by Calculated Risk on 1/29/2022 02:11:00 PM

Saturday, January 29, 2022

Real Estate Newsletter Articles this Week

At the Calculated Risk Real Estate Newsletter this week:

• Final Look at Local Housing Markets in December No Signs of Slowing; Inventory at Record Lows

• Case-Shiller National Index up 18.8% Year-over-year in November FHFA: "House price levels remained elevated in November, but the data indicate a pivot"

• December New Home Sales: Inventory of homes under construction highest since 2007 New Home Sales increase to 811,000 Annual Rate in December; Sales down 7.3% in 2021

• Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in NovemberAnd a look at "Affordability"

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free, but please subscribe!.

Schedule for Week of January 30, 2022

by Calculated Risk on 1/29/2022 08:11:00 AM

The key report scheduled for this week is the January employment report.

Other key indicators include January ISM manufacturing and services surveys, and January vehicle sales.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 61.7, down from 64.3 in December.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional Fed manufacturing surveys for November.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices for January.

8:00 AM: Corelogic House Price index for December.

10:00 AM: Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in November to 10.6 million from 11.1 million in October.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 57.5, down from 58.8 in December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 208,000 payroll jobs added in January, down from 807,000 added in December.

10:00 AM: the Q4 2021 Housing Vacancies and Homeownership from the Census Bureau.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 250 thousand from 260 thousand last week.

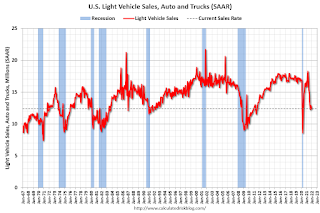

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 12.6 million SAAR in January, up from 12.4 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 12.6 million SAAR in January, up from 12.4 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

10:00 AM: the ISM Services Index for January.

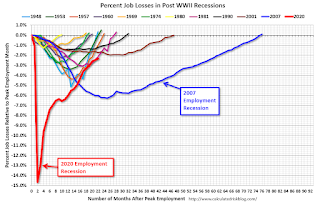

8:30 AM: Employment Report for January. The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%. There were 199 thousand jobs added in December, and the unemployment rate was at 3.9%.

8:30 AM: Employment Report for January. The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%. There were 199 thousand jobs added in December, and the unemployment rate was at 3.9%.This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 20 months after the onset, is now significantly better than the "Great Recession".

Friday, January 28, 2022

COVID Update: January 28, 2022: Falling Cases and Hospitalizations; 2,300 Deaths per Day

by Calculated Risk on 1/28/2022 09:01:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 211.3 | --- | ≥2321 | |

| New Cases per Day3 | 577,748 | 726,986 | ≤5,0002 | |

| Hospitalized3 | 139,164 | 146,333 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,300 | 1,910 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

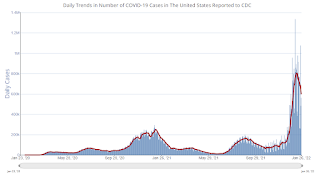

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Hotels: Occupancy Rate Down 16% Compared to Same Week in 2019

by Calculated Risk on 1/28/2022 01:52:00 PM

U.S. hotel performance remained relatively flat from the previous week, according to STR‘s latest data through Jan. 22.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Jan. 16-22, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 48.7% (-15.9%)

• Average daily rate (ADR): $122.17 (-1.4%)

• Revenue per available room (RevPAR): $59.52 (-17.1%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

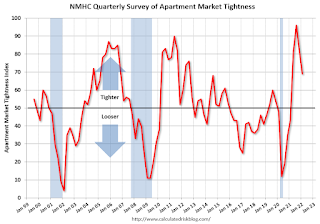

NMHC: January Apartment Market Survey shows "Strong Demand, Record-High Occupancy, Double Digit Rent Growth"

by Calculated Risk on 1/28/2022 11:01:00 AM

From the National Multifamily Housing Council (NMHC): January Apartment Market Conditions Show Improvement

Apartment market conditions generally improved according to the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for January 2022. The Market Tightness (69), Sales Volume (59), and Equity Financing (67) indexes all came in above the breakeven level (50) for the fourth quarter in a row, though many respondents indicated conditions remained unchanged across the indexes. The Debt Financing (36) index indicated weaker conditions for the second consecutive quarter.

“We are continuing to witness strong demand for apartments across the entire U.S., but most notably in the Sun Belt, where most markets have seen double-digit rent growth that has more than made up for the pandemic slowdown,” noted NMHC’s Chief Economist, Mark Obrinsky. “And even as construction continues to rebound from the lows of 2020, absorptions have more than kept pace, such that apartment occupancy remains at record-highs.”

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

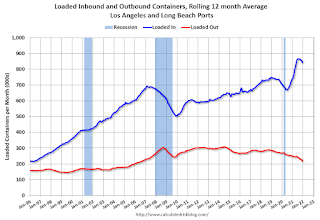

LA Area Port Traffic: Disappointing Traffic in December

by Calculated Risk on 1/28/2022 10:16:00 AM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, incoming port traffic is backed up significantly in the LA area with numerous ships at anchor waiting to unload.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic was down 1.2% in December compared to the rolling 12 months ending in November. Outbound traffic was down 2.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down 14% YoY in December, and exports were down 27% YoY.

Personal Income increased 0.3% in December; Spending decreased 0.6%

by Calculated Risk on 1/28/2022 08:37:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $70.7 billion (0.3 percent) in December according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $39.9 billion (0.2 percent) and personal consumption expenditures (PCE) decreased $95.2 billion (0.6 percent).The December PCE price index increased 5.8 percent year-over-year and the PCE price index, excluding food and energy, increased 4.9 percent year-over-year.

Real DPI decreased 0.2 percent in December and Real PCE decreased 1.0 percent; goods decreased 3.1 percent and services increased 0.1 percent. The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.5 percent

emphasis added

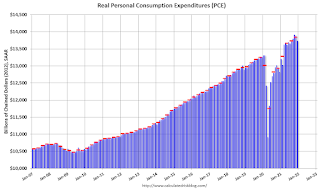

The following graph shows real Personal Consumption Expenditures (PCE) through December 2021 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was slightly below expectations, and the decrease in PCE was also slightly below expectations.

Thursday, January 27, 2022

Friday: Personal Income and Outlays

by Calculated Risk on 1/27/2022 08:25:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.5% increase in personal income, and for a 0.5% decrease in personal spending. And for the Core PCE price index to increase 0.5%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 68.6.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 211.2 | --- | ≥2321 | |

| New Cases per Day3 | 596,859 | 744,805 | ≤5,0002 | |

| Hospitalized3 | 139,974 | 145,650 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,288 | 1,829 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

A Few Comments on Q4 GDP and Investment

by Calculated Risk on 1/27/2022 02:53:00 PM

Earlier from the BEA: Gross Domestic Product, Fourth Quarter and Year 2021 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 6.9 percent in the fourth quarter of 2021, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.3 percent....On a Q4-over-Q4 basis, GDP was up 5.5%. An annual basis, GDP was up 5.7% in 2021 from 2020.

The increase in real GDP primarily reflected increases in private inventory investment, exports, personal consumption expenditures (PCE), and nonresidential fixed investment that were partly offset by decreases in both federal and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

The advance Q4 GDP report, at 6.9% annualized, was above expectations, primarily due to a strong increase in inventories.

Personal consumption expenditures (PCE) increased at a 3.3% annualized rate in Q4.

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So, the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern didn't apply.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.Residential investment (RI) decreased at a 0.8% annual rate in Q4. Equipment investment increased at a 0.8% annual rate, and investment in non-residential structures decreased at a 11.4% annual rate.

On a 3-quarter trailing average basis, RI (red) is down, equipment (green) is up, and nonresidential structures (blue) is still down.

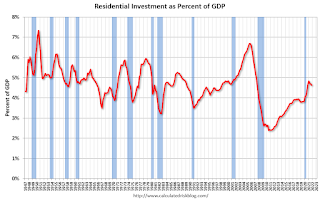

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP decreased in Q4.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single-family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

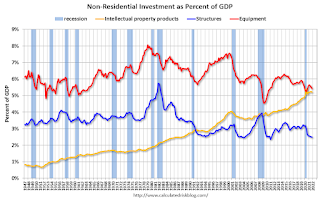

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in November

by Calculated Risk on 1/27/2022 12:00:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in November

Excerpt:

I’ve put together my own affordability index - since 1976 - that is similar to the FirstAm approach (more of a house price index adjusted by mortgage rates and the median household income).

I used median income from the Census Bureau (estimated 2021), assumed a 15% down payment, and used a 2% estimate for property taxes, insurance and maintenance. This is probably low for high property tax states like New Jersey and Texas, and too high for lower property tax states. If we were including condos, we’d also include HOA fees too (this is excluded).

For house prices, I used the Case-Shiller National Index, Seasonally Adjusted (SA). Also, for the down payment - there wasn’t a significant difference between 15% and 20%. For mortgage rates, I used the Freddie Mac PMMS (30-year fixed rates).

So here is what the index looks like (lower is more affordable like the FirstAm index)

...

In general, this would suggest houses are somewhat affordable right now (due to low mortgage rates). But this says nothing about if “now is a good time to buy” (see the bottom of my post Housing: A Look at "Affordability" Indexes).

Also, in November, the average 30-year mortgage rates were around 3.071%, and currently mortgage rates are close to 3.74% - so we already know the “Affordability Price Index” will increase over the next couple of months (meaning houses are less affordable).

emphasis added