 1,103,000; this is 2.7 percent above the revised October figure of 1,074,000. Authorizations of units in buildings with five units or more were at a rate of 560,000 in November.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in November compared to October. Multi-family starts were up 37% year-over-year in November.

Single-family starts (red) increased in November, and were down 0.7% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in November were above expectations, and starts in September and October were up slightly revised, combined.

I'll have more later …

Wednesday, December 15, 2021

Thursday: Housing Starts, Unemployment Claims, Industrial Production and more

by Calculated Risk on 12/15/2021 07:48:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 184 thousand last week.

• Also at 8:30 AM, Housing Starts for November. The consensus is for 1.570 million SAAR, up from 1.520 million SAAR.

• Also at 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 27.0, down from 39.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

And on COVID:

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 61.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 202.8 | --- | ≥2321 | |

| New Cases per Day3 | 117,950 | 121,889 | ≤5,0002 | |

| Hospitalized3🚩 | 49,594 | 44,777 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,143 | 1,122 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

FOMC Projections and Press Conference

by Calculated Risk on 12/15/2021 02:13:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

Here are the projections. In September, about half of participants expected one rate hike in 2022. Now, participants expect 3 rate hikes in 2022.

Wall Street forecasts are for GDP to increase at close to a 6.5% annual rate in Q4 that would put Q4-over-Q4 at around 5.4% - so the FOMC projections for 2021 were revised down.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Dec 2021 | 5.5 | 3.6 to 4.5 | 2.0 to 2.5 | 1.8 to 2.0 |

| Sept 2021 | 5.8 to 6.0 | 3.4 to 4.5 | 2.2 to 2.5 | 2.0 to 2.2 |

The unemployment rate was at 4.2% in November.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Dec 2021 | 4.2 to 4.3 | 3.4 to 3.7 | 3.2 to 3.6 | 3.2 to 3.7 |

| Sept 2021 | 4.6 to 4.8 | 3.6 to 4.0 | 3.3 to 3.7 | 3.3 to 3.6 |

As of October 2021, PCE inflation was up 5.0% from October 2020.

The projections for inflation were revised up sharply and the FOMC sees inflation solidly above target in 2022 and 2023.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Dec 2021 | 5.3 to 5.4 | 2.2 to 3.0 | 2.1 to 2.5 | 2.0 to 2.2 |

| Sept 2021 | 4.0 to 4.3 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

PCE core inflation was up 4.1% in October year-over-year.

Projections for core inflation were revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Dec 2021 | 4.4 | 2.5 to 3.0 | 2.1 to 2.4 | 2.0 to 2.2 |

| Sept 2021 | 3.6 to 3.8 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

FOMC Statement: Accelerate Taper

by Calculated Risk on 12/15/2021 02:04:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but continue to be affected by COVID-19. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation having exceeded 2 percent for some time, the Committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment. In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities. Beginning in January, the Committee will increase its holdings of Treasury securities by at least $40 billion per month and of agency mortgage‑backed securities by at least $20 billion per month. The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook. The Federal Reserve's ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

emphasis added

The Household Mystery

by Calculated Risk on 12/15/2021 01:01:00 PM

Today, in the Real Estate Newsletter: The Household Mystery

Excerpt:

Using the Census Bureau data, we can calculate the impact the number of households needed in the 1970s due to 1) population growth, and 2) changes in household size:

Over those 12 years, the US needed an additional 950 thousand housing units per year due to the changes in household size. However, the US only needed about 550 thousand housing units per year due to population growth. Because of the changes in household size, the U.S. needed far more additional housing units in the '70s than in recent years with the number of persons per household relatively stable.

Notes for all tables:

Over the last two years - in 2020 and 2021 - the US needed very few new housing units due to population growth, so the demand for homeownership and rentals must be coming mostly from smaller household size. (NOTE: There was also significant 2nd home buying and other reasons).

Is something similar happening now to household size with the millennials? It probably is, and unfortunately household data is not timely or reliable.

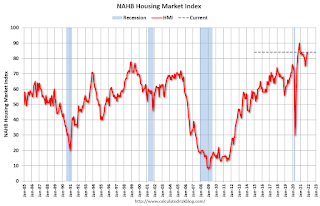

NAHB: Builder Confidence Increased to 84 in December

by Calculated Risk on 12/15/2021 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 84, up from 83 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Home Builder Sentiment Strong at Year’s End

Despite inflation concerns and ongoing production bottlenecks, home builder confidence edged higher for the fourth consecutive month on strong consumer demand and limited existing inventory. Builder sentiment in the market for newly built single-family homes moved one point higher to 84 in December, according to the NAHB/Wells Fargo Housing Market Index (HMI) released today. This ties the highest reading of the year that was posted in February.

“While demand remains strong, finding workers, predicting pricing and dealing with material delays remains a challenge,” said NAHB Chairman Chuck Fowke. “Policymakers need to work on supply chain improvements and controlling costly inflation. Addressing lumber tariffs would be a good place to start.”

“The most pressing issue for the housing sector remains lack of inventory,” said NAHB Chief Economist Robert Dietz. “Building has increased but the industry faces constraints, namely cost/availability of materials, labor and lots. And while 2021 single-family starts are expected to end the year 24% higher than the pre-Covid 2019 level, we expect higher interest rates in 2022 will put a damper on housing affordability.”

...

The HMI index gauging current sales conditions rose one point to 90 and the gauge charting traffic of prospective buyers also posted a one-point gain to 70. The component measuring sales expectations in the next six months held steady for the third consecutive month at 84.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose four points to 74, the Midwest posted a two-point gain to 74 and the South and West each posted a three-point rise to 87, respectively.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast, and a strong reading.

Retail Sales Increased 0.3% in November

by Calculated Risk on 12/15/2021 08:36:00 AM

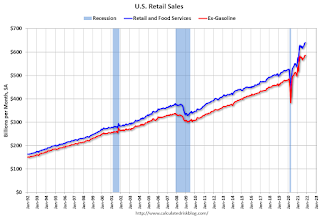

On a monthly basis, retail sales were increased 0.3% from October to November (seasonally adjusted), and sales were up 18.2 percent from November 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for November 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $639.8 billion, an increase of 0.3 percent from the previous month, and 18.2 percent above November 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 15.6% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 15.6% on a YoY basis.Sales in November were well below expectations, and sales in September and October were revised down, combined.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 12/15/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

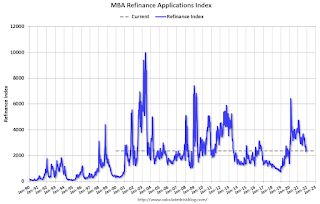

Mortgage applications decreased 4.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 10, 2021.

... The Refinance Index decreased 6 percent from the previous week and was 41 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 9 percent lower than the same week one year ago.

“Applications to refinance fell over the week, despite the 30-year fixed rate remaining at 3.30 percent. With rates more than 40 basis points higher than last year, applications were down 41 percent on an annual basis. Fewer homeowners have a strong incentive to refinance at current rates,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity increased slightly, as a 1.7 percent rise in conventional applications offset a 1.6 percent decline in applications for government loans. The strength in conventional purchase activity continues to support higher loan balances, which moved back over $400,000. Housing demand remains strong as the year comes to an end amidst tight inventory and steep home-price growth.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) remained unchanged at 3.30 percent, with points remaining unchanged at 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains slightly elevated, but down sharply from last year.

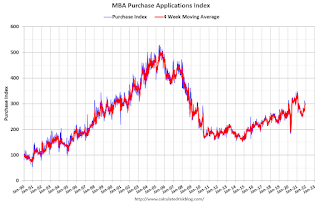

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 9% year-over-year unadjusted.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).