by Calculated Risk on 2/02/2022 04:00:00 PM

Wednesday, February 02, 2022

Mike Simonsen of Altos Research and I Discuss Housing

Mike Simonsen of Altos Research and I discussed housing on “Top of the Mind”.

Here is webpage: Looking for Risks in the Future of the Real Estate Market

We discussed:

• Bill McBride shares why he started the Calculated Risk blog

• How Bill predicted the 2005 housing bubble

• What risks does Bill foresee in the future real estate market?

• Why are there fewer houses for sale, and is it a problem?

• Millennial home-buying trends

• Bill’s predictions for the second half of 2022

• Real estate trends outside of the US

• Why sellers should wait for multiple offers instead of taking the first one

• What’s the next big shift in the real estate market?

• How the remote working trend is impacting the real estate market

Update: Framing Lumber Prices Up More Than Double from Two Years Ago

by Calculated Risk on 2/02/2022 01:54:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through February 2nd.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.A combination of strong demand and various supply constraints have pushed up the price of lumber.

HVS: Q4 2021 Homeownership and Vacancy Rates

by Calculated Risk on 2/02/2022 10:14:00 AM

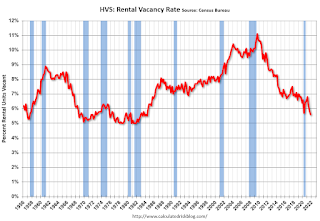

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2021.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the fourth quarter 2021 were 5.6 percent for rental housing and 0.9 percent for homeowner housing. The rental vacancy rate was 0.9 percentage points lower than the rate in the fourth quarter 2020 (6.5 percent) and not statistically different from the rate in the third quarter 2021 (5.8 percent).

The homeowner vacancy rate of 0.9 percent was 0.1 percentage points lower than the rate in the fourth quarter 2020 (1.0 percent) and virtually the same as the rate in the third quarter 2021 (0.9 percent).

The homeownership rate of 65.5 percent was not statistically different from the rate in the fourth quarter 2020 (65.8 percent) and not statistically different from the rate in the third quarter 2021 (65.4 percent). "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st, 1990, 2000 and 2010. The Census Bureau will release data for 2020 soon.

The results starting in Q2 2020 were distorted by the pandemic.

The HVS homeowner vacancy was unchanged at 0.9% in Q4.

The HVS homeowner vacancy was unchanged at 0.9% in Q4. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

ADP: Private Employment Decreased 301,000 in January

by Calculated Risk on 2/02/2022 08:19:00 AM

Private sector employment decreased by 301,000 jobs from December to January according to the January ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was well below the consensus forecast of 208,000 for this report.

“The labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth,” said Nela Richardson, chief economist, ADP. “The majority of industry sectors experienced job loss, marking the most recent decline since December 2020. Leisure and hospitality saw the largest setback after substantial gains in fourth quarter 2021, while small businesses were hit hardest by losses, erasing most of the job gains made in December 2021.”

emphasis added

The BLS report will be released Friday, and the consensus is for 155 thousand non-farm payroll jobs added in January. The ADP report has not been very useful in predicting the BLS report, but this suggests weakness in the January BLS report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 2/02/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 12.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 28, 2022.

... The Refinance Index increased 18 percent from the previous week and was 50 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 7 percent lower than the same week one year ago.

“Most mortgage rates in MBA’s survey continued to rise, with the 30-year fixed rate reaching its highest level since March 2020 at 3.78 percent. Despite the increase in rates, refinance applications were up 18 percent, driven mainly by a 22 percent jump in conventional applications. There has likely been some recent volatility in application counts due to holiday-impacted weeks, as well as from borrowers trying to secure a refinance before rates go even higher,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications also increased in the final full week of January but remained 7 percent lower than a year ago. The average purchase loan size hit a new survey high once again at $441,100. Stubbornly low inventory levels and swift home-price growth continue to push average loan sizes higher.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.78 percent from 3.72 percent, with points decreasing to 0.41 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 7% year-over-year unadjusted.

According to the MBA, purchase activity is down 7% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, February 01, 2022

Wednesday: ADP Employment, Q4 Housing Vacancies and Homeownership

by Calculated Risk on 2/01/2022 08:47:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 208,000 payroll jobs added in January, down from 807,000 added in December.

• At 10:00 AM, the Q4 2021 Housing Vacancies and Homeownership from the Census Bureau.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.0 | --- | ≥2321 | |

| New Cases per Day3 | 446,355 | 696,832 | ≤5,0002 | |

| Hospitalized3 | 129,637 | 144,898 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,287 | 2,197 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

January Vehicles Sales increased to 15.04 million SAAR

by Calculated Risk on 2/01/2022 05:52:00 PM

Wards Auto released their estimate of light vehicle sales for January. Wards Auto estimates sales of 15.04 million SAAR in January 2022 (Seasonally Adjusted Annual Rate), up 20.9% from the December sales rate, but down 10.4% from January 2021.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for January (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

Las Vegas Visitor Authority for December: Visitor Traffic Down 13.3% Compared to 2019

by Calculated Risk on 2/01/2022 04:05:00 PM

From the Las Vegas Visitor Authority: December 2021 Las Vegas Visitor Statistics

Las Vegas visitation saw positive gains through much of 2021, ending the year with 32.2M visitors, about three‐quarters of pre‐COVID volume but well ahead of the 19M visitors hosted in 2020.

Amidst the challenges of COVID, active and evolving safety and health protocols across the destination allowed Las Vegas conventions and meetings to continue in 2021 with an estimated attendance of 2.2 million for the year, roughly a third of pre‐COVID levels.

Overall hotel occupancy approached 67% for the year, dramatically ahead of 2020's 42.1% tally but below the 88.9% level of 2019. In part due to the challenged convention group segment, Midweek saw annual occupancy reach 60.5%, +23.1 pts vs. 2020 but ‐25.8 pts vs. 2019. Compared to midweek activity, weekends saw a stronger recovery, exceeding 87% in seven out of twelve months and ending the year at 81.3% (+28.5 pts vs. 2020 and ‐13.6 pts vs. 2019).

Click on graph for larger image.

Click on graph for larger image. This graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 13.3% compared to the same month in 2019.

Rents Still Increasing Sharply Year-over-year

by Calculated Risk on 2/01/2022 01:10:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Rents Still Increasing Sharply Year-over-year

A brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through December 2021 (Apartment List through January 2022).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

The Zillow measure is up 13.9% YoY in December, up from 13.2% YoY in November. And the ApartmentList measure is up 17.8% as of December, down slightly from 17.9% in November.

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 3.8% YoY in December, from 3.5% YoY in November - and will likely increase further in the coming months.

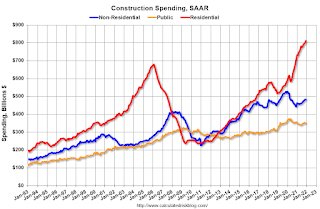

Construction Spending Increased 0.2% in December

by Calculated Risk on 2/01/2022 12:19:00 PM

From the Census Bureau reported that overall construction spending increased 0.2%:

Construction spending during December 2021 was estimated at a seasonally adjusted annual rate of $1,639.9 billion, 0.2 percent above the revised November estimate of $1,636.5 billion. The December figure is 9.0 percent above the December 2020 estimate of $1,504.2 billion.Private spending increased and public spending decreased:

The value of construction in 2021 was $1,589.0 billion, 8.2 percent above the $1,469.2 billion spent in 2020.

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,292.9 billion, 0.7 percent above the revised November estimate of $1,283.8 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $347.0 billion, 1.6 percent below the revised November estimate of $352.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 19% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 16% above the bubble era peak in January 2008 (nominal dollars) but has been soft recently.

Public construction spending is 7% above the peak in March 2009.

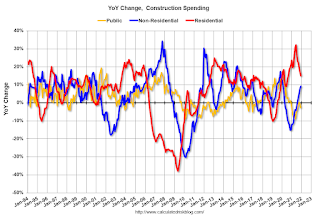

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 15.0%. Non-residential spending is up 9.1% year-over-year. Public spending is down 2.9% year-over-year.

Construction was considered an essential service during the early months of the pandemic in most areas and did not decline sharply like many other sectors. However, some sectors of non-residential have been under pressure. For example, lodging is down 23% YoY.