by Calculated Risk on 2/01/2022 04:05:00 PM

Tuesday, February 01, 2022

Las Vegas Visitor Authority for December: Visitor Traffic Down 13.3% Compared to 2019

From the Las Vegas Visitor Authority: December 2021 Las Vegas Visitor Statistics

Las Vegas visitation saw positive gains through much of 2021, ending the year with 32.2M visitors, about three‐quarters of pre‐COVID volume but well ahead of the 19M visitors hosted in 2020.

Amidst the challenges of COVID, active and evolving safety and health protocols across the destination allowed Las Vegas conventions and meetings to continue in 2021 with an estimated attendance of 2.2 million for the year, roughly a third of pre‐COVID levels.

Overall hotel occupancy approached 67% for the year, dramatically ahead of 2020's 42.1% tally but below the 88.9% level of 2019. In part due to the challenged convention group segment, Midweek saw annual occupancy reach 60.5%, +23.1 pts vs. 2020 but ‐25.8 pts vs. 2019. Compared to midweek activity, weekends saw a stronger recovery, exceeding 87% in seven out of twelve months and ending the year at 81.3% (+28.5 pts vs. 2020 and ‐13.6 pts vs. 2019).

Click on graph for larger image.

Click on graph for larger image. This graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 13.3% compared to the same month in 2019.

Rents Still Increasing Sharply Year-over-year

by Calculated Risk on 2/01/2022 01:10:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Rents Still Increasing Sharply Year-over-year

A brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through December 2021 (Apartment List through January 2022).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

The Zillow measure is up 13.9% YoY in December, up from 13.2% YoY in November. And the ApartmentList measure is up 17.8% as of December, down slightly from 17.9% in November.

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 3.8% YoY in December, from 3.5% YoY in November - and will likely increase further in the coming months.

Construction Spending Increased 0.2% in December

by Calculated Risk on 2/01/2022 12:19:00 PM

From the Census Bureau reported that overall construction spending increased 0.2%:

Construction spending during December 2021 was estimated at a seasonally adjusted annual rate of $1,639.9 billion, 0.2 percent above the revised November estimate of $1,636.5 billion. The December figure is 9.0 percent above the December 2020 estimate of $1,504.2 billion.Private spending increased and public spending decreased:

The value of construction in 2021 was $1,589.0 billion, 8.2 percent above the $1,469.2 billion spent in 2020.

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,292.9 billion, 0.7 percent above the revised November estimate of $1,283.8 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $347.0 billion, 1.6 percent below the revised November estimate of $352.7 billion.

Click on graph for larger image.

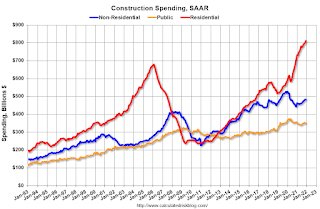

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 19% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 16% above the bubble era peak in January 2008 (nominal dollars) but has been soft recently.

Public construction spending is 7% above the peak in March 2009.

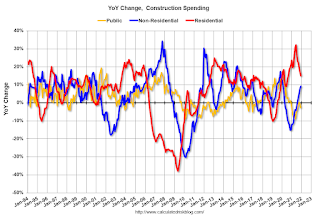

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 15.0%. Non-residential spending is up 9.1% year-over-year. Public spending is down 2.9% year-over-year.

Construction was considered an essential service during the early months of the pandemic in most areas and did not decline sharply like many other sectors. However, some sectors of non-residential have been under pressure. For example, lodging is down 23% YoY.

ISM® Manufacturing index Decreased to 57.6% in January

by Calculated Risk on 2/01/2022 10:09:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion in December. The PMI® was at 57.3% in January, down from 58.8% in December. The employment index was at 54.5%, up from 53.9% last month, and the new orders index was at 57.9%, down from 61.0%.

From ISM: Manufacturing PMI® at 57.6% January 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in January, with the overall economy achieving a 20th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at a slightly slower pace in January than in December.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The January Manufacturing PMI® registered 57.6 percent, a decrease of 1.2 percentage points from the seasonally adjusted December reading of 58.8 percent. This figure indicates expansion in the overall economy for the 20th month in a row after a contraction in April and May 2020. The New Orders Index registered 57.9 percent, down 3.1 percentage points compared to the seasonally adjusted December reading of 61 percent. The Production Index registered 57.8 percent, a decrease of 1.6 percentage points compared to the seasonally adjusted December reading of 59.4 percent. The Prices Index registered 76.1 percent, up 7.9 percentage points compared to the December figure of 68.2 percent. The Backlog of Orders Index registered 56.4 percent, 6.4 percentage points lower than the December reading of 62.8 percent. The Employment Index registered 54.5 percent, 0.6 percentage point higher compared to the seasonally adjusted December reading of 53.9 percent. The Supplier Deliveries Index registered 64.6 percent, down 0.3 percentage point from the December figure of 64.9 percent. The Inventories Index registered 53.2 percent, 1.4 percentage points lower than the seasonally adjusted December reading of 54.6 percent. The New Export Orders Index registered 53.7 percent, up 0.1 percentage point compared to the December reading of 53.6 percent. The Imports Index registered 55.1 percent, a 1.3-percentage point increase from the December reading of 53.8 percent.”

emphasis added

BLS: Job Openings "little changed" at 10.9 million in December

by Calculated Risk on 2/01/2022 10:04:00 AM

From the BLS: Job Openings and Labor Turnover Summary

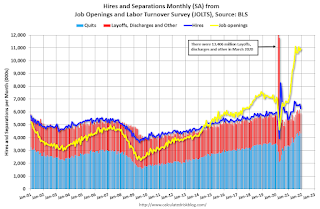

The number of job openings was little changed at 10.9 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Hires and total separations decreased to 6.3 million and 5.9 million, respectively. Within separations, the quits rate was little changed at 2.9 percent. The layoffs and discharges rate was little changed at 0.8 percent, a series low.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for December, the employment report on Friday will be for January.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in December to 10.9 million from 10.8 million in November.

The number of job openings (yellow) were up 62% year-over-year.

Quits were up 27% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

CoreLogic: House Prices up 18.5% YoY in December

by Calculated Risk on 2/01/2022 08:00:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Upward Trend in Annual Home Price Appreciation Continues; Up 18.5% in December

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2021.

Consumer desire for homeownership against persistently low supply of for-sale homes created one of the hottest housing markets in decades in 2021 — and spurred record-breaking home price growth. Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%. Home price growth in 2021 started off at 10% in the first quarter, steadily increasing and ending the year with an increase of 18% for the fourth quarter.

While there have been questions surrounding whether we are currently in a housing bubble, the CoreLogic Market Risk Indicators suggest a small probability of a nationwide price decline, and points to the larger likelihood that a fall in price will be limited to specific, at-risk markets. Still, the CoreLogic HPI Forecast shows the national 12-month growth steadily slowing over 2022. During the early months of the year, it’s projected to remain above 10% while decelerating each month to a 12-month rise of 3.5% by December 2022. Comparing the average projected National HPI for 2022 with the previous year, the CoreLogic HPI Forecast shows the annual average up 9.6% in 2022.

"Much of what we’ve seen in the run-up of home prices over the last year has been the result of a perfect storm of supply and demand pressures,” said Dr. Frank Nothaft, chief economist at CoreLogic. “As we move further into 2022, economic factors – such as new home building and a rise in mortgage rates – are in motion to help relieve some of this pressure and steadily temper the rapid home price acceleration seen in 2021.”

...

Nationally, home prices increased 18.5% in December 2021, compared to December 2020. On a month-over-month basis, home prices increased by 1.3% compared to November 2021.

...

Home price gains are projected to slow to a 3.5% annual increase by December 2022.

emphasis added

Monday, January 31, 2022

Tuesday: Construction Spending, Job Openings, ISM Mfg

by Calculated Risk on 1/31/2022 08:03:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates in a Lull After January's Rapid Rise

... we're in a holding pattern ... As for today itself, most lenders offered just slightly lower rates compared to last Friday, but still well within the range seen last week. [30 year fixed 3.68%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for December.

• At 10:00 AM, Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

• Also, at 10:00 AM, Job Openings and Labor Turnover Survey for December from the BLS.

• Also, at 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to be at 57.5, down from 58.8 in December.

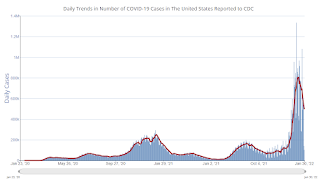

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 211.8 | --- | ≥2321 | |

| New Cases per Day3 | 497,296 | 680,381 | ≤5,0002 | |

| Hospitalized3 | 126,699 | 145,610 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,234 | 2,023 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

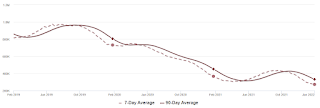

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in December

by Calculated Risk on 1/31/2022 04:06:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 1.25% in December, from 1.33% in November. The serious delinquency rate is down from 2.87% in December 2020.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 3.48% are seriously delinquent (down from 3.61% in November).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Freddie Mac reported earlier.

Median vs Repeat Sales Index House Prices

by Calculated Risk on 1/31/2022 12:50:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Median vs Repeat Sales Index House Prices

Excerpt:

Back in October, I wrote The Coming Deceleration in House Price Growth. In that post, I noted that the median prices (as reported by the National Association of Realtors® (NAR) was showing a slowdown in year-over-year (YoY) house price growth.

In October ... the YoY growth in median prices started falling - and I expected Case-Shiller to follow.

Sure enough, the YoY growth in the Case-Shiller has shown deceleration.

...

The Case-Shiller index will probably show slower YoY growth over the next couple of reports, however median prices have picked up over the last two months - so there isn’t evidence of a sharp decline in the YOY growth.

emphasis added

Housing Inventory January 31st Update: Inventory Down 1.9% Week-over-week; New Record Low

by Calculated Risk on 1/31/2022 09:50:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.