by Calculated Risk on 12/17/2021 07:24:00 PM

Friday, December 17, 2021

December 17th COVID-19: Cases, Hospitalizations and Deaths Increasing

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 61.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 203.5 | --- | ≥2321 | |

| New Cases per Day3🚩 | 122,296 | 120,444 | ≤5,0002 | |

| Hospitalized3🚩 | 59,995 | 54,937 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,179 | 1,090 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Lawler: Early Read on Existing Home Sales in November

by Calculated Risk on 12/17/2021 11:50:00 AM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.45 million in November, up 1,7% from October’s preliminary pace but down 2.1% from last November’s seasonally adjusted pace. Unadjusted sales should be little changed from a year earlier, with the SA/NSA difference reflecting this November’s higher business day count relative to last November’s.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY % decline in the inventory of existing homes for sale last month was larger than was the case in October.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 13.0% from last November.

CR Note: The National Association of Realtors (NAR) is scheduled to release November existing home sales on Wednesday, December 22, 2021, at 10:00 AM ET. The consensus is for 6.20 million SAAR. Take the over.

Q4 GDP Forecasts: Up to 7%

by Calculated Risk on 12/17/2021 10:01:00 AM

From Goldman Sachs:

We boosted our Q4 GDP tracking estimate by 0.5pp to +7.0% (qoq ar), reflecting the further recovery in auto production and the sharp rise in housing starts in November. [December 16 estimate]From BofA:

emphasis added

4Q GDP tracking moved up to 6.5% qoq saar from 6.0%, reflecting the strong signal from the BAC card spending data. [December 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 7.2 percent on December 16, up from 7.0 percent on December 15. [December 16 estimate]

4th Look at Local Housing Markets in November

by Calculated Risk on 12/17/2021 08:07:00 AM

Today, in the Real Estate Newsletter: 4th Look at Local Housing Markets in November

Excerpt:

This update adds Austin, California, Des Moines, Memphis, Minneapolis, Minnesota, Rhode Island, and Sacramento.

...

Here is a summary of active listings for these housing markets in November. Inventory was down 15.3% in November month-over-month (MoM) from October, and down 26.7% year-over-year (YoY).

Inventory almost always declines seasonally in November, so the MoM decline is not a surprise. Last month, these markets were down 23.4% YoY, so the YoY decline in November is larger than in October. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3. Totals do not include Denver or Minneapolis (included in state totals).

Thursday, December 16, 2021

December 16th COVID-19: Hospitalizations and Deaths Increasing

by Calculated Risk on 12/16/2021 09:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 61.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 203.2 | --- | ≥2321 | |

| New Cases per Day3 | 119,546 | 121,284 | ≤5,0002 | |

| Hospitalized3🚩 | 59,354 | 54,042 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,187 | 1,099 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Hotels: Occupancy Rate Down 5% Compared to Same Week in 2019

by Calculated Risk on 12/16/2021 02:17:00 PM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

U.S. hotel performance increased from the previous week, according to STR‘s latest data through December 11.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

December 5-11, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 57.4% (-4.8%)

• Average daily rate (ADR): $128.35 (+2.3%)

• Revenue per available room (RevPAR): $73.73 (-2.7%)

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

AIA: "Demand for design services continues to grow" in November

by Calculated Risk on 12/16/2021 12:33:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Demand for design services continues to grow

Architecture firms reported increasing demand for design services for the tenth consecutive month in November, according to a new report today from The American Institute of Architects (AIA).

The ABI score for November was 51.0, down from 54.3 the previous month. While this score is down slightly from October’s score, it still indicates positive business conditions overall (any score above 50 indicates billings growth). During November, scoring for both the new project inquiries and design contracts moderated slightly, but remained in positive territory, posting scores of 59.4 and 55.8 respectively.

“The period of elevated billing scores nationally, and across the major regions and construction sectors seems to be winding down for this cycle,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Ongoing external challenges like labor shortages, supply chain disruptions, spiking inflation, and prospects for rising interest rates will likely continue to slow the growth in firm billings in the coming months.”

...

• Regional averages: Midwest (57.6); South (53.7); West (50.9); Northeast (45.5)

• Sector index breakdown: mixed practice (56.9); multi-family residential (51.4); commercial/industrial (50.5); institutional (50.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.0 in November, down from 54.3 in October. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index was below 50 for eleven consecutive months, but has been positive for the last ten months.

November Housing Starts: Most Housing Units Under Construction Since 1973

by Calculated Risk on 12/16/2021 10:08:00 AM

Today, in the Real Estate Newsletter: November Housing Starts: Most Housing Units Under Construction Since 1973

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Red is single family units. Currently there are 752 thousand single family units under construction (SA). This is the highest level since March 2007.

For single family, most of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since most of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices.

Blue is for 2+ units. Currently there are 734 thousand multi-family units under construction. This is the highest level since July 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Census will release data next year on the length of time from start to completion, and that will probably show long delays in 2021. In 2020, it took an average of 6.8 months from start to completion for single family homes, and 15.4 months for buildings with 2 or more units.

Combined, there are 1.486 million units under construction. This is the most since 1973.

Industrial Production Increased 0.5 Percent in November

by Calculated Risk on 12/16/2021 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.5 percent in November. The indexes for both manufacturing and mining increased 0.7 percent, while the index for utilities decreased 0.8 percent.

At 102.3 percent of its 2017 average, total industrial production in November was 5.3 percent above its year-earlier level and at its highest reading since September 2019. Capacity utilization for the industrial sector increased 0.3 percentage point to 76.8 percent; even so, it was 2.8 percentage points below its long-run (1972–2020) average.

emphasis added

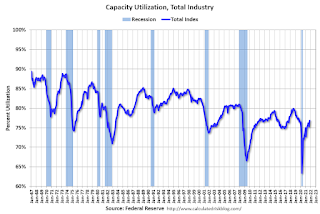

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 76.8% is 2.8% below the average from 1972 to 2020. This was at consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 102.3. This is above the February 2020 level.

The change in industrial production was slightly below consensus expectations.

Weekly Initial Unemployment Claims Increase to 206,000

by Calculated Risk on 12/16/2021 08:45:00 AM

The DOL reported:

In the week ending December 11, the advance figure for seasonally adjusted initial claims was 206,000, an increase of 18,000 from the previous week's revised level. The previous week's level was revised up by 4,000 from 184,000 to 188,000. The 4-week moving average was 203,750, a decrease of 16,000 from the previous week's revised average. This is the lowest level for this average since November 15, 1969 when it was 202,750. The previous week's average was revised up by 1,000 from 218,750 to 219,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 203,750.

The previous week was revised up.

Regular state continued claims decreased to 1,845,000 (SA) from 1,999,000 (SA) the previous week.

Weekly claims were sligthly above the consensus forecast.